With Bitcoin (BTC) now trading at $113,660 as of September 24,2025, the question on every forward-thinking investor’s mind is: Will less than 1 Bitcoin be enough to retire by 2035? The answer isn’t as simple as a yes or no. It depends on your country, lifestyle expectations, and how you integrate crypto into your retirement portfolio, especially if you’re looking at innovative vehicles like a 401(k) with digital asset exposure.

Bitcoin Maintains Position Above $100,000: What This Means for Retirement Planners

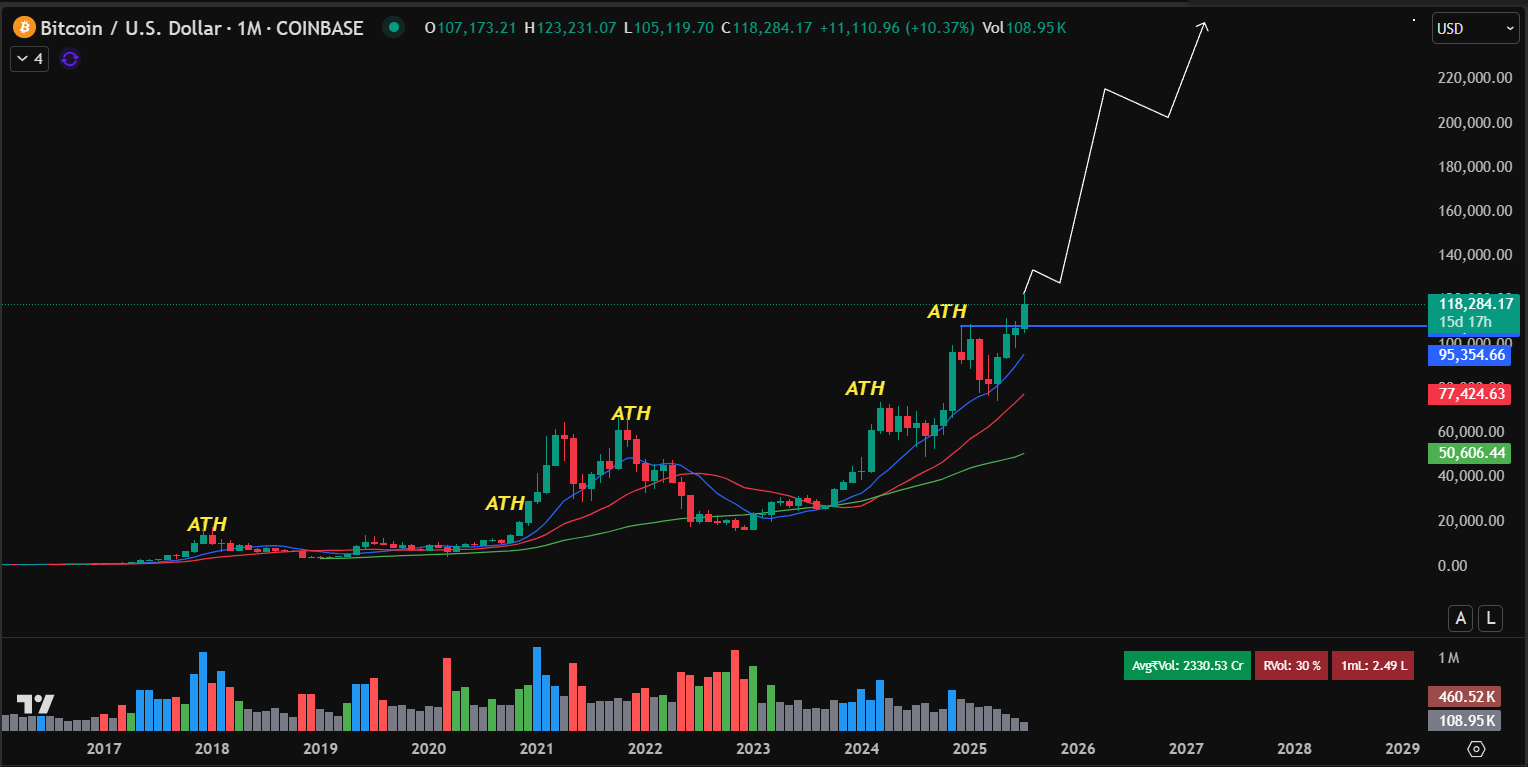

The psychological and technical milestone of Bitcoin holding above $100,000 is game-changing. Ten years ago, the idea that half a Bitcoin could be a ticket to financial freedom seemed outlandish. Now, with BTC at $113,660, projections are bolder than ever. Finder. com’s July 2025 survey of crypto specialists forecasts Bitcoin reaching $1.02 million by 2035. Michael Saylor echoes this million-dollar target (source). If these predictions hold water, even 0.5 BTC could be worth ~$500,000 in a decade.

