On August 7,2025, President Trump signed Executive Order #14330, a move that could fundamentally alter the landscape of retirement investing in the United States. This directive, titled “Democratizing Access to Alternative Assets for 401(k) Investors, ” signals a new era for retirement planners and investors seeking exposure to digital assets like Bitcoin and Ethereum within their 401(k) plans. The implications are both far-reaching and nuanced, especially as Bitcoin now trades at $109,525.00 and Ethereum at $3,899.87: levels unthinkable just a few years ago.

Breaking Down the Executive Order: A New Chapter for Alternative Assets in 401(k)s

Trump’s executive order directs the Department of Labor (DOL) to revise existing ERISA regulations, paving the way for 401(k) providers to offer a broader menu of investment choices. For the first time, mainstream retirement accounts may soon include not only stocks and bonds but also private equity, real estate, and crucially, cryptocurrencies.

This policy pivot is designed to democratize access, giving everyday Americans a shot at asset classes previously reserved for institutional or high-net-worth investors. The White House fact sheet frames it as a move toward better returns and diversification. But for savvy retirement planners, the real story is about risk management, regulatory clarity, and the practicalities of integrating volatile assets like Bitcoin into long-term portfolios.

Regulatory Coordination: The DOL, SEC, and Treasury Step In

The executive order doesn’t simply throw open the gates. Instead, it mandates a coordinated effort between the DOL, Securities and Exchange Commission (SEC), and Treasury Department to develop clear guidelines for including alternative assets in 401(k)s. This is a critical step for plan sponsors and fiduciaries, without it, legal uncertainty could expose them to significant liability.

Key issues on the table include:

- Suitability standards for digital assets in retirement accounts

- Disclosure requirements around volatility and risk

- Best practices for custody and cybersecurity

Already, industry groups are lobbying for frameworks that balance innovation with investor protection. Expect robust debate over how much crypto exposure is appropriate in a retirement context, and what educational resources must accompany these new options.

Fiduciary Duty Meets Crypto Volatility

For plan administrators and financial advisors, due diligence is more important than ever. The inclusion of cryptocurrencies in 401(k)s means fiduciaries must rigorously assess whether these assets align with their obligations under ERISA. That means evaluating:

- Participant risk profiles: Not every investor can stomach 10% and daily swings in portfolio value

- Portfolio allocation strategies: Most experts recommend limiting crypto exposure to a small percentage of total assets

- Education and disclosure: Investors need comprehensive guidance on the unique risks of digital assets

The Department of Labor’s recent rollback of prior guidance that disadvantaged crypto investments signals a more open regulatory climate, but also heightens the need for robust fiduciary processes.

Bitcoin (BTC) Price Prediction 2026-2031: Post-401(k) Executive Order Era

Professional forecast reflecting the impact of expanded 401(k) access, regulatory shifts, and market trends

| Year | Minimum Price | Average Price | Maximum Price | Annual Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $87,000 | $115,000 | $145,000 | -20% to +32% | Potential initial volatility as 401(k) adoption ramps; regulatory uncertainties persist |

| 2027 | $95,000 | $130,000 | $170,000 | +9% to +17% | Steady inflows from retirement accounts; improved regulatory clarity; mild bull trend |

| 2028 | $110,000 | $155,000 | $200,000 | +16% to +19% | Broader institutional adoption; macroeconomic factors favor digital assets |

| 2029 | $125,000 | $180,000 | $240,000 | +13% to +20% | Increased allocation caps for crypto in retirement funds; competition from other digital assets |

| 2030 | $140,000 | $210,000 | $280,000 | +12% to +17% | Maturing crypto market; enhanced security and custody solutions drive confidence |

| 2031 | $160,000 | $245,000 | $325,000 | +14% to +16% | Mainstream adoption in retirement portfolios; potential for new all-time highs |

Price Prediction Summary

Bitcoin’s price outlook from 2026 to 2031 is shaped by the landmark 2025 executive order enabling 401(k) crypto investing. The expanded access is expected to fuel significant long-term demand, but near-term volatility is likely as the retirement industry adapts and regulatory frameworks evolve. While minimum price predictions reflect possible corrections amid market cycles and regulatory risks, the maximum projections account for strong institutional inflows and continued technological advances. Overall, the forecast anticipates a progressive appreciation in BTC value, with average prices more than doubling over six years, but with wide annual ranges due to the asset’s inherent volatility.

