Bitcoin hovers at $67,929.00 today, a level that underscores its staying power amid market ups and downs. Yet for most 401(k) participants, direct exposure to this asset remains out of reach. Plan administrators continue to sideline 401k bitcoin options, even after regulatory green lights. This hesitation stems from deep-seated concerns over risk, duty, and participant outcomes, leaving savvy investors hunting for workarounds to add bitcoin to 401k portfolios in 2026.

Administrators aren’t just dragging their feet; they’re bound by strict fiduciary standards under ERISA. They must prioritize plans that safeguard long-term savings, not chase speculative trends. Crypto’s reputation for sharp swings keeps them up at night, especially when headlines scream about crashes wiping out gains.

Fiduciary Duties Trump Crypto Hype

At the core of this standoff lies the fiduciary responsibility to act solely in participants’ interests. Offering bitcoin etf retirement plan choices or direct crypto holdings could invite lawsuits if markets sour. Competitors to pioneers like Fidelity point to low demand and crypto’s speculative aura as reasons to hold back. One expert even pegs core menu integration at five to 10 years out, blaming high costs and liquidity snags.

Consider the numbers: Bitcoin’s 24-hour range swung from $66,510.00 to $68,241.00, a reminder of its volatility. Administrators fear such moves could derail decades of compounding. Lawmakers echo this, pressing DOL and SEC on transparency gaps and harm potential. No wonder they ignore 401k plan administrator bitcoin pleas.

Plan sponsors must weigh education needs alongside governance, often opting for the status quo.

Regulatory Tailwinds Ignored by Cautious Gatekeepers

Shifts in Washington should have cracked the door wider. In May 2025, DOL rescinded its 2022 cautionary guidance on crypto in 401(k)s, moving to neutral ground. Then came President Trump’s August 2025 executive order, nudging DOL and SEC to embrace private assets like cryptocurrencies in defined contribution plans. Fidelity responded with a new crypto IRA, but adoption hinges on employer buy-in.

