On August 7,2025, President Donald Trump signed an executive order that could fundamentally reshape the landscape of American retirement investing. By instructing the Department of Labor to review and update guidance under ERISA, this policy now paves the way for cryptocurrencies, private equity, and real estate to be included in 401(k) plans. For investors who have watched from the sidelines as digital assets like Bitcoin and Ethereum soared in value, this is a watershed moment, one that effectively unlocks access to the $12.5 trillion 401(k) market for alternative assets.

What Does Trump’s Executive Order Actually Change?

The executive order does not instantly add Bitcoin or Ethereum to your 401(k) lineup tomorrow morning. Instead, it directs key regulatory agencies, the Department of Labor, Treasury Department, and SEC, to revisit existing restrictions that have long kept alternative assets out of employer-sponsored retirement accounts. This means new guidance is coming on how plan sponsors can prudently offer crypto in retirement plans without running afoul of fiduciary duties.

The order specifically targets what it calls overregulation and excessive litigation risk as barriers to innovation in defined contribution plans. By lowering those hurdles, it aims to democratize access to high-growth opportunities that were previously available only to institutional investors or ultra-high-net-worth individuals.

Why This Matters: The $12.5 Trillion Opportunity

The U. S. 401(k) system represents $12.5 trillion in assets, an enormous pool that has historically been limited to stocks, bonds, mutual funds, and target-date funds. With this executive order, asset managers like Blackstone, KKR, Apollo Global Management, and leading crypto custodians are poised for a new wave of inflows if plan sponsors embrace these changes.

For everyday investors, the ability to diversify into crypto or private equity within tax-advantaged accounts could mean higher return potential, and higher volatility. The move also signals a fundamental shift in how Americans think about retirement security: it is no longer just about minimizing risk but also about seizing growth opportunities as markets evolve.

Key Benefits and Risks of Crypto in Your 401(k)

-

Diversification Beyond Stocks and Bonds: Adding cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) offers exposure to alternative assets, potentially reducing reliance on traditional market cycles.

