With Bitcoin (BTC) now trading at $115,726 as of September 20,2025, many retirement savers are re-examining how digital assets fit into their long-term strategies. The conversation has shifted from “should I own crypto in my 401(k)?” to the more nuanced question: How much Bitcoin is enough for a balanced retirement portfolio? As plan sponsors and regulators warm to the idea of crypto in retirement accounts, understanding allocation strategies is essential for anyone seeking diversification without overexposure.

Current Expert Guidance on Crypto Allocation in 401(k)s

The debate over the right crypto allocation is heating up. In December 2024, BlackRock issued guidance suggesting that interested investors consider allocating up to 2% of their portfolios to Bitcoin, citing its diversification benefits due to low correlation with traditional assets. However, they were quick to caution about Bitcoin’s notorious volatility and the risk of sharp selloffs. (Reuters)

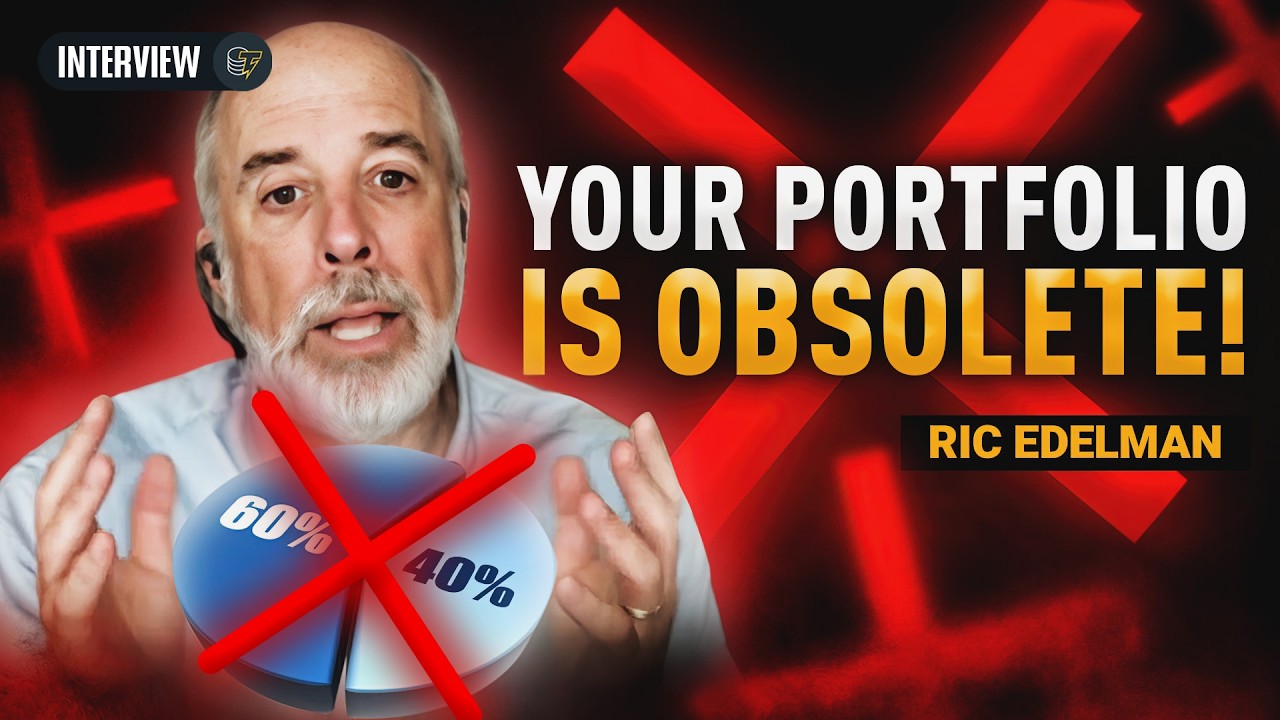

Fast forward to June 2025: Ric Edelman, a well-known financial advisor and commentator, made waves by calling for a minimum 10% allocation to cryptocurrencies in conservative portfolios, and up to 40% in aggressive ones. Edelman argues that the classic 60/40 stock-bond split is outdated for today’s market realities. Instead, he sees digital assets as an essential pillar of modern portfolio construction. (401k Specialist Magazine) This divergence among experts illustrates just how personal – and potentially polarizing – your crypto allocation can be.

