On August 7,2025, President Donald Trump signed Executive Order #14330, a sweeping directive that could fundamentally reshape the landscape of 401(k) retirement plans in the United States. The order, titled Democratizing Access to Alternative Assets for 401(k) Investors, instructs the Department of Labor (DOL) to reevaluate its stance on alternative assets in retirement portfolios, including cryptocurrencies, private equity, and real estate. This move comes at a time when Bitcoin (BTC) is trading at a robust $110,967.00, underscoring the growing significance of digital assets in mainstream finance.

Trump Executive Order Crypto 401k: What’s Changing?

The Trump executive order marks a dramatic policy reversal from previous administrations, especially the Biden-era restrictions that limited high-risk assets in employer-sponsored retirement accounts. Now, plan sponsors may soon be able to offer employees direct exposure to crypto in 401(k) retirement plans, alongside other alternative investments like private equity and real estate. According to industry analysts, this could unlock new diversification opportunities but also introduces new layers of complexity and risk.

For context, the DOL is now tasked with collaborating with the Securities and Exchange Commission (SEC) and other federal agencies to craft guidance that balances innovation with investor protection. This collaboration is critical, as the regulatory clarity (or lack thereof) will determine how quickly and smoothly crypto retirement investing in the US takes root in mainstream 401(k) offerings.

Bitcoin Maintains Position Above $100,000: A New Era for Crypto Retirement Investing

