SEC Chair Paul Atkins’ recent endorsement of Bitcoin exposure in 401(k) plans marks a pivotal shift for retirement investors. With Bitcoin holding steady at $69,970.00 despite a 24-hour dip of $550.00, or -0.78%, Atkins argues that professional management can harness crypto’s growth potential while mitigating risks. This aligns with President Trump’s 2025 executive order reevaluating qualified assets for the $12.5 trillion 401(k) market, potentially democratizing access to digital assets long confined to high-net-worth circles.

Atkins’ stance isn’t reckless optimism. Drawing from existing pension fund models where Americans already gain indirect crypto exposure through pros, he emphasizes safeguards like diversified allocations and rigorous oversight. In late January 2026 remarks, he declared “the time is right” for measured integration, countering fears by prioritizing investor education and regulated products. For retirement savers eyeing paul atkins sec bitcoin 401k developments, this signals opportunity amid evolution.

Atkins’ Push Meets Regulatory Headwinds from Warren

Senator Elizabeth Warren’s January 12,2026, letter to Atkins highlights the tension. Citing crypto volatility, she demands details on Trump’s executive order, warning it endangers savers. Sources from the Senate Banking Committee and CNBC echo her view that workers could “lose big” without ironclad protections. Yet Atkins, backed by Commissioner Hester Peirce, pushes forward, noting CFTC collaboration via Project Crypto and confidence in a 2026 bipartisan bill.

This debate underscores bitcoin 401k regulations 2026 as a battleground between innovation and caution. Warren’s scrutiny, while valid, overlooks Bitcoin’s maturation; at $69,970.00, it’s far from the wild swings of yesteryear, with institutional inflows stabilizing markets. Atkins’ measured approach, mirroring foreign private issuer evolutions he addressed recently, reassures that sec approval crypto retirement won’t repeat past pitfalls.