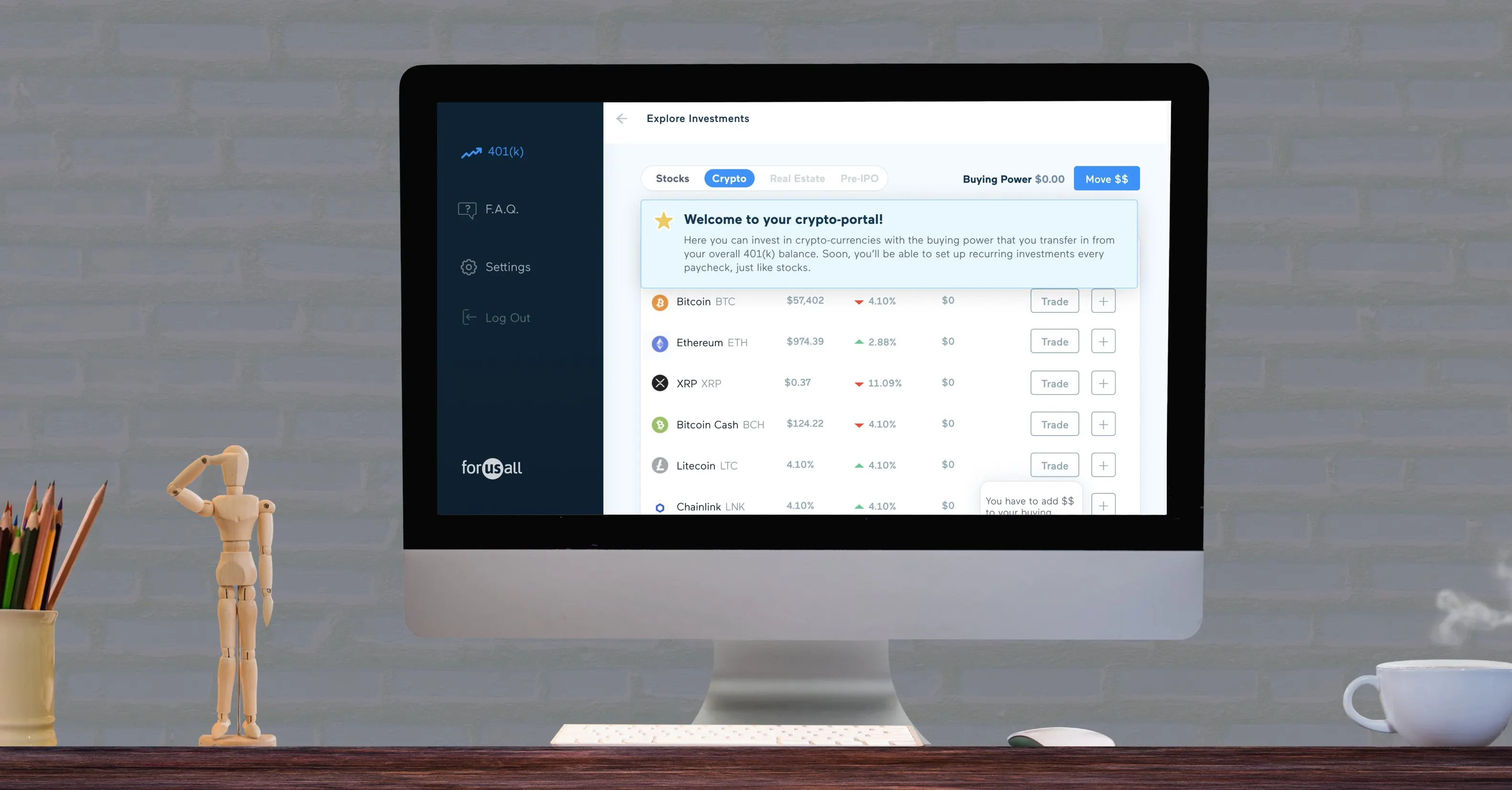

Despite this, uptake lags. Experts urge caution with private assets, citing risks that once prompted dropped guidance. ForUsAll’s guides highlight participant and sponsor must-knows, yet many plans stick to stocks and bonds. Trump’s pro-crypto stance smooths paths, but doesn’t erase volatility qualms or fraud shadows.

Three big knocks persist: wild price swings threatening savings, crypto’s lack of tangible output, and rampant scams. AOL outlines these pitfalls sharply, while senators flag investor harm. Administrators, risk-averse by design, prioritize stability over Bitcoin’s allure at $67,929.00.

Why Volatility and Scams Keep Bitcoin Off Menus

Dig deeper, and crypto’s downsides hit hard. A single downturn could slash retirement nests built over years. Unlike dividend-paying stocks, Bitcoin generates no income; its value rides sentiment and adoption waves. Theft and hacks compound woes, eroding trust.