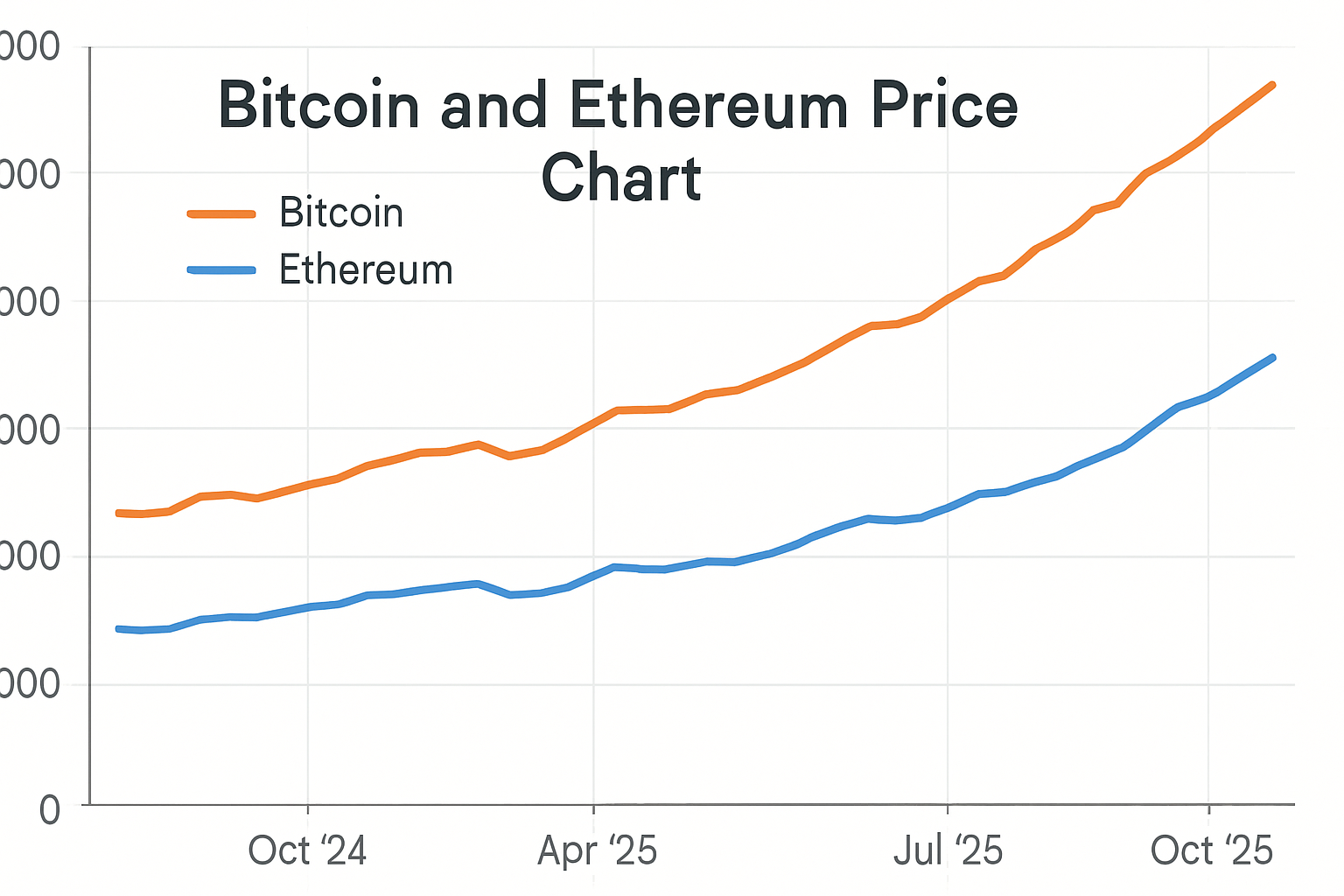

With Bitcoin maintaining a price well above $100,000, currently at $110,967.00: the narrative around digital assets as speculative outliers is shifting. The executive order arrives as more Americans seek inflation-resistant, high-growth alternatives for their long-term savings. As of October 20,2025, Ethereum (ETH) is priced at $3,975.18, further fueling interest in crypto as a legitimate asset class for retirement planning.

Bitcoin (BTC) Price Prediction for 401(k) Investors: 2026-2031

Forecast based on current market context, regulatory changes, and adoption trends post-2025 Trump Executive Order

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $92,000 | $115,000 | $138,000 | +3.6% | Initial volatility as 401(k) inflows begin; regulatory clarity boosts confidence but high volatility persists. |

| 2027 | $105,000 | $128,000 | $155,000 | +11.3% | Broader adoption in retirement accounts; institutional inflows increase, but macroeconomic uncertainty tempers upside. |

| 2028 | $115,000 | $142,000 | $175,000 | +10.9% | Bullish cycle supported by mainstream acceptance in pension funds; possible Bitcoin ETF expansion; tech upgrades drive optimism. |

| 2029 | $123,000 | $156,000 | $198,000 | +9.9% | Regulatory stability and improved custody solutions; halving event (2028) impacts supply, supporting upward trend. |

| 2030 | $136,000 | $175,000 | $225,000 | +12.2% | Peak of adoption wave in retirement products; competition from other assets, but Bitcoin maintains dominance. |

| 2031 | $124,000 | $162,000 | $210,000 | -7.4% | Possible market consolidation; profit-taking and increased regulation lead to correction, but long-term outlook remains strong. |

Price Prediction Summary

Bitcoin’s inclusion in 401(k) plans following the Trump Executive Order is expected to drive significant new demand from retirement investors, supporting steady price appreciation through 2030. While short-term volatility is likely as markets adjust to regulatory changes and increased institutional participation, the long-term outlook remains positive. By 2030, Bitcoin could see average prices near $175,000, with potential peaks above $225,000 under bullish scenarios. However, investors should be prepared for corrections and increased regulatory scrutiny as adoption grows.

Key Factors Affecting Bitcoin Price

- Impact of the Trump Executive Order enabling 401(k) crypto allocations, increasing mainstream and institutional demand.

- Evolving regulatory frameworks—supportive policies could drive prices higher, while restrictive measures may cause volatility.

- Market cycles and Bitcoin halving events, particularly the 2028 halving, influencing supply/demand dynamics.

- Technological advancements (e.g., Layer 2, improved custody and compliance tools) enhancing usability and security.

- Competition from other crypto assets and alternative investments in 401(k)s potentially moderating Bitcoin’s dominance.

