Bitcoin’s climb to $91,449.00 puts a fresh spotlight on retirement savings, especially as the Retirement Investment Choice Act gains traction. This bill could make it straightforward for 401(k) plans to include cryptocurrencies like Bitcoin, building on President Trump’s executive order from August 2025. For everyday investors tired of stock-and-bond limits, this shift promises real choice in building wealth.

The push starts with equity. Right now, many public pension plans and high-net-worth folks access alternatives like private equity or real estate. Why not the average worker? President Trump’s Executive Order 14330 directs the Department of Labor to update ERISA rules, opening doors to crypto in 401k 2025. It rescinded old DOL guidance that scared off fiduciaries from digital assets, shifting to a neutral stance: decide based on risk and fit for participants.

Trump’s Executive Order: Breaking Down Barriers to Alternatives

Signed August 7,2025, the order declares every American deserves retirement funds with private markets, real estate, and yes, cryptocurrencies. The DOL quickly applauded, stating the government shouldn’t dictate investment picks. This follows their May 2025 move easing crypto hurdles in plans. Suddenly, fiduciaries face less red tape; they evaluate Bitcoin’s volatility against potential upside, like its 24-hour gain of and $2,404.00 from $87,858.00 low to $92,203.00 high.

Implementation is swift. The Trump administration targets quick DOL revisions, aiming for permanence beyond any administration change. For 401(k) holders, this means plans might soon offer Bitcoin ETFs or direct exposure, democratizing tools once reserved for elites. Check this guide for early steps.

Retirement Investment Choice Act: From Order to Law

Enter Representative Troy Downing’s H. R.5748, the bitcoin 401k bill introduced in October 2025. It codifies the executive order, ensuring Trump executive order 401k crypto rules stick through legislation. Referred to House Education and Workforce and Financial Services committees, it mandates DOL finalize pro-alternative regs within 180 days. No more flip-flopping; plans could legally embrace crypto in 401k 2025.

Downing frames it as fairness: government workers invest in alternatives via pensions, so should private-sector savers. The bill covers “exotic” assets – private credit, commodities, digital vehicles. For Bitcoin at $91,449.00, this greenlights fiduciaries to allocate if prudent, potentially supercharging returns amid mainstream adoption.

“The federal government should not be making retirement investment decisions for hardworking Americans. ” – U. S. Department of Labor

Bitcoin’s Role in a Diversified 401(k): Opportunities and Realities

With DOL neutral, fiduciaries assess Bitcoin’s fit. At $91,449.00, it’s no fringe asset; spot ETFs hold billions. The act could allow crypto in retirement plans, letting you dial in 1-5% exposure for growth without ditching stability. Imagine compounding at Bitcoin’s historical rates, balanced by bonds.

Yet volatility demands caution. That 24-hour swing reminds us: crypto amplifies ups and downs. Experts urge diversification, advisor chats, and matching your risk tolerance. Plans might start with BTC ETFs for liquidity. See portfolio implications here.

Bitcoin (BTC) Price Prediction 2026-2030

Conservative (Minimum/Bearish), Base Case (Average), and Bullish (Maximum) Scenarios for 401(k) Allocation Planning Amid Retirement Investment Choice Act

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) |

|---|---|---|---|

| 2026 | $80,000 | $140,000 | $250,000 |

| 2027 | $110,000 | $220,000 | $450,000 |

| 2028 | $150,000 | $350,000 | $700,000 |

| 2029 | $200,000 | $500,000 | $1,000,000 |

| 2030 | $300,000 | $750,000 | $1,500,000 |

Price Prediction Summary

Starting from the current price of approximately $91,449 in late 2025, Bitcoin is forecasted to experience strong growth through 2030, propelled by the Retirement Investment Choice Act’s potential to integrate BTC into 401(k) plans, driving trillions in institutional capital. Base case projects an average price of $750,000 by 2030 (+740% from 2025), with bearish floors rising progressively and bullish peaks reflecting mass adoption and halving effects.

