Adding the $RETIRE token to your crypto 401k is a bold move for forward-thinking investors aiming to diversify their retirement portfolios. With the recent policy shift by the U. S. Department of Labor, plan sponsors now face fewer regulatory hurdles when offering digital assets in retirement plans. However, not every 401k will support niche tokens like $RETIRE right out of the gate. This guide will walk you through what’s possible in 2025 and how to get started.

RETIRE Token (RETIRE) Price Prediction 2026-2031

Professional forecast for $RETIRE’s potential performance in retirement portfolios, considering market, regulatory, and adoption dynamics.

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.0065 | $0.0102 | $0.0185 | +13% | Volatility remains high; regulatory clarity boosts exposure but meme coin risks persist. |

| 2027 | $0.0080 | $0.0135 | $0.0250 | +32% | Increased 401(k) crypto adoption, but competition from larger tokens limits upside. |

| 2028 | $0.0092 | $0.0160 | $0.0320 | +19% | Market matures, Solana ecosystem growth benefits RETIRE, but hype-driven pumps possible. |

| 2029 | $0.0088 | $0.0150 | $0.0290 | -6% | Potential meme coin fatigue; regulatory tightening risk; sideways to slightly bearish. |

| 2030 | $0.0100 | $0.0175 | $0.0360 | +17% | Broader crypto acceptance in retirement plans; favorable cycles could trigger renewed interest. |

| 2031 | $0.0095 | $0.0162 | $0.0325 | -7% | Market consolidation; long-term holders dominate, but speculative demand wanes. |

