Adding cryptocurrency to your 401(k) is no longer a pipe dream for U. S. investors. Thanks to the August 2025 executive order and rapid innovation among plan providers, digital assets like Bitcoin and Ethereum are now on the menu for retirement savers looking to diversify beyond stocks and bonds. But how do you actually get crypto in your 401k? Let’s break down the process, highlight the latest market realities, and help you navigate the evolving landscape of 401k digital assets.

Crypto in 401k: The New Frontier for U. S. Retirement Savers

The regulatory environment for crypto retirement accounts has shifted dramatically. In August 2025, President Trump signed an executive order instructing the Department of Labor and SEC to issue guidance allowing employers and plan sponsors to include private assets, including cryptocurrencies, in 401(k) plans. This move aims to democratize access to alternative investments and give everyday investors a shot at higher diversification and potentially greater long-term returns. But the rollout isn’t uniform: your access depends on your employer, your plan administrator, and the investment vehicles they offer.

Some of the largest providers, like Fidelity, have started offering direct cryptocurrency investments in select 401(k) plans, while others are taking a more cautious approach. According to the Government Accountability Office, since 2022, some retirement plans have offered the option to invest in crypto assets, but it’s still far from universal. As of October 2025, the inclusion of crypto in your 401k is a real possibility, but not a guarantee.

Step 1: Check If Your 401k Plan Supports Crypto Investments

Before you get starry-eyed about adding Bitcoin or Ethereum to your retirement nest egg, you need to confirm whether your current 401k plan offers digital asset options. Here’s how:

How to Check if Your 401(k) Allows Crypto

-

Review Your 401(k) Plan Documents: Log in to your retirement plan portal or request the Summary Plan Description (SPD) from your HR department. Look for mentions of “cryptocurrency,” “digital assets,” or “self-directed brokerage windows” in the investment options.

-

Contact Your Plan Administrator or HR: Reach out directly to your plan administrator (e.g., Fidelity, Vanguard, Empower, Charles Schwab) or your employer’s HR team. Ask if your 401(k) offers access to crypto assets or a Self-Directed Crypto Window.

-

Check for Supported Crypto Providers: Some 401(k) providers, like Fidelity Investments and ForUsAll, now offer crypto investment options. Visit your provider’s website or search their support center for information on cryptocurrency access.

-

Review Recent Plan Updates: Due to the 2025 executive order, many plans are updating their offerings. Check for recent communications from your employer or plan administrator about new investment options, including crypto.