Regulatory Shifts: A New Era for Crypto Retirement Investing

The regulatory landscape has also evolved rapidly. In May 2025, the U. S. Department of Labor (DOL) rescinded its previous guidance urging plan sponsors to exercise “extreme care” when offering cryptocurrency investments inside 401(k) plans. This move signals a more neutral stance from regulators and could open doors for wider adoption of digital assets in workplace retirement accounts. (Kiplinger) Still, fiduciaries are expected to carefully vet any private or alternative offerings before making them available, as highlighted by recent White House commentary.

This shift means more Americans may soon have direct access to Bitcoin and other cryptocurrencies through their employer-sponsored plans – but it also places greater responsibility on individuals and advisors to make informed decisions about exposure levels.

Navigating Volatility: How Much Bitcoin Is Too Much?

The allure of outsized returns must always be balanced against risk management – especially with an asset as volatile as Bitcoin. Over the past year alone, BTC has traded above $115,000 with daily swings exceeding $1,000 not uncommon. While such volatility can boost returns during bull runs, it can also erode wealth quickly during downturns.

AARP and Investopedia both urge caution: If your plan offers crypto options, keep allocations small unless you have a high risk tolerance and a long investment horizon (CNBC). Regular reviews and disciplined rebalancing are essential tools for managing this risk over time.

Bitcoin (BTC) Price Prediction 2026-2031

Professional Outlook for Bitcoin Allocation in 401(k) Retirement Portfolios

| Year | Minimum Price | Average Price | Maximum Price | Potential Annual Change (%) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $88,000 | $120,000 | $155,000 | -24% to +34% | Possible post-halving volatility; regulatory clarity improves access but volatility remains high |

| 2027 | $103,000 | $135,000 | $180,000 | +17% to +40% | Broader institutional adoption; ETF flows grow; potential for new all-time highs |

| 2028 | $120,000 | $155,000 | $210,000 | +12% to +35% | Fourth halving year; supply shock could drive price higher if demand remains strong |

| 2029 | $138,000 | $175,000 | $250,000 | +13% to +38% | Retirement fund adoption accelerates; macroeconomic uncertainty boosts appeal as alternative asset |

| 2030 | $160,000 | $200,000 | $295,000 | +14% to +36% | Mainstream 401(k) presence; possible regulatory hurdles, but global adoption rises |

| 2031 | $180,000 | $225,000 | $340,000 | +12% to +32% | Mature market, slower growth; focus shifts to utility and integration with traditional finance |

Price Prediction Summary

Bitcoin is projected to experience significant price appreciation over the next several years, driven by increased institutional adoption, integration into retirement portfolios, and periodic supply shocks from halving events. While volatility remains a core risk, the overall trend is positive, with average prices expected to rise from $120,000 in 2026 to $225,000 by 2031. The minimum and maximum price ranges reflect potential bear and bull scenarios influenced by regulation, global macroeconomics, and technological progress.

Key Factors Affecting Bitcoin Price

- Regulatory clarity and U.S. DOL stance on crypto in retirement plans

- Institutional adoption (401(k), pension funds, ETFs) accelerating demand

- Bitcoin halving events reducing new supply every four years

- Global macroeconomic trends (inflation, currency debasement, risk appetite)

- Technological improvements in Bitcoin infrastructure and security

- Potential competition from alternative digital assets and tokenized securities

- Market sentiment and retail investor participation

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Key Factors When Determining Your Crypto Allocation Strategy

- Your age and time horizon: Younger investors with decades until retirement may afford higher allocations than those nearing withdrawal age.

- Risk tolerance: Can you stomach double-digit drawdowns or will sleepless nights undermine your discipline?

- Total portfolio size: A small percentage in crypto can still represent significant dollar amounts when markets surge.

