With Bitcoin recently holding steady at $107,075.00, more Americans are asking: Can I add Bitcoin to my 401K in 2024? The answer is increasingly yes, as evolving regulations and new retirement plan offerings open the door to digital assets within traditional retirement accounts. If you’re eager to diversify your retirement savings and tap into crypto’s unique growth potential, it’s essential to understand each step before diving in.

Why Consider Adding Bitcoin to Your 401K?

Bitcoin’s role as a non-correlated alternative asset has become a hot topic among financial advisors and retirement planners. As traditional markets fluctuate, Bitcoin’s performance can move independently, potentially helping to reduce portfolio risk when used thoughtfully. The IRS has clarified that crypto can be held in retirement accounts, and some plan providers now offer direct access or ETF-based exposure.

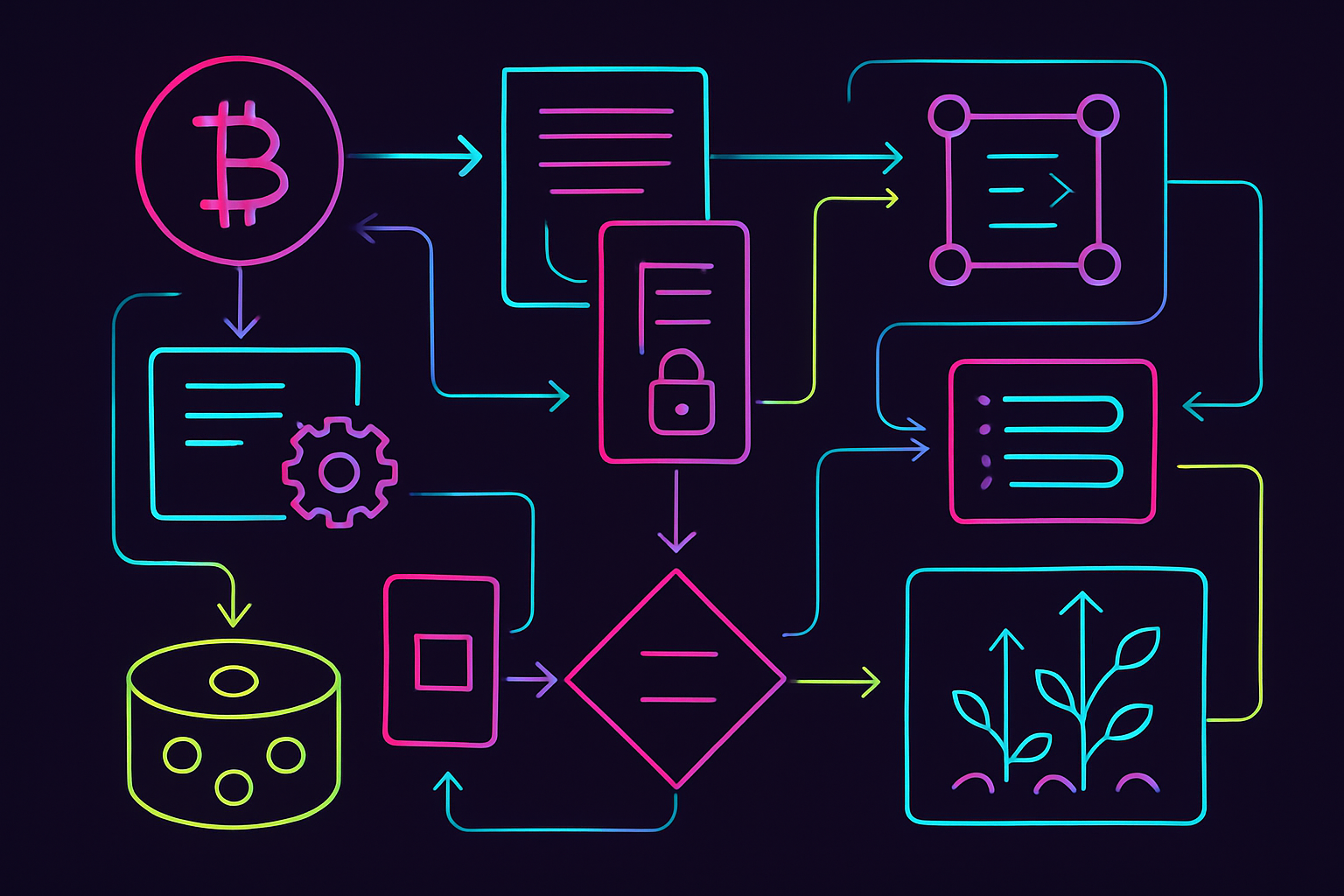

However, adding Bitcoin to your 401K isn’t as simple as buying a stock or mutual fund. It comes with unique risks, regulatory requirements, and plan-specific hurdles. Let’s break down what you need to know and how to get started.

Step-by-Step Guide: How to Add Bitcoin to Your 401K in 2024

Checking If Your 401K Allows Bitcoin Investments

The first step is reviewing your current 401K plan options. Not all employers or plan providers offer crypto access yet. Look for a self-directed brokerage window or ask about crypto-specific accounts, such as Fidelity’s Digital Assets Account or a Self-Directed Crypto Window from providers like ForUsAll. As of this year, some plans allow up to 20% of your 401K balance to be allocated to Bitcoin, but many employers set lower limits, sometimes as little as 5%.