-

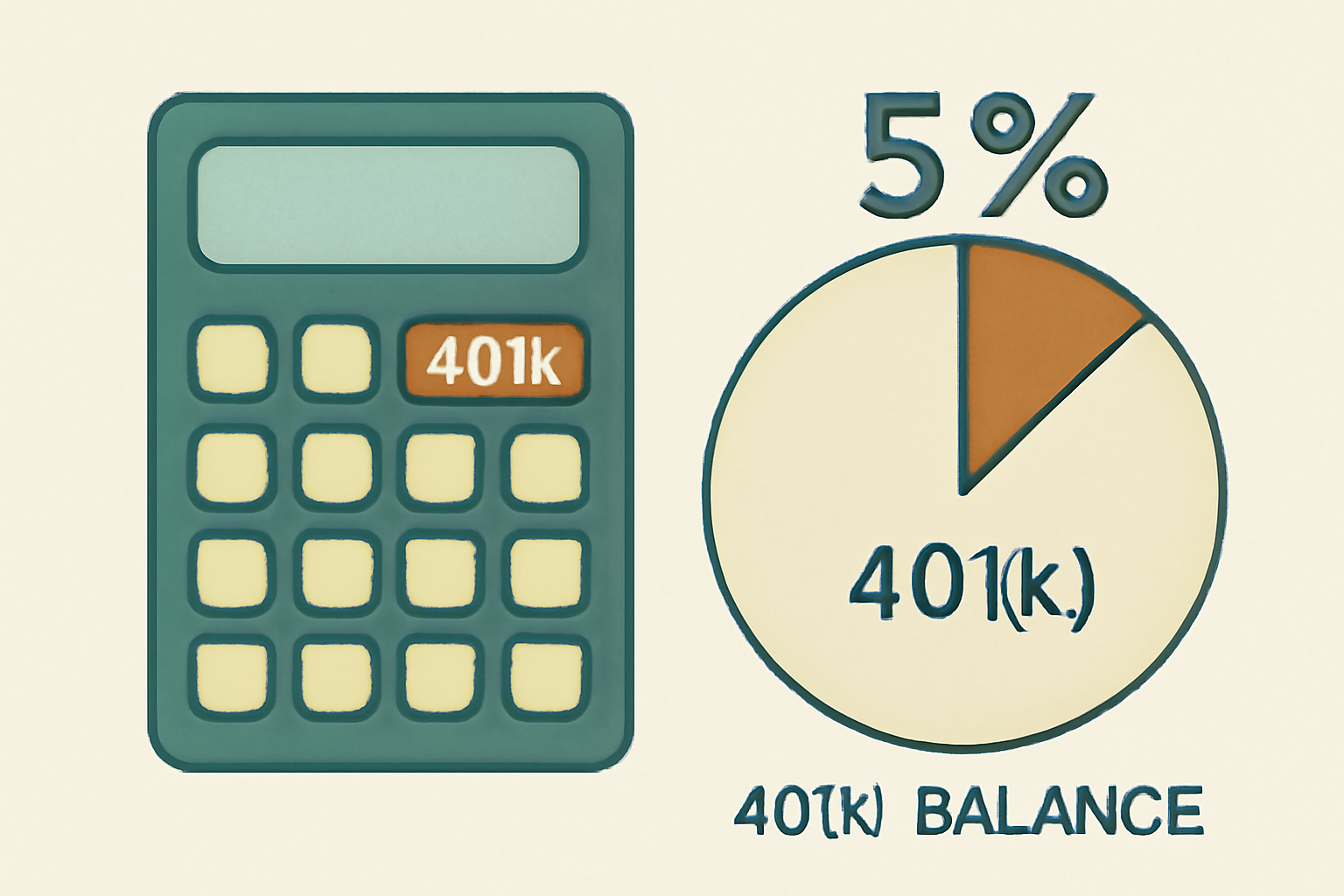

Look for Self-Directed Brokerage or Crypto Windows: Some plans allow a portion (often up to 5%) of your 401(k) balance to be invested in crypto via a self-directed window. Confirm if this feature is enabled and what cryptocurrencies are supported.

Some plans offer a Self-Directed Crypto Window, letting you allocate up to 5% of your 401(k) balance toward approved cryptocurrencies. Others may bundle crypto exposure via ETFs or trusts, while a few forward-thinking administrators allow direct purchase of select coins.

If your provider doesn’t offer crypto yet, don’t fret, market momentum and regulatory clarity are pushing more administrators to explore these options. Keep checking with your HR department or plan sponsor for updates.

Step 2: Understand the Risks and Rewards of Crypto Retirement Accounts

Crypto is a high-volatility, high-reward asset class. It’s non-correlated with traditional equities and bonds, which means it can act as a portfolio diversifier, but it comes with unique risks:

- Market volatility: Crypto prices can swing wildly in short periods, impacting your overall retirement balance.

- Regulatory uncertainty: While the recent executive order clarifies a lot, the landscape is still evolving.

- Security: Unlike stocks or mutual funds, digital assets require robust custodial solutions.

- Liquidity: Some crypto vehicles in 401ks may have limited liquidity or higher fees than traditional options.

