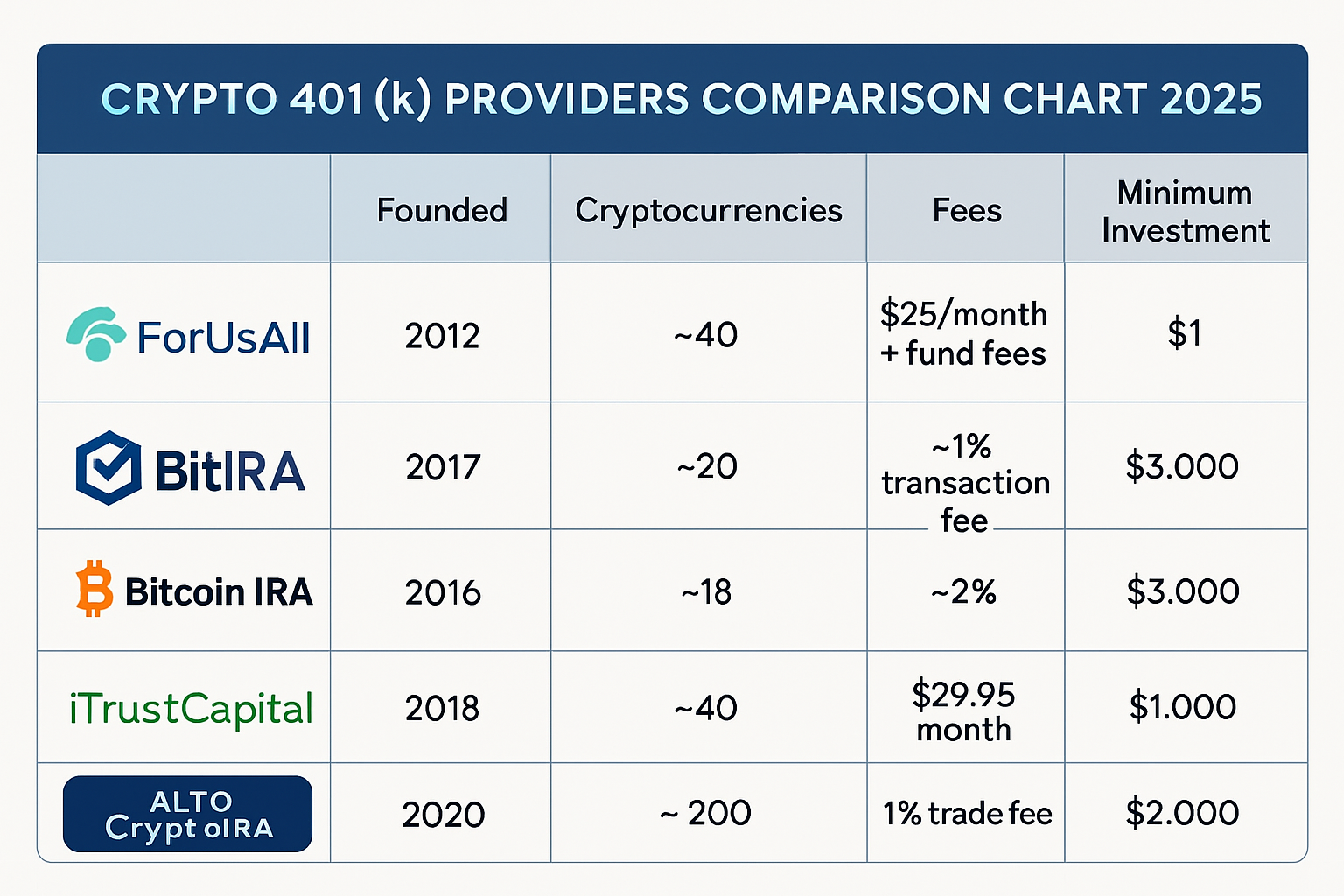

Crypto 401(k) providers have rapidly evolved, giving retirement savers unprecedented access to digital assets alongside traditional investments. As of September 2025, the landscape features a select group of platforms that stand out for their regulatory rigor, supported coins, and fee transparency. For investors seeking to diversify their 401(k) with crypto exposure, understanding the differences between these providers is essential for optimizing risk-adjusted returns and minimizing unnecessary costs.

