As Bitcoin hovers around $67,947.00 on February 12,2026, with a slight 0.45% dip from the prior close, its wild ride continues to spark debate among retirement savers. Just days ago, it plunged below $67,000 in an 11% drop, erasing post-election gains and reminding us why bitcoin 401k volatility tops the list of concerns for those eyeing crypto in 401k risks. Yet, with the U. S. Department of Labor now taking a neutral stance on crypto in plans, the door cracks open wider. Should you dip into bitcoin retirement accounts despite these swings?

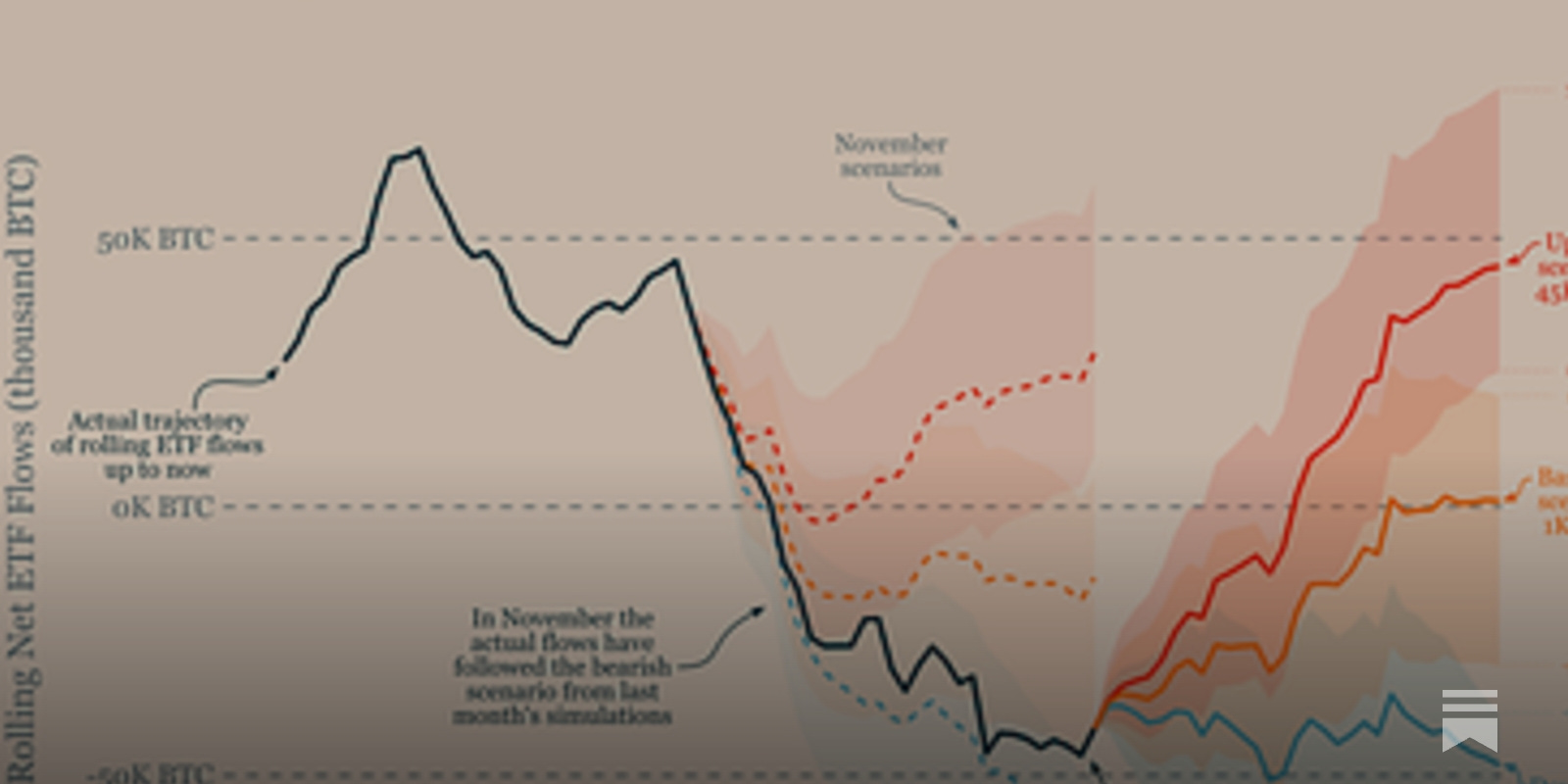

From a swing trader’s lens, Bitcoin’s chart screams momentum plays but whispers caution for long-term nests like 401ks. The recent low of $65,839 against a high of $68,428 in 24 hours underscores its penchant for sharp reversals, fueled by regulatory jitters and ETF outflows topping $3 billion this January. I’ve traded these patterns for years, and while breakouts can yield 50% and gains in weeks, the drawdowns test even iron stomachs.