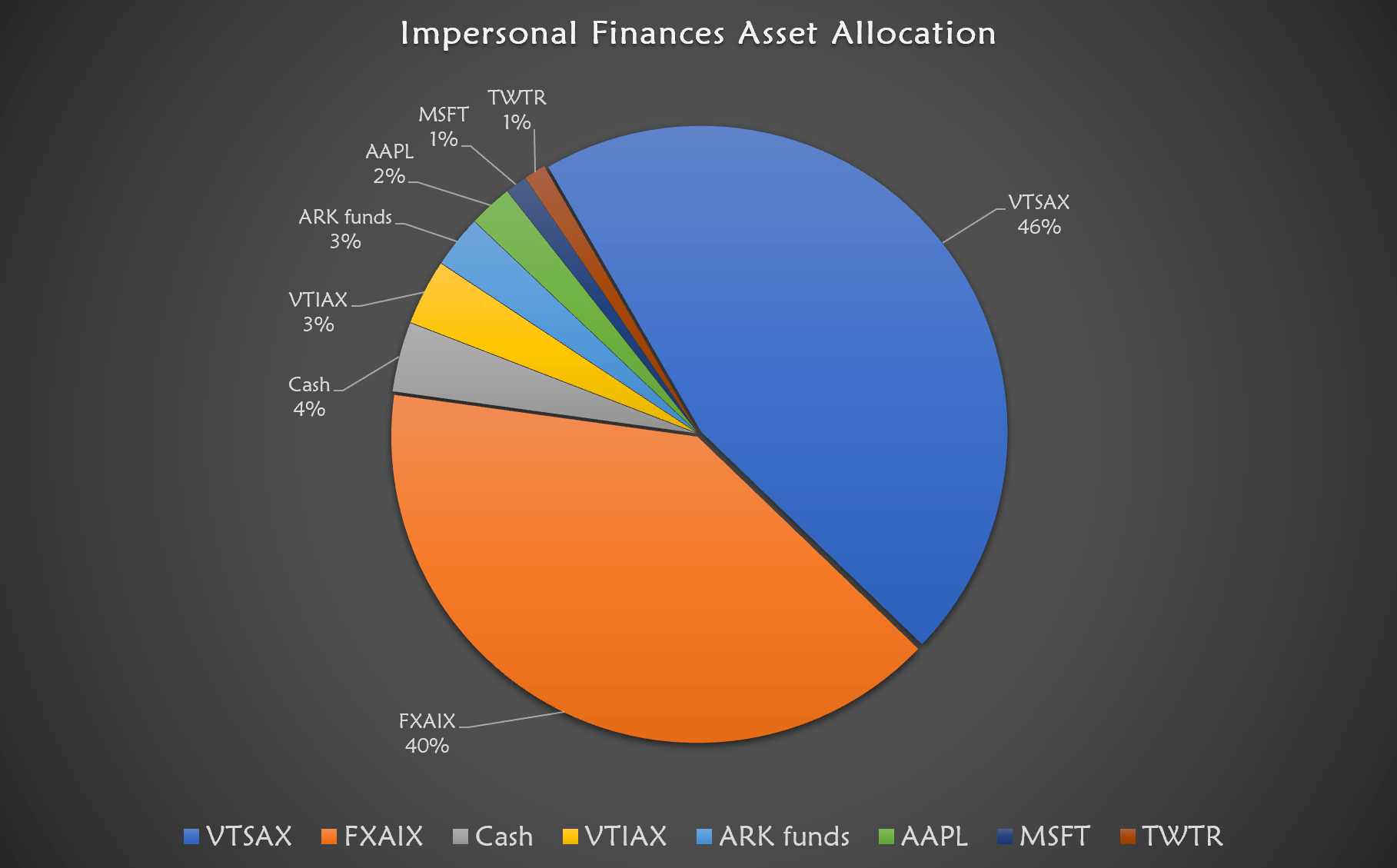

- Diversification needs: Are you seeking true non-correlation or simply chasing performance?