Why Bitcoin Fits Modern 401(k) Portfolios

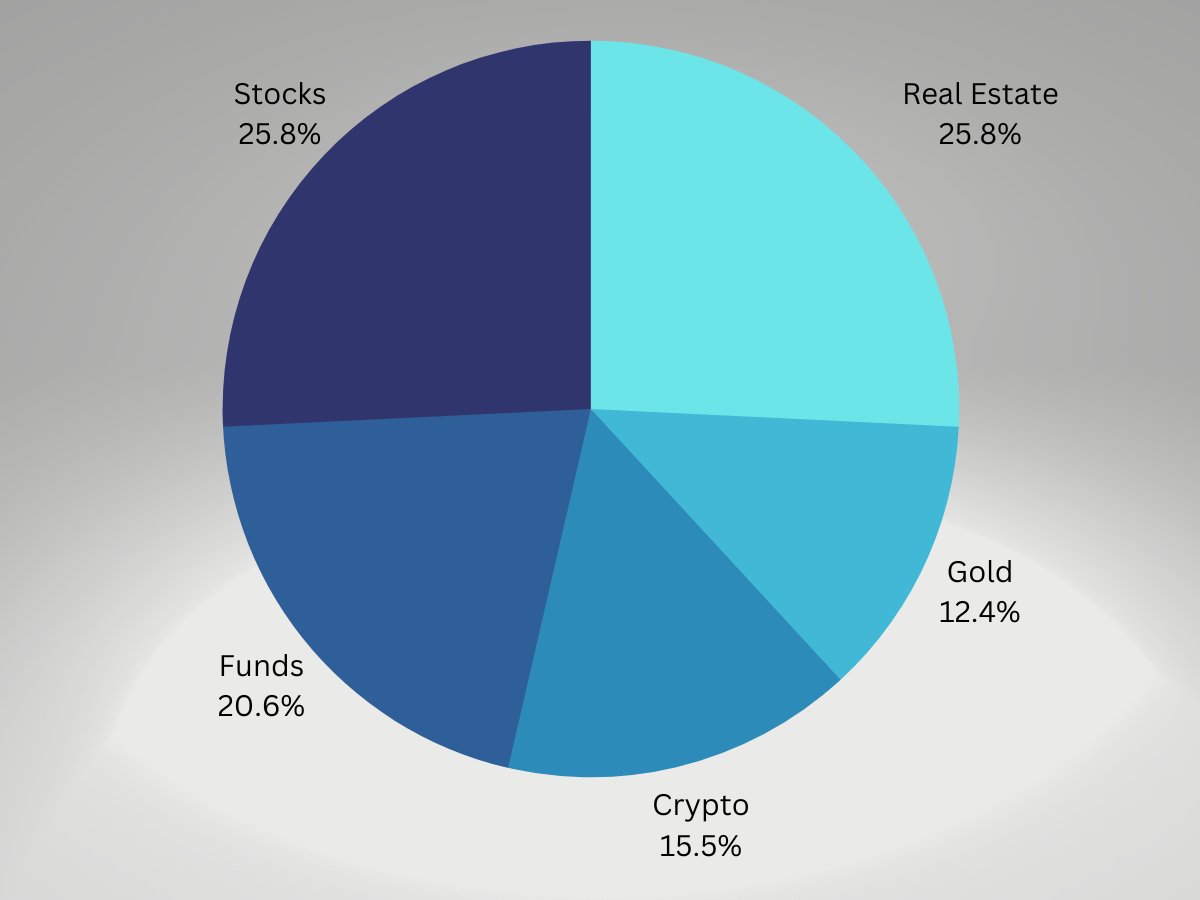

Bitcoin’s role in diversification shines analytically. Traditional 60/40 stock-bond mixes falter in low-yield eras, but a 1-5% crypto sleeve, professionally managed, enhances returns with low correlation to equities. Historical data shows Bitcoin’s long-term compound growth outpacing many assets, even after dips like today’s -0.78% to $69,970.00. Atkins highlights this in pension contexts, where oversight ensures suitability.

Bitcoin (BTC) Price Prediction 2027-2032: Impact of SEC Chair Atkins’ 401(k) Push

Projections incorporating regulatory advancements, retirement plan adoption, market cycles, and halving events amid $12.5T potential inflows

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

|---|---|---|---|

| 2027 | $85,000 | $115,000 | $165,000 |

| 2028 | $105,000 | $155,000 | $235,000 |

| 2029 | $125,000 | $185,000 | $295,000 |

| 2030 | $100,000 | $150,000 | $250,000 |

| 2031 | $140,000 | $210,000 | $350,000 |

| 2032 | $170,000 | $260,000 | $450,000 |

Price Prediction Summary

Under SEC Chair Paul Atkins’ advocacy for managed crypto exposure in 401(k) plans, Bitcoin is set for substantial growth from its current ~$70,000 level. Conservative 2030 target of $100,000, base $150,000, and bullish $250,000 align with table averages; extension to 2032 projects up to $450,000 in optimistic scenarios, factoring in 2028 halving, institutional trillions, and adoption despite volatility critiques from Sen. Warren.

Key Factors Affecting Bitcoin Price

- SEC policy shift enabling 401(k) access to Bitcoin via professional management

- Trillions in retirement inflows unlocking mass institutional demand

- 2028 Bitcoin halving enhancing scarcity and price momentum

- Favorable U.S. regulatory clarity under Trump admin and bipartisan bills

- Maturing ETFs, tech upgrades (e.g., Layer 2), and global adoption trends

- Macro risks: volatility concerns, competition from altcoins, potential recessions