-

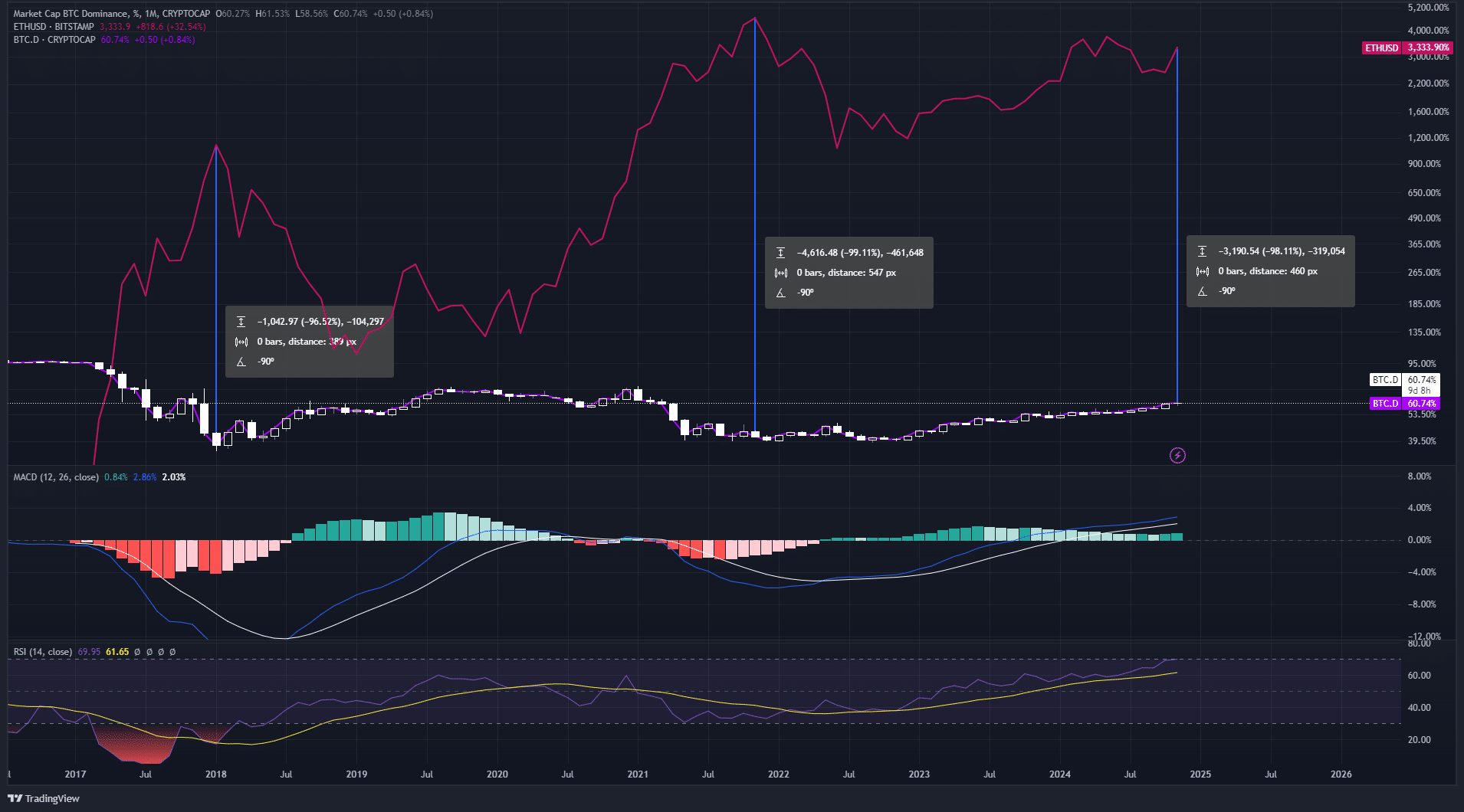

Potential for Higher Returns: Crypto assets have historically delivered significant gains during bull markets, offering the possibility of outsized growth compared to conventional 401(k) holdings.

