Cryptocurrency has officially entered the retirement mainstream. With the U. S. Department of Labor’s 2025 policy shift and President Trump’s executive order opening the door for crypto in 401(k)s, digital assets like Bitcoin are no longer fringe options for retirement savers. But before you jump in, it’s crucial to understand the crypto 401k tax implications and how IRS rules treat these assets inside your retirement plan.

How Crypto Is Taxed in a 401(k): The Basics

The IRS classifies cryptocurrency as property, not currency, for tax purposes. In a standard taxable account, every time you sell or trade crypto, you trigger a capital gain or loss. However, holding crypto within a 401(k) changes the game entirely.

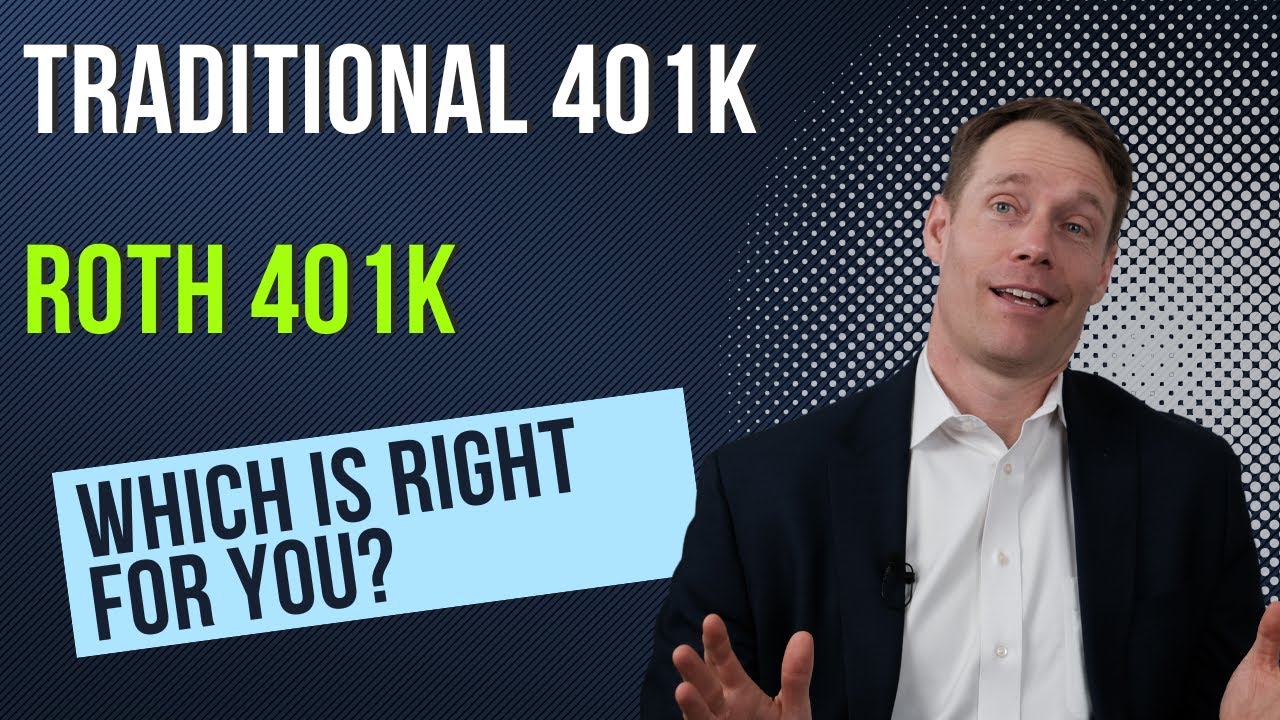

Within both traditional and Roth 401(k)s, your crypto is shielded from immediate taxation:

- Traditional 401(k): Contributions are made pre-tax. Your investments – including any gains from crypto – grow tax-deferred until withdrawal. At that point, distributions are taxed as ordinary income.

- Roth 401(k): You contribute after-tax dollars. Qualified withdrawals in retirement (including all potential crypto appreciation) are tax-free.

This means no capital gains taxes each time your Bitcoin or Ethereum rises in value inside your plan. You only face taxes upon distribution (traditional) or possibly not at all (Roth), depending on your account type and eligibility.

The Latest Regulatory Shifts: What Changed in 2025?

The landscape for IRS crypto retirement guidance has evolved quickly. In August 2025, two major changes occurred:

- The Department of Labor rescinded its previous warning to employers about offering crypto in 401(k)s, moving to a more neutral stance (Kiplinger).

- An executive order directed the SEC to revise regulations so that alternative assets – including cryptocurrencies – can be included in defined contribution plans (Reuters).