Price Prediction Summary

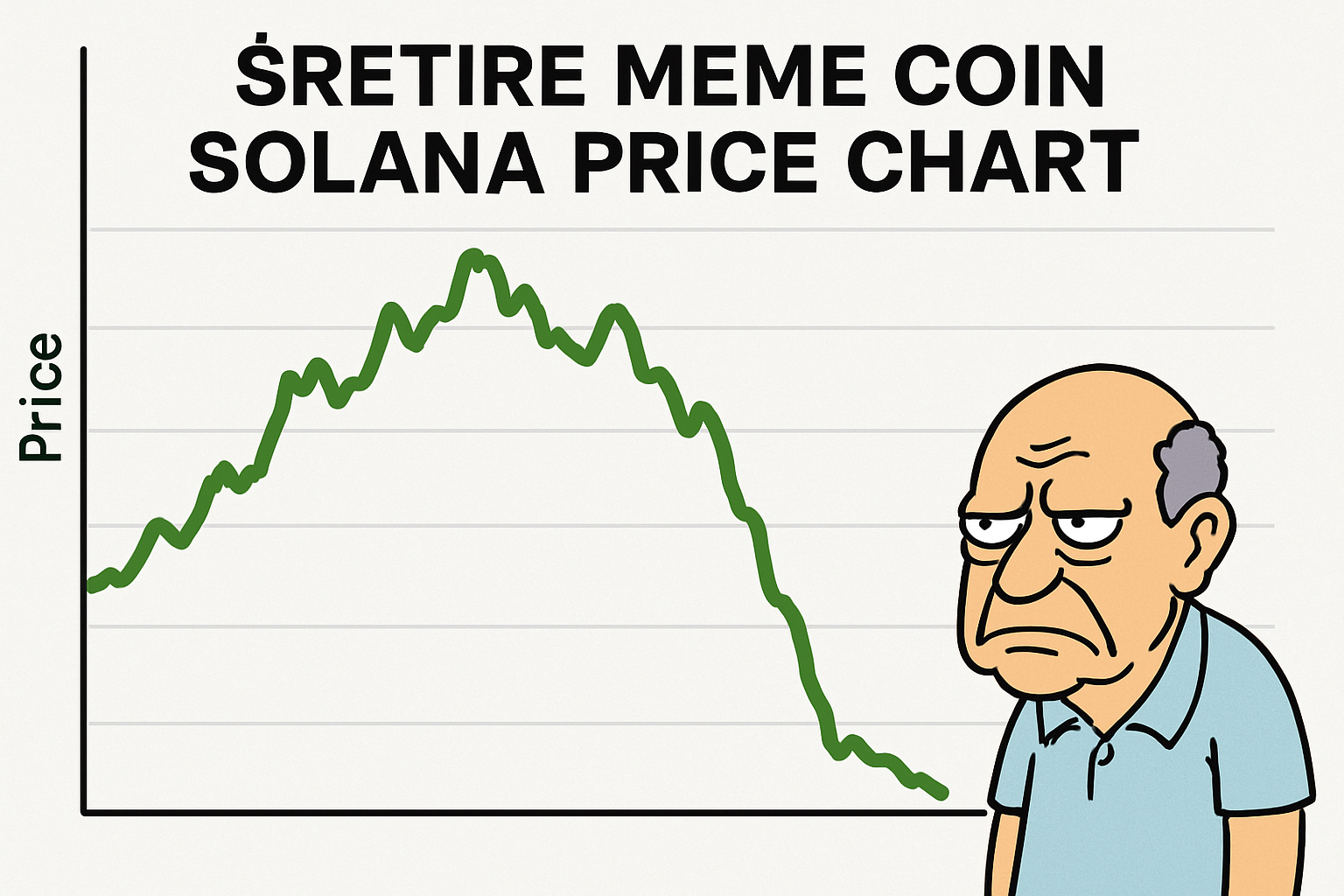

RETIRE’s price outlook reflects the high volatility and speculative nature of meme coins, especially in a retirement portfolio context. While regulatory easing and crypto adoption in 401(k) plans provide tailwinds, the token’s niche status and meme branding mean it remains vulnerable to hype cycles and sudden sentiment shifts. Average prices are projected to trend upward through 2028, with periods of correction and consolidation expected as the market matures. Investors should treat $RETIRE as a high-risk, high-reward asset, suitable for only a small allocation in diversified retirement portfolios.

Key Factors Affecting RETIRE Token Price

- Regulatory changes affecting retirement plans and crypto inclusion.

- Adoption of crypto in mainstream 401(k) and retirement products.

- Volatility and sentiment-driven price action common to meme coins.

- Competition from more established cryptocurrencies (e.g., Bitcoin, Ethereum, Solana-native tokens).

- Technological developments on the Solana blockchain.

- Market cycles, including hype-driven rallies and corrections.

- Liquidity and market cap constraints for smaller, niche tokens like $RETIRE.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Understanding $RETIRE’s Role in Your Tokenized 401k Retirement Strategy

$RETIRE is a meme coin built on Solana with a community-driven theme around early retirement and financial independence. As of October 2025, it trades at $0.009037, reflecting a and 0.0332% change over the last 24 hours (source). While meme coins carry higher volatility and risk than established cryptocurrencies, some investors see them as speculative vehicles for outsized returns if managed wisely.

The good news: with regulatory pressure easing (details here), more plan sponsors are exploring crypto options for their participants. Yet, inclusion of tokens like $RETIRE depends on your specific plan structure and whether your provider offers a brokerage window or self-directed crypto option.

Can You Really Add $RETIRE to Your Crypto 401k?

The answer: it depends on your plan’s features. While mainstream coins like Bitcoin are increasingly accessible in some 401ks, niche tokens such as $RETIRE are only available if your plan offers a brokerage window or allows direct crypto investments through custodial partners.

- Brokerage Windows: Some larger providers let you invest in a wide range of assets through these optional accounts within your 401k. If enabled, you may be able to access Solana-based tokens including $RETIRE.

- Certain Plan Sponsors: Innovative employers or self-directed solo 401ks sometimes allow broader asset choices, but always check with your administrator first.

- Crypto IRAs and Rollovers: If your employer’s plan doesn’t support direct crypto purchases, rolling over funds into a self-directed IRA with crypto support is another route (see BitIRA’s guide). This approach may offer exposure to more tokens but comes with its own rules and fees.

No matter which path you choose, start by confirming what’s available through your specific provider before making any moves.