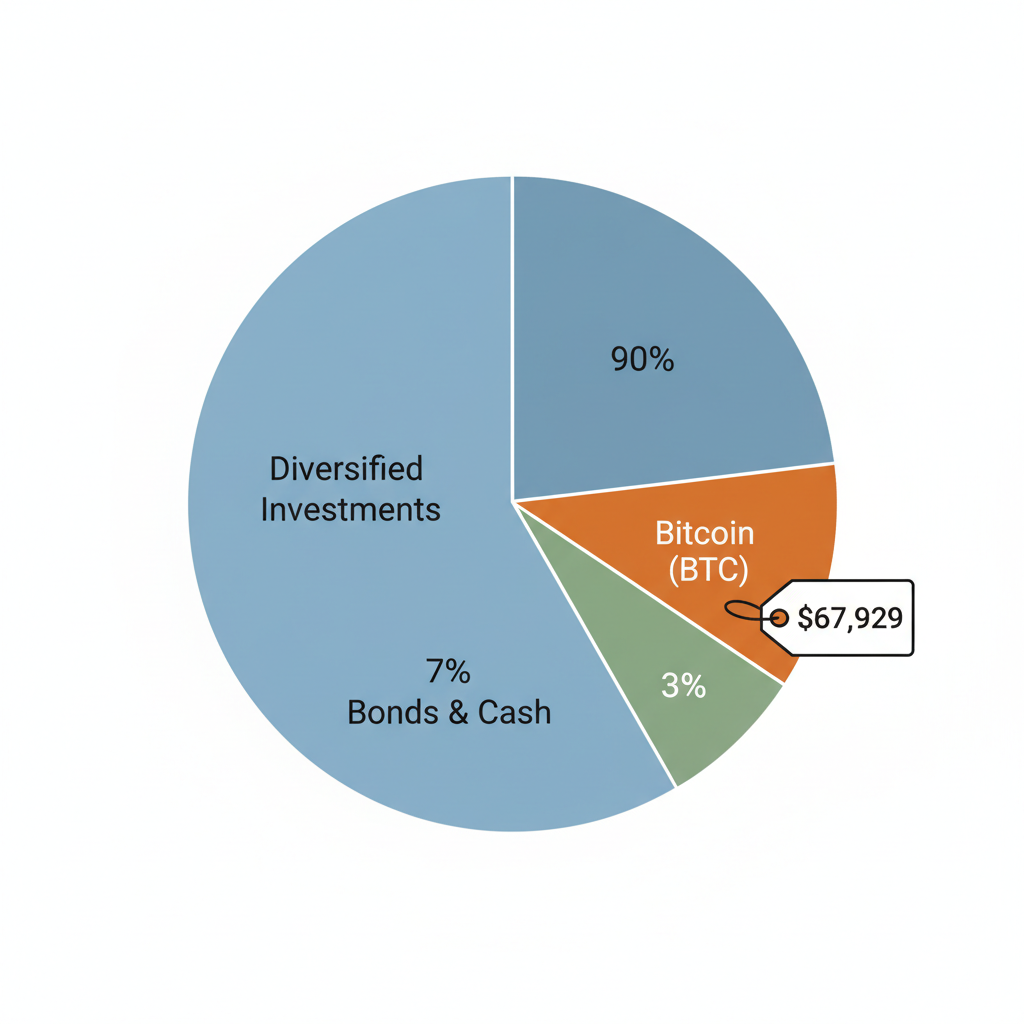

Financial advisors cap crypto at 2-5% of portfolios for good reason. Platforms like 401(x) offer bridges, weaving crypto into existing 401(k)s without full overhauls. Self-directed IRAs provide another avenue when employer plans balk. But for core offerings, administrators demand ironclad risk controls and education first.

Bitcoin (BTC) Price Predictions 2027-2032

Conservative projections for 2-5% allocations in 401(k) plans, accounting for regulatory shifts, adoption trends, and volatility risks

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from 2026 Baseline of $70,000) |

|---|---|---|---|---|

| 2027 | $50,000 | $95,000 | $160,000 | +36% |

| 2028 | $75,000 | $140,000 | $240,000 | +47% |

| 2029 | $110,000 | $200,000 | $350,000 | +43% |

| 2030 | $150,000 | $280,000 | $500,000 | +40% |

| 2031 | $200,000 | $380,000 | $650,000 | +36% |

| 2032 | $260,000 | $500,000 | $850,000 | +32% |

Price Prediction Summary

Bitcoin is projected to experience significant growth from current levels (~$68,000 in 2026) to an average of $500,000 by 2032, fueled by institutional adoption in retirement plans and regulatory progress. Wide min-max ranges highlight volatility; limit to 2-5% portfolio allocation for risk management.