Key Factors Affecting Bitcoin Price

- Regulatory tailwinds from Retirement Investment Choice Act and DOL policy shifts enabling 401(k) BTC allocations

- Institutional inflows from retirement plans and ETFs

- Bitcoin halving in 2028 boosting scarcity

- Macro trends: inflation hedging and fiat currency weakening

- Technological advancements in scalability and Layer-2 solutions

- Historical market cycles with increased adoption reducing volatility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Early adopters in self-directed 401(k)s already test waters post-DOL shift. As the bill advances, expect providers like Fidelity to expand menus. This isn’t hype; it’s policy catching innovation, positioning your nest egg for a digital economy.

Providers are already adapting. Fidelity and others, sensing the shift, have ramped up crypto offerings in brokerage accounts tied to retirement plans. If the Retirement Investment Choice Act passes, expect 401(k) menus to mirror this: Bitcoin spot ETFs alongside target-date funds. At $91,449.00, Bitcoin’s stability above $90,000 signals maturity, drawing institutional interest that could steady prices for long-term holders.

Fiduciary Duties in the New Landscape: Balancing Risk and Reward

Fiduciaries won’t get a free pass. ERISA still demands prudence: plans must document why Bitcoin fits, cap exposure, and monitor volatility. That 24-hour range from $87,858.00 to $92,203.00 underscores the need for guardrails, like 5% portfolio limits or redemption policies. I see this as smart evolution; forcing stocks-only ignores how Bitcoin has outpaced S and P 500 returns over a decade. But rushing in without education? That’s a fiduciary foul.

Plans might use vehicles like the iShares Bitcoin Trust, already holding over $20 billion. DOL’s neutral stance empowers them to weigh upsides, such as inflation hedging amid Bitcoin’s and $2,404.00 daily gain. For younger savers, a sliver of crypto could turbocharge growth; boomers might skip it entirely. Tailor to demographics, and suddenly 401(k)s compete with self-directed IRAs.

