The landscape for crypto 401k security is changing at breakneck speed. In August 2025, President Trump’s executive order cracked open the door for alternative assets like cryptocurrencies in retirement plans, sending shockwaves through both Wall Street and Main Street. While the potential for higher returns is tantalizing, the risks are just as real – and far more complex than with traditional stocks or bonds. If you’re considering digital assets in your retirement account, understanding the security pitfalls and best practices isn’t optional. It’s mission critical.

Crypto in Your 401(k): Why Security Is Non-Negotiable

Let’s get tactical. Crypto’s volatility is legendary, but that’s only half the story. According to the Government Accountability Office (GAO), high volatility can erode your retirement savings fast if you aren’t careful with allocation. But even more pressing are the unique security threats: cyberattacks, exchange insolvency, wallet mismanagement, and regulatory uncertainty all loom large over crypto 401(k) accounts.

Unlike traditional equities held by institutional custodians with robust insurance and oversight, crypto assets often live on exchanges or in wallets that can be hacked or lost forever with a single misstep. The Department of Labor has flagged these custodial vulnerabilities as a top concern (source). Simply put: if you lose your private keys, there’s no customer service line to call.

Major Security Risks Facing Crypto 401(k) Investors

Top 5 Security Risks of Crypto in 401(k) Accounts

-

Extreme Price Volatility: Cryptocurrencies like Bitcoin and Ethereum are known for rapid price swings, which can cause dramatic fluctuations in your retirement savings. This volatility makes it difficult to predict long-term returns and increases the risk of significant losses.