- Bearish floors account for corrections; bullish highs driven by hype cycles

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

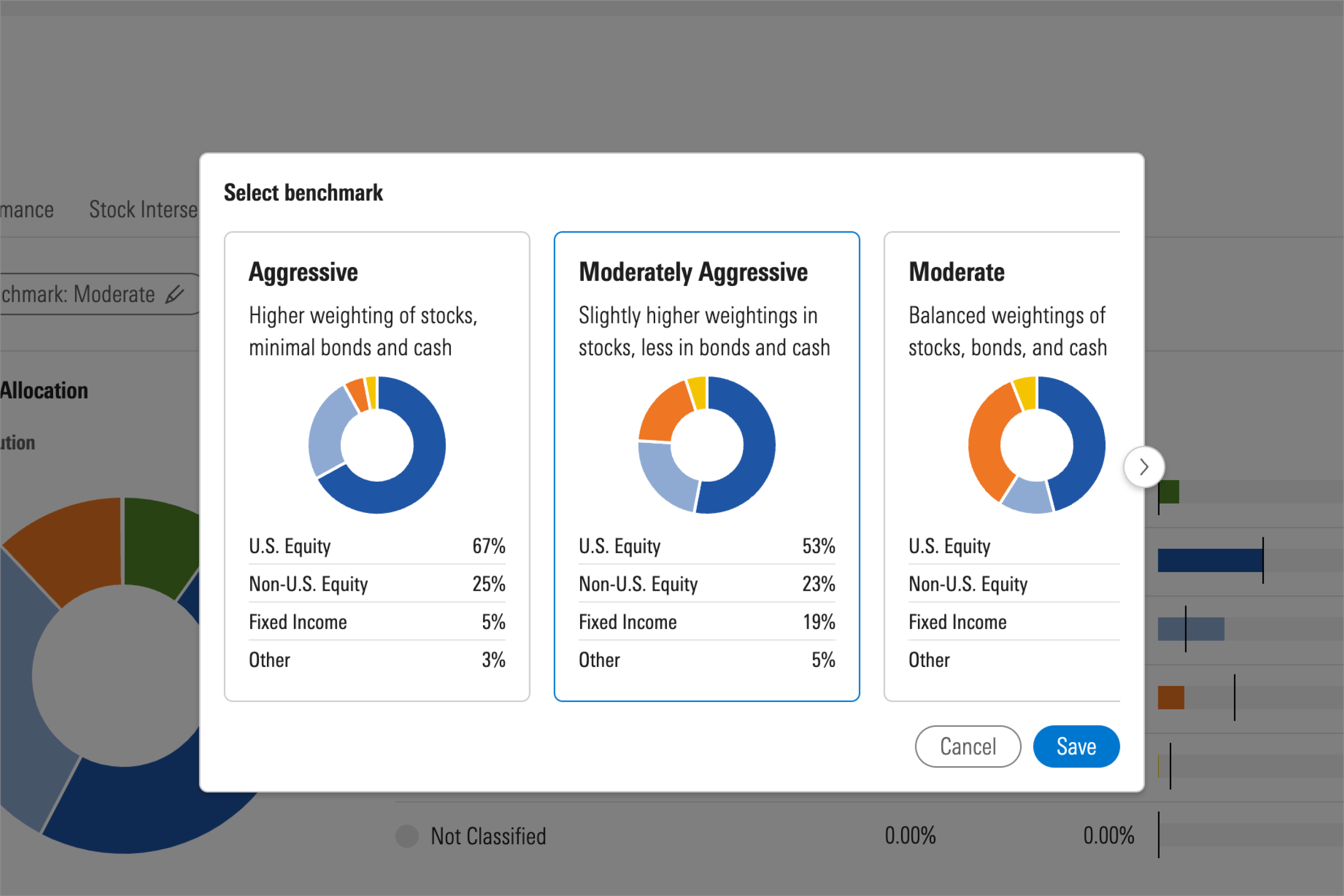

For retirement planners, congress bitcoin 401k push via Atkins amplifies urgency. Unlike direct retail trading, 401(k) crypto would flow through custodians like Fidelity or BlackRock, vetted ETFs, or futures-based funds. This structure addresses Warren’s volatility fears, capping exposure and mandating disclosures. My decade in portfolio management affirms: with discipline, Bitcoin bolsters resilience against inflation and fiat debasement.

Immediate Preparation Strategies for Investors

Start by auditing your 401(k) provider’s roadmap. Many, anticipating sec approval crypto retirement, are piloting crypto options. Request prospectuses detailing allocation limits, often 5% max initially, and rebalancing protocols. Educate via CFP meetings; stress-test scenarios where Bitcoin at $69,970.00 drops 20% yet recovers, preserving principal through bonds.

Diversify thoughtfully: pair Bitcoin with Ethereum via regulated vehicles, avoiding overconcentration. Monitor Trump’s executive order impacts, which Atkins champions. Build liquidity buffers outside retirement accounts for near-term needs, ensuring crypto serves long-horizon growth.