But before you bet your entire retirement on the “1 BTC plan, ” it’s critical to factor in volatility and personal circumstances. As Benzinga points out repeatedly, assuming one Bitcoin will guarantee a comfortable retirement is risky business, living costs vary wildly and the crypto market is anything but predictable.

How Much Bitcoin Do You Really Need? Market Research and Global Context

A growing body of research tries to answer the question: How much Bitcoin do you need to retire? According to Smitty’s Bitcoin Retirement Guide (via AInvest), some individuals could retire with less than 1 BTC by 2035 provides but only in certain countries with lower cost-of-living indices. For Americans or Western Europeans expecting first-world standards of living, aiming for just one coin might be cutting it close unless BTC truly goes parabolic.

Bitcoin Needed for Retirement by Country & Lifestyle (2035)

-

United States (Comfortable Lifestyle): Estimated average needed is 0.7 BTC (~$700,000 if BTC hits $1M). This covers moderate expenses in major cities, factoring in healthcare and inflation.

-

Germany (Urban Comfort): Residents may need 0.5 BTC (~$500,000) for a middle-class retirement, given lower healthcare costs and strong social safety nets.

-

Japan (Urban Middle-Class): Average retirement requires 0.6 BTC (~$600,000), reflecting high living costs in cities like Tokyo but offset by national pension benefits.

-

Mexico (Expats/Local Middle-Class): A comfortable retirement is possible with just 0.25 BTC (~$250,000), thanks to lower living costs and affordable healthcare.

-

Thailand (Expats/Local Middle-Class): Estimated 0.2 BTC (~$200,000) needed for a relaxed lifestyle in popular cities like Chiang Mai or Bangkok.

-

Portugal (Coastal/Mild Urban): Retirees may need 0.3 BTC (~$300,000), with Portugal’s favorable tax regime and affordable coastal living.

The reality is nuanced. While some YouTube analysts suggest you may need as little as 4.4 BTC, or even less, for early retirement (source), others warn that relying solely on price appreciation ignores risks like regulatory shifts or black swan events.

The Evolution of Crypto in 401(k)s: New Rules Open Doors

The U. S. Department of Labor’s recent policy shift has made it more feasible than ever for employers to include crypto in 401(k)s. This regulatory green light removes much of the old friction for plan sponsors who want to offer digital assets alongside traditional equities (source). For investors bullish on long-term bitcoin adoption, and willing to stomach volatility, allocating even a small portion of your tax-advantaged retirement account to BTC could yield outsized returns.

Bitcoin (BTC) Price Prediction 2026-2031

Professional outlook based on current market trends, adoption, and regulatory context. All prices in USD.

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $95,000 | $160,000 | $210,000 | +41% | Post-halving momentum continues; possible correction after 2025 highs. |

| 2027 | $110,000 | $200,000 | $275,000 | +25% | Increased institutional adoption in 401(k)s; global macro uncertainty boosts BTC demand. |

| 2028 | $140,000 | $270,000 | $370,000 | +35% | Next Bitcoin halving year; renewed bull cycle likely, but regulatory risks remain. |

| 2029 | $175,000 | $350,000 | $480,000 | +30% | Mainstream use in retirement accounts grows; technology upgrades (e.g., Layer 2) increase utility. |

| 2030 | $220,000 | $458,000 | $600,000 | +31% | Wider acceptance as a store of value; competition from CBDCs and altcoins. |

| 2031 | $280,000 | $575,000 | $780,000 | +25% | Potential approach to $1M; maturing market, increased regulation, and large-scale adoption. |

Price Prediction Summary

Bitcoin is projected to experience substantial growth through 2031, driven by increased institutional adoption, technological improvements, and its growing role in retirement portfolios. While significant volatility and periodic corrections are expected, the overall trend remains strongly bullish with potential for high returns over the next decade.

