As of October 2025, adding Bitcoin to your 401(k) is no longer a futuristic fantasy. With Bitcoin (BTC) trading at $121,879.00, and regulatory changes making crypto more accessible, forward-thinking retirement savers are exploring how to diversify their portfolios with digital assets. This step-by-step guide demystifies the process and helps you assess if Bitcoin belongs in your retirement plan.

Regulatory Shifts: Crypto’s Green Light in 401(k)s

The regulatory climate for crypto retirement investing has shifted dramatically. In May 2025, the U. S. Department of Labor (DOL) rescinded its 2022 guidance that urged plan sponsors to use “extreme care” with cryptocurrencies. Now, plan fiduciaries can evaluate digital assets like Bitcoin under the same ERISA standards as traditional investments. This change opens the door for more employers and providers to offer crypto in their 401(k) menus. Learn more about the DOL’s updated stance.

Is Your Employer On Board?

Before you start allocating funds, check whether your employer’s 401(k) plan offers access to Bitcoin or other cryptocurrencies. While providers like Fidelity have paved the way for crypto integration, not all workplace plans have adopted these options. Contact your HR department or plan administrator for details. Some companies now allow up to 20% of your account balance to be allocated to Bitcoin, but limits vary by employer.

Bitcoin 401(k) Providers and Plan Mechanics

Fidelity Investments set the tone in April 2022 by announcing that employees could allocate a portion of their retirement savings to Bitcoin, provided their employer opted in. Now, in late 2025, Fidelity and a handful of other major players offer direct Bitcoin exposure within select 401(k) plans. For most plans, the process is streamlined:

- Select Bitcoin as an investment option within your plan portal (if available).

- Choose your allocation percentage. Some plans cap this at 5%, others allow up to 20%.

- Review fees and disclosures. For example, Fidelity charges an annual fee between 0.75% and 0.9% on crypto allocations, plus trading fees. See how Fidelity’s Bitcoin 401(k) works.

Current Market Snapshot: Bitcoin Holds at $121,879.00

The current price of Bitcoin is $121,879.00, reflecting its entrenched position as a major asset class. This valuation is important context as you weigh the potential risks and rewards of adding BTC to your retirement savings.