The Risks and Rewards of Adding Meme Coins Like $RETIRE at $0.009037

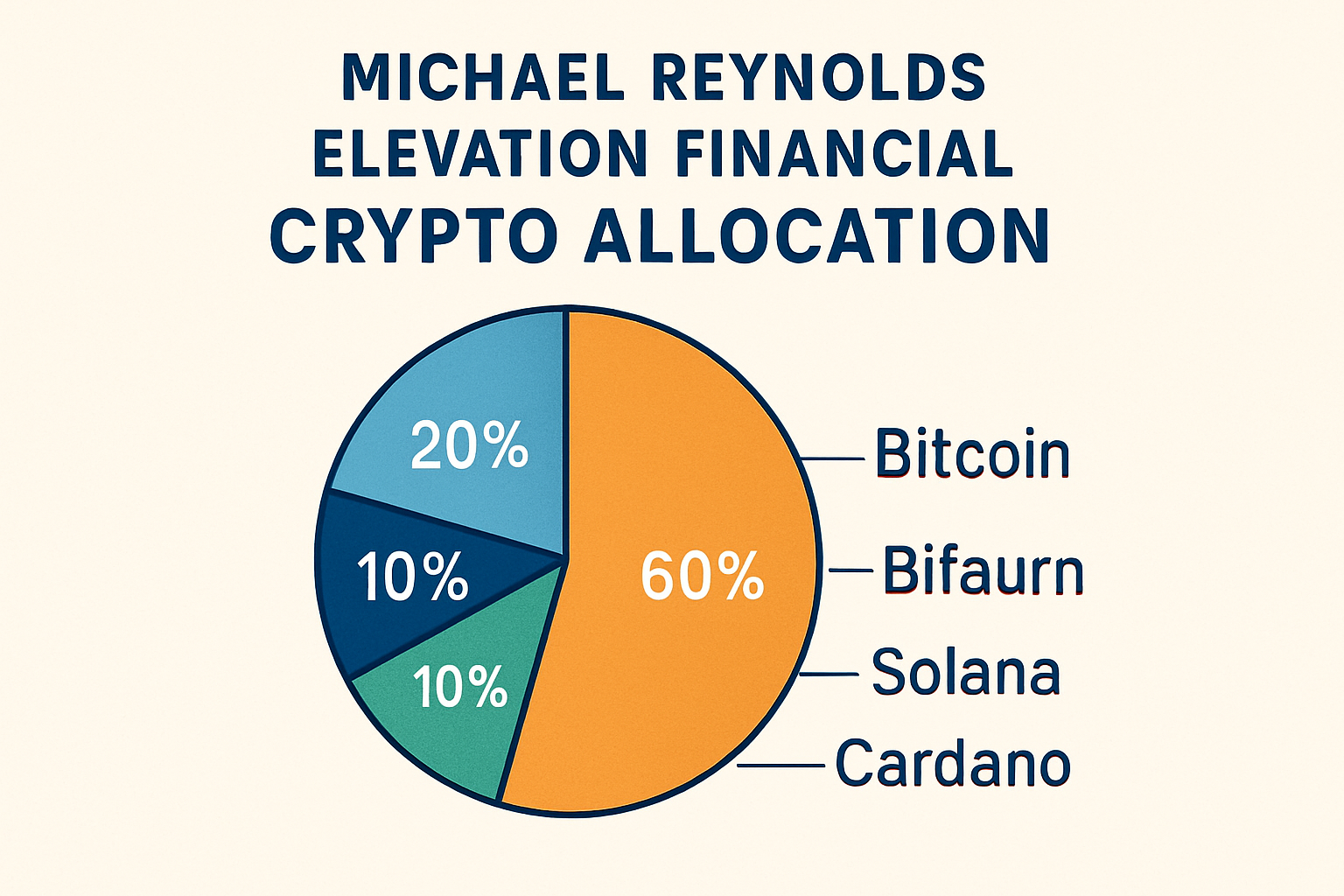

Meme coins can deliver dramatic gains but also pose significant risks, especially inside retirement accounts where capital preservation matters. As Michael Reynolds (Elevation Financial) advises, even for those bullish on crypto, limiting allocation to around 1% may be prudent (source). With $RETIRE currently at $0.009037, volatility should be expected; price swings can be sharp both up and down due to limited liquidity and speculative trading patterns common among meme tokens.