-

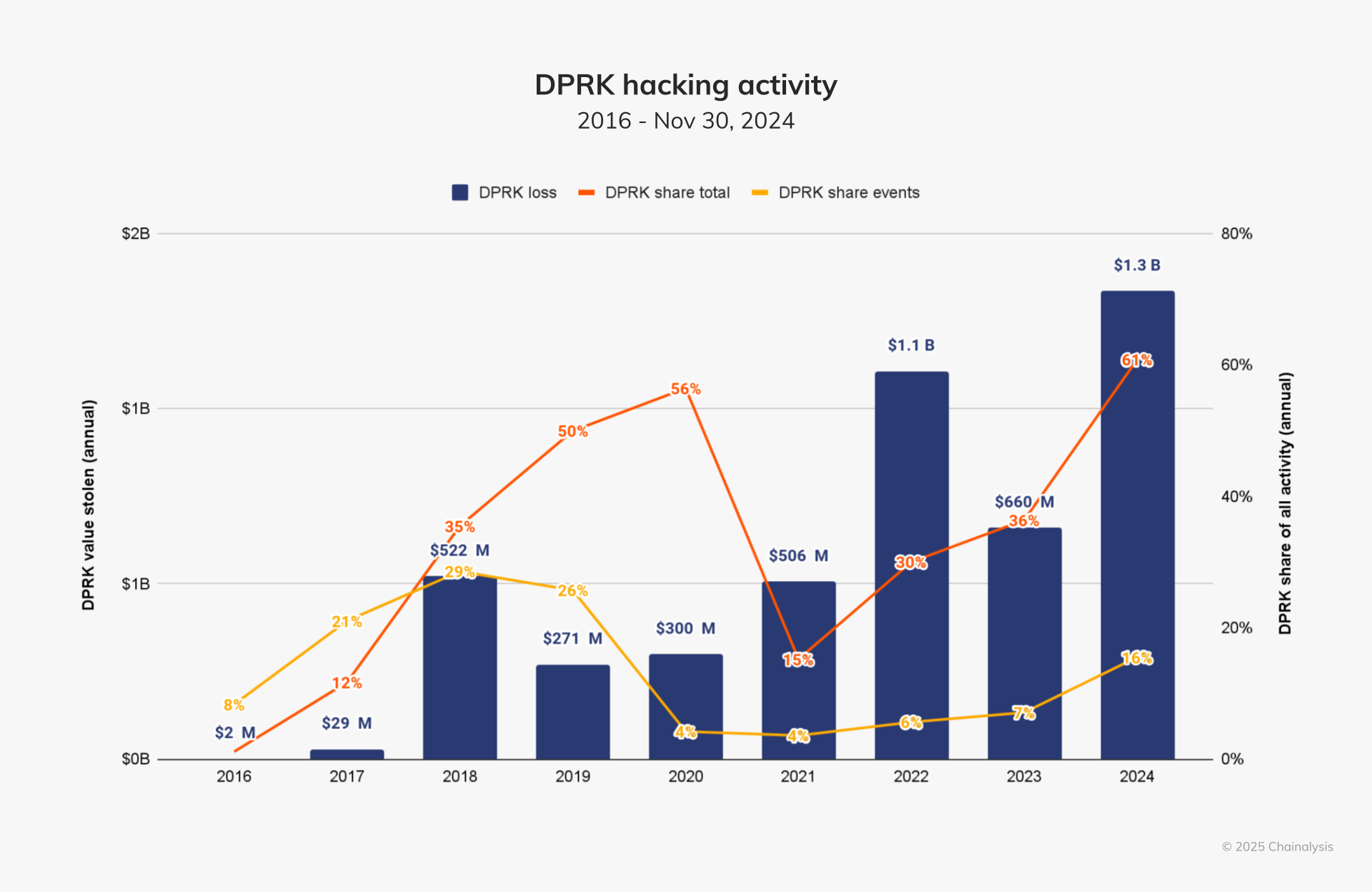

Cybersecurity Threats: Digital assets in 401(k) accounts are vulnerable to hacking, phishing, and malware attacks. Even major exchanges and custodians have suffered breaches, leading to the loss of investor funds.

-

Custodial and Wallet Risks: If your 401(k) provider or custodian mishandles private keys or uses insecure storage solutions, your crypto assets could be lost or stolen with little chance of recovery.

-

Regulatory Uncertainty: The legal landscape for crypto in retirement accounts is constantly evolving. Sudden regulatory changes or new restrictions could impact access, taxation, or even force liquidation of digital assets.

-

Liquidity Challenges: Unlike stocks or bonds, many cryptocurrencies have limited liquidity, especially during market stress. This can make it difficult to quickly convert holdings to cash without incurring losses.

1. Cybersecurity Threats: Hackers target exchanges and custodians relentlessly. Even major platforms have suffered breaches resulting in millions lost.

2. Custody and Key Management: Losing access to private keys means losing your funds – permanently. Many investors underestimate this risk until it’s too late.

3. Exchange Insolvency: If your provider goes under (think FTX), your assets may be tied up in bankruptcy court for years – or gone entirely.

4. Regulatory Uncertainty: Rules around custody and reporting are still evolving, leaving gaps that bad actors can exploit.

5. Lack of Insurance: Unlike FDIC-insured bank deposits or SIPC-protected brokerage accounts, most crypto holdings have limited or no insurance coverage against theft or loss (source). This makes picking the right custodian absolutely essential.

Tactical Best Practices for Retirement Account Digital Asset Safety

If you’re serious about protecting your nest egg while exploring crypto exposure, it pays to operate like a pro trader – not a tourist. Here are actionable steps every investor should take:

- Diversify Your Custody Solutions: Don’t leave all assets on a single exchange; consider institutional-grade cold storage for long-term holdings (think multi-signature wallets held offline).

- MFA Is Mandatory: Two-factor authentication (2FA) is non-negotiable for any platform managing your retirement funds.

- Select Insured Custodians: Work only with providers offering explicit insurance policies covering theft and cybercrime – read the fine print carefully.

- Avoid Hot Wallets for Large Sums: Hot wallets are convenient but vulnerable; use them only for small balances needed for active trading.

- KYC and Regulatory Compliance: Ensure your provider complies with U. S. regulations to avoid legal headaches down the road (source).

