Bitcoin’s journey from a fringe digital asset to a mainstream investment option is rewriting the rules of retirement planning. As of October 2025, Bitcoin is trading at $123,305.00, and recent regulatory changes have opened the door for Americans to include this digital gold in their 401(k) retirement accounts. If you’re intrigued by the idea of adding Bitcoin to your retirement portfolio, you’re not alone, employers and plan providers are finally catching up with investor demand.

“Adding Bitcoin to your 401(k) is no longer a hypothetical, it’s a practical reality for forward-thinking investors. “

Why Consider Bitcoin in Your 401(k) Portfolio?

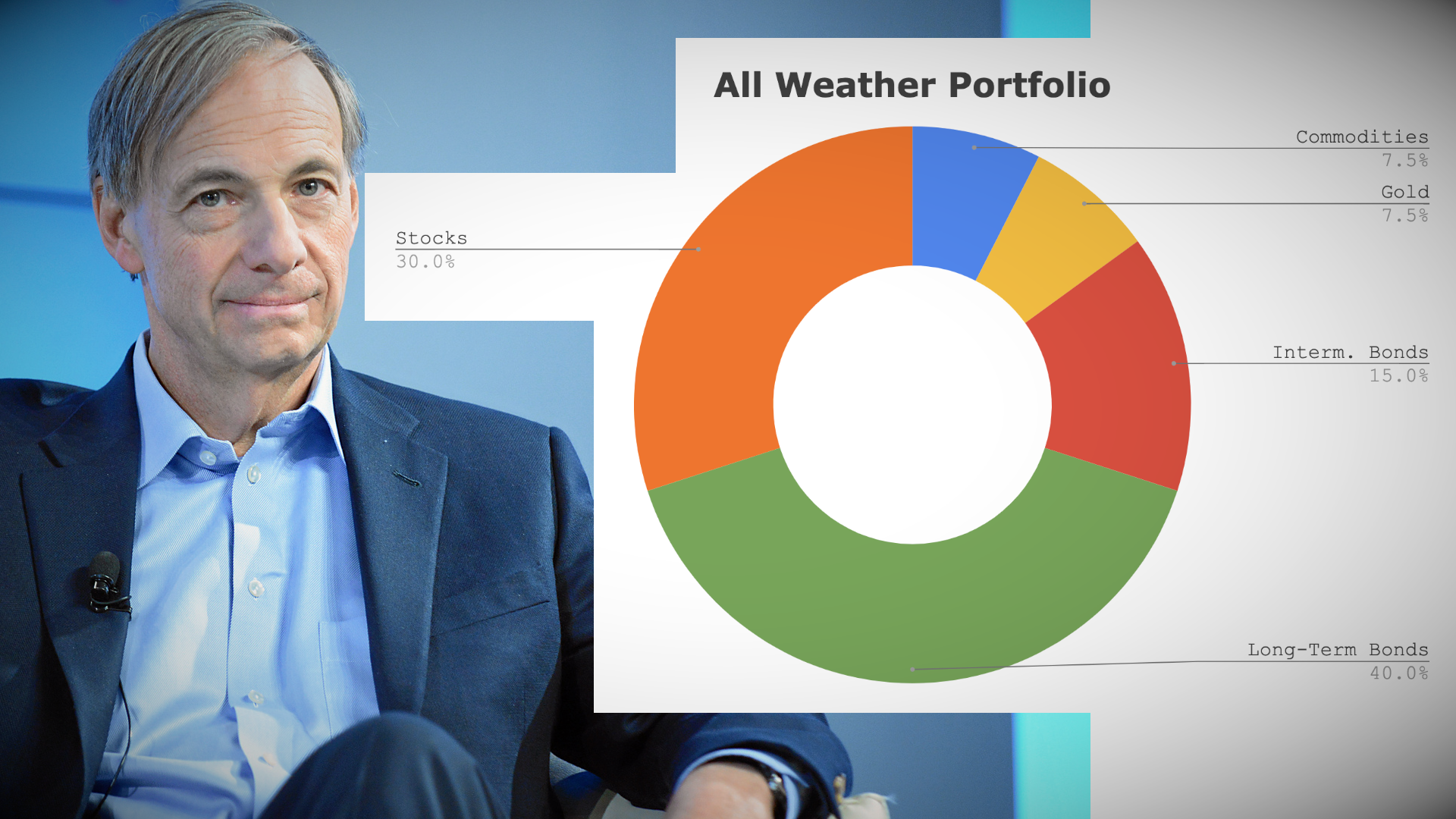

The debate around cryptocurrency in retirement accounts has shifted dramatically. Financial advisors now recognize Bitcoin as a non-correlated alternative asset class, meaning it doesn’t always move in tandem with stocks or bonds. That’s why some recommend allocating a small portion, often less than 5%: of your portfolio to crypto, providing diversification without overwhelming your risk profile.

- Diversification: Crypto can help reduce overall portfolio risk by acting independently from traditional assets.

- Growth Potential: With Bitcoin at $123,305.00, its long-term trajectory continues to attract attention from both institutional and individual investors.

- Regulatory Momentum: The August 2025 executive order has catalyzed new options for crypto exposure inside workplace retirement plans (source).