- Global macroeconomic factors (inflation, rate policies, geopolitical tensions) affecting investor risk appetite and capital flows.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

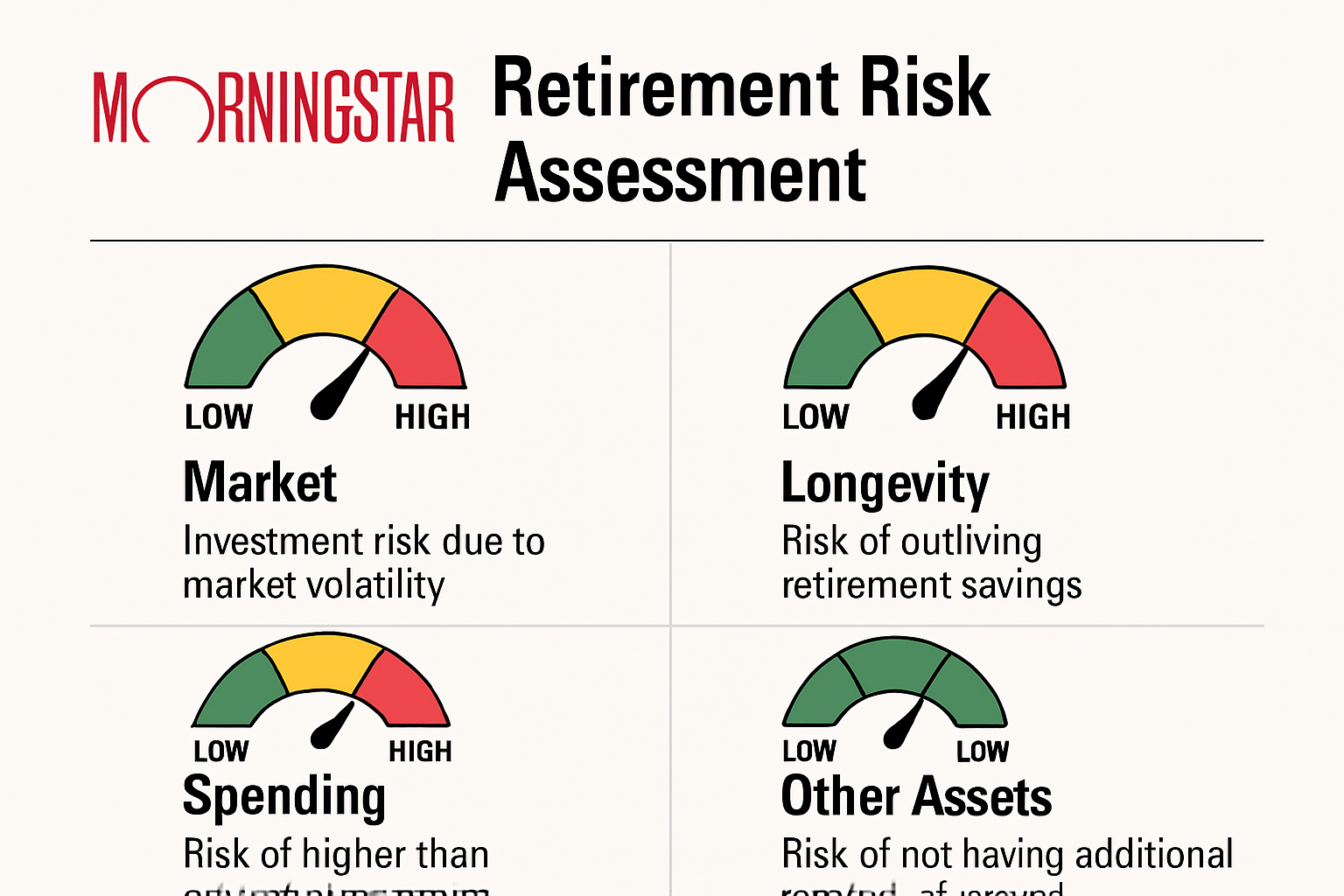

While this policy change excites many forward-thinking investors eager to diversify beyond stocks and bonds, it also raises important questions about volatility and fiduciary duty. Plan sponsors must now grapple with how to evaluate and monitor crypto allocations within 401(k)s, a challenge that will require new expertise and robust risk assessment frameworks.

Opportunities and Risks: What Savvy Investors Need to Know

Diversification Opportunities: The inclusion of digital assets like Bitcoin and Ethereum can help hedge against traditional market downturns and inflationary pressures. For investors who have watched Bitcoin surge past key price milestones, the ability to allocate a portion of their 401(k) to crypto offers both growth potential and portfolio resilience.