It’s not just about ticking boxes – it’s about future-proofing your retirement. As the Department of Labor reevaluates crypto guidance in response to the latest executive order, expect a tighter regulatory environment and higher expectations for both plan sponsors and individual investors. The stakes are high: a single lapse in digital asset security could wipe out years of savings. That’s why it pays to stay ahead of the curve and treat your crypto 401(k) like a high-value target.

Cold Storage vs. Hot Wallets: What Works for 401(k) Crypto?

The debate between 401k crypto cold storage and hot wallets is more than academic. Cold storage – offline, air-gapped hardware wallets with multi-signature protocols – offers maximum protection against hacks and unauthorized access. It’s the gold standard for institutional investors, and it should be your baseline for retirement accounts. Hot wallets, while convenient for quick trades or rebalancing, leave assets exposed to online threats. If your plan provider doesn’t offer robust cold storage solutions, ask tough questions or look elsewhere.

Insurance is another layer you can’t afford to skip. With limited industry-wide standards, some custodians now offer bespoke crypto custodian insurance policies covering theft or cyber incidents. Review these policies line by line; exclusions are common, and coverage limits might not match your account value if Bitcoin continues its upward trajectory.

Red Flags: When Your Crypto 401(k) Isn’t As Safe As You Think

Even with new regulatory momentum, not all providers are created equal. Watch out for red flags:

- Lack of transparency around custody arrangements or insurance details

- No independent audits or third-party attestations of reserves

- Poor customer support or unclear recovery procedures if something goes wrong

- Unregulated offshore custodians, which can complicate recourse in case of loss

- Lax KYC/AML controls, putting your account at risk of regulatory scrutiny or even seizure

The bottom line? Security is never set-and-forget in the world of retirement account digital asset safety. Regularly review your provider’s protocols, stay updated on evolving regulations, and don’t hesitate to move assets if you spot warning signs.

If you want outsized returns, you need outsized discipline on security.

– Sophie Delgado

How to Take Action Now: Secure Your Crypto 401(k)

If you’re ready to get tactical about protecting your retirement savings from digital threats:

