On August 7,2025, President Donald Trump signed an executive order that could fundamentally reshape how Americans approach their retirement savings. By directing the Department of Labor and the Securities and Exchange Commission (SEC) to expand access to alternative assets in 401(k) plans, the Trump crypto retirement plan is poised to bring digital assets like Bitcoin and Ethereum into the mainstream of retirement investing. This move is more than a regulatory tweak – it signals a seismic shift in how individuals can diversify and potentially grow their nest eggs for the future.

What the Executive Order Means for 401(k) Investors

The core of the crypto in 401k executive order is about democratizing access to alternative assets. For years, 401(k) participants have been limited to traditional investments such as stocks, bonds, and mutual funds. Now, with this executive order, plan sponsors can consider adding cryptocurrencies, private equity, and real estate to their investment menus, subject to evolving fiduciary standards. The Department of Labor has been tasked with revising ERISA guidelines to accommodate these new asset classes, while the SEC is expected to clarify regulatory pathways for crypto inclusion.

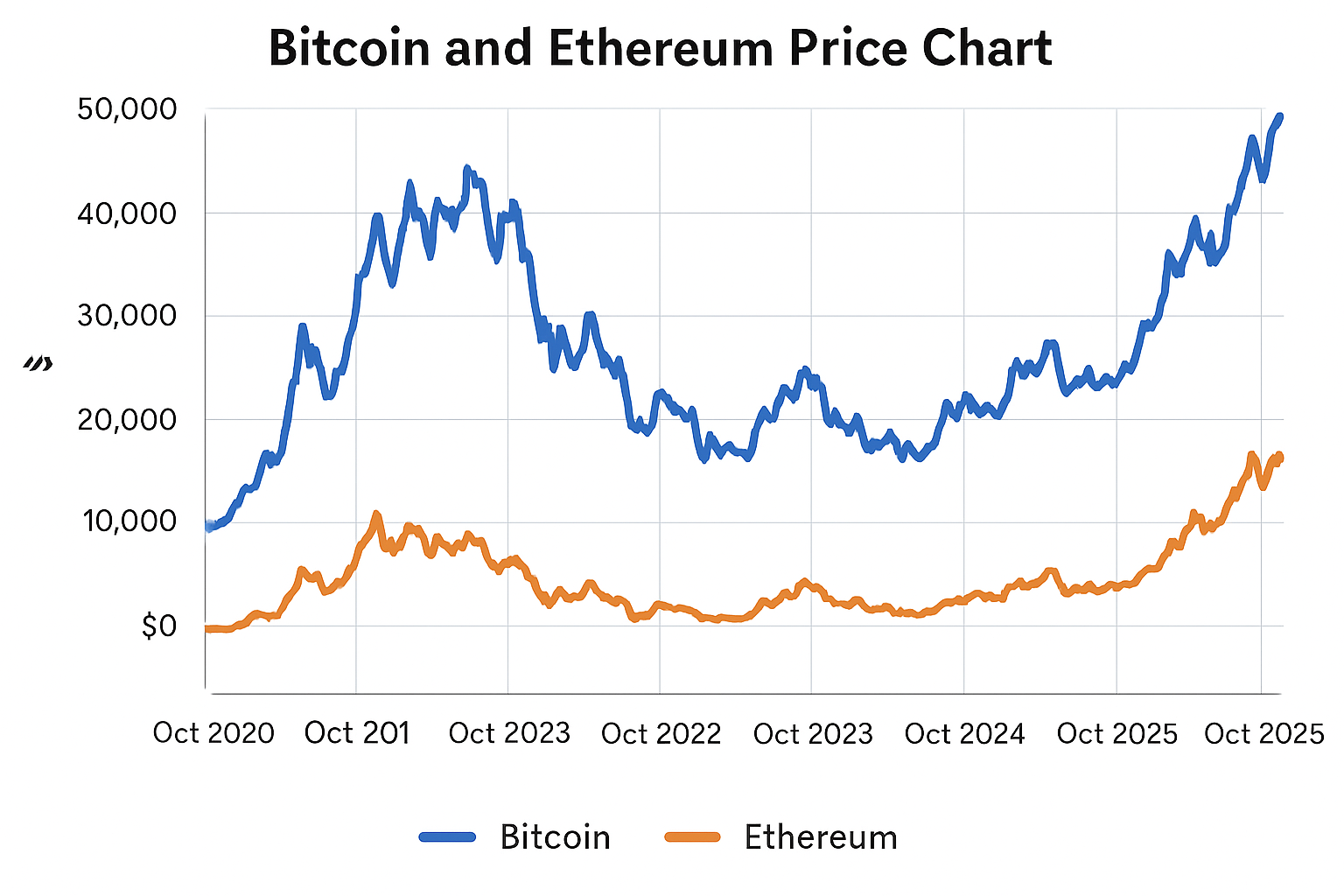

For investors, this opens doors to assets that were once the exclusive domain of institutional players or high-net-worth individuals. The timing is striking: as of October 8,2025, Bitcoin (BTC) is trading at $121,827, having experienced a 1.75% dip in the last 24 hours, while Ethereum (ETH) sits at $4,457.03, down 4.68%. These price points highlight both the appeal and the volatility of digital assets, underscoring why this policy change is generating such intense debate.

Why Crypto in Retirement Accounts Is a Game Changer

The inclusion of cryptocurrencies in 401(k) plans is not merely about chasing outsized returns. It’s about portfolio diversification in an era where traditional asset correlations are shifting. Over the past decade, Bitcoin and Ethereum have outperformed most traditional assets, albeit with much higher volatility. For younger investors or those with a higher risk appetite, the chance to allocate a portion of their retirement savings to crypto could be a compelling value proposition.

But the risks are real. Digital assets are notorious for dramatic price swings and regulatory uncertainty. The executive order acknowledges this by instructing regulators to balance innovation with investor protections. As fiduciary standards evolve, plan sponsors will need to carefully consider how to structure these offerings – including limits on allocation, education requirements, and ongoing risk assessments.

How Will This Impact Your Retirement Strategy?

