SEC Chair Paul Atkins just flipped the script on retirement investing. With his bold declaration that ‘the time is right’ for paul atkins 401k crypto inclusion, Bitcoin is no longer a sidelined asset in your nest egg. Millions of Americans already dip into digital assets outside plans, but 2026 marks the pivot: neutral DOL guidance, Trump’s executive order, and Atkins’ push for sec chair crypto retirement access. This isn’t hype; it’s a regulatory green light for bitcoin 401k allocation 2026.

Picture this: your 401(k) humming with Bitcoin’s potential, backed by White House nods to diversification perks. Critics like Elizabeth Warren warn of volatility pitfalls, citing a Senate letter on risks. Yet Atkins counters with education and disclosure, echoing CFTC insights. Forward-thinkers, this is your cue to act on add crypto to 401k plan opportunities.

Atkins’ Stance Reshapes 401k Bitcoin ETF Eligibility

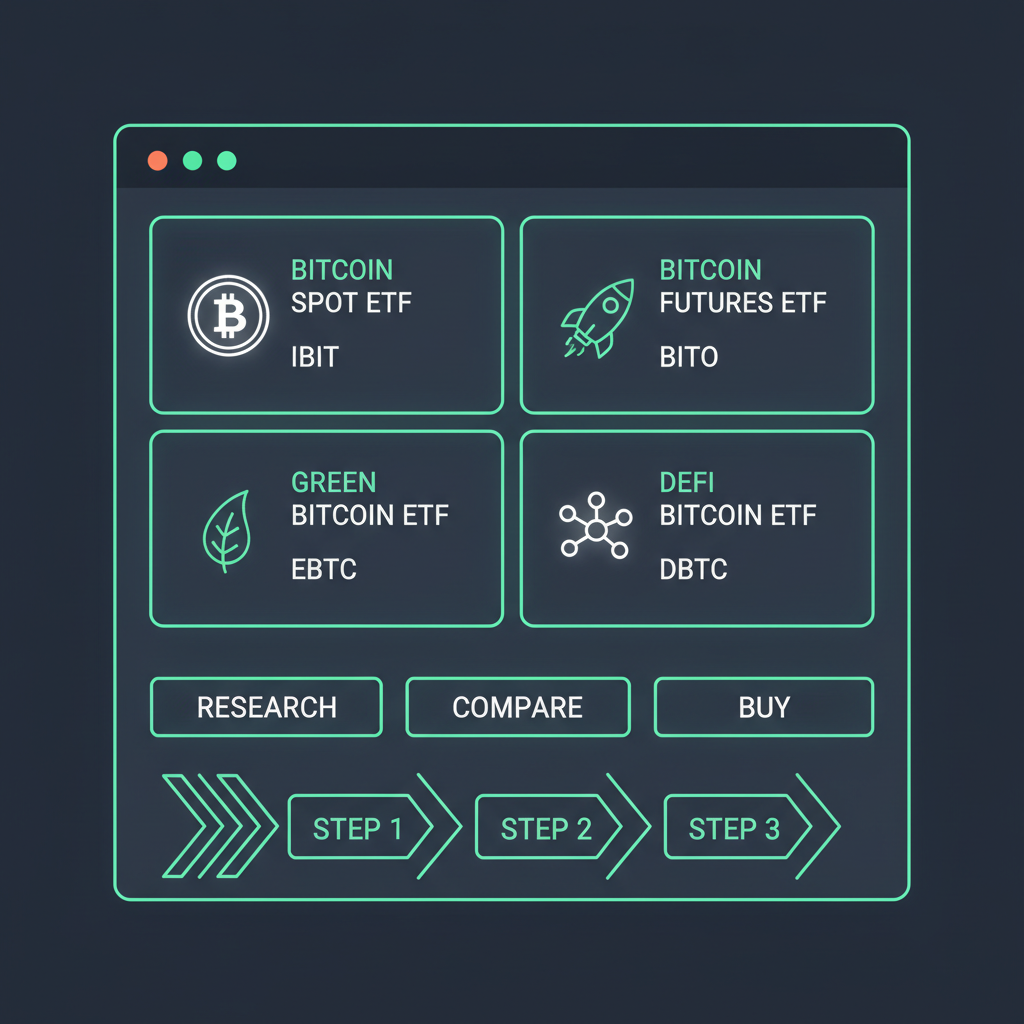

Paul Atkins isn’t whispering; he’s directing the orchestra. Post-2025 DOL shift from discouragement to neutrality, and August’s executive order, Atkins emphasizes responsible paths. Senate probes on volatility? Acknowledged, but not a roadblock. His vision: empower plans via self-directed windows from Fidelity or ForUsAll. This setup primes 401k bitcoin etf eligibility for spot ETFs like IBIT and FBTC, blending crypto’s edge with retirement guardrails.