Tactical Steps to Secure Your Crypto 401(k) Today

-

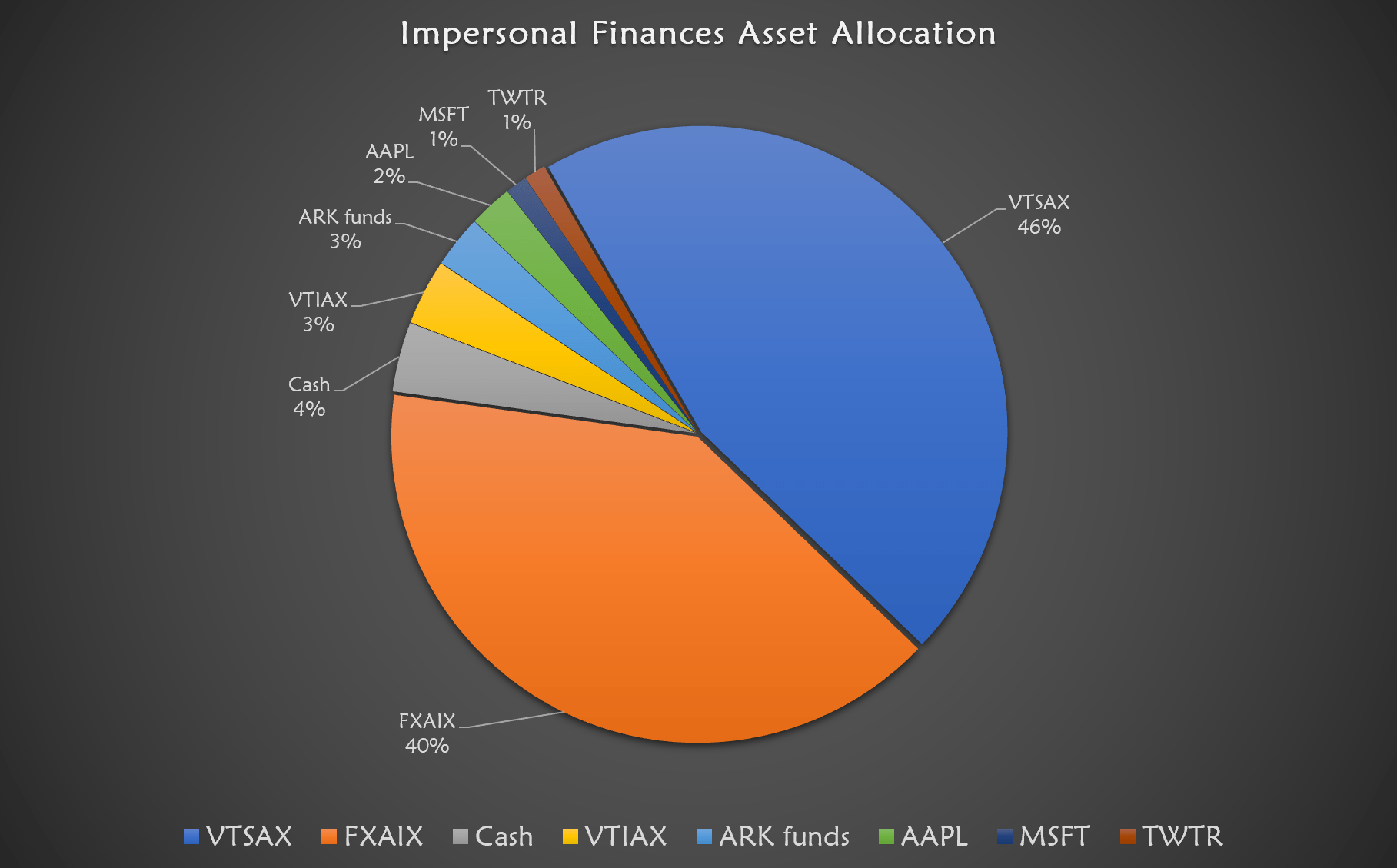

Limit Crypto Allocation: Financial experts recommend keeping your crypto exposure to a small percentage of your overall 401(k) portfolio—typically no more than 5%—to manage volatility and risk.

-

Choose a Reputable 401(k) Provider: Opt for established platforms like Fidelity Investments or ForUsAll that offer crypto options with robust security protocols and regulatory compliance.

-

Enable Two-Factor Authentication (2FA): Always activate 2FA on your 401(k) and crypto exchange accounts to add an extra layer of protection against unauthorized access.

-

Use Institutional-Grade Custodians: Ensure your crypto assets are held with regulated custodians such as Coinbase Custody or BitGo, which offer insurance and advanced security measures.

-

Regularly Review Regulatory Updates: Stay informed about Department of Labor (DOL) guidance and any changes following the August 2025 executive order to ensure your investments remain compliant.

-

Consult a Financial Advisor: Work with a fiduciary financial advisor who understands crypto assets and can help you navigate evolving risks and opportunities in your 401(k).

-

Monitor Account Activity: Frequently check your 401(k) and linked crypto accounts for suspicious transactions or unauthorized changes.

-

Secure Recovery Phrases Offline: Store any wallet recovery phrases or private keys in a secure, offline location such as a hardware wallet or safe deposit box—never online or in cloud storage.

-

Understand Liquidity Constraints: Be aware that crypto assets in 401(k)s may have limited liquidity compared to traditional investments, making it harder to access funds quickly if needed.

-

Educate Yourself Continuously: Take advantage of resources from reputable organizations like FINRA, SEC, and Investopedia to stay up to date on crypto risks, best practices, and market trends.

The future of retirement investing is being rewritten in real time. With Bitcoin holding strong above key levels and regulators poised to expand access further, now is the time to shore up your defenses before allocating more capital into this volatile – but potentially rewarding – asset class.