-

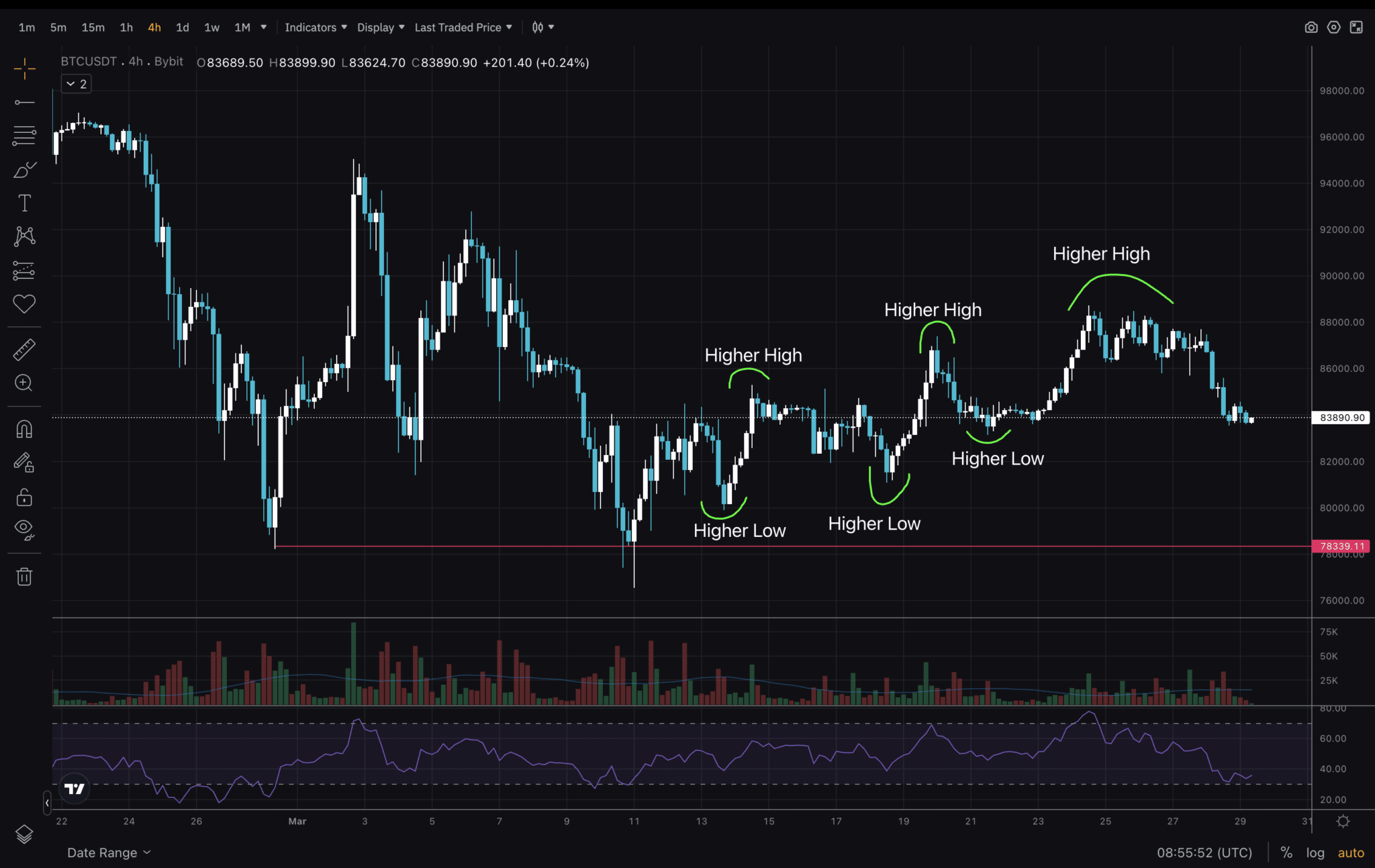

Increased Portfolio Volatility: Cryptocurrencies are highly volatile, with prices subject to rapid swings. This can lead to substantial short-term losses, making them riskier than traditional investments.

-

Regulatory and Security Risks: The evolving regulatory landscape and risks of hacks or fraud mean crypto investments in retirement accounts may face unexpected challenges or restrictions.

-

Liquidity and Fee Concerns: Many crypto investment options in 401(k)s may have higher fees and limited liquidity compared to stocks or mutual funds, potentially impacting returns and access to funds.

The New Rules: What Can You Actually Hold?

According to the Department of Labor’s ongoing implementation efforts (source), employers will soon be able to offer exposure not only to leading cryptocurrencies like Bitcoin but also altcoins such as Ethereum, provided they meet certain liquidity and custody standards. The same applies for private equity funds and real estate investment vehicles.

This expansion comes with caveats: these investments often carry increased risks compared with traditional equities or bonds. Crypto is notorious for its volatility; private equity can lock up funds for years; real estate is illiquid compared with ETFs or mutual funds. Fees may also be higher than mainstream index options.

Cautious Optimism from Experts

Financial advisors urge caution amid the excitement. As noted by USA Today, Trump’s executive order acknowledges both the growing role of alternative investments in modern portfolios and their unique risks (see coverage). Investors are advised to understand these complexities before allocating significant portions of their nest eggs into high-volatility assets like Bitcoin.

So, what does this mean for your retirement strategy? The door is officially open, but stepping through it requires a new level of diligence. Plan sponsors and asset managers are rapidly building out product offerings that comply with the revised regulatory framework, but not all crypto 401(k) options will be created equal. Expect to see a flurry of new funds, managed accounts, and direct asset choices, each with its own risk profile and fee structure.

Regulatory agencies are under pressure to deliver clear guidance on custody, reporting, and fiduciary standards. For now, most experts expect that only the most established digital assets, like Bitcoin and Ethereum, will make the first wave of approved 401(k) options. Illiquid or unproven tokens will likely remain off-limits until further clarity emerges.

How to Approach Crypto in Your 401(k): Smart Steps for Investors

If you’re considering adding crypto to your retirement portfolio, start by reviewing your current plan’s investment menu. Not every employer will move at the same pace; some may wait for additional legal clarity or stick with traditional offerings. If your provider introduces crypto or private equity options, ask these key questions:

- What percentage of my portfolio should be allocated? Most advisors suggest keeping alternative assets below 10% of total retirement holdings.

- What are the fees? Crypto products often carry higher management and custody costs.

- What is the liquidity profile? Understand any lock-up periods or withdrawal restrictions.

- How is security handled? Inquire about institutional-grade custody solutions and insurance protections.

The potential upside is real: Bitcoin’s historical returns have outpaced most traditional assets over the past decade. However, past performance does not guarantee future results, and drawdowns can be severe. Consider dollar-cost averaging if you’re new to digital assets within retirement accounts, rather than making a lump-sum allocation at a market peak.

Timeline: When Will Crypto Be Available in My 401(k)?

The regulatory gears are turning quickly. The Department of Labor has already begun issuing preliminary guidance and soliciting public feedback on implementation timelines (official source). Some large plan providers could roll out pilot programs by early next year if compliance hurdles are cleared efficiently. Expect broader adoption throughout 2026 as more product providers receive green lights from regulators.

The Bottom Line: Adaptation Is Now Essential

This executive order marks a paradigm shift for American retirement savers, a move from passive exposure to traditional markets toward active engagement with emerging asset classes like crypto and private equity. The opportunity is massive but so are the risks; education and careful planning have never been more important.

If you want your portfolio positioned for tomorrow’s growth while managing today’s volatility, stay informed as new rules take shape, and don’t hesitate to tap into expert advice as this landscape evolves.