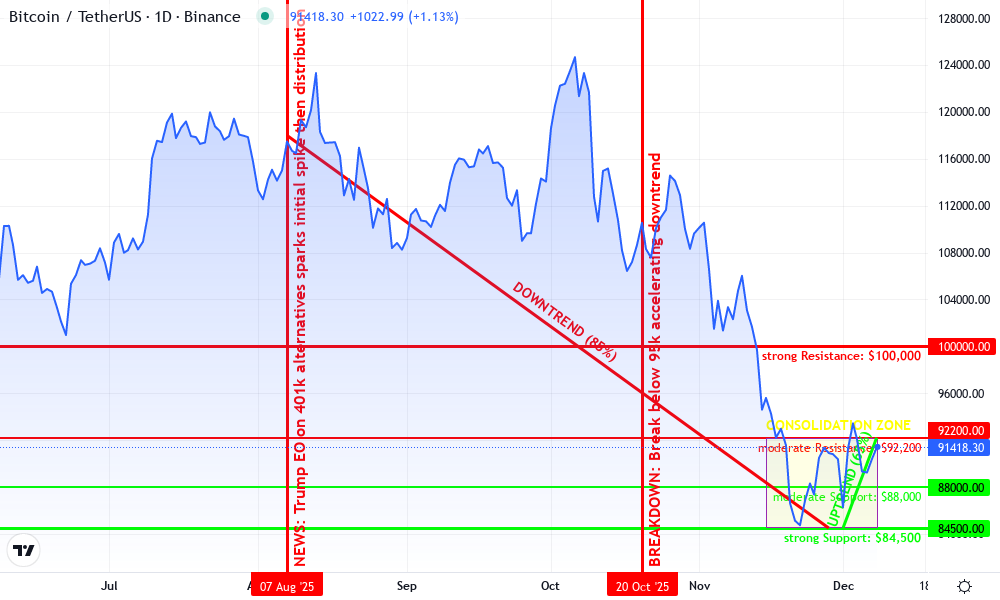

Bitcoin Technical Analysis Chart

Analysis by Jenna Morgan | Symbol: BINANCE:BTCUSDT | Interval: 1D | Drawings: 9

Technical Analysis Summary

To annotate this BTCUSDT chart in my balanced hybrid style, start by drawing a primary downtrend line connecting the August 2025 high at approximately 118,000 to the late November low around 84,000, using ‘trend_line’ for the bearish channel. Add a short-term uptrend line from the December 1 low at 84,500 to the recent high near 92,000. Mark horizontal lines at key support levels: 88,000 (recent lows), 85,000 (major support), and resistance at 92,500, 95,000, and 100,000. Use fib_retracement from the August high to December low for potential retracement levels around 88,000 (38.2%) and 92,000 (50%). Highlight the November-December consolidation rectangle between 84,500 and 92,000. Add callouts for volume drying up during the drop and recent MACD bullish crossover. Place long_position marker near 90,000 entry with stop_loss below 88,000 and profit_target at 95,000. Vertical line for the August 2025 policy news impact around August 7. Use arrow_mark_up for recent bounce and text notes for risk-managed entries.

Risk Assessment: medium

Analysis: Volatile crypto market with supportive policy tailwinds but technical correction ongoing; consolidation suggests basing but no breakout confirmation yet

Jenna Morgan’s Recommendation: Scale into longs on confirmation above 92.5k with tight stops, max 3% risk per trade—prioritize preservation in retirement-aligned portfolios

Key Support & Resistance Levels

📈 Support Levels:

-

$88,000 – Recent 24h low and minor swing low, tested multiple times in Dec

moderate -

$84,500 – Major November low aligning with 0.618 fib retracement, strong volume shelf

strong

📉 Resistance Levels:

-

$92,200 – 24h high and upper consolidation boundary

moderate -

$95,000 – Psychological level and prior October swing high

weak -

$100,000 – Key round number and September support-turned-resistance

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$90,449 – Bounce from 88k support in uptrend channel, MACD bullish cross confirmation

medium risk -

$88,500 – Dip buy at moderate support if volume picks up, aligning with medium risk tolerance

medium risk

🚪 Exit Zones:

-

$92,200 – First profit target at resistance flip

💰 profit target -

$95,000 – Extended target on breakout

💰 profit target -

$87,500 – Stop below recent lows and channel support

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: decreasing on decline, stabilizing recent bounce

Volume dried up during downtrend suggesting exhaustion, uptick on recent lows indicates potential accumulation

📈 MACD Analysis:

Signal: bullish crossover

MACD line crossing above signal in late Dec, histogram expanding positively near zero line

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Jenna Morgan is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Path Forward: What 2025 Holds for Crypto in 401(k)s

Passage isn’t guaranteed. Committees must act fast; with midterms looming, bipartisan buy-in from retirement hawks could propel H. R.5748. If signed by early 2026, DOL regs follow suit, letting plans onboard alternatives by mid-year. Watch for amendments tightening crypto definitions, excluding pure speculation plays. Meanwhile, states like Wyoming pioneer with crypto pensions, pressuring feds.

Bitcoin at $91,449.00 isn’t peaking; halving cycles and ETF inflows suggest more runway. Pairing it with real estate or private credit diversifies beyond stocks, potentially lifting average 401(k) balances from $100,000 to match elite pensions. I’ve advised clients to model scenarios: 2% Bitcoin allocation historically doubles growth in bull markets, cushions bears with bonds.

This bill flips the script on retirement inertia. No longer sidelined, workers choose assets matching a tokenized future. Providers will compete on fees and education, fiduciaries sharpen pencils, and savers like you gain leverage. Start by reviewing your plan docs; ask about self-directed options today.

Risks persist, sure. Regulatory whiplash or black swan events could dent confidence. Yet denying access because of them echoes blocking the internet in 1995. Forward-thinking plans will thrive, rewarding those who adapt. With Bitcoin’s momentum, 2025 marks the pivot where crypto in 401k 2025 moves from fringe to fixture.

Chat with your advisor about stress-testing a Bitcoin slice. Platforms evolve quickly; by spring, options abound. This isn’t about getting rich quick, but stacking odds for a robust retirement in an asset-rich world.