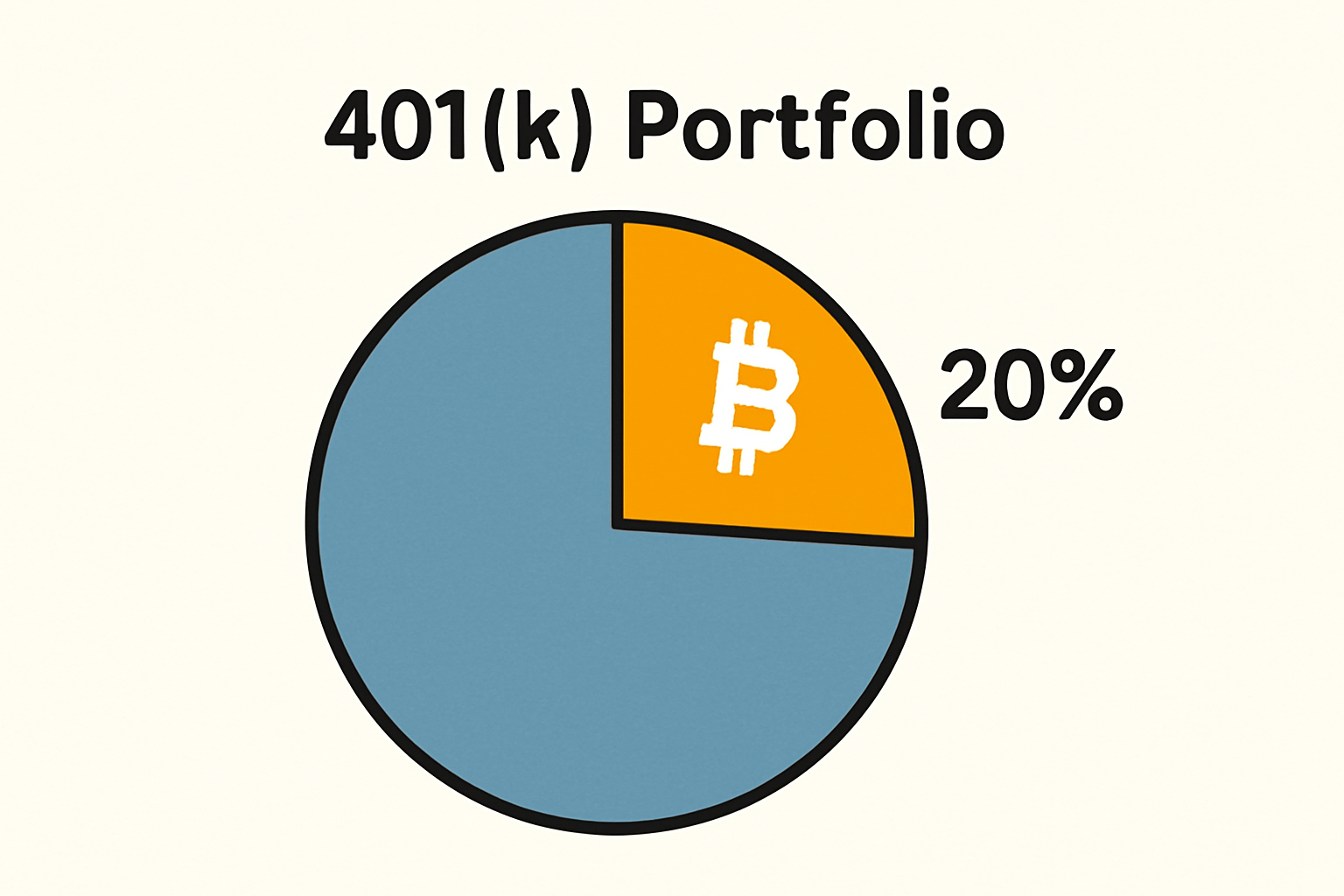

Allocating Wisely: How Much Bitcoin Should You Add?

Crypto’s volatility means it should be approached with caution in any retirement portfolio. Many experts recommend keeping your allocation modest – often between 1% and 5% of your total 401(k) balance. This strategy allows you to participate in potential upside without overexposing yourself to risk. Some plans now allow up to 20%, but that level is only appropriate for investors with high risk tolerance and long time horizons.

Up next, we’ll explore practical risk management tips, IRS rules for crypto in retirement accounts, and how to monitor your new digital asset allocation over time.

Risk Management: Safeguarding Your Crypto 401(k)

Investing in Bitcoin through your 401(k) brings both opportunity and uncertainty. Unlike traditional assets, Bitcoin’s price can swing dramatically, as seen with its current value at $121,879.00: a figure that could shift significantly in a short time frame. To manage this volatility:

Risk Management Strategies for Bitcoin in Your 401(k)

-

Set Allocation Limits: Limit your Bitcoin exposure to a small percentage of your 401(k) portfolio. For example, Fidelity allows up to 20% allocation, but many experts recommend capping crypto investments at 5% or less to reduce risk.

-

Rebalance Your Portfolio Regularly: Schedule periodic reviews (e.g., quarterly or annually) to adjust your Bitcoin holdings back to your target allocation. This helps lock in gains and manage volatility as Bitcoin’s price—currently $121,879.00—fluctuates.

-

Use Dollar-Cost Averaging (DCA): Invest a fixed amount into Bitcoin at regular intervals, rather than making lump-sum purchases. DCA can help smooth out the impact of price swings and reduce the risk of buying at market peaks.