Increased Risk Exposure: However, cryptocurrencies remain highly volatile. The current 24-hour range for Bitcoin spans from $107,510.00 to $111,647.00, a reminder that price swings can be swift and significant. Savvy investors must weigh these risks against their personal investment horizons, risk tolerance, and retirement goals.

Fiduciary Responsibilities: With the regulatory environment in flux, plan sponsors face heightened scrutiny regarding their due diligence processes. The DOL’s forthcoming guidance will be pivotal in shaping best practices for evaluating alternative assets within retirement plans.

For more on how these regulatory shifts could impact your portfolio allocations, see our in-depth analysis.

Industry Response: Divided Opinions on Crypto in 401(k) Retirement Plans

The reaction from the financial industry has been mixed. Proponents argue that democratizing access to alternative assets empowers individual investors by providing tools previously reserved for institutions or high-net-worth individuals. Critics warn that opening the door to volatile assets like crypto could expose retirement savers to undue risks, especially those without the resources or knowledge to navigate complex markets.

Ultimately, the Trump executive order brings both promise and uncertainty. As regulatory agencies work out the details, investors should stay informed, conduct thorough due diligence on any alternative asset options presented within their plans, and consult with qualified financial advisors before making allocation decisions.

Looking ahead, the real test for crypto in 401(k) retirement plans will be how plan sponsors implement these changes and how individual investors respond. The Department of Labor’s guidance will likely set new standards for transparency, disclosure, and risk management, but it will also challenge retirement plan administrators to educate participants about the unique characteristics of digital assets. As with any major shift in retirement investing, knowledge and preparation will be key for those hoping to benefit from these expanded options.

How to Navigate the New Crypto 401(k) Landscape

For investors considering crypto allocations in their 401(k), it’s essential to take a measured approach. Start by understanding the basics of digital assets, including their volatility, market drivers, and the specific products being offered within your plan. Not all crypto investment vehicles are created equal, some may offer direct exposure to assets like Bitcoin or Ethereum, while others could be structured as trusts or funds with additional layers of fees and risk.

Key Steps for Evaluating Crypto in Your 401(k)

