In the volatile world of cryptocurrency, the idea of leveraging a 401k loan to buy Bitcoin has gained traction among bold investors eyeing a 2026 retirement boost. With Bitcoin currently trading at $68,528, down 1.75% in the last 24 hours after a sharp correction from its October 2025 peak of $126,210.50, timing feels precarious yet opportunistic. A Reddit user in r/Bitcoin sparked debate by sharing their plan to borrow from their 401k and go all-in on BTC, drawing warnings of potential 50% drawdowns alongside optimistic calls for $500,000 by 2030. This 401k loan bitcoin strategy embodies the high-stakes gamble at the intersection of retirement security and digital asset speculation, especially as macroeconomic pressures like regulatory overhangs weigh on prices.

From a big-picture perspective, global markets are navigating post-election policy shifts and inflation cycles that amplify crypto’s beta to risk assets. Borrowing up to $50,000 or 50% of your vested balance from a 401k offers low-interest repayment to yourself, sidestepping credit checks and taxes if repaid timely. Yet, as Labor Department guidance urges “extreme care” with crypto in plans, using loans for outside BTC purchases skirts direct plan exposure while introducing personal leverage risks.

Decoding 401k Loan Mechanics for Crypto Plays

Traditional 401k loans allow participants to access funds without penalties, repaid via payroll over five years at prime-plus-1% rates, often around 9-10% today. For buy bitcoin with 401k loan tactics, investors withdraw cash to purchase BTC on exchanges, betting on appreciation to outpace loan costs. Investopedia highlights Roth 401k advantages here: post-tax contributions mean BTC gains could emerge tax-free in retirement, a boon if Bitcoin rebounds from $68,528 toward cycle highs.

“You’ll be fine in 6 years when it’s 500k. But don’t be surprised if your investment is over half down this time next year. ”

This Reddit sentiment captures the duality. Repayment discipline is key; job loss triggers full repayment within 60 days or taxes plus 10% penalty apply, turning a strategic move into a fiscal nightmare amid BTC’s intraday swings from $68,294 to $70,908.