This regulatory clarity means more plan sponsors may soon offer direct exposure to digital assets within employer-sponsored plans. However, while access is expanding, the fundamental tax treatment remains unchanged:

- No capital gains taxes on trades within your 401(k)

- No need to report each buy/sell event while funds remain in the account

- Taxation only occurs at withdrawal (traditional) or may be avoided entirely (Roth)

Key Pros and Cons of Crypto in Your 401(k)

-

Tax-Deferred or Tax-Free Growth: Crypto assets held in a traditional 401(k) grow tax-deferred, meaning you only pay taxes when you withdraw funds. In a Roth 401(k), qualified withdrawals (including crypto gains) are tax-free.

-

Portfolio Diversification: Adding cryptocurrencies like Bitcoin to your 401(k) can diversify your retirement portfolio beyond traditional stocks and bonds, potentially reducing overall risk.

-

High Volatility Risk: Cryptocurrencies are known for their price swings, which can lead to significant gains or losses in your retirement savings. Financial advisors typically recommend limiting crypto exposure to 5% or less of your portfolio.

-

Regulatory Uncertainty: While recent changes have made it easier to include crypto in 401(k)s, future regulatory shifts could impact access, taxation, or even the legality of holding certain digital assets in retirement accounts.

-

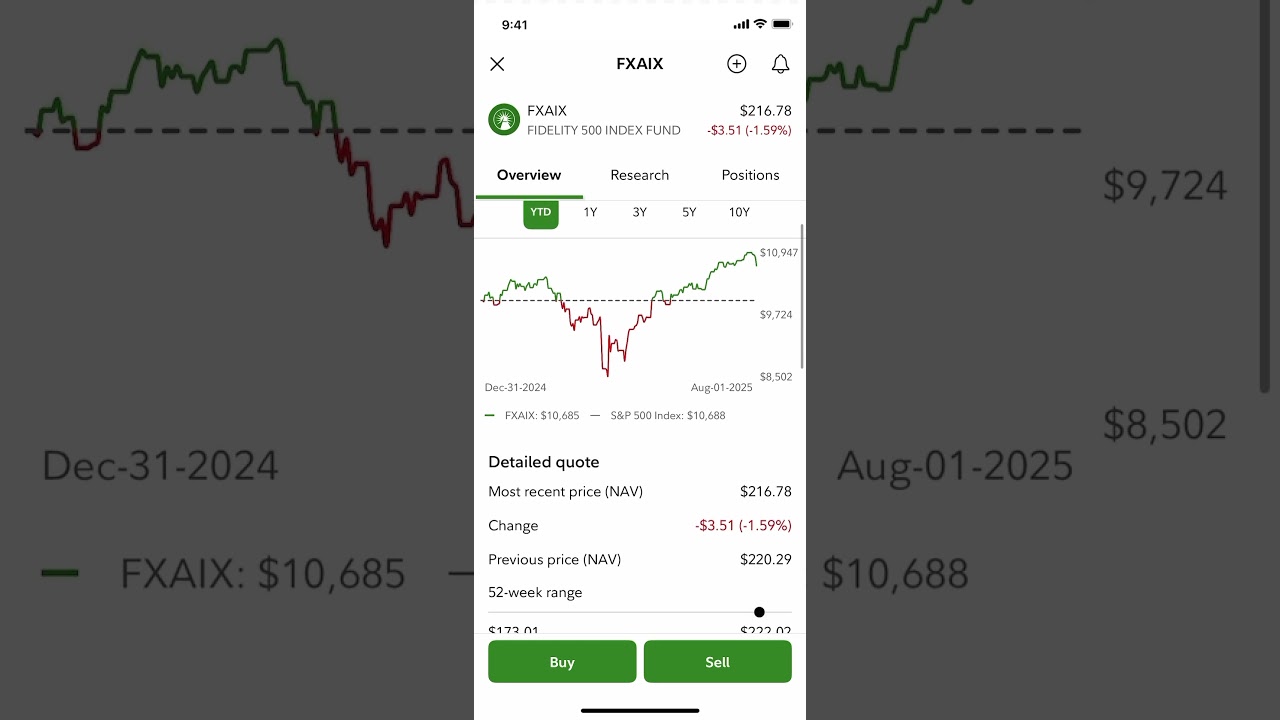

Limited Platform Availability: As of 2025, only a handful of major 401(k) providers—such as Fidelity—offer direct cryptocurrency investment options, which may limit your choices and flexibility.

-

Custody and Security Concerns: Storing crypto in a 401(k) relies on the provider’s security infrastructure. While regulated custodians offer protection, risks like hacking or mismanagement remain.

Navigating Reporting Requirements for Crypto Retirement Accounts

If you’re used to tracking every transaction for taxable accounts, you’ll find reporting requirements much simpler inside a qualified retirement plan. According to recent guidance (JasonFinTips.com):

- You do not need to report individual trades or capital gains for assets held within a 401(k), whether traditional or Roth.