-

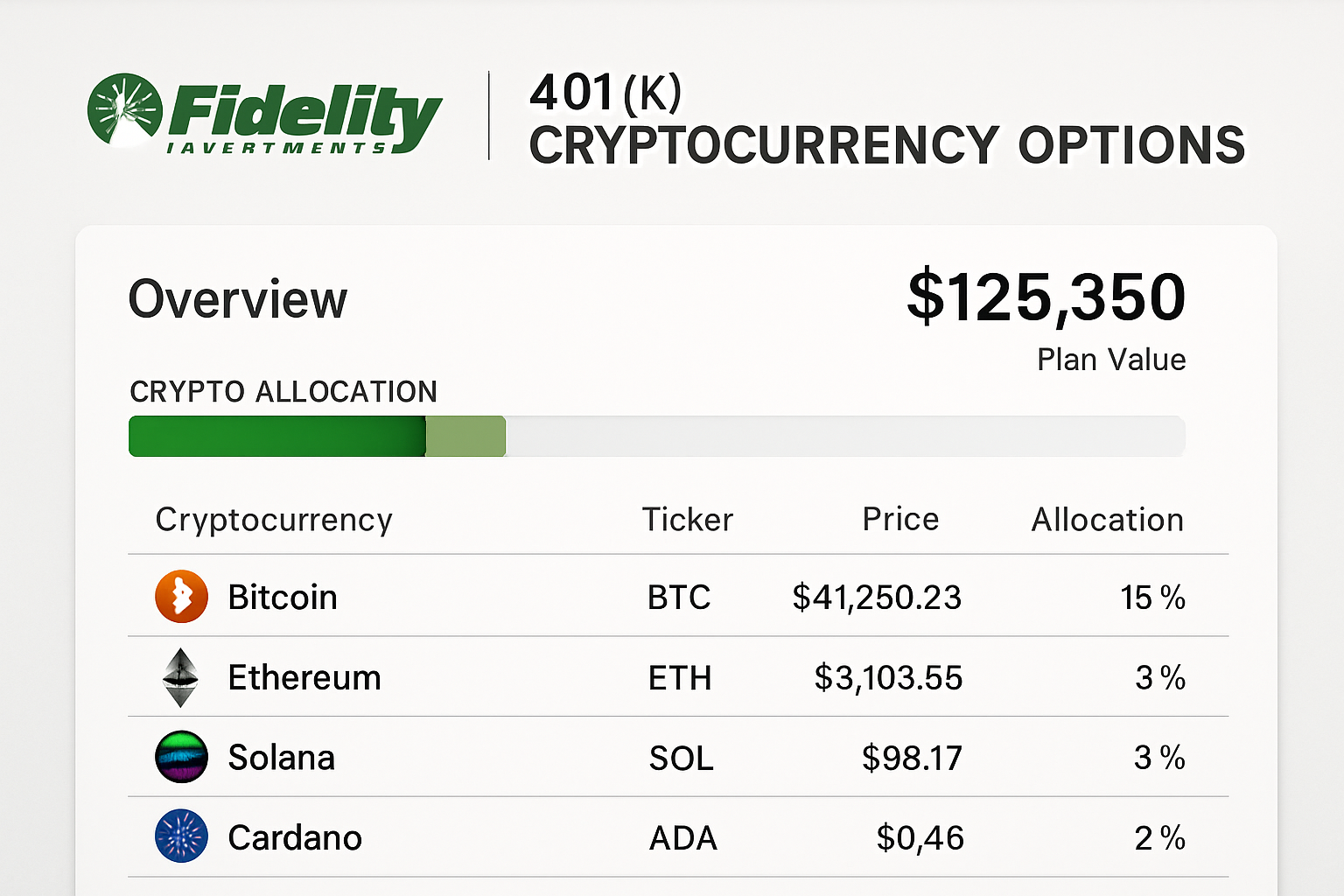

Review Your 401(k) Plan’s Updated Options: After the Trump executive order, many major plan providers like Fidelity Investments and Charles Schwab have begun offering access to cryptocurrency funds or trusts within 401(k) menus. Log in to your account or contact your plan administrator to see if crypto options—such as Grayscale Bitcoin Trust (GBTC) or Fidelity Digital Assets—are now available.

-

Assess the Specific Cryptocurrencies Offered: Most employer-sponsored plans currently focus on established digital assets such as Bitcoin (BTC) and Ethereum (ETH). As of October 20, 2025, Bitcoin is priced at $110,967 and Ethereum at $3,975.18. Compare their historical performance, volatility, and role in diversified portfolios.