Key Players in Crypto 401(k): Who’s Leading in 2025?

The current market is dominated by five core platforms: ForUsAll, BitIRA, Bitcoin IRA, iTrustCapital, and Alto CryptoIRA. Each offers a unique approach to integrating cryptocurrency into retirement planning, from employer-sponsored plan integration to self-directed IRAs with robust digital asset menus.

Top 5 Crypto 401(k) Providers for 2025

-

ForUsAll: Offers a self-directed cryptocurrency window within 401(k) plans, partnering with Coinbase Institutional. Participants can invest up to 5% of their retirement savings in cryptocurrencies tracked by the CoinDesk Market Select Index. Standout features include low trading fees (0.15%), no setup fees, and a broad range of supported coins.

-

BitIRA: Provides secure crypto IRA and 401(k) solutions with end-to-end insurance and cold storage. BitIRA supports a diverse selection of digital assets, including Bitcoin and Ethereum, and emphasizes robust security measures such as multi-signature wallets and full insurance coverage for digital holdings.

-

Bitcoin IRA: One of the largest and most established crypto retirement platforms, Bitcoin IRA allows users to invest in Bitcoin, Ethereum, and other cryptocurrencies within tax-advantaged retirement accounts. Features include a user-friendly mobile app, 24/7 trading, and up to $700 million in custody insurance.