How Regulatory Changes Make This Possible

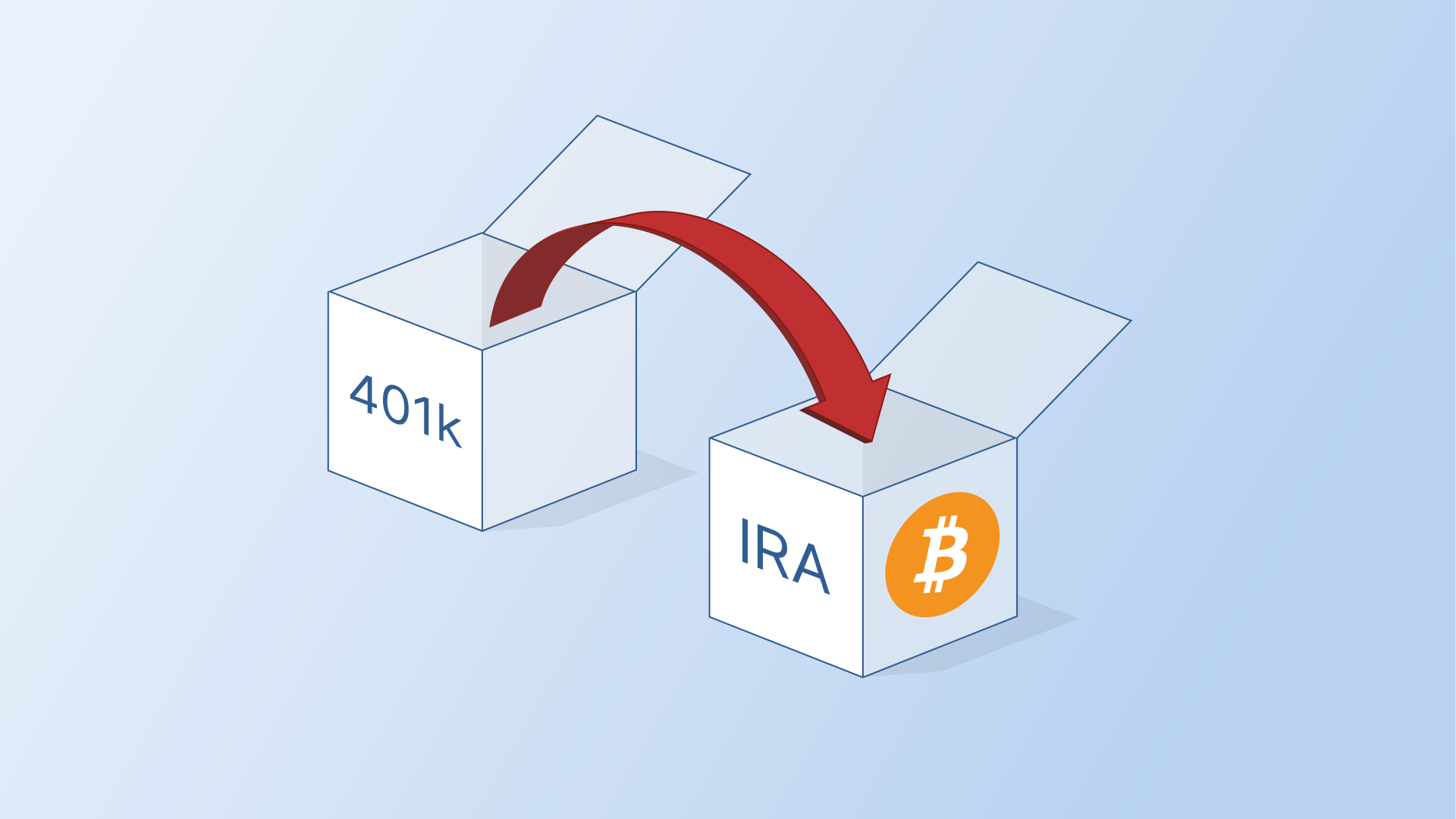

The regulatory landscape for crypto in retirement plans has evolved rapidly. In August 2025, President Trump signed an executive order instructing federal agencies to revise regulations allowing cryptocurrencies like Bitcoin in 401(k)s. This move accelerated institutional adoption and prompted major players like Fidelity Investments to offer direct crypto allocations, up to 20% of your account balance if your employer approves (source). However, not all employers have opted in yet, so availability varies by plan.

The IRS treats cryptocurrencies as property for tax purposes, so gains within a tax-advantaged account like a Roth or traditional 401(k) can grow without immediate tax consequences, a crucial advantage for long-term investors. Always check the latest IRS guidance before making allocation decisions (source).

Your Step-by-Step Guide: Adding Bitcoin to Your 401(k) in 2024

If you’re ready to explore this new frontier, here’s how you can add Bitcoin to your retirement account:

The process typically involves confirming whether your employer offers cryptocurrency as an investment option (often via a “self-directed window”), setting up access through your provider’s portal, and choosing what percentage of your contributions or existing balance you want allocated to Bitcoin or other supported digital assets.

A word of caution: Crypto remains highly volatile, even with regulatory support and institutional backing, prices can swing dramatically within days or even hours. Limiting exposure (such as Fidelity’s capped allocations) helps manage this risk while still letting you benefit from potential upside.