If your plan doesn’t currently support crypto, you’re not alone. According to recent GAO and CNBC reports, roughly 40% of plans now offer some form of self-directed option, but the majority still do not. This is rapidly changing as regulatory clarity improves and demand grows.

If your employer hasn’t added crypto options yet, consider voicing your interest to HR or your plan administrator. Demand is a key driver for expanding investment menus.

Understanding Limits, Fees, and IRS Rules for Crypto 401Ks

Before making any allocation, it’s crucial to understand the investment limits, fees, and IRS rules for crypto 401Ks. For example, Fidelity’s Digital Assets Account may allow up to 20% allocation, but some plans restrict this to 5%. Fees for crypto investments in 401Ks can be higher than traditional assets, sometimes including custodial, trading, and administrative charges.

Additionally, most plans require investors to complete educational modules about crypto’s risks and volatility before investing. This is designed to help you make informed decisions and avoid emotional pitfalls during periods of price swings.

For a deeper dive into IRS rules on crypto in retirement plans and the latest policy changes, see our guide: How to Add Bitcoin to Your 401K: Step-by-Step Guide for 2024.

What Happens Next?

Once you’ve confirmed your plan allows Bitcoin investments and you understand the rules, you’ll need to complete any required education and make your allocation choices. Experts recommend starting with a small percentage, often no more than 1-2% of your total portfolio, to manage risk while you gain comfort with crypto’s volatility. Regular monitoring and rebalancing are essential as the market evolves.

As you move forward, keep in mind that adding Bitcoin to your 401K is not a one-time event. The crypto market’s rapid pace means ongoing education and vigilance are non-negotiable. Even after you’ve made your initial allocation, whether that’s 1%, 5%, or up to the plan maximum, you’ll want to check in at least quarterly. This ensures your crypto position still aligns with your risk tolerance and overall retirement goals, especially as Bitcoin’s price now sits at $107,075.00, reflecting both its growth potential and volatility.

Smart Strategies for Managing Your Bitcoin 401K Allocation

Smart Strategies for Managing Bitcoin in Your 401(k)

-

Dollar-Cost Averaging (DCA): Invest a fixed amount in Bitcoin at regular intervals—regardless of its price—to reduce the impact of volatility and avoid trying to time the market. Many 401(k) providers, like Fidelity, allow you to automate recurring contributions for crypto allocations.

-

Periodic Portfolio Rebalancing: Review and adjust your portfolio periodically to maintain your target allocation to Bitcoin. For example, if you set a 5% allocation and Bitcoin rises sharply, rebalance by selling some Bitcoin or increasing other assets to stay on track. Platforms like Fidelity Investments and ForUsAll offer tools for rebalancing within self-directed crypto windows.

-

Set Price Alerts and Monitor Volatility: Use your 401(k) platform’s alert features or trusted apps (such as Fidelity or Coinbase) to receive notifications about significant Bitcoin price changes (e.g., when BTC moves above or below certain thresholds). This helps you stay proactive in managing your holdings, especially given current prices (e.g., $107,075.00 as of October 2025).

-

Stay Informed on Regulatory Updates: Regularly check updates from sources like the U.S. Department of Labor and your plan administrator for changes affecting crypto in retirement plans. Regulations and plan rules can evolve, impacting your investment options and limits.

Some investors use dollar-cost averaging to smooth out their entry into Bitcoin, allocating small amounts over time rather than all at once. Others set price alerts or calendar reminders to review their portfolio when major price swings occur. With the IRS continuing to clarify tax treatment for crypto assets in retirement accounts, staying current on the latest guidance is also key.

Risks and Safeguards: What Every Crypto Retirement Saver Should Know

Volatility remains the most significant risk. While Bitcoin’s surge past $100,000 has captured headlines and investor imagination alike, it can just as quickly experience sharp corrections. That’s why financial advisors urge savers not to overexpose themselves, crypto should complement, not dominate, a balanced retirement portfolio.

Additionally, security is paramount. When held within a qualified retirement plan, assets benefit from institutional-grade custody solutions, reducing risks tied to personal wallets or exchange hacks. Still, always verify how your plan custodies digital assets and what protections are in place if a provider were to experience technical or financial trouble.

Expanding Your Crypto Retirement Options

If your employer doesn’t yet offer direct Bitcoin access in the 401K menu, or if you want broader exposure, consider exploring other vehicles like Bitcoin IRAs. These specialized accounts allow you to roll over existing retirement funds into a self-directed IRA with wider crypto access. However, fees and custodial structures differ from standard workplace plans.

You can also look into ETF-based options if available within your plan; these typically offer more liquidity but may come with their own cost structures and tracking nuances.

Remember: The regulatory landscape is evolving fast. For the latest on how policy changes could impact your retirement strategy, including recent executive orders and SEC moves, see this overview: What Trump’s New Order and SEC Moves Mean for Retirement Investors in 2025.

Is Now the Right Time?

The decision ultimately comes down to personal conviction and planning discipline. With Bitcoin maintaining its position above $100,000, and mainstream acceptance growing, it’s no longer an exotic choice reserved for tech enthusiasts or risk-seekers alone. Yet prudent allocation size and ongoing education remain critical.

If you’re ready to take action or simply want more clarity on where things stand today, including step-by-step instructions tailored for 2024, visit our comprehensive guide: How to Add Bitcoin to Your 401K: Step-by-Step Guide for 2024.