Key Factors Affecting Bitcoin Price

- Regulatory clarity from 2025 DOL neutral stance and Trump executive order enabling crypto in 401(k)s

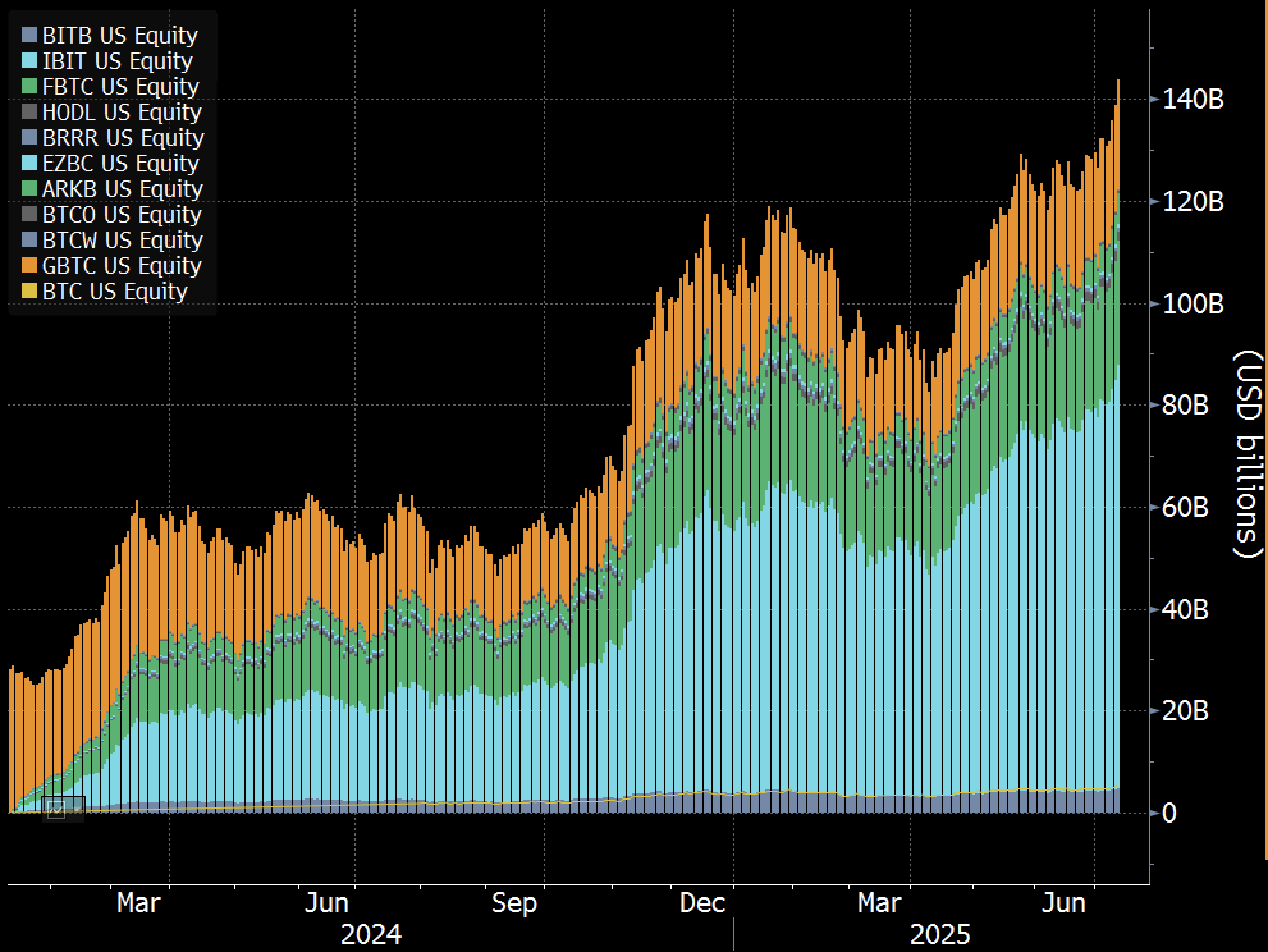

- Institutional inflows via Fidelity Crypto IRA and platforms like 401(x)

- 2028 Bitcoin halving reinforcing supply scarcity

- Macro trends including ETF approvals and economic cycles

- Ongoing risks: market volatility, fraud concerns, and competition from altcoins

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Morningstar notes ways to hold crypto now, minus rapid menu shifts. Blockworks questions if others will chase Fidelity’s Bitcoin bet. As 2026 unfolds, these tensions define crypto in 401k 2026 debates, pushing individuals toward alternatives.