Track legislative momentum closely. Atkins’ optimism for a bipartisan crypto bill in 2026 could cement bitcoin 401k regulations 2026, clarifying paths for plan sponsors. Pair this vigilance with personal benchmarking: compare your portfolio’s Sharpe ratio pre- and post-crypto simulation, aiming for improved risk-adjusted returns.

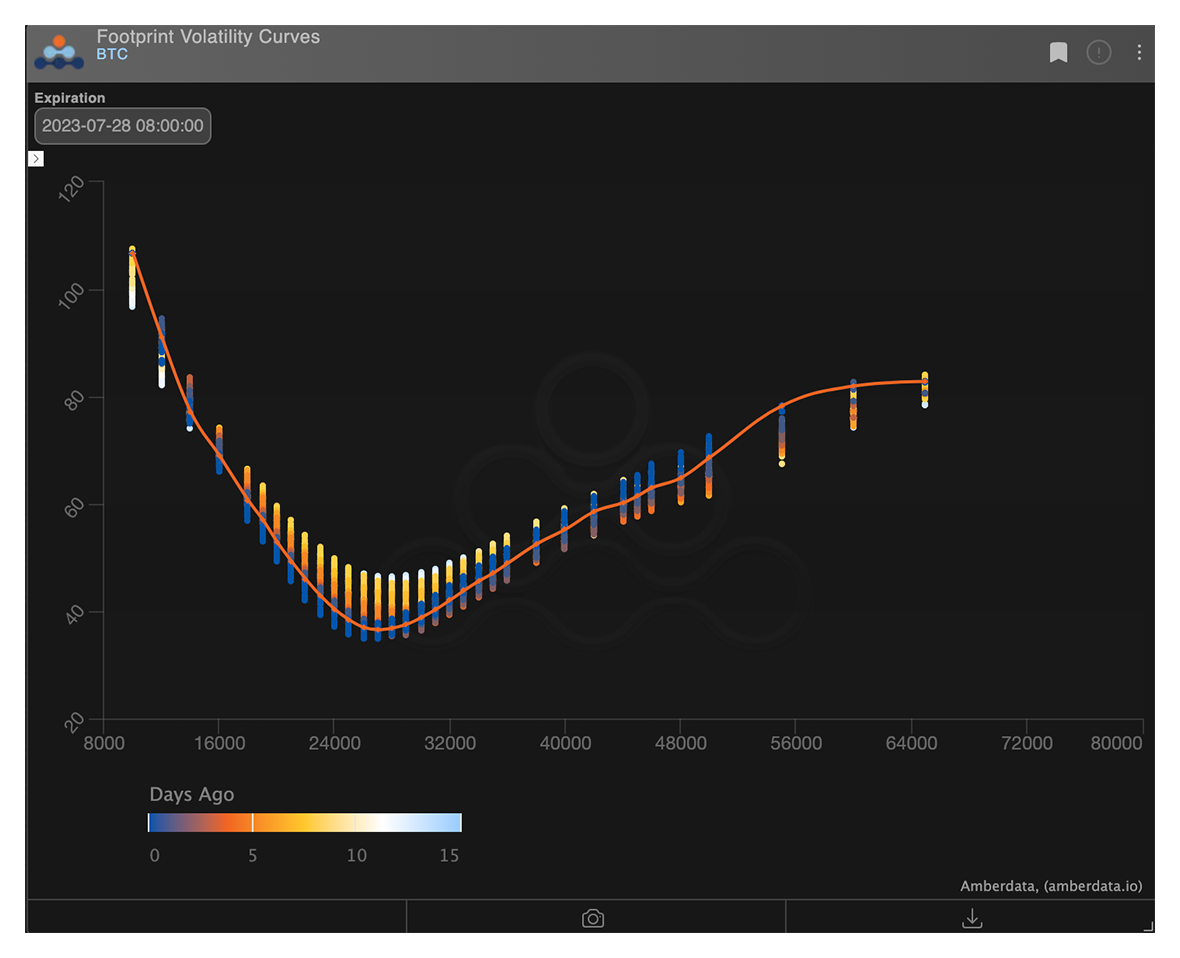

Navigating Volatility: Lessons from Bitcoin’s Maturity

Critics like Warren fixate on Bitcoin’s past volatility, yet at $69,970.00 with a modest 24-hour decline of -0.78% from a high of $72,024.00, it demonstrates newfound stability. Institutional adoption via ETFs and corporate treasuries has dampened swings, creating a floor supported by real demand. In 401(k)s, daily trading limits and automatic rebalancing would further smooth exposure, turning volatility into a feature for compounding gains over decades.