If you’re planning your retirement strategy today, the Trump executive order means you could soon have access to a broader palette of investment options within your 401(k). Imagine allocating a small percentage of your portfolio to Bitcoin at its current price of $121,827 or Ethereum at $4,457.03. The potential for growth is significant, but so is the risk of short-term drawdowns or regulatory changes that could impact asset values.

It’s crucial to approach crypto 401(k) investment with the right mindset: not as an all-or-nothing bet, but as one component of a diversified portfolio. Financial advisors recommend starting small, understanding the unique risks, and staying informed as regulations evolve. For those nearing retirement, stability remains paramount; for younger savers, the calculus may tilt more toward growth and innovation.

Bitcoin (BTC) Price Prediction for 401(k) Investors: 2026-2031

Professional outlook based on the impact of the 2025 Executive Order allowing crypto in 401(k)s, current market conditions, and adoption trends.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $95,000 | $135,000 | $180,000 | +11% | Post-EO inflows drive demand, but volatility and regulatory uncertainty persist. Bearish scenario: macro headwinds or ETF rejections. Bullish: rapid 401(k) adoption. |

| 2027 | $110,000 | $155,000 | $220,000 | +15% | 401(k) adoption grows, institutional interest increases. Bearish: tech setbacks or tax clampdowns. Bullish: further regulatory clarity and increased pension fund exposure. |

| 2028 | $125,000 | $175,000 | $260,000 | +13% | Mainstream acceptance in retirement portfolios. Bearish: global recession or hacking incidents. Bullish: Layer 2 scaling and new use cases increase utility. |

| 2029 | $140,000 | $200,000 | $320,000 | +14% | Bitcoin seen as digital gold in retirement accounts. Bearish: severe crypto-specific regulation. Bullish: US/Europe harmonize crypto rules, boosting confidence. |

| 2030 | $160,000 | $230,000 | $380,000 | +15% | Wider global retirement fund integration. Bearish: competing technologies (e.g., CBDCs) gain traction. Bullish: generational wealth transfer increases crypto exposure. |

| 2031 | $175,000 | $260,000 | $440,000 | +13% | Full normalization in retirement investing. Bearish: security vulnerabilities or major exchange failures. Bullish: further institutionalization and integration with other asset classes. |

Price Prediction Summary

Bitcoin’s inclusion in 401(k) plans following the 2025 Executive Order is likely to drive long-term demand and price appreciation, albeit with continued volatility. Average prices are projected to rise steadily, reflecting increased adoption, institutional participation, and regulatory maturation. Min/max ranges account for both bullish and bearish outcomes, including macroeconomic shifts and crypto-specific events. BTC could evolve into a core asset for retirement portfolios by 2031, but investors should weigh risks and diversify accordingly.