Individuals aren’t powerless in this landscape. With Bitcoin steady at $67,929.00, forward-thinkers can sidestep administrative roadblocks through targeted strategies that fit within retirement rules. These approaches balance the thrill of crypto upside against real-world safeguards, ensuring your nest egg stays resilient.

Bridging the Gap: Self-Directed IRAs and Platform Innovations

Self-directed IRAs stand out as a primary workaround when your employer’s 401(k) shuns bitcoin etf retirement plan options. These accounts let you steer investments toward cryptocurrencies via custodians like Equity Trust or Directed IRA, which support digital assets. Roll over funds from your 401(k) or traditional IRA seamlessly, then allocate to Bitcoin or approved ETFs. Platforms such as 401(x) take it further, overlaying crypto choices onto existing 401(k)s without plan amendments. Employers opt in, but participants drive the demand.

Key Crypto Retirement Alternatives

-

Self-Directed IRAs: Use providers like Alto IRA or BitcoinIRA to hold Bitcoin and other cryptos directly in an IRA, bypassing 401(k) restrictions.

-

401(x) Platform: 401x.io integrates crypto investments into existing 401(k) plans without changing providers.

-

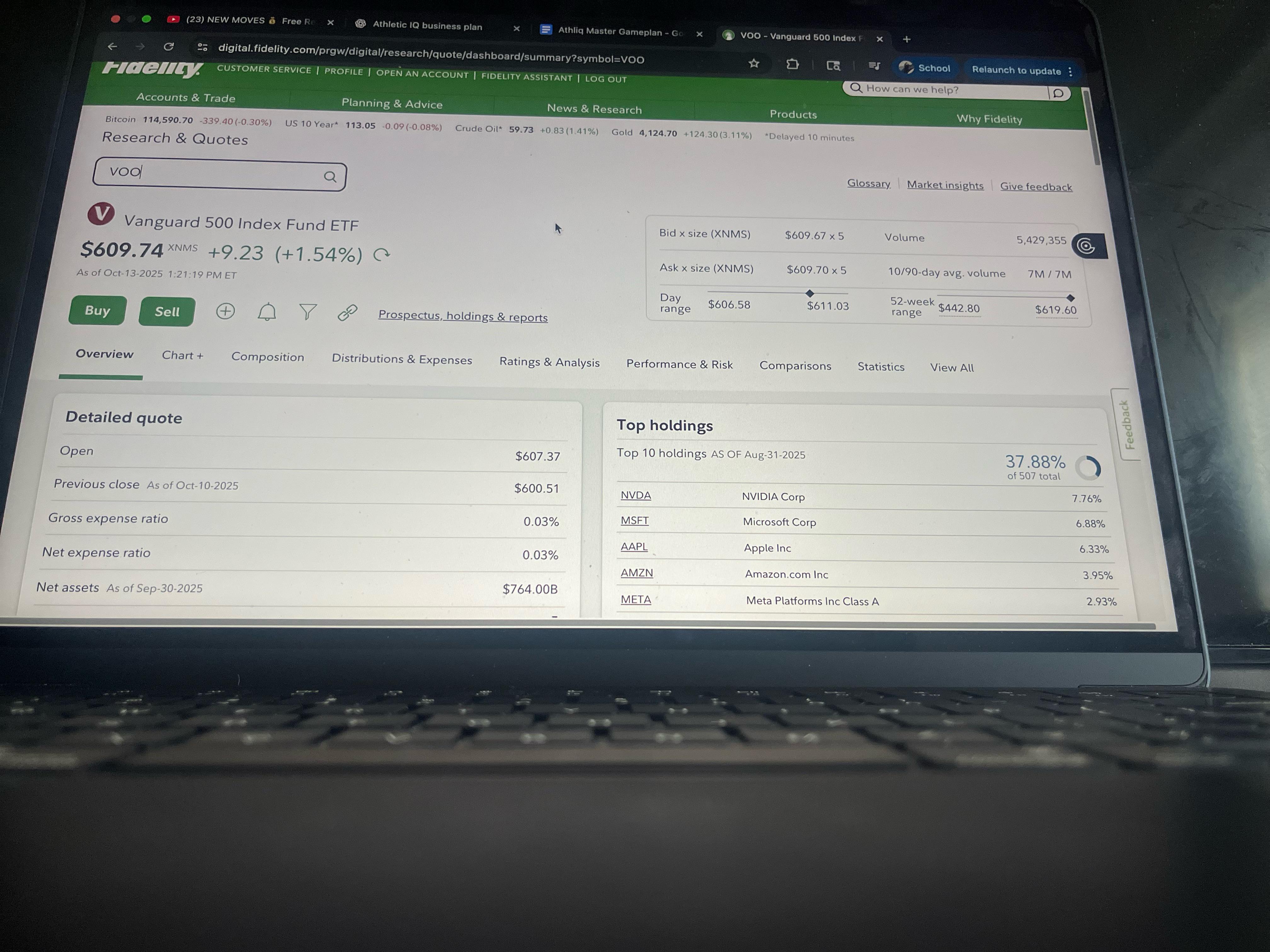

Spot Bitcoin ETFs: Invest in approved ETFs like IBIT (BlackRock) or FBTC (Fidelity), accessible in many IRAs and some 401(k)s.

-

ForUsAll Crypto 401(k): Plan sponsor platform offering Bitcoin and crypto allocations in custom 401(k) plans.

-

Fidelity Crypto Offerings: Fidelity’s Digital Assets account or Crypto IRA for employer-adopted retirement plans.

Fidelity’s crypto IRA adds another layer, available if your employer greenlights it. ForUsAll equips sponsors with tools for crypto 401(k)s, emphasizing education to meet fiduciary bars. Yet, even here, caution reigns: cap exposure at 2-5% to weather volatility, as advisors insist. Bitcoin’s recent 24-hour climb of and 0.9350% from $66,510.00 low tempts, but history demands discipline.