Crafting a Crypto 401k Loan Strategy Amid 2026 Uncertainty

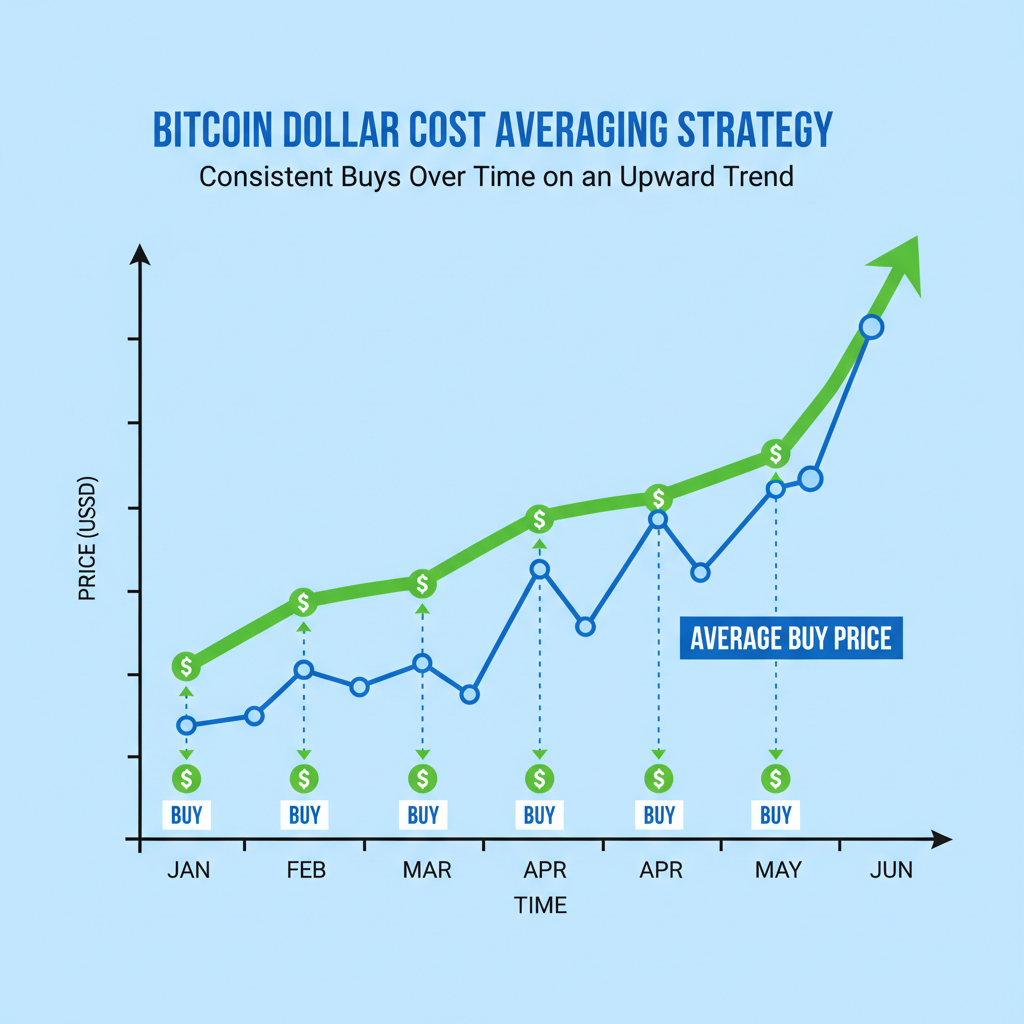

Forward-thinking crypto 401k loan strategy demands macro alignment. Dollar-cost average loan proceeds into BTC during dips below $68,528, capitalizing on mean reversion in commodity-like cycles. Pair with diversified retirement holdings; limit to 5-10% of portfolio to mitigate volatility. AARP and Wealthtender advisors note employee buy-and-hold behavior could stabilize BTC if plans eventually offer it, but loans enable earlier entry.

Consider the Yahoo Finance tale of a $150,000 borrower via personal loans for crypto: three years on, outcomes vary wildly. For 2026, post-selloff positioning favors those viewing Bitcoin’s halving rhythms and institutional inflows as tailwinds, potentially lifting from current $68,528 lows.

Bitcoin Price Prediction 2027-2032: 401k Loan Strategies & Retirement Outlook

Realistic forecasts from 2026 baseline of $68,500 amid post-peak correction, factoring halving cycles, regulations, and high volatility risks for retirement investors

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior) |

|---|---|---|---|---|

| 2027 | $55,000 | $90,000 | $140,000 | +31% |

| 2028 | $80,000 | $150,000 | $250,000 | +67% |

| 2029 | $120,000 | $220,000 | $350,000 | +47% |

| 2030 | $160,000 | $300,000 | $450,000 | +36% |

| 2031 | $220,000 | $400,000 | $600,000 | +33% |

| 2032 | $300,000 | $500,000 | $800,000 | +25% |

Price Prediction Summary

Bitcoin faces near-term volatility from 2026’s 46% drop from $126k peak, but anticipates strong recovery via 2028 halving bull cycle. Average prices could 7x to $500k by 2032 in adoption-driven scenarios, offering retirement boosts for patient 401k loan investors despite regulatory and risk hurdles.

Key Factors Affecting Bitcoin Price

- 2028 Bitcoin halving catalyzing bull market

- Regulatory clarity post-2024/2025 policy shifts

- Institutional adoption through ETFs and 401k plans

- Macro cycles: inflation hedging amid rate cuts

- Tech upgrades (e.g., scalability solutions)

- Persistent volatility and 401k-specific risks

- Competition from altcoins and traditional safe havens

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Yet strategy hinges on liquidity buffers. Quick and Dirty Tips outlines eight pros, like tax-deferred growth, against cons such as plan restrictions on crypto. Self-directed brokerage windows in some 401ks allow indirect exposure, but loans bypass this for pure BTC bets.

Unpacking Bitcoin Retirement Loan Risks in Current Markets

Bitcoin retirement loan risks loom largest in volatility. Bitcoin’s plunge below pre-2024 election levels underscores speculative retreats, per AP News. Center for Retirement Research deems direct 401k BTC “not prudent, ” citing poor risk-adjusted returns; loans amplify this via forced selling if prices crater further from $68,528.

GAO warns high volatility erodes retirement security, while Finder US pros/cons extend to loans: diversification benefits clash with correlation spikes during downturns. Opportunity cost bites too, as loan repayments forgo stock market compounding at 7-10% historical rates.

Job market fragility adds another layer: unemployment could force immediate repayment, crystallizing losses if Bitcoin languishes below $68,528 amid regulatory scrutiny from the Labor Department and DOL.

Mitigating Risks in a 401k Crypto Loan Strategy

Navigating these pitfalls requires a disciplined framework that tempers enthusiasm with macroeconomic realism. Limit loan size to 10% of vested balance, ensuring repayments fit comfortably within cash flow even if BTC drops 50% from $68,528. Build in stop-loss mentalities, though crypto’s illiquidity demands psychological fortitude over automated triggers. Diversify repayment sources beyond payroll, like side income, to buffer economic cycles.

Macro tailwinds offer counterbalance. Bitcoin’s commodity supercycle, driven by halvings and ETF inflows, positions it for rebounds from current troughs. Post-2025 election hype faded into regulation fears, but clearer U. S. policies could catalyze recovery, echoing past cycles where drawdowns preceded multi-fold gains. For retirement timelines extending to 2030, this volatility compresses into alpha if patience prevails.

Step-by-Step Roadmap for Prudent 401k Loan Bitcoin Deployment

Forward investors blending 401k crypto investment 2026 with caution can follow a structured path. First, audit your plan’s loan provisions via HR or provider portal, confirming max borrowable up to $50,000. Stress-test scenarios: model BTC at $34,000 (half current $68,528) against 10% loan rates over five years.