-

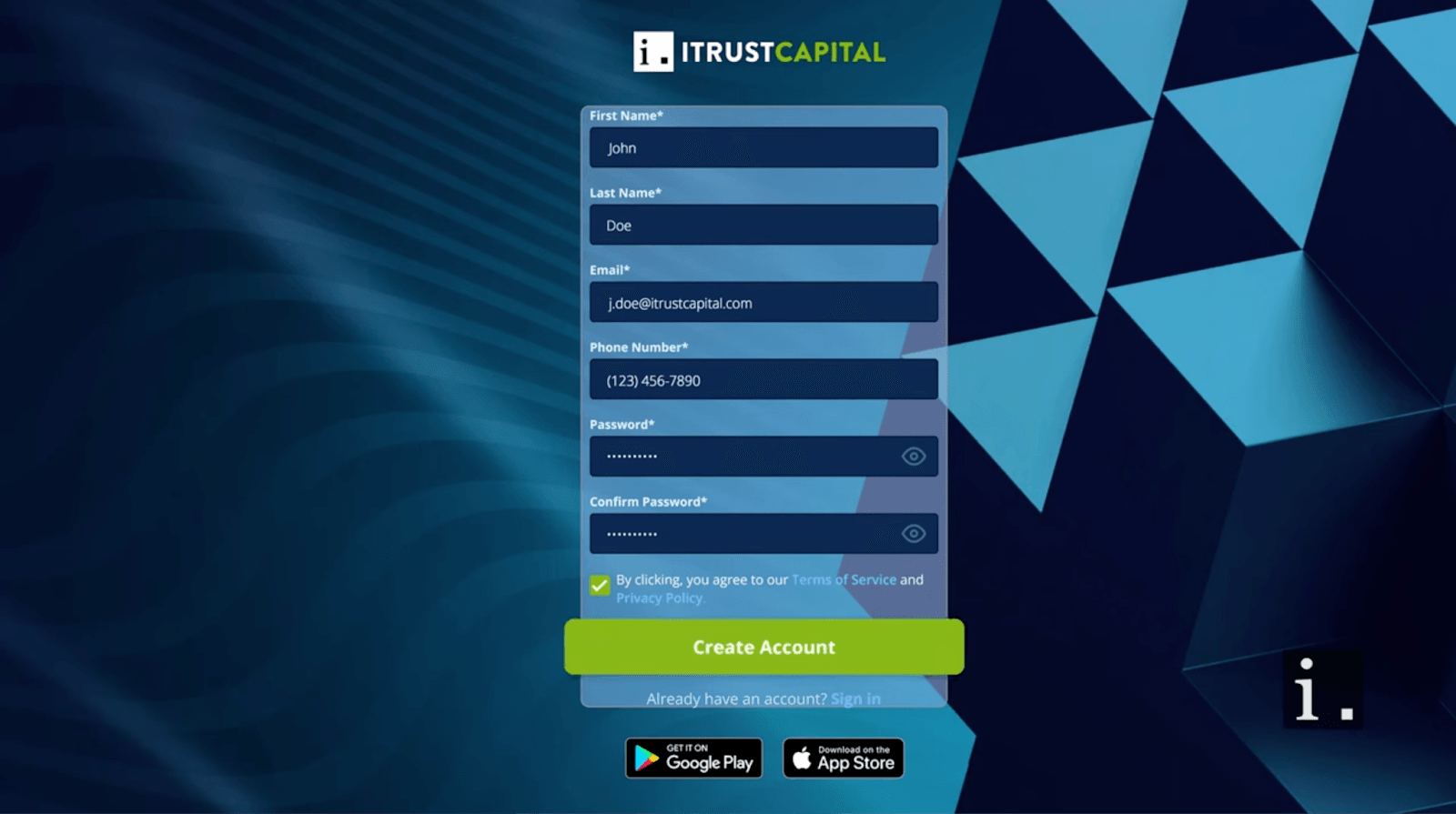

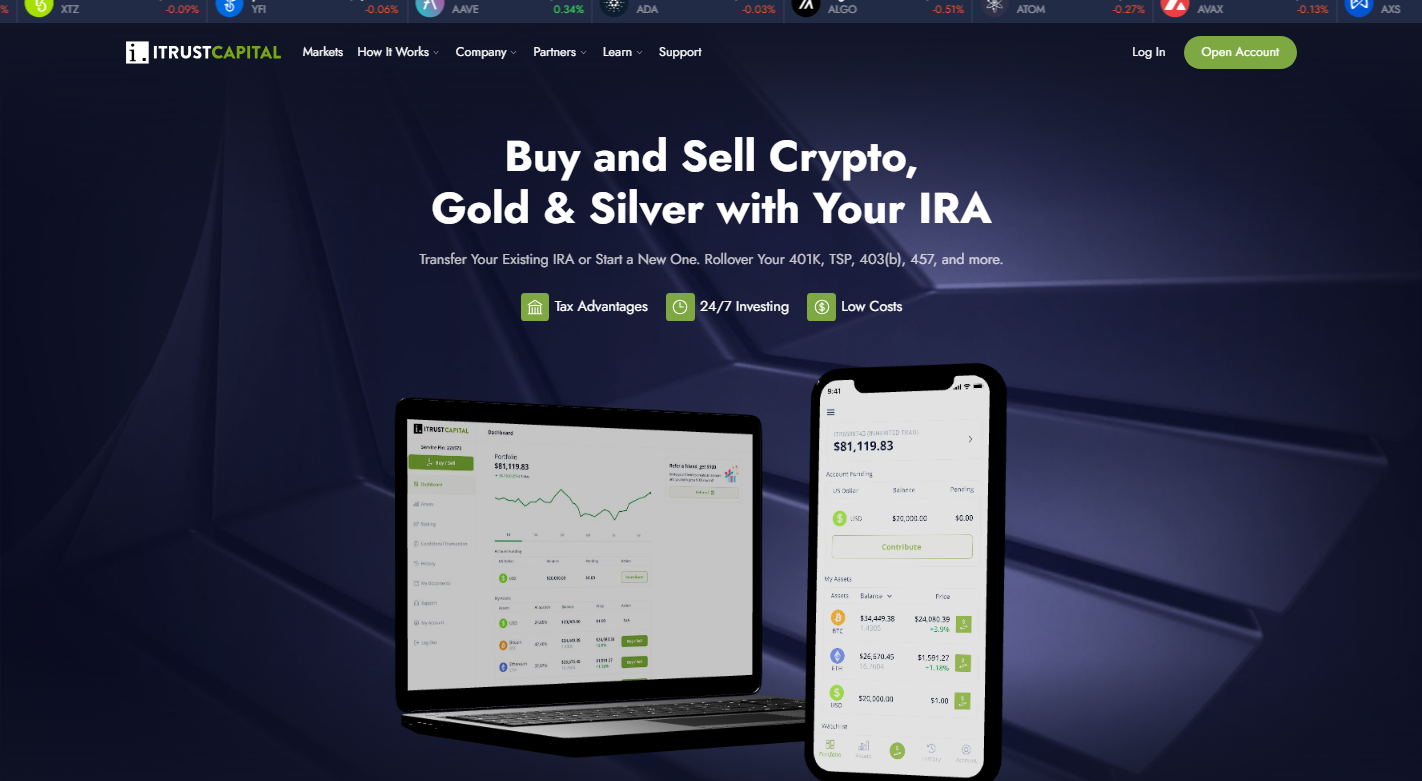

iTrustCapital: Known for its low fees and wide asset selection, iTrustCapital enables investors to trade 34 cryptocurrencies—including Bitcoin and Ethereum—within IRA accounts. There are no setup or maintenance fees, and crypto trades incur a 1% commission. The minimum investment is $1,000.

-

Alto CryptoIRA: Offers a flexible, self-directed crypto IRA platform with access to over 200 cryptocurrencies through integration with Coinbase. Alto is recognized for its transparent fee structure, easy account setup, and the ability to diversify retirement holdings with a broad range of digital assets.

Comparing Supported Coins Across Leading Platforms

The range of cryptocurrencies available within a retirement account can be a major differentiator. Here’s how the leading platforms stack up:

- ForUsAll: Through its partnership with Coinbase Institutional, ForUsAll enables access to a curated selection of coins based on the CoinDesk Market Select Index. This typically includes Bitcoin (BTC), Ethereum (ETH), and several large-cap altcoins. The focus is on liquidity and regulatory clarity.

- BitIRA: BitIRA supports a focused lineup featuring Bitcoin, Ethereum, Litecoin (LTC), Bitcoin Cash (BCH), and Ethereum Classic (ETC). The platform emphasizes security over breadth.

- Bitcoin IRA: Investors can choose from over 60 supported cryptocurrencies, including DeFi tokens and stablecoins. This breadth appeals to users seeking diversified crypto exposure beyond just BTC or ETH.

- iTrustCapital: With support for more than 30 coins, including Bitcoin, Ethereum, Cardano (ADA), Polkadot (DOT), and Chainlink (LINK): iTrustCapital balances variety with institutional-grade custody solutions.

- Alto CryptoIRA: Alto offers access to more than 200 cryptocurrencies through its integration with Coinbase. This makes it one of the most comprehensive options for investors aiming for broad diversification within their retirement accounts.

A Data-Driven Look at Fees: What Will It Cost?

No two platforms structure fees identically, making comparison critical for maximizing net returns.

- ForUsAll: Charges a monthly fee equal to 0.083% of your crypto balance plus trading fees at 0.15%. There are no setup or account minimums (source).

- BitIRA: Typically charges setup fees ranging from $50-$150 and annual maintenance fees around $300-$400. Trading spreads apply but are not always disclosed upfront.

- Bitcoin IRA: Has a one-time setup fee between 0.99%–2.99% of deposited funds, transaction fees at 2% per trade, plus a monthly security fee equal to 0.08% of AUM (source).