- Your plan administrator handles all required reporting until you begin taking distributions.

- If you roll over funds between qualified plans (such as from a traditional IRA or another employer’s plan), these transactions are generally not taxable events if done correctly.

This hands-off approach is one of the biggest cryptocurrency tax benefits for 401k holders. But remember: once you start withdrawing funds in retirement, those distributions become taxable income (unless it’s a qualified Roth withdrawal).

Strategic Considerations: How Much Crypto Belongs in Your 401(k)?

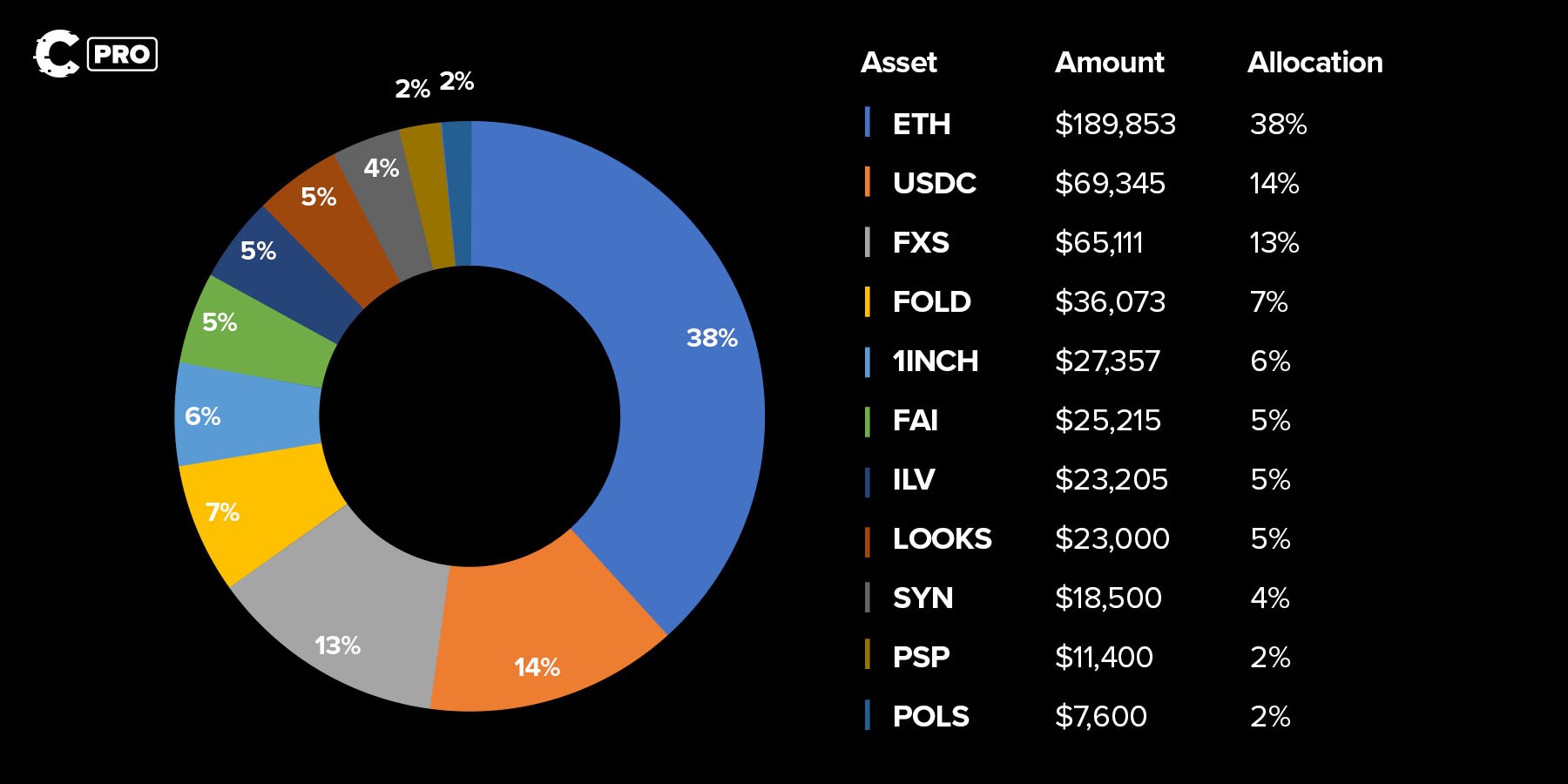

With easier access and streamlined tax reporting, it’s tempting to load up on digital assets. However, the risks of crypto volatility don’t disappear inside a retirement account. Most financial advisors urge caution, allocating no more than 5% of your portfolio to crypto is a widely cited rule of thumb. Unlike stocks and bonds, cryptocurrencies can experience rapid swings that may not align with your long-term retirement horizon.