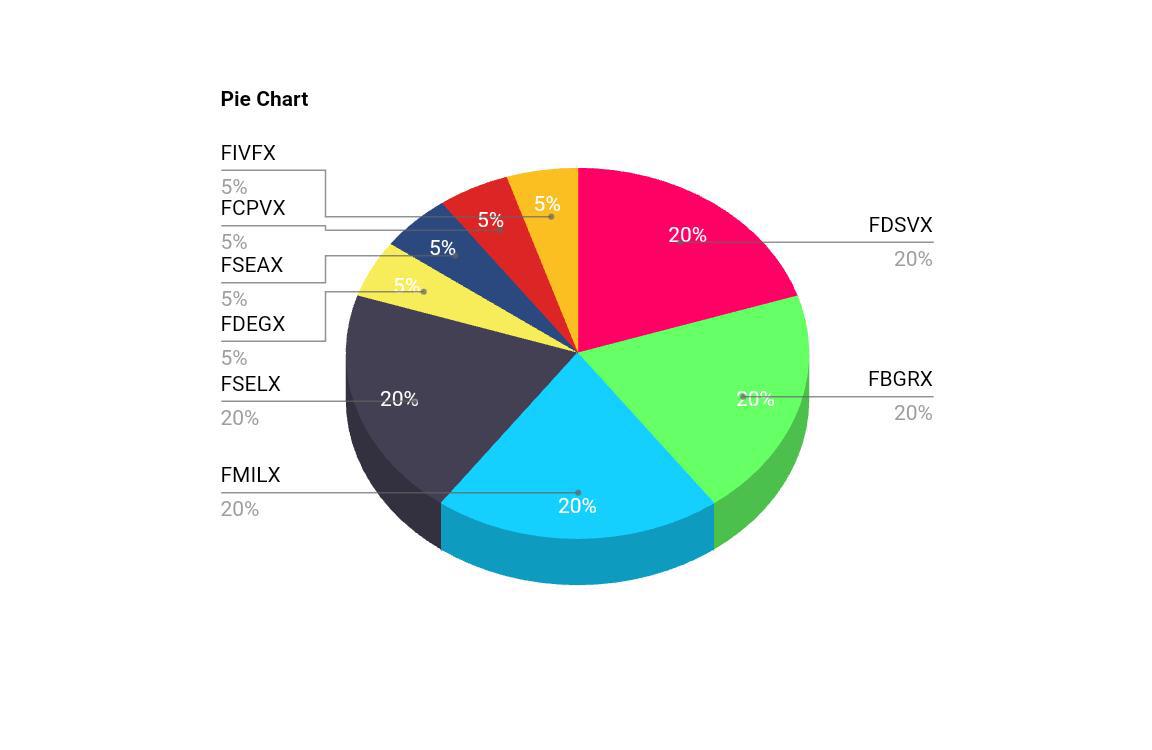

Most experts recommend capping your crypto allocation at 5% of your total 401k balance, a guideline echoed by plan providers like ForUsAll and major financial advisors. This approach lets you tap into upside potential while limiting downside risk.

Navigating US Crypto 401k Rules: What’s Allowed in 2025?

The latest guidance from the Department of Labor and the SEC gives plan sponsors significant flexibility, but also places the onus on them to perform due diligence on any crypto investment options they offer. Here’s what’s typically allowed in a modern U. S. crypto 401k:

- Direct crypto exposure: Buy and hold select cryptocurrencies within a self-directed window.

- Crypto ETFs or trusts: Access diversified baskets or single-asset funds tracking major coins.

- Capped allocations: Most plans limit crypto exposure to 5% of your total account value.

This framework is designed to balance innovation with investor protection. You’ll need to review your plan’s specific rules, as some administrators may set stricter limits or only offer indirect exposure via ETFs.

Once you’ve confirmed your plan’s crypto options and assessed the risks, it’s time to take action. The mechanics of adding digital assets to your 401k are straightforward but demand attention to detail. Here’s how to proceed:

Most platforms will prompt you to open a Self-Directed Crypto Window or select from approved crypto ETFs. You’ll typically:

- Log in to your 401k portal and navigate to the alternative investments or self-directed section.

- Choose your crypto allocation (remember the 5% cap is standard in 2025).

- Select which digital assets or funds you want, often Bitcoin, Ethereum, or a diversified ETF.

- Review fees carefully. Crypto windows may have higher admin or custody costs than traditional funds.

- Confirm your allocation and monitor performance alongside your other retirement holdings.

Some plans allow recurring contributions to your crypto window, automating your exposure over time. This can help smooth out volatility by dollar-cost averaging into the asset class.

Smart Strategies: Maximizing Your Crypto 401k Allocation

The golden rule? Keep crypto as a satellite position, not the core of your retirement portfolio. Here’s how savvy investors are approaching the new landscape:

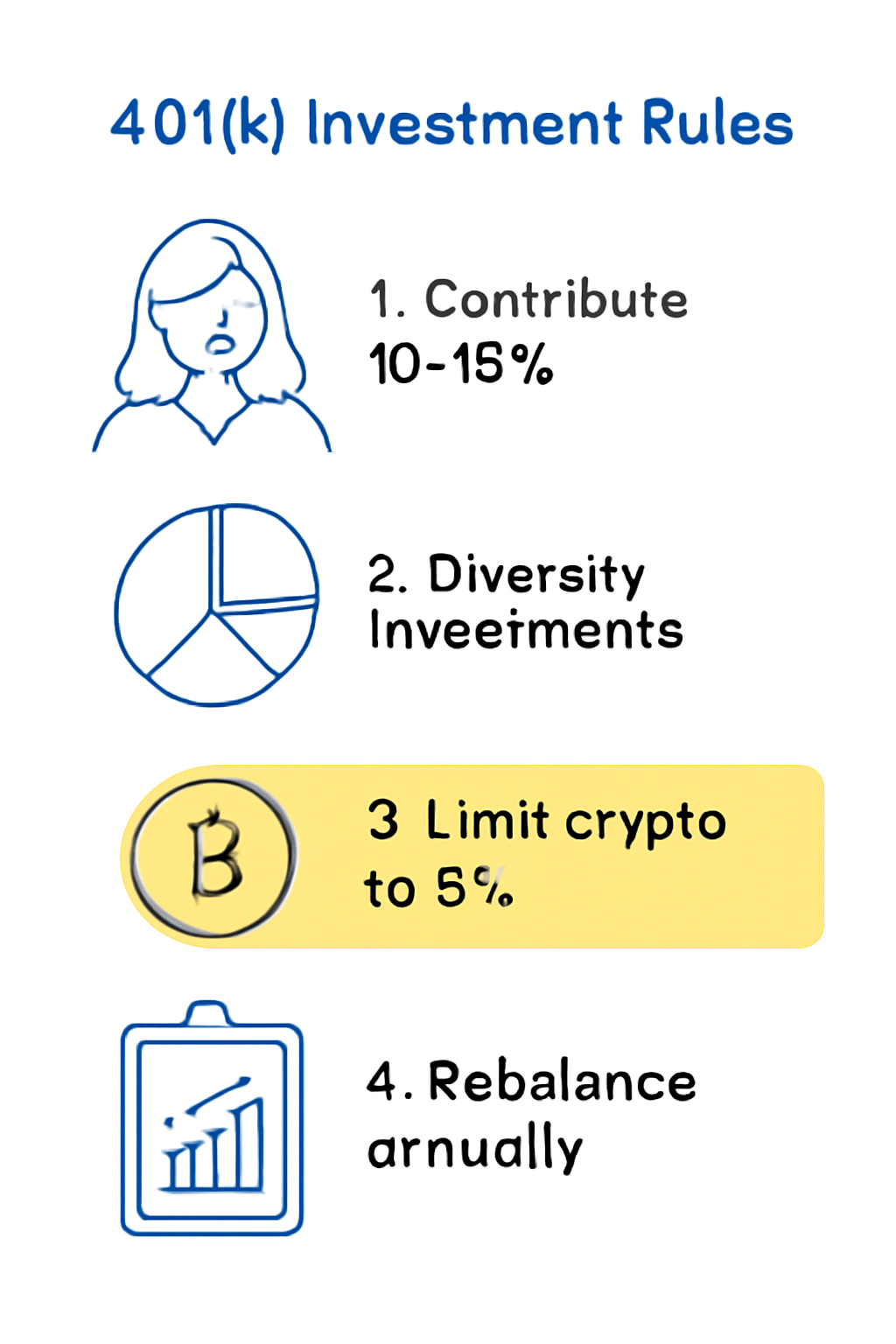

Best Practices for Managing Crypto in Your 401(k)

-

Limit Exposure to 5% or Less: Most 401(k) providers, like ForUsAll, cap crypto allocations at 5% of your portfolio to reduce risk and volatility.

-

Diversify with Traditional Assets: Pair crypto with stocks, bonds, and REITs to balance risk, as recommended by Fidelity and Charles Schwab.

-

Use Secure, Reputable Providers: Choose established platforms like Fidelity or ForUsAll that offer robust security and clear crypto options.

-

Review Plan Fees and Liquidity: Crypto options may come with higher fees and limited liquidity. Always check fee disclosures and withdrawal rules with your plan administrator.

-

Stay Updated on Regulatory Changes: The 2025 executive order expanded crypto access, but rules can change. Monitor updates from the Department of Labor and SEC.

-

Rebalance Regularly: As crypto prices fluctuate, periodically rebalance your 401(k) to maintain your target allocation.

-

Consult a Financial Advisor: Work with a fiduciary advisor experienced in crypto to tailor your allocation and manage risk.

Rebalance regularly. As crypto can be volatile, your allocation might drift above or below your target. Set a calendar reminder to check your balance each quarter, trimming or adding as needed to stay within your plan’s guidelines.

Stay informed. Regulatory changes, new investment vehicles, and market conditions can shift quickly. Bookmark authoritative resources like the Kiplinger coverage of the executive order for ongoing updates.

What’s Next: The Future of Digital Assets in US Retirement Accounts

With the regulatory floodgates open, expect more employers to roll out crypto 401k options in the coming years. But don’t expect a free-for-all. Plan sponsors and the Department of Labor are laser-focused on investor protection, so most plans will continue to limit crypto allocations and offer only the most established coins or vetted funds.

As always, diversification is your friend. Crypto can add a valuable non-correlated return stream, but it’s not a substitute for broad equity, bond, and alternative exposure. Use it to complement, not replace, your existing retirement strategy.

Want to see how digital assets are performing right now? Check the live price widget above for the latest on Bitcoin and Ethereum, essential reference points for any crypto retirement account.

Momentum is my compass. Don’t chase every trend, let the market come to you and adjust with discipline.