Key Factors Affecting Bitcoin Price

- 401(k) crypto adoption rate among retirement savers

- U.S. and global regulatory clarity and enforcement

- Technological improvements in Bitcoin scalability and security

- Macroeconomic trends (inflation, dollar strength, global liquidity)

- Competition from other digital assets (e.g., Ethereum, tokenized assets)

- Market cycles and halving events impacting supply dynamics

- Institutional and corporate adoption trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

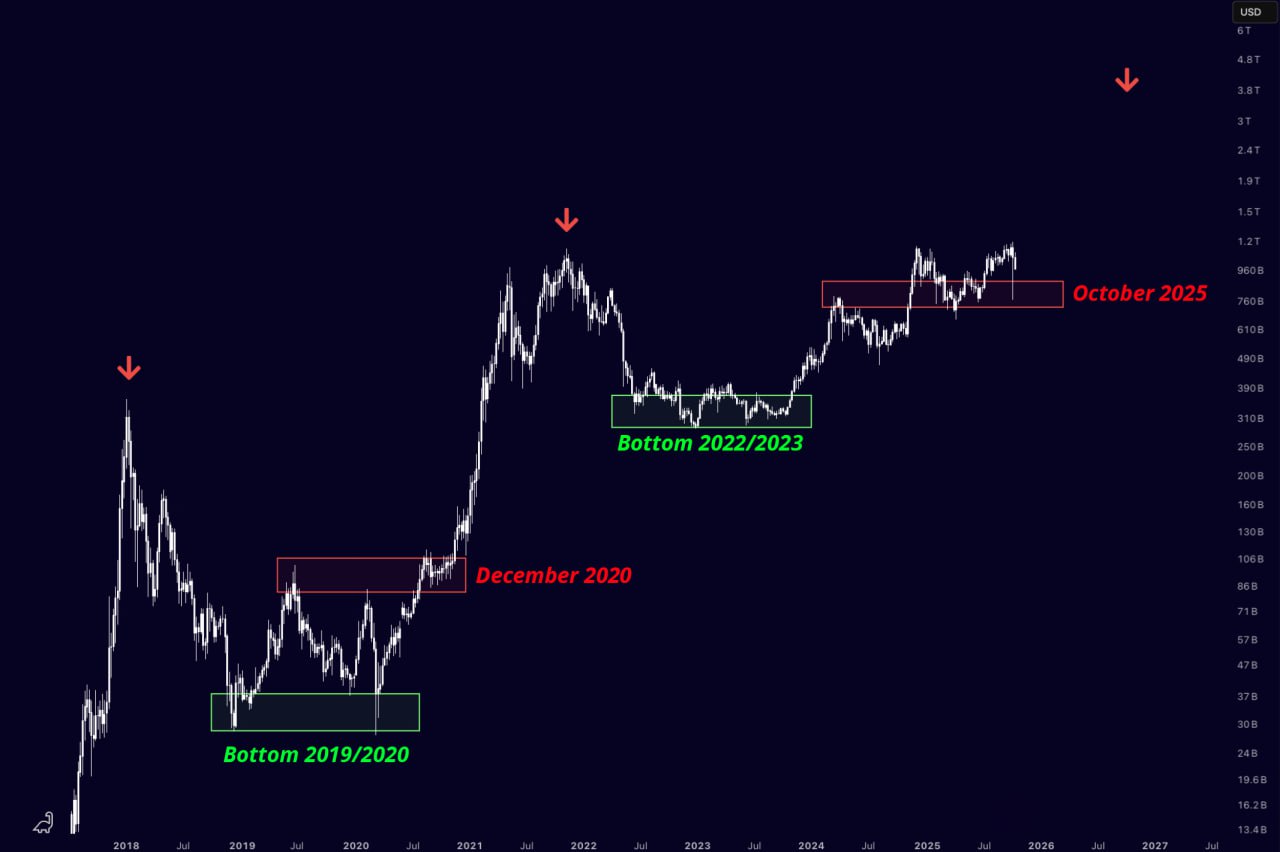

Bitcoin’s Position Above $100,000: What It Means for 401(k) Allocations

With Bitcoin maintaining its position above $100,000, trading today at $109,525.00: the narrative has shifted from “if” crypto belongs in retirement plans to “how much” is prudent. Higher prices attract attention but also amplify volatility risk. Ethereum’s current price of $3,899.87 further underscores crypto’s growing presence in mainstream finance.