Navigating Bitcoin’s 2026 Price Action in a Retirement Context

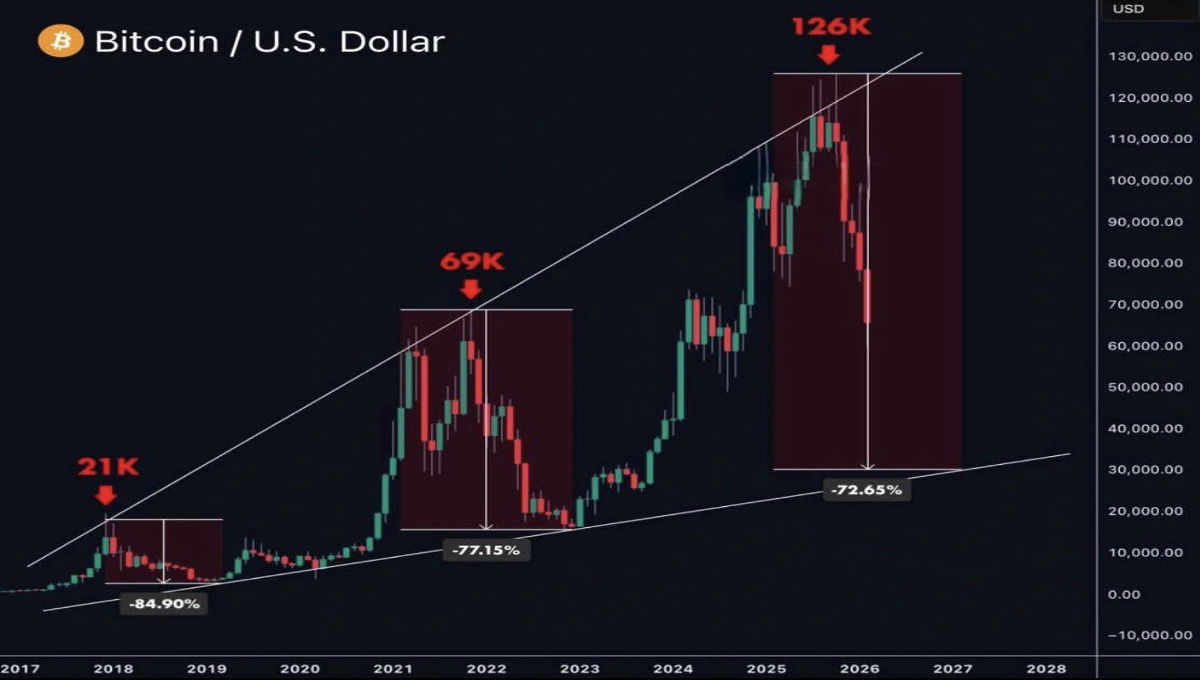

Bitcoin’s path this year mirrors classic volatility clusters: post-Trump election hype faded into profit-taking, with the asset now stabilizing near $67,947.00 after dipping under key support. Chartists like me watch the 50-day moving average around $70,000 as resistance; a break above could signal renewed upside, but failure risks testing $60,000 lows. For 401k holders, this isn’t day-trading fodder. Crypto in 401k risks amplify when retirement timelines shorten, as a 20% weekly swing could derail years of compounding.

Consider the broader backdrop: U. S. spot Bitcoin ETFs saw massive redemptions, continuing a trend from late 2024. This rout wiped trillions market-wide, prompting Senator Elizabeth Warren to fire off letters to the SEC, warning that crypto in retirement accounts sows seeds for family financial ruin. Her Senate committee echoes this, highlighting how bitcoin 401k volatility preys on everyday savers.

Trump-Era Policy Shift: Crypto Gets a Neutral Nod in 401ks

The Trump administration’s rollback of the DOL’s 2022 crypto caution marks a pivotal turn. Gone is the “extreme care” mandate; fiduciaries now call the shots without regulatory side-eye. This pro-crypto pivot aligns with pushes to weave digital assets into mainstream retirement vehicles, potentially via ETFs or direct allocations. Check out Trump’s 2025 executive order explained for the nuts and bolts.

Yet, experts from CNBC to CoinDesk urge restraint. Financial planners peg ideal crypto slices at 1-5% of portfolios, citing Bitcoin’s superior long-term returns over stocks but hammered by lacking history and liquidity traps. Navia Benefit Solutions nails it: volatility, regs, and thin data make crypto a speculative bet, not a staple.