Key Factors Affecting Bitcoin Price

- Institutional and 401(k) adoption of Bitcoin as a retirement asset

- Regulatory developments in the US and globally

- Bitcoin halving cycles and their impact on supply/demand dynamics

- Technological advancements (e.g., scalability, security, Layer 2 solutions)

- Economic instability and increased demand for alternative stores of value

- Competition from other cryptocurrencies and central bank digital currencies (CBDCs)

- Market sentiment, macroeconomic trends, and geopolitical events

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This doesn’t mean everyone should pile into crypto blindly. Financial advisors still urge caution; bitcoin remains speculative and volatile compared to blue-chip stocks or bonds. But if you’re under age 40 and have time on your side, or if you’re simply looking for asymmetric upside, a disciplined allocation within your 401(k) can be a strategic play.

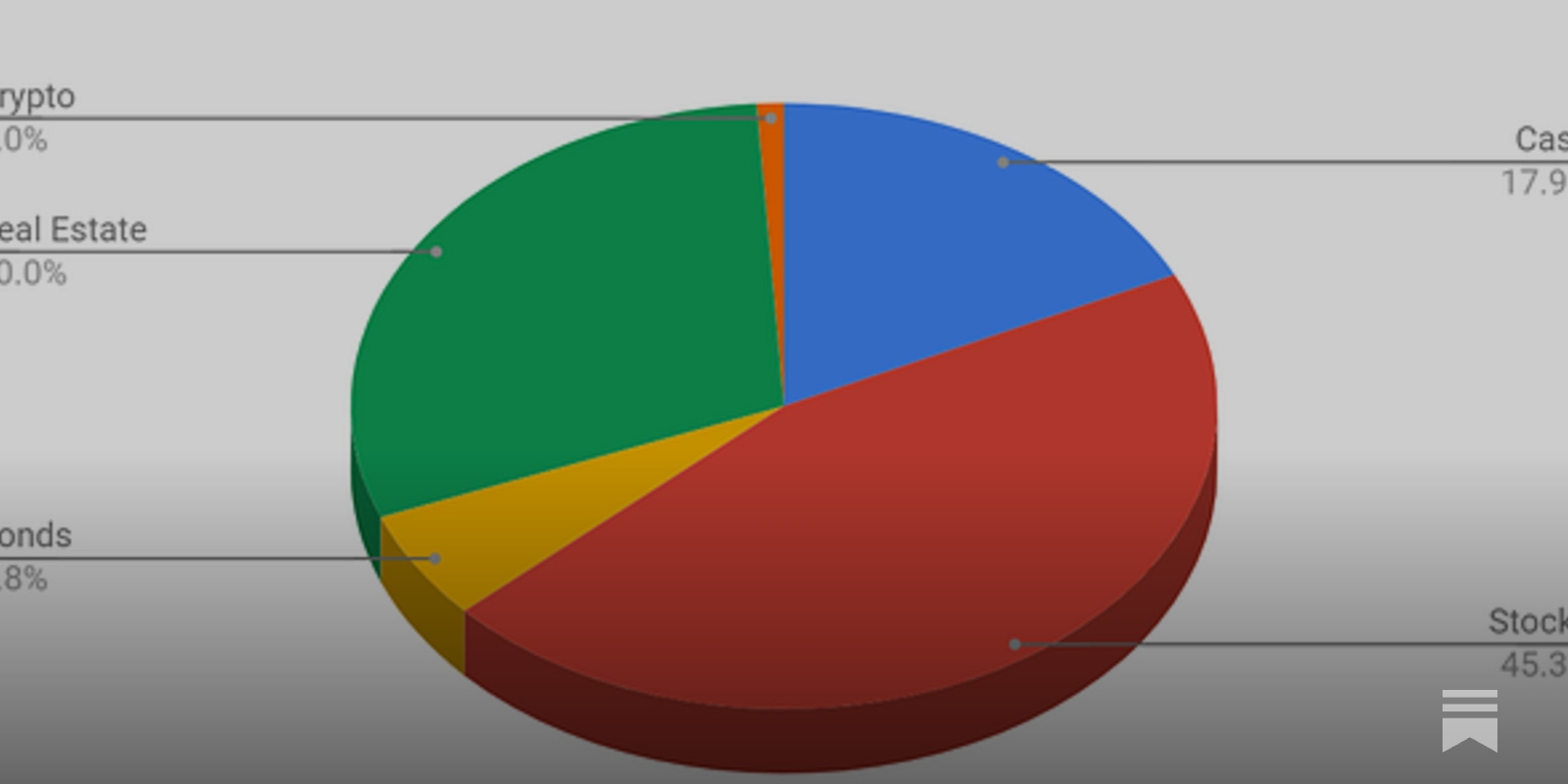

When considering crypto retirement strategies, diversification is your lifeline. Bitcoin’s historical returns are eye-popping, but its drawdowns can be brutal. If you’re planning to retire with bitcoin, ask yourself: Can you withstand a 50% and drop just before retirement? That’s not just theory, BTC has seen it happen multiple times in the last decade.

For most investors, the sweet spot may be integrating crypto as a minority position within your broader retirement portfolio. Think 5-15% exposure, depending on risk tolerance and time horizon. This approach leverages bitcoin’s upside while cushioning downside shocks with traditional assets.

Practical Steps: Building a Bitcoin-Backed 401(k) Retirement Plan

The mechanics of adding bitcoin to your 401(k) have never been easier. Thanks to recent regulatory shifts, more plan providers now offer direct crypto allocations or access via trusts and ETFs. Here’s how to get started:

Checklist: Adding Bitcoin to Your 401(k)

-

Research 401(k) Providers Supporting Bitcoin: Choose a provider that offers Bitcoin investment options, such as Fidelity Investments or ForUsAll, both of which allow direct Bitcoin exposure in 401(k) plans.

-

Understand Plan Fees and Custody Arrangements: Review all associated fees, including management, trading, and custody fees. Platforms like Fidelity and ForUsAll disclose these costs—ensure you know how they impact your returns.