For those considering crypto allocations in their 401(k), now is the time to revisit risk tolerance models and scenario planning. As always, patterns tell the story, crypto’s historic surges are often followed by sharp corrections.

If you want to dive deeper into how these regulatory changes could reshape your retirement strategy or explore best practices for crypto allocations in 401(k)s, check out our detailed guide at How Trump’s Executive Order Could Reshape Crypto Allocations in 401(k) Retirement Plans.

Looking ahead, the practical integration of Bitcoin and Ethereum into 401(k) menus will hinge on the infrastructure built by plan providers. Expect a wave of new products, target-date funds with a crypto sleeve, managed crypto baskets, and self-directed brokerage windows offering digital asset access. The challenge for sponsors will be to vet these offerings for security, transparency, and liquidity, especially as cyber threats and regulatory scrutiny intensify.

For retirement savers, this means more choices, but also more homework. The temptation to chase outsized returns as Bitcoin trades at $109,525.00 and Ethereum at $3,899.87 is real, but so are the risks of overexposure. Historical data shows that crypto’s drawdowns can be rapid and severe, eroding gains for those who fail to rebalance or set prudent allocation limits. Diversification remains the cornerstone of sound retirement planning, especially when venturing into volatile asset classes.

Key Steps to Evaluate Crypto in Your 401(k)

-

Review Your 401(k) Provider’s Crypto Offerings: Check if your plan administrator partners with established platforms like Fidelity or ForUsAll that support crypto investments. Confirm which cryptocurrencies—such as Bitcoin (BTC) and Ethereum (ETH)—are available, and note current prices: BTC: $109,525, ETH: $3,899.87.

-

Understand Regulatory Guidelines and Fiduciary Duties: Stay updated on guidance from the Department of Labor (DOL) and SEC regarding crypto in retirement plans. Ensure your plan’s crypto options comply with ERISA standards for risk assessment and participant education.

-

Assess Volatility and Risk Tolerance: Cryptocurrencies are highly volatile. Analyze historical price swings—such as Bitcoin’s recent range from $106,779 to $110,278—and determine if your risk profile aligns with such assets.