Pros of Bitcoin Exposure: Potential Rewards Outweigh Swings for Some

Proponents aren’t wrong: Bitcoin has crushed traditional 401k holdings, delivering annualized returns north of 100% since inception versus the S and P’s 10%. In a diversified setup, a sliver of BTC acts as a hedge against fiat debasement and equity correlations. For younger investors with 20 and years to retirement, riding out swings via dollar-cost averaging into $67,947.00 levels could supercharge growth. I’ve seen momentum strategies turn 5% allocations into portfolio boosters during bull legs.

Read up on crypto allocation strategies for 401ks to gauge your fit. But here’s my take: without disciplined risk rules, like stop-losses or rebalancing triggers, volatility turns opportunity into regret.

Bitcoin (BTC) Price Prediction 2027-2032 for 401(k) Planning

Forecasts amid volatility, regulatory shifts, and market cycles (Baseline: $67,947 as of Feb 2026)

| Year | Minimum Price | Average Price | Maximum Price | Avg YoY % Change |

|---|---|---|---|---|

| 2027 | $65,000 | $95,000 | $145,000 | +40% |

| 2028 | $110,000 | $150,000 | $240,000 | +58% |

| 2029 | $155,000 | $220,000 | $350,000 | +47% |

| 2030 | $220,000 | $310,000 | $500,000 | +41% |

| 2031 | $300,000 | $430,000 | $680,000 | +39% |

| 2022 | $410,000 | $580,000 | $920,000 | +35% |

Price Prediction Summary

Bitcoin prices are forecasted to grow substantially through 2032, fueled by the 2028 halving, institutional adoption via ETFs, and pro-crypto policies, but wide min-max ranges highlight persistent volatility—ideal for limited 401(k) exposure (1-5%) for risk-tolerant long-term investors.

Key Factors Affecting Bitcoin Price

- 2028 Bitcoin halving increasing scarcity and historical bull cycles

- Favorable U.S. regulatory environment under Trump administration enabling 401(k) inclusion

- Growing institutional adoption through spot ETFs despite recent outflows

- Macroeconomic factors like interest rates and inflation impacting risk assets

- Technological upgrades enhancing scalability and real-world use cases

- Persistent volatility from market sentiment, geopolitical risks, and altcoin competition

- Potential DOL/SEC scrutiny balancing innovation with retirement saver protections

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Investopedia outlines it well: higher gains tempt, but only if you stomach the cons. As outflows persist and Warren’s scrutiny mounts, plan sponsors face fiduciary heat. Still, for the forward-thinker, modest exposure via ETFs in bitcoin retirement accounts merits a hard look, armed with charts and conviction.

That conviction starts with facing the downsides head-on. Bitcoin’s bitcoin 401k volatility isn’t just chart noise; it’s a retirement wrecker for the unprepared. A single 11% plunge, like early February’s slide to $65,839, can shave years off compounding in a tax-sheltered 401k. Critics from the Economic Policy Institute to Inc. com hammer this: everyday savers lack the tools to navigate crypto’s liquidity crunches or regulatory whiplash.

The Cons Stack Up: Why Volatility Crushes Most Retirement Portfolios

Senator Warren’s push to the SEC underscores the fiduciary minefield. Her committee’s January letter blasts crypto as a gateway for workers to “lose big, ” especially amid $2 trillion market routs and $3 billion ETF outflows in 2026 alone. Without long-term data, Bitcoin’s cycles, booms to busts in months, clash with 401k’s steady-growth mandate. Near-retirees face amplified crypto in 401k risks: a 50% drawdown at $67,947.00 levels could force delayed retirements or slashed lifestyles.

Financial planners at Yahoo Finance and Navia echo this caution. Private equity might offer steadier alts, but crypto’s 24-hour swings dwarf them. My trading desk has witnessed it: momentum fades fast, leaving bagholders. For 401ks, this means rebalancing nightmares and emotional sells at lows.

Pros, Cons & Tips: Bitcoin in 401(k)s

-

Pro: High Return Potential Bitcoin has historically offered higher gains than traditional 401(k) assets like stocks and bonds, per Investopedia.

-

Con: Extreme Volatility 24h range: $65,839 low to $68,428 high; 11% drop below $67,000 on Feb 5, 2026. Current: $67,947.

-

Pro: Portfolio Diversification Bitcoin’s low correlation with stocks/bonds can reduce overall portfolio risk over time.

-

Con: Regulatory Scrutiny Sen. Elizabeth Warren and Senate warn of risks; DOL was cautious until 2026 rollback to neutral stance.

-

Con: Recent ETF Outflows U.S. spot Bitcoin ETFs saw over $3 billion outflows in January 2026 amid market rout.