- Diversification: Only consider adding meme coins as part of a broader portfolio that includes traditional assets.

- Regulatory Shifts: The DOL has relaxed its stance but future guidance could change quickly, stay updated on policy shifts affecting crypto in retirement plans.

- Sponsor Discretion: Ultimately it’s up to your employer or plan sponsor whether tokens like $RETIRE are supported at all within their investment menu or brokerage window options.

Beyond the basics, it’s critical to understand that tokenized 401k retirement strategies are still evolving. Even as $RETIRE sits at $0.009037, its path inside retirement accounts will be shaped by ongoing innovation among plan providers and shifting participant demand. If you’re set on adding $RETIRE, keep these actionable points in mind:

Key Considerations Before Adding $RETIRE to Your Crypto 401K

-

Check Your 401(k) Plan’s Crypto Access: Not all 401(k) plans allow direct cryptocurrency investments. Confirm with your plan administrator if your provider offers a brokerage window or access to digital assets, and whether $RETIRE is available.

-

Understand $RETIRE’s Volatility: As of October 2025, $RETIRE trades at $0.009037 with a 24h change of +0.0332%. Meme coins like $RETIRE are highly volatile and can experience rapid price swings, which may not suit all retirement savers.

-

Regulatory Environment Has Shifted: The U.S. Department of Labor rescinded its 2022 guidance, making it easier for employers to offer crypto in 401(k)s. However, regulations can change, so stay updated on compliance and legal considerations.

-

Consider Portfolio Allocation: Financial advisors such as Michael Reynolds of Elevation Financial recommend limiting crypto exposure to 1% of your retirement portfolio to manage risk.

-

Review Plan Fees and Custody Solutions: Crypto investments in 401(k)s may involve higher fees and unique custody arrangements. Compare costs and security measures offered by your plan’s crypto provider, such as Fidelity Digital Assets or BitIRA.

-

Consult a Financial Advisor: Before allocating funds to $RETIRE or any cryptocurrency, seek advice from a fiduciary financial advisor to ensure your strategy aligns with long-term retirement goals.

Taxes and Custody: Crypto held within a 401k or IRA enjoys tax-deferred (or sometimes tax-free) growth, but only if managed through compliant custodians. Make sure your provider supports Solana-based tokens and offers secure custody solutions for assets like $RETIRE.

Liquidity Limitations: Unlike mainstream coins, meme tokens may face trading restrictions or limited liquidity within certain brokerage windows. This can lead to wider bid-ask spreads and slower trades, especially if you need to rebalance quickly.

Practical Steps to Safeguard Your Crypto Retirement Portfolio

If you’re integrating $RETIRE into your retirement plan, disciplined risk management is paramount. Consider the following steps:

Stay Informed: Regulatory guidance can shift rapidly. The DOL’s recent policy change (details here) makes crypto inclusion easier now, but future reversals are possible. Monitor official updates and regularly review your plan’s investment menu for changes.

Pro tip: If your employer doesn’t offer a brokerage window or direct crypto option yet, consider advocating for expanded choices with your HR department or benefits committee.

Community Insights: What Investors Are Saying About $RETIRE in 401ks

The conversation around crypto 401k $RETIRE guide topics is heating up on social media and financial forums. Many early adopters are enthusiastic about the potential for outsized returns, while others urge caution due to high volatility and uncertain regulatory treatment.

$RETIRE Token at $0.009037: Is Now the Time?

The current price of $0.009037 makes $RETIRE accessible for those willing to speculate with a small portion of their retirement savings. However, remember that timing meme coins is notoriously difficult; prices can spike on hype and crash just as quickly when sentiment shifts.

If you proceed, do so with clear eyes and realistic expectations, treat meme coin allocations as speculative side bets rather than core retirement holdings.

Your move into tokenized retirement planning should be guided by research, risk limits, and regular portfolio reviews, not memes alone.