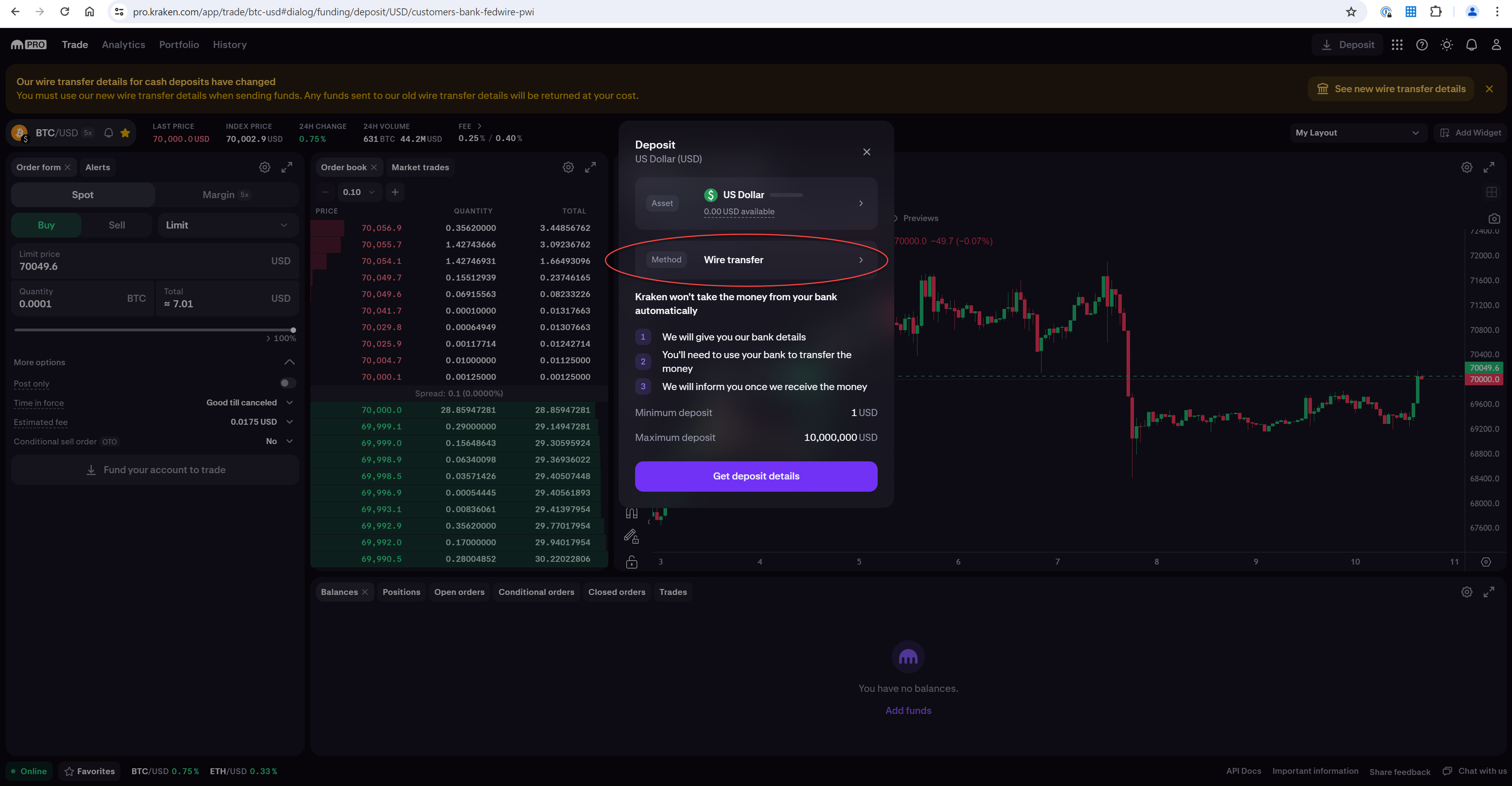

- iTrustCapital: No setup or maintenance fees; trades incur a flat commission of 1%. Minimum investment is $1,000 (source).

- Alto CryptoIRA: Charges $10–$25 per month depending on account activity plus trading commissions that vary by coin but are generally competitive within the industry.

This fee breakdown demonstrates why platform selection is not trivial, over time, even seemingly small differences in ongoing costs can erode long-term returns substantially. Investors should also weigh these expenses against factors like insurance coverage, cold storage policies, and user interface quality when evaluating options.

Security, Custody, and Insurance: What Sets Each Provider Apart?