Bitcoin (BTC) Price Prediction 2026-2031

Professional outlook based on current market trends, regulatory momentum, and institutional adoption for Bitcoin as a 401(k) asset (as of October 2025, BTC price: $123,305)

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Market Scenario Summary |

|---|---|---|---|---|---|

| 2026 | $105,000 | $128,000 | $155,000 | +3.8% | Regulatory changes finalized; moderate volatility as adoption grows in retirement plans. |

| 2027 | $110,000 | $138,000 | $175,000 | +7.8% | Increased 401(k) participation, institutional FOMO, but macroeconomic uncertainty persists. |

| 2028 | $120,000 | $150,000 | $200,000 | +8.7% | Bitcoin halving cycle drives momentum; global adoption expands. |

| 2029 | $140,000 | $170,000 | $235,000 | +13.3% | Bullish cycle as BTC gains status as a mainstream retirement asset; tech upgrades boost scalability. |

| 2030 | $160,000 | $192,000 | $275,000 | +12.9% | Strong institutional presence; ETF inflows and 401(k) allocations increase. |

| 2031 | $185,000 | $217,000 | $320,000 | +13.0% | Peak adoption in retirement accounts, but market faces increased competition and regulatory scrutiny. |

Price Prediction Summary

Bitcoin’s integration into 401(k) plans is a major catalyst for institutional adoption over the next six years. While short-term volatility remains likely, the long-term trend points to steady price appreciation, especially with regulatory clarity and growing retirement account allocations. Both minimum and maximum projections reflect potential bear and bull market cycles, with technological improvements and macroeconomic factors influencing yearly outcomes.