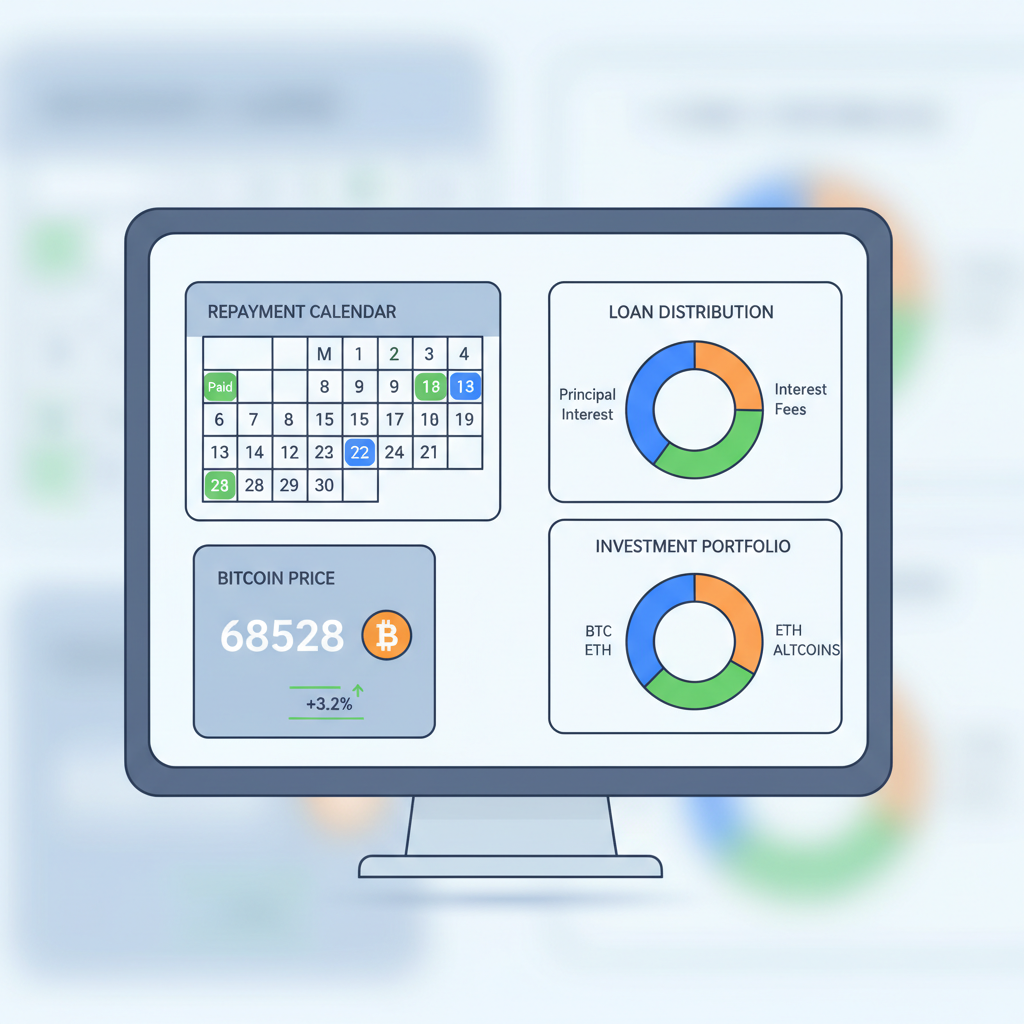

Next, execute via reputable exchanges with self-custody options, dollar-cost averaging inflows over 3-6 months to average into dips. Monitor via dashboards tying loan amortization to BTC performance. Repay aggressively during upswings, potentially tax-free in Roth structures as Investopedia notes. This approach transforms leverage from gamble to tactical overlay on core retirement assets.

Real-world precedents underscore variability. The Reddit poster betting on $500,000 horizons mirrors survivors of 2022’s crash, who timed loans post-capitulation. Conversely, over-levered cases from Yahoo Finance highlight margin calls absent in 401k structures, yet repayment cliffs mimic them. Center for Retirement Research skepticism holds for mass adoption, but selective, informed use sidesteps prudence critiques.

Big-picture, Bitcoin’s role in 401ks evolves amid institutional maturation. While direct plan allocations face fiduciary hurdles, loans democratize access for conviction holders. As volatility moderates with market cap growth, $68,528 represents a pivot: sellers exhausted, accumulators positioning for supply squeezes. Pairing this with equities hedges beta risks, fostering resilient portfolios.

Ultimately, success pivots on cycle awareness. Inflation erodes fiat savings; Bitcoin’s scarcity narrative counters it, but only for those enduring drawdowns without forced exits. Advisors from Wealthtender observe 401k holders’ low turnover favors HODL strategies, amplifying loan efficacy if timed macro-optically.

For 2026 retirement boosts, weigh personal horizon against Bitcoin’s $68,528 baseline. Prudent deployment yields asymmetric upside; recklessness invites ruin. Align with your risk DNA, and this hybrid tactic could redefine diversified longevity.