Key Factors Affecting Bitcoin Price

- Impact of the 2025 Executive Order on 401(k) investment flows

- Ongoing US and global regulatory developments

- Institutional and pension fund adoption rates

- Bitcoin’s perceived role as digital gold and inflation hedge

- Market cycles (halvings, bull/bear phases)

- Technological improvements (scalability, security)

- Competition from other digital assets and traditional alternatives

- Macroeconomic environment (inflation, interest rates, recessions)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As the landscape changes, staying educated will be key. For deeper analysis of how these regulatory changes may reshape 401(k) allocations, see this detailed breakdown.

With the regulatory floodgates opening, plan sponsors and participants alike are entering uncharted territory. The mechanics of integrating crypto into 401(k)s are complex, involving new custodial solutions, compliance protocols, and ongoing monitoring to ensure fiduciary responsibilities are met. Expect robust debate within the financial community about the optimal percentage of a retirement portfolio that should be allocated to digital assets, especially as price volatility remains a defining feature.

Key Considerations Before Adding Crypto to Your 401(k)

Key Risks and Opportunities of Crypto in 401(k)s

-

Potential for Higher Returns: Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have delivered substantial long-term gains, with Bitcoin currently priced at $121,827 and Ethereum at $4,457.03. Including crypto in your 401(k) could offer new avenues for growth and diversification.

-

Extreme Volatility: Crypto assets are known for sharp price swings. For example, Bitcoin’s price recently fluctuated between $120,701 and $125,094 in a single day. Such volatility can lead to significant gains—or losses—especially for retirement savers.

-

Regulatory Uncertainty: The executive order instructs the Department of Labor and SEC to review rules, but the regulatory landscape for crypto in retirement accounts remains unsettled. Future changes could impact how these assets are held or taxed in your 401(k).

-

Custody and Security Risks: Storing digital assets in retirement accounts introduces new security concerns. Major custodians like Fidelity Digital Assets and Coinbase Custody are developing solutions, but risks of hacking and loss persist.