Key Factors Affecting Bitcoin Price

- Regulatory clarity enabling broader 401(k) access to Bitcoin

- Institutional adoption and retirement account flows

- Bitcoin halving cycles and supply dynamics

- Global macroeconomic environment (inflation, interest rates, risk appetite)

- Technological advancements (scalability, security)

- Competition from other digital assets or traditional investments

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Choosing to add Bitcoin to your 401(k) is a bold move, but it’s one that’s becoming more accessible and mainstream by the month. As you weigh this decision, keep in mind that your employer’s plan rules will determine whether you can access a crypto window and how much of your account you can allocate. For example, Fidelity allows up to 20%, while other providers may set lower caps or restrict crypto entirely. If your plan doesn’t currently offer Bitcoin, consider voicing your interest, employers are increasingly responsive as demand grows.

Key Considerations Before You Invest

Before making any allocation, ask yourself these questions:

Checklist Before Adding Bitcoin to Your 401(k)

-

Check if Your Employer Offers Bitcoin: Not all 401(k) plans include cryptocurrency options. Confirm with your HR department or plan administrator whether Bitcoin is available as an investment choice.

-

Understand Provider Policies (e.g., Fidelity): Major providers like Fidelity Investments may allow up to 20% of your 401(k) to be allocated to Bitcoin, but this depends on employer approval and plan specifics.

-

Review Regulatory Updates: As of October 2025, new regulations are being rolled out to support Bitcoin in 401(k) plans. Stay updated on federal guidelines and your plan’s compliance.

-

Assess Your Risk Tolerance: Bitcoin is highly volatile, with the current price at $123,305.00 (as of October 2025). Decide how much risk you’re comfortable taking with your retirement savings.

-

Limit Your Exposure: Financial advisors recommend keeping crypto allocations small—often no more than 5% of your 401(k)—to help manage risk.

-

Consider Tax Implications: Understand how holding Bitcoin in a tax-advantaged account like a 401(k) or Roth 401(k) may impact your taxes now and in retirement.

-

Research Custody and Security Measures: Ensure your plan provider uses secure, reputable custodians for digital assets to protect your retirement funds from theft or loss.

-

Consult a Financial Advisor: Speak with a certified financial planner or retirement specialist to determine if adding Bitcoin aligns with your long-term goals.

Volatility: Even with Bitcoin’s current price at $123,305.00, history shows rapid price swings are the norm. Are you comfortable with seeing sharp drops (and gains) in the value of your retirement savings?

Long-Term Horizon: Crypto markets can be unpredictable in the short run but may reward patient investors over years or decades. Align your allocation with your time horizon and risk tolerance.

Tax Implications and Fees: While tax-advantaged accounts shelter you from immediate capital gains taxes, some providers charge additional fees for crypto transactions or custody. Read the fine print before proceeding.

Staying Informed: Best Practices for Crypto 401(k) Investors

The landscape is evolving quickly, so staying informed is crucial. Regularly review:

- Your Plan Rules: Providers may update crypto allocation limits or available coins as regulations change.

- IRS Guidance: The tax treatment of digital assets could evolve as adoption increases (see latest IRS rules here).

- Market Conditions: Check real-time prices and trends before rebalancing or making new contributions.

Is Adding Bitcoin Right for Your Retirement Strategy?

No single asset fits every investor’s needs, especially one as dynamic as Bitcoin. If you’re interested in portfolio diversification and believe in the long-term value proposition of digital assets, allocating a small portion (such as 1-5%) could make sense within an overall balanced strategy. Remember: You don’t have to go all-in to benefit from potential upside.

The most successful retirement portfolios are built on education, discipline, and adaptability, not hype or fear.

The path forward is clear: With regulatory barriers falling and institutional support growing, adding Bitcoin to your 401(k) is now a practical option for many Americans. Just proceed thoughtfully, monitor developments closely, and keep your long-term goals front and center as this exciting chapter in retirement investing unfolds.