-

Set a Target Allocation for Bitcoin: Decide what percentage of your 401(k) portfolio to allocate to Bitcoin. Financial advisors typically recommend limiting crypto to 5-10% due to volatility.

-

Review Employer and Regulatory Policies: Confirm your employer permits Bitcoin in their 401(k) plan and review the latest U.S. Department of Labor guidance on crypto in retirement accounts.

-

Monitor Bitcoin’s Price and Market Projections: Stay updated on Bitcoin’s current price ($113,660 as of September 24, 2025) and future projections, as these can impact your retirement planning.

-

Consult a Financial Advisor: Speak with a licensed advisor who understands both retirement planning and cryptocurrency to align your Bitcoin allocation with your risk tolerance and retirement goals.

Remember, every provider is different, some allow direct BTC purchases, others offer funds tracking crypto indices. Always scrutinize fees and security protocols. And don’t neglect rebalancing; crypto allocation can balloon or shrink rapidly in a volatile market.

What If Bitcoin Hits $1 Million by 2035?

If projections are right and Bitcoin reaches $1 million by 2035, even holding 0.25 BTC (about $28,415 at today’s price of $113,660) could translate into a quarter-million-dollar nest egg in ten years. But don’t build your entire future on price predictions alone, use tools like a bitcoin retirement calculator, factor in inflation, taxes, withdrawal rates, and healthcare costs.

Mistakes to avoid:

- Overconcentration: Betting everything on one asset is never wise, even if it’s digital gold.

- Ignoring volatility: Prepare emotionally for wild swings; set rules for when you’ll rebalance or take profits.

- Poor tax planning: Crypto gains in tax-advantaged accounts are powerful, make sure you’re maximizing those benefits.

Will Less Than One Bitcoin Be Enough?

The bottom line: For some savers, especially those in lower-cost countries or with modest lifestyle needs, less than one bitcoin could be enough to retire by 2035 if bullish forecasts play out. For U. S. -based investors aiming for upper-middle-class comfort, however, relying solely on the “1 BTC plan” is aggressive at best.

Your best bet? Use bitcoin as an asymmetric bet within a diversified portfolio. Stay adaptable as regulations evolve and new products emerge (details here). And above all, keep learning as the landscape shifts.