-

Pro: Fiduciary Flexibility Trump-era DOL rollback removes prior ‘extreme care’ guideline, enabling crypto in plans.

-

Tip: Modest Allocation Limit to 1-5% of portfolio for risky assets like Bitcoin, per financial planners.

-

Tip: Match Risk Tolerance Avoid if nearing retirement; suit for long-term, high-risk tolerant savers only.

Actionable Strategies: Taming Volatility in Your Bitcoin Retirement Account

Don’t ditch the idea entirely, smart exposure demands rules. As a swing trader, I layer in technicals: buy dips above the 200-day moving average, currently near $62,000, and cap at 3-5% of your total 401k. Dollar-cost average into $67,947.00 amid consolidations, but set annual rebalances to trim winners and fund losers. This curbs drawdown risks while capturing upside.

Target 401k bitcoin etf 2026 options like spot ETFs, now fiduciary-friendly post-DOL shift. Fidelity and others offer them, blending crypto purity with plan compliance. Pair with MSTR for leveraged MSTR 401k exposure: MicroStrategy’s Bitcoin hoard turns stock into a proxy, though its premium adds beta. I’ve charted MSTR breakouts syncing with BTC pumps; a 1% slice here juices returns without direct custody hassles.

For hands-on execution, follow a disciplined playbook:

- Assess risk tolerance: If a 30% drop keeps you up nights, stick to bonds.

- Check plan menus: Post-Trump, more sponsors add crypto sleeves.

- Monitor volatility indexes: VIX-like crypto gauges flag exit signals.

- Harvest tax losses annually within the 401k wrapper.

This approach turned my test portfolios resilient through 2025’s chaos. See how to add Bitcoin to your 401k step-by-step for provider specifics.

Bitcoin Technical Analysis Chart

Analysis by Lucas Bradford | Symbol: BINANCE:BTCUSDT | Interval: 4h | Drawings: 8

Technical Analysis Summary

Aggressively mark the dominant downtrend with a thick red trend_line from the swing high on 2026-02-02 at $72,300 to the recent pullback low on 2026-02-12 at $67,947, extending it forward for potential targets. Draw a broken uptrend line in dashed green from the Jan low 2026-01-08 at $58,200 to the 2026-02-02 high $72,300 to highlight the failed rally. Add horizontal_lines for key resistance at $68,428 (recent high, moderate) and $70,000 (major psych level, strong), and supports at $65,839 (24h low, strong) and $65,000 (cluster). Use fib_retracement from the Jan low to Feb high for pullback zones, targeting 50% at ~$65,250. Rectangle the distribution range mid-Jan at 65k-68k. Arrow_mark_down on MACD bearish cross near 2026-02-05. Callout declining volume on the recent bounce. Short_position marker at $67,900 entry, stop above $68,500, target $65,000. Vertical_line on 2026-02-05 breakdown. Text notes on high risk momentum fade.

Risk Assessment: high

Analysis: Elevated volatility from regulatory FUD, overextended short-term bounce in downtrend, but high reward potential on momentum plays

Lucas Bradford’s Recommendation: Aggressively short with 2-3% portfolio risk, trail stops—my high tolerance thrives here, target 65k fast.

Key Support & Resistance Levels

📈 Support Levels:

-

$65,839 – 24h low and recent swing low cluster, strong defense

strong -

$65,000 – Psychological round number with prior tests

moderate

📉 Resistance Levels:

-

$68,428 – 24h high rejection zone

moderate -

$70,000 – Major overhead supply from Jan rally failure

strong

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$67,900 – Aggressive short on breakdown confirmation below 68k, momentum fade

medium risk

🚪 Exit Zones:

-

$65,000 – Measured move target from channel projection

💰 profit target -

$68,500 – Tight stop above recent high to limit downside

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Declining volume on recent bounce, confirming weakness

Bars shrinking on green candles, lack of conviction in upside

📈 MACD Analysis:

Signal: Bearish crossover with histogram fading

MACD line crossed below signal mid-Feb, divergence from price highs

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Lucas Bradford is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

Real-World Check: Does Crypto Fit Your Timeline?

Young guns under 40? Lean in, time smooths volatility, and Bitcoin’s scarcity narrative holds against inflation. My projections eye $150,000 by 2030 if halving cycles persist, turning 5% allocations into retirement accelerators. Older savers? Sideline it; preservation trumps speculation.

Plan sponsors now weigh DOL neutrality against Warren’s fire, but your fiduciary duty is personal. Crypto’s already infiltrating via ETFs; ignoring it risks opportunity cost in bull markets.

Bitcoin at $67,947.00 tests resolve now. Chart the swings, allocate modestly, manage ruthlessly. In retirement’s long game, volatility bows to discipline, position your 401k to win it.