I see it daily in fintech trenches: equities plateau, crypto surges. Atkins aligns with data-driven reality, urging 1-5% allocations to capture upside without capsizing portfolios. White House backing underscores competitive returns, making inaction the real risk.

Step 1: Verify 401(k) Plan Eligibility with Atkins’ Guidance

First move: confirm your employer’s plan supports crypto. Not all do, but providers like Fidelity or ForUsAll now integrate seamlessly, fueled by SEC Chair Paul Atkins’ 2026 guidance on crypto inclusion. Log into your portal, scan for self-directed brokerage options. If absent, nudge HR; post-DOL neutrality, momentum builds.

Actionable tip: Cross-check plan docs for alternative asset windows. Atkins’ pro-stance means more plans comply, unlocking Bitcoin without rogue moves. Skip this, and you miss the boat.

Step 2: Review Regulatory Updates for Smart Entry

Dig into SEC approvals for Bitcoin spot ETFs like IBIT and FBTC, now 401(k)-eligible. Layer in CFTC insights from the January 2026 Senate letter on volatility; it’s a reality check, not deterrent. Atkins frames this as education fuel, ensuring you grasp mechanics before committing.

Pro moves: Bookmark SEC filings, note ETF liquidity. Warren’s fears? Valid for the uninformed, but armed with updates, you position for Atkins-endorsed growth. This step cements compliance, dodging future headaches.

Step 3: Assess Personal Risk Tolerance Before Allocating

Bitcoin’s 50% and volatility from 2025 data demands scrutiny. Map your retirement timeline: nearing 65? Cap at 1%. Decades out? Push 5%. Evaluate portfolio balance; crypto diversifies beyond stocks’ doldrums.

Opinion: Too many sleepwalk into assets mismatched to tolerance. Atkins preaches balance; use tools like risk quizzes from plan providers. This guardrail turns volatility into volatility advantage, aligning with White House diversification rationale.

Step 4: Select Approved Crypto Products for Your 401(k)

Zero in on SEC-approved Bitcoin ETFs or direct holdings greenlit for 401(k)s. Prioritize low-fee warriors like BlackRock’s IBIT, which packs institutional-grade security and liquidity. Atkins’ framework spotlights these as bridges from speculation to strategy, sidestepping direct custody headaches in retirement wrappers.

Smart pick: Scan expense ratios under 0.25%; IBIT shines here, tracking Bitcoin faithfully without the wild swings of unvetted coins. This choice amplifies bitcoin 401k allocation 2026 without courting Warren-style wipeouts. Ditch hype tokens; stick to battle-tested ETF proxies for that Atkins-approved polish.

Step 5: Consult Advisor or Administrator on Integration

Loop in your financial advisor or plan administrator now. Hash out integration tactics, spotlighting White House-cited diversification wins and tax quirks for Roth versus Traditional 401(k)s. Atkins stresses this dialogue; it’s your firewall against missteps in a post-EO landscape.

From my fintech vantage, advisors who blend crypto with equities unlock alpha. Probe Roth conversions for tax-free growth or Traditional deferrals for current deductions. This consult transforms abstract policy into your personalized add crypto to 401k plan blueprint, dodging Senate volatility flags.

Step 6: Implement, Monitor, and Rebalance Your Allocation

Execute via the brokerage window, then track relentlessly with apps like CoinMarketCap. Rebalance quarterly, honoring Atkins’ diversification nod. Start small, scale on milestones; this rhythm tames Bitcoin’s pulse into portfolio fuel.

Ruthless reality: Set alerts for 20% drifts, automate if possible. Quarterly tweaks keep your 1-5% slice potent amid market gyrations, turning CFTC-noted volatility into your edge. Atkins envisions this discipline; deliver it.

Atkins’ pivot isn’t permission to gamble; it’s a mandate to evolve. With DOL neutrality and executive momentum, sec chair crypto retirement doors swing wide in 2026. Providers adapt fast, ETFs mature, critics fade to footnotes. Your move: layer Bitcoin thoughtfully, harvest diversification dividends. Portfolios ignoring this stall; those embracing accelerate. Adapt faster, secure deeper.