-

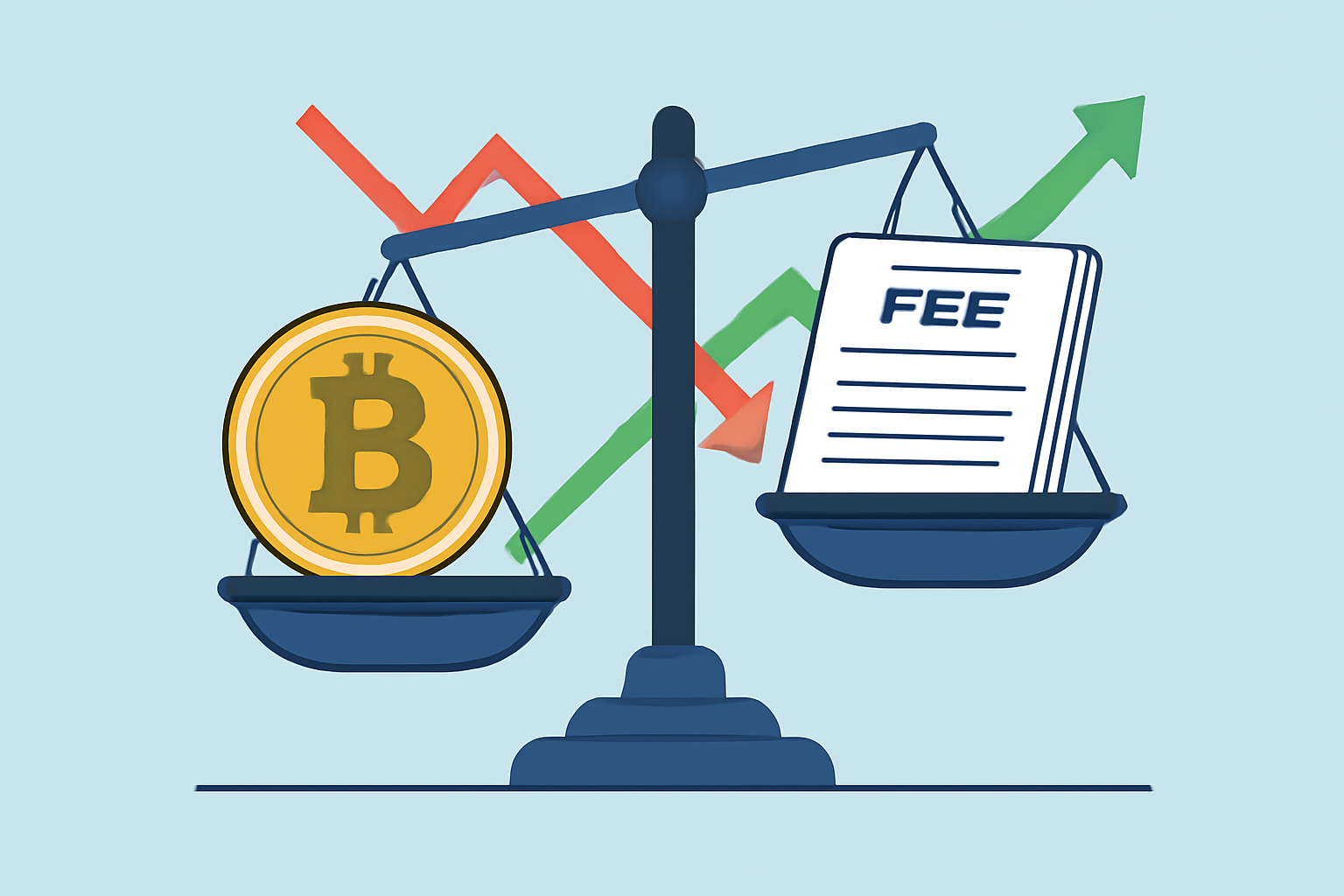

Monitor Fees and Costs: Cryptocurrency investments in 401(k) plans often come with higher fees. For instance, Fidelity charges between 0.75% and 0.9% in account fees, plus trading fees. High fees can erode long-term returns, so compare providers and fee structures.

-

Stay Informed on Regulatory Changes: The regulatory landscape for crypto in retirement accounts is evolving. Keep up with updates from the U.S. Department of Labor and your plan provider to ensure compliance and adapt your strategy as needed.

Be proactive about rebalancing your portfolio. If Bitcoin’s value surges, it could quickly exceed your intended allocation, exposing you to outsized risk. Set periodic reviews, quarterly or semi-annually, to bring your allocations back in line with your goals and risk tolerance.

IRS Guidelines: Tax Implications of Crypto in 401(k)s

One of the benefits of holding Bitcoin in a 401(k) is tax deferral. Gains made inside the plan aren’t taxed until distribution (traditional 401(k)) or may be tax-free if using a Roth 401(k), provided IRS rules are followed. However, the IRS treats cryptocurrency as property, not currency, which means recordkeeping is crucial for tracking cost basis and reporting distributions correctly. For more on the evolving IRS approach to crypto in retirement accounts, review the latest guidance on official resources or consult a tax professional familiar with digital assets.

Monitoring and Adjusting: Staying on Top of Your Crypto Allocation

Once you’ve added Bitcoin to your 401(k), ongoing monitoring is essential. Use your provider’s dashboard to track performance, fees, and allocation percentages. Many platforms now offer real-time reporting for digital asset holdings. Consider setting up alerts for major price movements, especially relevant with Bitcoin at $121,879.00: so you can respond appropriately if the market shifts.

Key Takeaways for Crypto Retirement Planning in 2025

- Access is expanding: More employers are offering Bitcoin in 401(k) plans following regulatory changes.

- Start small: Limit exposure to a modest allocation unless you have high risk tolerance and decades until retirement.

- Understand costs: Fees for crypto investments are higher than for index funds or ETFs, factor these into your decision.

- Stay informed: The legal and tax landscape is evolving; keep up with IRS rules and plan disclosures.

Ready to Add Bitcoin to Your 401(k?

If your employer’s plan offers crypto options through providers like Fidelity, the process is more accessible than ever. With Bitcoin holding at $121,879.00, digital assets are firmly on the menu for modern retirement savers willing to accept volatility in exchange for long-term growth potential. As always, balance optimism with caution, and seek expert advice when needed, to ensure your crypto retirement planning aligns with your broader financial goals.