Consider the math: a 2% allocation to Bitcoin since 2015 would have boosted a standard S and amp;P 500 portfolio by over 50% cumulatively, per backtests from firms like Fidelity. Atkins’ pension analogy holds; those funds thrive with similar alternatives under fiduciary duty. Retirement investors preparing for paul atkins sec bitcoin 401k shifts should view this not as speculation, but strategic asymmetry against stagnant bonds yielding under 4%.

Risk Mitigation Frameworks for Crypto in Retirement

Professional wrappers are key. Expect SEC-guided products like spot Bitcoin ETFs from BlackRock or multi-asset crypto funds from Vanguard, limited to 5-10% of plan assets. These enforce dollar-cost averaging, harvesting dips like today’s to $69,496.00 low, and mandate stress tests against 50% drawdowns. As a CFA, I advocate layering in on-chain metrics: monitor Bitcoin’s realized cap and MVRV Z-score for overbought signals, accessible via free dashboards.

Address sequence-of-returns risk head-on. For those nearing retirement, opt for target-date funds embedding crypto gradually, phasing out as horizons shorten. This counters Warren’s ‘lose big’ narrative with data-driven prudence. Simulate via tools from Morningstar: even aggressive 5% crypto tilts weather 2022-style crashes, rebounding stronger.

Essential Bitcoin 401(k) Checklist

-

1. Confirm provider crypto readinessVerify your 401(k) administrator supports Bitcoin exposure. Providers like Fidelity Investments offer pilots for direct Bitcoin holdings or spot ETFs like iShares Bitcoin Trust (IBIT), ensuring regulated access amid SEC Chair Atkins’ push.

-

2. Cap allocation at 5%Limit Bitcoin to no more than 5% of your portfolio to manage volatility risks, as current price stands at $69,970 with a 24h change of -0.78%, aligning with prudent diversification principles.

-

3. Review rebalancing rulesExamine your plan’s rebalancing frequency (e.g., quarterly) to counteract Bitcoin’s volatility, preventing overexposure during swings like the recent 24h range of $69,496–$72,024.

-

4. Stress-test portfolioSimulate scenarios using tools from Vanguard or Fidelity calculators, modeling Bitcoin drops of 50%+ based on historical data, to reassure long-term resilience under professional management Atkins advocates.

-

5. Consult fiduciary advisorEngage a fiduciary advisor (e.g., CFP® professionals via NAPFA.org) bound by ERISA standards to tailor Bitcoin integration, addressing Warren’s volatility concerns with personalized safeguards.

-

6. Track Atkins’ regulatory updatesMonitor SEC.gov and Chair Atkins’ statements for 401(k) crypto rules, following Trump’s executive order developments and bipartisan bills expected in 2026 for safe, ordered access.

Broader tailwinds bolster confidence. Trump’s executive order, which Atkins operationalizes, targets the $12.5 trillion market for inclusive growth. Congress signals support through alternative asset access encouragements, positioning congress bitcoin 401k push as inevitable.

Your Actionable Roadmap Forward

Today, log into your 401(k) portal and query crypto timelines; forward-thinking providers like Fidelity already offer pilots. Allocate mock funds to test conviction, using Bitcoin’s current $69,970.00 as baseline. Engage plan sponsors via email, citing Atkins’ remarks for urgency.

For self-directed IRAs as a bridge, explore custodians like Directed IRA with Bitcoin vaults. This hybrid prepares muscles for full 401(k) rollout. Stay abreast via executive order analyses tailored to savers.

Atkins’ vision transforms retirement from preservation to prosperity. Bitcoin at $69,970.00, backed by policy tailwinds, invites measured participation. Forward-thinking savers who act now, blending caution with conviction, position for outsized longevity in their nests. Future-proofing demands evolution; this is your cue.