It’s also worth noting that ERISA fiduciary standards still apply to plan sponsors. While the Department of Labor has softened its stance, employers must act prudently and may still limit or structure crypto offerings to protect participants from outsized risk. As always, diversification remains the best defense against market turbulence.

Potential Pitfalls and Planning Opportunities

While holding crypto in a 401(k) offers unique tax advantages, it’s not without pitfalls. Here are a few key issues investors should keep in mind:

Common Mistakes to Avoid When Adding Crypto to Your 401(k)

-

Ignoring Tax Treatment Differences Between Account Types: Failing to understand how Traditional 401(k) and Roth 401(k) accounts handle crypto gains can lead to unexpected tax bills. Traditional 401(k)s defer taxes until withdrawal, while Roth 401(k)s offer tax-free qualified withdrawals—including on crypto gains.

-

Overallocating to Crypto Assets: Allocating more than the recommended 5% of your portfolio to cryptocurrencies exposes you to excessive risk due to crypto’s volatility. Most financial advisors suggest keeping crypto as a small portion of your retirement assets.

-

Neglecting Plan Provider Restrictions: Not all 401(k) providers or platforms—like Fidelity or Charles Schwab—offer cryptocurrency investment options. Always verify your plan’s specific rules and available crypto products before making changes.

-

Overlooking Regulatory and Custody Risks: The regulatory landscape for crypto in 401(k)s is evolving. Failing to monitor changes from entities like the U.S. Department of Labor or SEC could impact your investment’s security or eligibility.

-

Withdrawing Funds Without Understanding Tax Consequences: Taking early distributions from your crypto 401(k) can trigger ordinary income taxes and possible penalties. Know the rules for qualified withdrawals to avoid costly surprises.

- Early withdrawals: Distributions before age 59½ generally trigger ordinary income taxes plus a 10% penalty, regardless of whether your holdings are in Bitcoin, Ethereum, or traditional assets.

- Required minimum distributions (RMDs): Traditional 401(k)s (including those with crypto) require you to start taking RMDs at age 73. Failing to comply can result in steep penalties.

- Lack of insurance: Crypto held inside a plan isn’t insured by the FDIC or SIPC. Custody solutions vary by provider, so review security protocols carefully.

If you’re considering rolling over funds between accounts, say, from a traditional IRA into a Roth crypto 401(k): be mindful of potential tax consequences. Direct rollovers between like accounts are typically non-taxable, but converting pre-tax funds into a Roth triggers immediate income taxes on the converted amount (JasonFinTips.com). Strategic timing matters here; consult with an advisor before making moves that could impact your bracket.

Key Takeaways for Crypto Retirement Investors

The inclusion of digital assets in workplace retirement plans is now reality, but maximizing their benefits requires careful planning and awareness:

Steps to Maximize Tax Efficiency with Crypto in Your 401(k)

-

Choose the Right 401(k) Type: Opt for a Roth 401(k) if you expect your tax rate to be higher in retirement, as qualified withdrawals (including crypto gains) are tax-free. Traditional 401(k)s offer tax deferral, but withdrawals are taxed as ordinary income.

-

Limit Allocation to Crypto: Financial experts, including those at Fidelity and Charles Schwab, recommend keeping crypto exposure to no more than 5% of your retirement portfolio to manage risk and volatility.

-

Utilize Direct Rollovers for Tax-Free Transfers: If moving funds from a traditional 401(k) or IRA to a crypto-enabled retirement account (like Alto Crypto IRA), use a direct rollover to avoid triggering taxes or penalties.

-

Rebalance Regularly: Use your plan’s built-in tools or platforms like Fidelity NetBenefits to periodically rebalance your portfolio, ensuring your crypto allocation stays within your target range and maintains tax-advantaged growth.

-

Track Regulatory Updates: Stay informed about IRS and SEC rules regarding crypto in 401(k)s, as regulations are evolving. Reliable sources include IRS.gov, SEC.gov, and major financial news outlets.

- Select the right account type: Weigh the pros and cons of traditional vs Roth contributions based on your current and expected future tax rates.

- Diversify beyond crypto: Use digital assets as one part of an overall balanced portfolio, it shouldn’t be your only growth engine.

- Stay informed on IRS guidance: Regulations evolve quickly; subscribe to updates from reputable sources and check plan disclosures regularly.

- Keep meticulous records: While you don’t need to report trades within your plan now, maintaining documentation can help if rules change or if you roll funds out later.

The bottom line? The core crypto 401k tax implications are straightforward: defer taxes until withdrawal (traditional), or potentially avoid them altogether with qualified Roth distributions, even as Bitcoin maintains its position above $100,000. The real challenge is integrating these tools wisely into your broader retirement strategy while staying nimble as regulations shift. As always, consult with an experienced advisor before making major allocation changes or executing complex rollovers involving digital assets within qualified accounts.