Security remains the cornerstone of any reputable crypto 401(k) provider. BitIRA and Bitcoin IRA both offer end-to-end insurance on digital assets held in custody, with BitIRA leveraging fully insured cold storage through major custodians. iTrustCapital partners with Fireblocks and Coinbase Custody for institutional-grade protection, while ForUsAll also utilizes Coinbase Institutional’s robust security stack. Alto CryptoIRA, meanwhile, gives clients the flexibility to choose between cold storage and hot wallet solutions depending on their risk tolerance.

User experience is another differentiator. ForUsAll is tailored for employees participating in employer-sponsored plans, offering seamless payroll integration and automatic rebalancing features. Alto CryptoIRA stands out for its intuitive onboarding and broad coin selection, ideal for hands-on investors seeking portfolio customization. In contrast, Bitcoin IRA’s platform appeals to those looking for advanced analytics tools and real-time market tracking within their retirement dashboard.

Who Should Consider Each Platform?

- ForUsAll: Best suited for employees at companies offering crypto-enabled 401(k) plans who want low fees and regulatory clarity.

- BitIRA: Appeals to conservative investors prioritizing security, insurance, and a focused coin selection.

- Bitcoin IRA: Ideal for those seeking a wide array of coins, integrated gold options, and advanced trading features, at a premium fee structure.

- iTrustCapital: Strong fit for cost-conscious investors who want direct exposure to leading cryptocurrencies with no ongoing account fees.

- Alto CryptoIRA: Designed for active investors who want access to hundreds of coins and are comfortable managing more granular account details.

Choosing the Right Crypto 401(k) Provider: What Matters Most?

The optimal choice depends on your personal priorities, whether that’s minimizing fees, maximizing supported coins, or demanding the highest level of asset protection. Here are some key questions to ask when comparing providers:

Top 5 Crypto 401(k) Providers for 2025

-

ForUsAll: Offers a self-directed cryptocurrency window within 401(k) plans, partnering with Coinbase Institutional. Supports a range of digital assets via the CoinDesk Market Select Index, with low trading fees (0.15%) and no setup fees. Ideal for employers seeking compliant, integrated crypto retirement solutions.

-

BitIRA: Specializes in secure crypto IRAs and 401(k)s, featuring end-to-end insurance and multi-signature cold storage. Supports major cryptocurrencies like Bitcoin and Ethereum, with a strong focus on regulatory compliance and asset protection. Best for investors prioritizing security and insurance.

-

Bitcoin IRA: Enables direct investment in Bitcoin and other cryptocurrencies within retirement accounts. Offers a user-friendly interface, 24/7 trading, and insured cold storage. Fees include a one-time setup charge and a 2% transaction fee. Known for its robust platform and educational resources.

-

iTrustCapital: Provides IRA accounts supporting 34 cryptocurrencies, including Bitcoin and Ethereum, as well as gold and silver. No setup or maintenance fees; trades carry a 1% commission. Minimum investment is $1,000. Great for investors seeking asset variety and low fees.

-

Alto CryptoIRA: Offers self-directed IRAs with access to over 200 cryptocurrencies through partnerships with major exchanges. Transparent, low-cost fee structure and a seamless digital onboarding process. Ideal for those wanting broad coin access and user-friendly management.

If your employer offers ForUsAll or you prefer a straightforward interface with transparent pricing, it may be the most frictionless option. If you’re seeking maximum diversification or want to experiment with emerging altcoins inside your retirement account, Alto CryptoIRA’s extensive menu is hard to beat. For those wary of security risks or regulatory uncertainty, BitIRA provides peace of mind through its insurance-backed cold storage approach.

No matter which platform you choose from this curated list provides ForUsAll, BitIRA, Bitcoin IRA, iTrustCapital, or Alto CryptoIRA: the landscape in September 2025 is far more robust than even two years prior. Fees have become more transparent, supported assets have expanded significantly, and user protections have matured in response to both investor demand and regulatory scrutiny.

The bottom line: conducting a data-driven comparison using current fee schedules, supported coins lists, insurance policies, and user reviews will help you avoid costly pitfalls as you integrate crypto into your long-term retirement plan. As always, consult with an advisor who understands both digital assets and ERISA regulations before making allocation decisions that could impact your financial future.