-

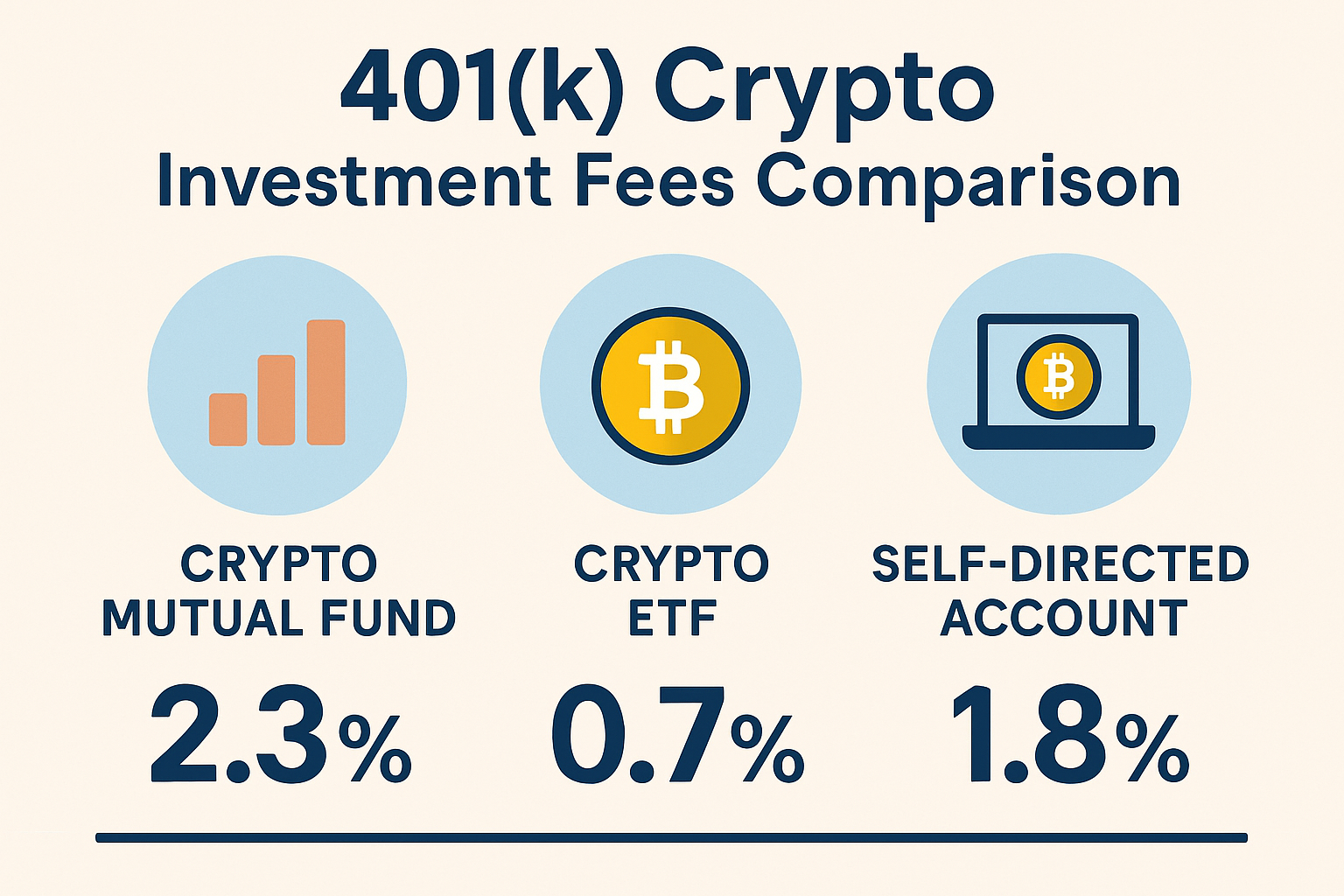

Higher Fees and Limited Choices: Crypto investment options in 401(k)s may come with higher management and custody fees compared to traditional mutual funds or ETFs. Review your plan’s fee structure before allocating retirement savings to digital assets.

-

Portfolio Diversification: Adding crypto can diversify your retirement portfolio beyond stocks and bonds, potentially reducing overall risk if managed carefully. However, overexposure may increase volatility, so balance is key.

-

Suitability for Different Investors: Crypto may not be appropriate for everyone—especially those nearing retirement or with low risk tolerance. Financial advisors recommend assessing your time horizon and risk appetite before investing.

As you weigh this new opportunity, consider the following:

- Volatility: Bitcoin’s current price of $121,827 can swing thousands of dollars in a single day. Ethereum, now at $4,457.03, is no stranger to double-digit percentage moves. Such swings can be unnerving, especially for those close to retirement age.

- Custody and Security: Safeguarding crypto assets within a retirement plan demands robust custodial solutions. Unlike stocks or bonds, digital assets require advanced cybersecurity and insurance protocols.

- Fees: Expect higher costs compared to traditional assets. Crypto investments often involve additional layers of management, security, and transaction fees, which can eat into returns over time.

- Regulatory Flux: The executive order is a first step, but the regulatory landscape is still evolving. Future changes could impact how crypto is taxed, reported, or even permitted in retirement accounts.

For those ready to embrace this new asset class, education is non-negotiable. Understanding blockchain fundamentals, wallet management, and the nuances of tax reporting will be crucial as crypto transitions from a speculative asset to a mainstream retirement option. The Department of Labor’s forthcoming guidance will be essential reading for both plan sponsors and participants.

What’s Next? Navigating the New Era of Crypto Retirement Planning

The Trump crypto retirement plan is likely to accelerate innovation across the retirement industry. Expect a wave of new investment products, from diversified crypto index funds to actively managed digital asset portfolios tailored specifically for 401(k)s. Some providers are already piloting educational modules and risk assessment tools to help investors make informed decisions about crypto allocations.

Still, this is not a one-size-fits-all revolution. For many, the prudent path will be a modest allocation, perhaps 1-5% of a portfolio, while maintaining a core of traditional assets. The ability to rebalance and adjust as market conditions and regulations evolve will be a key advantage for proactive savers.

As the dust settles, the real winners will be those who combine innovation with discipline. Whether you’re intrigued by Bitcoin at $121,827 or see Ethereum’s $4,457.03 as a long-term growth engine, the new rules of retirement investing demand both curiosity and caution.

For more on how these changes could impact your portfolio construction, check out this in-depth guide.

Action Steps for Forward-Thinking Investors

- Consult with your plan administrator about upcoming crypto options and regulatory updates.

- Assess your risk tolerance and investment horizon before allocating to digital assets.

- Stay informed, regulatory guidance is evolving rapidly and will shape what’s possible in your 401(k).

Ultimately, the executive order marks a pivotal moment in American retirement planning. As crypto and other alternative assets become accessible to all, the responsibility to invest wisely, and the opportunity to capture future growth, rests squarely with each individual saver.