-

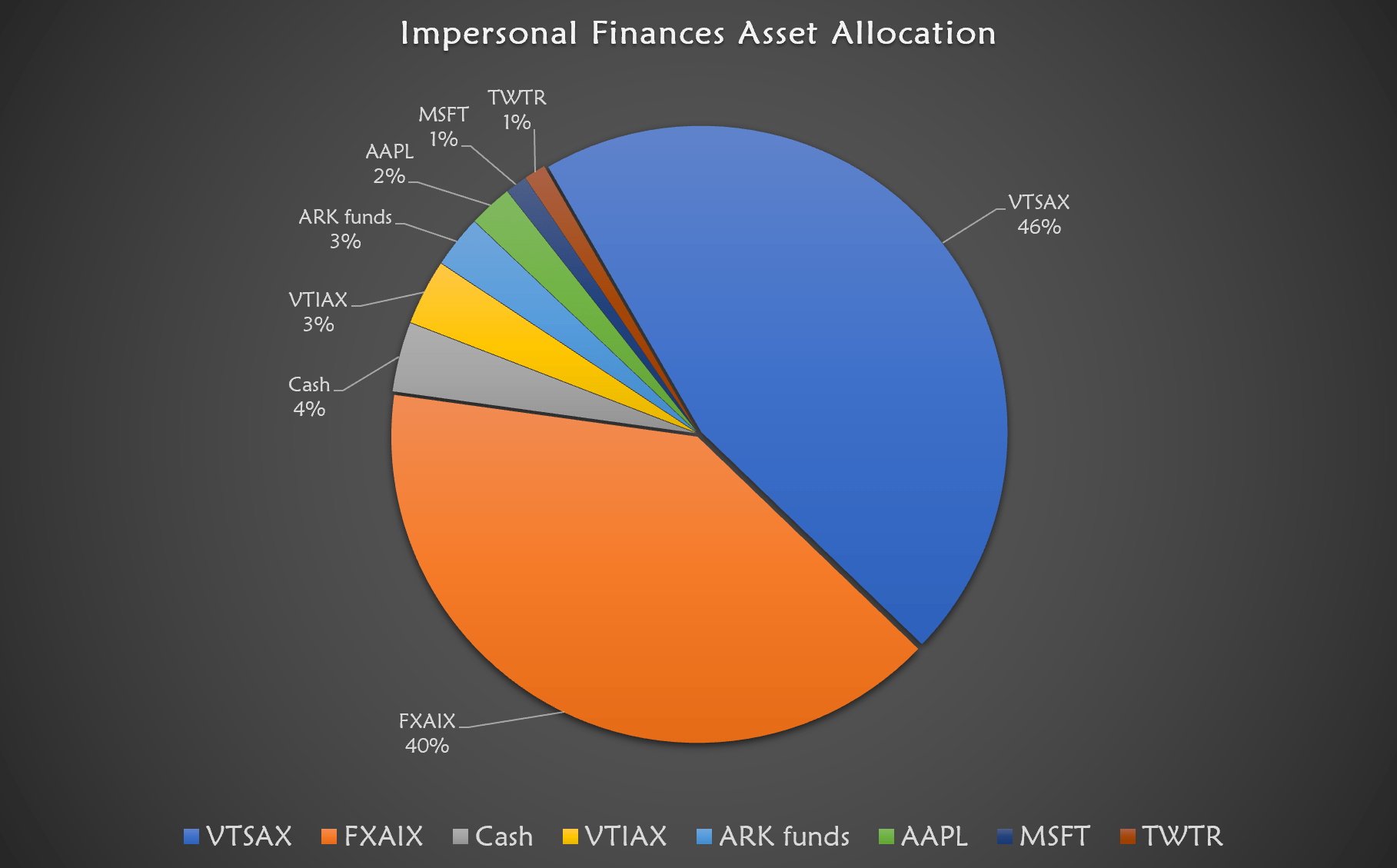

Determine Appropriate Portfolio Allocation: Financial advisors often suggest limiting crypto exposure to 5% or less of your total 401(k) portfolio. Use allocation tools from providers like Fidelity or Vanguard to model potential impacts.

-

Evaluate Custody and Security Measures: Ensure your 401(k) plan uses reputable custodians such as Coinbase Institutional or BitGo for digital asset storage. Confirm that robust security protocols—like multi-signature wallets and insurance—are in place.

-

Stay Informed on Fees and Tax Implications: Compare management fees, trading costs, and tax reporting requirements for crypto investments within your 401(k). Reference resources from the IRS and your plan administrator for details.

Industry voices are split. Some, like Senator Warren, warn that the executive order exposes Americans to unnecessary risk. Others argue it finally levels the playing field, giving ordinary investors access to the same alternative strategies used by endowments and pension funds. The Department of Labor’s new guidance, paired with SEC oversight, should provide a framework that balances innovation with responsibility.

Keep in mind: the regulatory process is ongoing. The DOL, SEC, and Treasury will issue further guidance in the coming months, and plan providers will need time to adapt. For now, the best move is to stay informed, consult with a fiduciary advisor, and avoid making impulsive allocation decisions based solely on headline prices.

Patterns tell the story. Crypto’s ascent into 401(k)s is a historic inflection point, but prudent risk management and education are more important than ever as digital assets go mainstream.

For a detailed breakdown of how these policy shifts could impact your long-term retirement planning, see our analysis at How Trump’s Executive Order Could Change 401K Crypto Investing: What Savvy Retirement Planners Need to Know.