After years of debate and regulatory tug-of-war, the Retirement Investment Choice Act is poised to make a seismic impact on how Americans can invest for their futures. This proposed legislation aims to transform 401(k) plans by giving legal force to President Trump’s 2025 executive order, which directed the Department of Labor (DOL) to open the gates for alternative assets like private equity, real estate, and, most notably, cryptocurrencies. For forward-thinking investors and retirement savers, this is nothing short of a watershed moment.

What Is the Retirement Investment Choice Act?

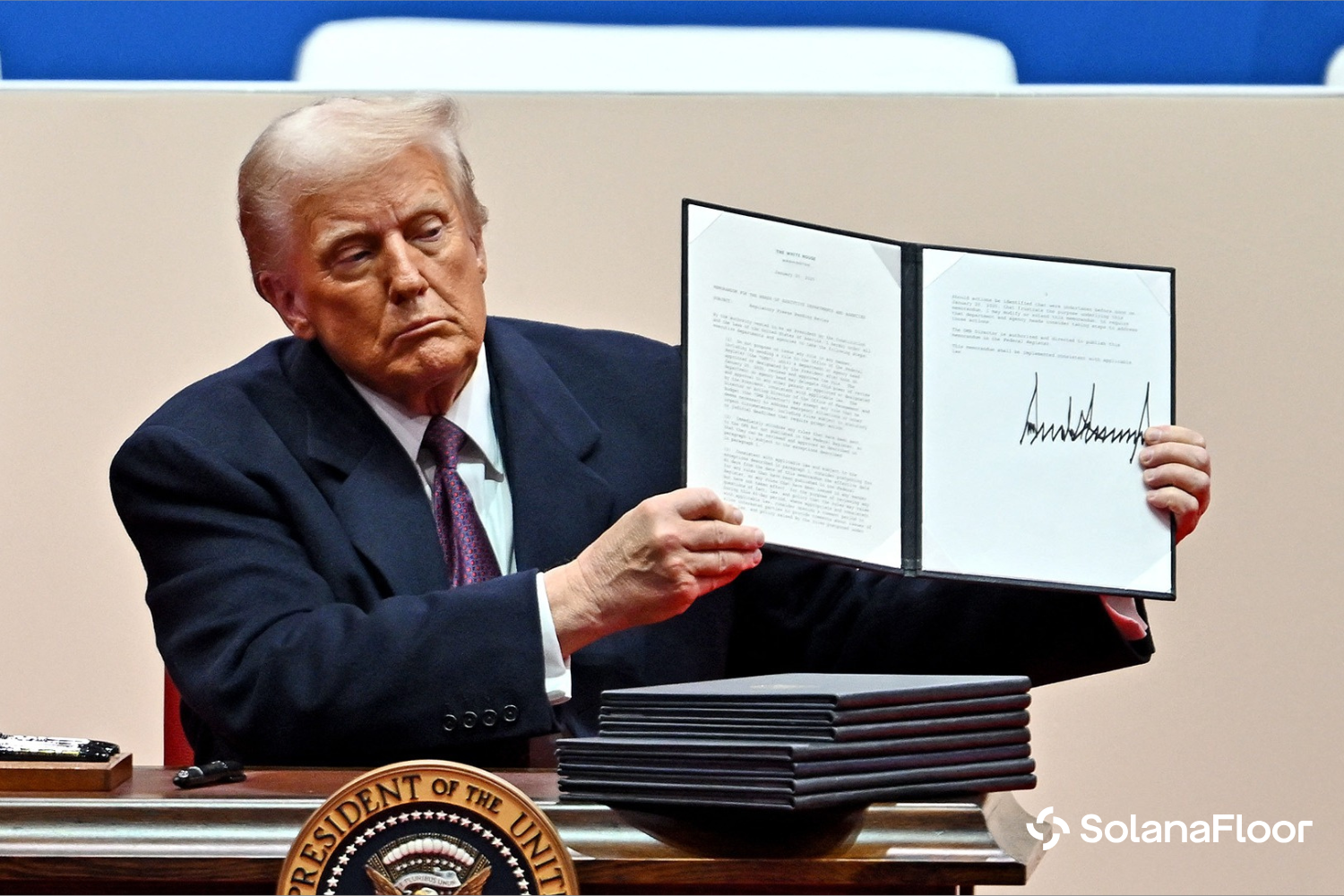

The Retirement Investment Choice Act is a new bill introduced by GOP lawmakers to cement Trump’s Executive Order 14330 as federal law. The order, signed in August 2025, instructed the DOL to revise its previous stance, which had discouraged cryptocurrencies in 401(k)s, and instead allow plan sponsors to consider digital assets alongside traditional investments. The bill’s language specifically calls for “democratizing access to alternative assets for 401(k) investors, ” pushing the DOL and SEC to eliminate regulatory barriers that have long kept crypto and other alternatives out of mainstream retirement plans.

This isn’t just about Bitcoin or Ethereum. The Act would also clear the way for private equity, real estate, and other non-traditional assets within retirement accounts, potentially reshaping portfolio construction for millions of Americans. If passed, it would force regulators to take a neutral stance: plan fiduciaries would be responsible for prudently evaluating any alternative asset, including crypto, before offering it to participants.

Key takeaway: If you’ve been waiting for a green light to add crypto to your 401(k), this could be it, but with new opportunity comes new responsibility.

How Did We Get Here? A Timeline of Crypto in 401(k)s

The path to this point has been anything but linear. In early 2020s, the DOL took a hardline stance against cryptocurrency exposure in retirement plans, citing volatility and fiduciary risk. But as crypto markets matured and institutional adoption grew, pressure mounted for regulators to reconsider. President Trump’s executive order marked a dramatic policy reversal in August 2025, tasking the DOL with removing obstacles for plan sponsors interested in alternatives, including digital assets.