- Your plan’s investment menu: Not all plans offer direct Bitcoin access; some use trusts or managed funds with unique risks/costs.

While headline numbers like a 10% or even 40% crypto allocation make for bold conversation, most retirement savers should approach their crypto allocation 401k strategy with measured discipline. The optimal mix isn’t about chasing the highest returns, but about achieving a balance that supports your long-term goals and risk profile.

Practical Crypto Allocation Models for Your 401(k)

Let’s break down some practical approaches, drawing from both current market data and expert commentary:

Conservative, Balanced, and Aggressive Crypto Allocations for 401(k)s

-

Conservative Model (1–2% Bitcoin Allocation): Leading asset managers such as BlackRock recommend allocating up to 2% of your retirement portfolio to Bitcoin. This approach aims to capture diversification benefits while limiting exposure to crypto’s volatility. With Bitcoin currently trading at $115,726 (as of September 20, 2025), a conservative allocation is best suited for investors with low risk tolerance or those nearing retirement.

-

Balanced Model (5–10% Crypto Allocation): Financial advisors like Ric Edelman suggest increasing crypto exposure to 5–10% for a balanced retirement portfolio. This model may include a mix of Bitcoin and other established cryptocurrencies, such as Ethereum (ETH), to enhance potential returns while still managing risk. Regular rebalancing is key to maintaining this target allocation.

-

Aggressive Model (20–40% Crypto Allocation): For investors with high risk tolerance and a long investment horizon, Edelman advocates for an allocation of 20–40% to cryptocurrencies. This aggressive approach seeks to maximize growth potential but comes with significant volatility. Diversification across multiple digital assets, and ongoing portfolio reviews, are essential for managing risk in this model.

Conservative Model (1-2%): This approach aligns with BlackRock’s guidance. Allocating just 1-2% of your 401(k) to Bitcoin at its current price of $115,726 can offer diversification without exposing your portfolio to excessive volatility. For many investors, this is enough to capture potential upside while containing risk.

Balanced Model (5-10%): Inspired by Ric Edelman’s recommendations, this range reflects a moderate embrace of digital assets. It may suit investors who are comfortable with volatility and want meaningful exposure to Bitcoin’s growth potential as part of a broader alternative asset sleeve.

Aggressive Model (15% and ): Some experienced investors and those with long time horizons may consider higher allocations. However, this level is not for everyone, large swings in BTC price can lead to significant portfolio drawdowns. Regular rebalancing becomes critical at these levels.

Rebalancing: Your Best Defense Against Volatility

No matter which model you choose, disciplined rebalancing is essential. As Bitcoin’s price shifts, sometimes dramatically, your exposure can quickly drift outside your target range. Setting calendar-based or threshold-based rebalancing rules ensures you lock in gains during rallies and avoid overexposure during corrections.

Tools and Resources: Making Informed Decisions

If you’re wondering how much Bitcoin to retire, online calculators and professional guidance can be invaluable. Look for a Bitcoin retirement calculator that factors in projected returns, volatility assumptions, contribution rates, and withdrawal timelines specific to your situation. These tools help visualize how even small allocations might impact your nest egg over decades, without betting the farm on any single asset.

What To Watch As Crypto Grows Inside 401(k)s

- Plan changes: More employers are adding crypto options as DOL guidance evolves, keep an eye on your plan menu each year.

- Product structures: Understand whether you’re buying spot Bitcoin exposure or a managed fund; fees and risks differ substantially.

- Regulatory updates: Laws continue to shift, stay informed by following trusted outlets like Kiplinger.

- Your own behavior: Avoid emotional reactions during market swings; stick to the plan you set when emotions were calm.

If there’s one constant in retirement investing, it’s change, and crypto is accelerating it. The key isn’t finding the “perfect” percentage today but building a process flexible enough to adapt as markets evolve.

The bottom line? There’s no magic number when it comes to how much Bitcoin is enough for your retirement portfolio. Whether you lean toward BlackRock’s caution or Edelman’s conviction, success lies in knowing yourself, and staying balanced as you build toward the future.