Solana-based options like HSDT highlight broader altcoin access in IRAs, though Bitcoin remains king for retirement due to maturity. Morningstar charts paths to hold crypto now, stressing liquidity hurdles that slow core adoption. As competitors eye Fidelity’s moves, demand could tip scales, but 2026 likely favors these indirect routes.

Navigating Risks with Smart Allocations

Opting in means confronting critiques head-on. Volatility can erase gains overnight, as AOL warns, potentially gutting savings. Crypto yields no dividends or yields, relying on price appreciation alone, which feels fragile next to blue-chip stability. Fraud risks loom large, from exchange hacks to rug pulls, demanding vetted custodians and cold storage where possible.

Yet dismissing Bitcoin ignores its evolution. At $67,929.00, it boasts institutional backing via ETFs and clearer regulations post-DOL shifts. Trump’s order paves roads, but administrators prioritize participant protection, often requiring opt-in education modules. Financial planners craft hybrid portfolios: 60% equities, 30% bonds, 5-10% alternatives including 2% Bitcoin. This tempers swings while capturing growth.

Senators’ scrutiny underscores transparency needs, but neutral DOL stance empowers choice. HR Brew notes Trump’s crypto affinity could accelerate shifts, though Yahoo experts advise measured steps with private assets.

Embarking on this path starts with assessing your risk tolerance. Consult a fiduciary advisor versed in crypto to align with ERISA if rolling from a 401(k). Document decisions meticulously; courts favor prudent processes over outcomes. Platforms simplify compliance, tracking trades and reporting seamlessly to IRS.

Looking ahead, 2026 holds promise. Rising Bitcoin prices and maturing infrastructure may nudge more plans forward. For now, these tactics let you weave crypto in 401k 2026 threads without waiting on gatekeepers. Knowledge arms you against pitfalls, turning regulatory thaw into personal gain. Platforms evolve, demand builds, and your retirement portfolio gains an edge precisely calibrated for the long haul.

Explore a detailed step-by-step for adding Bitcoin, adapting seamlessly to 2026 realities.