By May 2025, the DOL officially rescinded its restrictive guidance and adopted a neutral position: fiduciaries must apply standard duties of prudence and loyalty when considering crypto or any other alternative asset. The Retirement Investment Choice Act seeks to give this new framework the power of law, making it harder for future administrations or agencies to roll back access.

Why Crypto in 401(k)s? Potential Benefits and Risks

Key Benefits & Risks of Crypto in Your 401(k)

-

Diversification: Adding cryptocurrencies like Bitcoin and Ethereum to your 401(k) can broaden your investment mix, reducing reliance on stocks and bonds. This diversification may help balance risk and reward over the long term.

-

Growth Potential: Major cryptocurrencies have delivered significant returns in past cycles, attracting investors seeking higher growth opportunities than traditional assets. However, past performance does not guarantee future results.

-

Inflation Hedge: Some investors view Bitcoin as a digital alternative to gold, potentially helping protect retirement savings from inflation. Its fixed supply is often cited as a key feature for this purpose.

-

Volatility: Cryptocurrency prices can swing dramatically, sometimes within hours. This high volatility can lead to significant gains but also steep losses, making crypto a risky addition to retirement accounts.

-

Regulatory Uncertainty: The legal landscape for crypto in retirement accounts is evolving. While recent executive orders and bills have eased restrictions, future regulations could impact access or tax treatment.

-

Suitability Concerns: Crypto investments may not be appropriate for everyone, especially those nearing retirement or with low risk tolerance. Financial advisors recommend careful consideration before allocating retirement funds to digital assets.

The case for allowing cryptocurrency in retirement plans is simple yet compelling: diversification and growth potential. Digital assets like Bitcoin have outperformed traditional markets over the past decade, offering an asymmetric return profile that can boost overall portfolio performance. For younger investors with long time horizons, even a modest allocation could translate into outsized gains by retirement age.

But let’s be clear, crypto is not a one-size-fits-all solution. Volatility remains high compared to stocks or bonds, and regulatory clarity is still evolving. Financial experts warn that crypto may not be appropriate for everyone, especially those nearing retirement who can’t stomach steep drawdowns. Fiduciaries will need robust processes to assess suitability and educate participants about potential risks.

The Road Ahead: What Investors Should Watch

If passed into law, the Retirement Investment Choice Act could rapidly accelerate adoption of crypto in 401(k) plans across America. But this new era won’t be without growing pains. Plan sponsors will need clear frameworks for evaluating digital assets. Investors will need guidance on how much, if any, crypto exposure makes sense for their age and risk tolerance.

For those eager to learn more about how these changes might affect their own portfolios or retirement strategies, check out our in-depth analysis on how Trump’s executive order could transform crypto 401(k) investments.

As the dust settles around the Retirement Investment Choice Act, the next phase is all about implementation. If your 401(k) provider decides to offer crypto, expect a wave of new products and educational resources aimed at helping you make sense of this evolving asset class. The onus will be on fiduciaries to ensure that any crypto options are vetted, diversified, and suitable for a broad range of plan participants, not just the most risk-tolerant investors.

For investors, this shift means more choice and more responsibility. You’ll want to ask tough questions: Which coins or tokens are available? What fees are involved? How is custody handled? And perhaps most crucially, how much of your retirement savings should you actually allocate to crypto, if any? Financial advisors are already fielding these questions, and guidance will likely evolve as the market matures and more data becomes available.

What Should You Do Now? Key Steps for Savvy Retirement Savers

Crypto 401(k) Investment Checklist: Key Steps

-

Consult a fiduciary or financial advisor with experience in alternative assets. Professional guidance helps ensure crypto aligns with your long-term retirement goals and that you understand your plan sponsor’s due diligence obligations under the new DOL rules.

-

Assess your personal risk tolerance before investing. Cryptocurrencies are known for high volatility, which may not suit every investor—especially those closer to retirement. Use tools from reputable firms like Vanguard or Charles Schwab to help gauge your comfort with market swings.

-

Review all associated fees and expenses for crypto allocations in your 401(k). Compare costs from major providers like Fidelity, Schwab, or Coinbase to ensure you understand trading fees, custody charges, and potential tax implications.

-

Start with a small allocation to crypto assets. Financial experts recommend limiting exposure to a modest percentage of your portfolio—often no more than 5%—to manage risk while exploring potential growth.

-

Monitor regulatory updates and plan changes regularly. Stay informed about new guidance from the Department of Labor and the SEC that could impact your crypto holdings in retirement accounts.

Early adopters may benefit from first-mover advantage, but it pays to be strategic. Start small, diversify, and keep a close eye on both regulatory developments and market volatility. Remember: just because you can add crypto to your 401(k) doesn’t mean you should go all in. A disciplined, long-term approach, grounded in research and professional advice, remains your best bet for retirement success.

If you’re intrigued by the potential upside but wary of the risks, you’re not alone. Many plan sponsors are expected to take a cautious approach, rolling out pilot programs or limiting allocations to a small percentage of total assets. Over time, as more data becomes available on performance and participant outcomes, we’ll get a clearer picture of how crypto fits into the broader retirement landscape.

For a deeper dive into how these regulatory shifts could unlock new opportunities, and what to watch for as crypto 401(k) options roll out, don’t miss our feature on how Trump’s executive order allowing crypto in 401(k)s could transform your retirement strategy.

The bottom line? The Retirement Investment Choice Act is a game-changer for anyone looking to future-proof their nest egg with digital assets. But as with any new frontier, knowledge is your greatest ally. Stay informed, stay diversified, and keep your eyes on the horizon, because growth, after all, is the only evidence of life.