-

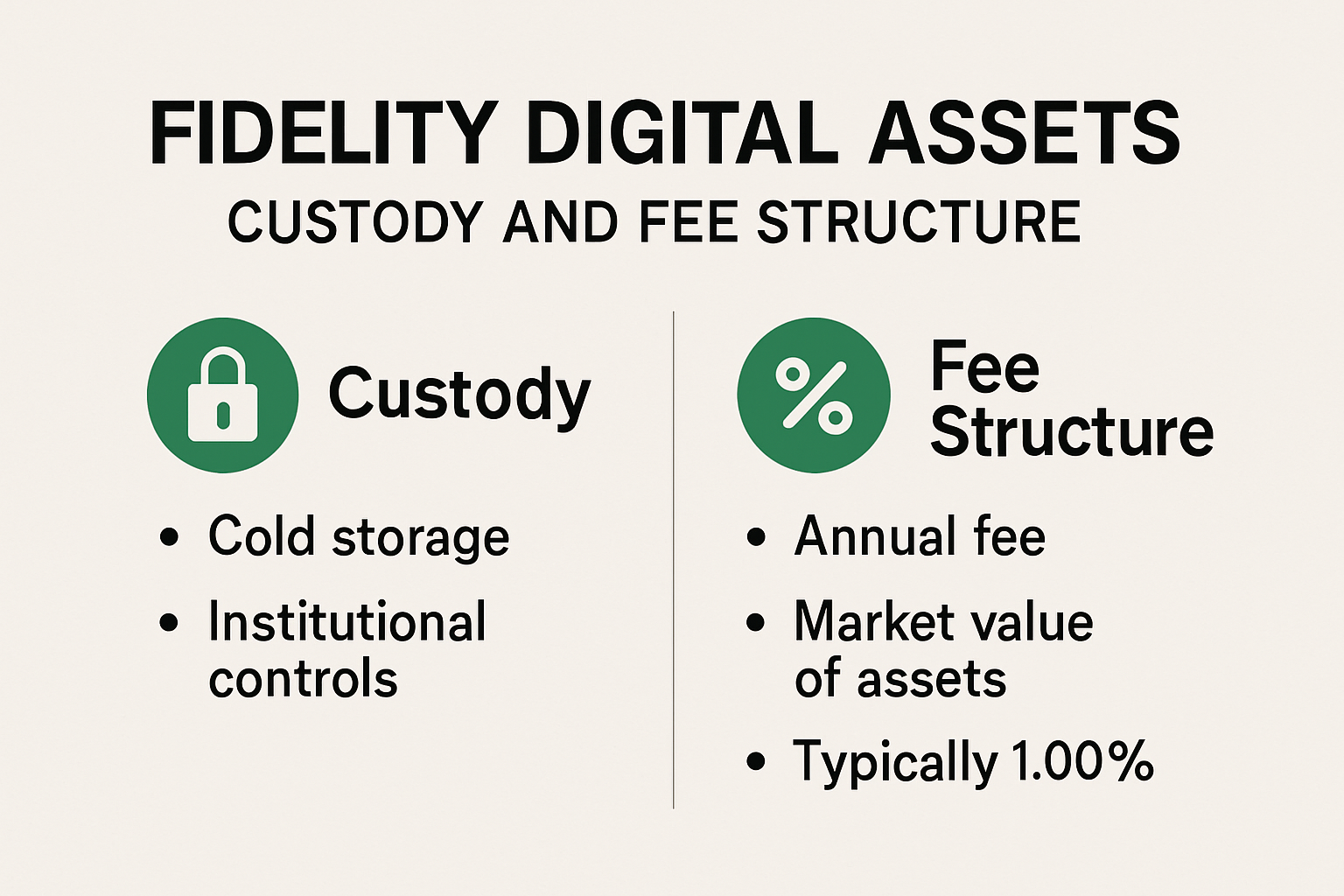

Understand Fees and Custody Arrangements: Crypto investments in 401(k)s often come with unique fees for custody, trading, and management. Review disclosures from providers like Fidelity Digital Assets or Coinbase Institutional to understand all costs and how your crypto will be securely held.

-

Evaluate Your Risk Tolerance and Time Horizon: Cryptocurrencies are highly volatile. Use tools from established platforms like Vanguard or Morningstar to assess your risk profile and determine what percentage—if any—of your retirement portfolio should be allocated to crypto assets.

-

Consult with a Fiduciary or Financial Advisor: Speak with a certified professional—such as a CFP® or a fiduciary advisor from Charles Schwab—to review how crypto fits your long-term retirement goals and ensure compliance with Department of Labor guidance.

Don’t overlook the importance of ongoing monitoring. Crypto markets are notoriously dynamic, with prices for assets like Bitcoin currently ranging from $107,510.00 to $111,647.00 in a single day. Even a small allocation can have an outsized impact on your overall retirement portfolio if not managed carefully. Make use of any educational resources provided by your plan sponsor and stay attuned to updates from regulatory agencies as the landscape evolves.

Another critical consideration is fees. Crypto investment products often carry higher expense ratios than traditional mutual funds or ETFs. Over a multi-decade retirement horizon, these costs can erode returns significantly. Compare all available options and ask your plan administrator for clear disclosures on costs and liquidity restrictions.

What’s Next? Staying Ahead in a Shifting Regulatory Environment

The Trump executive order has set off a wave of innovation and debate within the retirement industry. As more employers begin to offer crypto in 401(k) plans, expect to see new products and custodial solutions emerge, alongside enhanced scrutiny from regulators and consumer advocates. While some see this as the dawn of a new era for alternative assets in retirement planning, others urge caution and call for robust investor education initiatives.

For those eager to learn more about how these changes could affect their long-term savings strategy, resources like this detailed guide can provide additional context and actionable insights.

Ultimately, whether you choose to embrace crypto as part of your 401(k) or take a wait-and-see approach, the most important step is to stay informed and proactive. The regulatory framework is still being written, and with Bitcoin at $110,967.00 and Ethereum at $3,975.18 today, the stakes for retirement savers have never been higher.