Imagine unlocking the power of Bitcoin in your 401(k), supercharging your retirement savings with the asset that’s redefined wealth creation. SEC Chair Paul Atkins is leading the charge, declaring ‘the time is right’ for crypto in the $12.5 trillion 401(k) universe. With Bitcoin holding steady at $66,325.00 despite a 1.80% dip over the last 24 hours, this isn’t just talk; it’s a seismic shift on the horizon for paul atkins 401k crypto integration.

Atkins’ bold stance before the House Committee on Financial Services has ignited excitement among forward-thinking investors. He’s pushing for alternative investments like Bitcoin in retirement plans, mirroring how pensions already tap private equity and real estate. This aligns perfectly with President Trump’s August 2025 executive order, directing the DOL, SEC, and Treasury to overhaul ERISA rules by 2026, classifying digital assets as qualified investments. Plan sponsors, get ready: bitcoin in 401k 2026 is no longer a pipe dream.

Atkins’ Vision: Crypto as a Retirement Game-Changer

Paul Atkins isn’t mincing words. In his February 1,2026, Yahoo Finance spotlight, he emphasized investor education and safeguards while championing access to high-growth assets. ‘401(k)s should evolve, ‘ he told lawmakers, positioning crypto alongside proven alts. His 2026 SEC priorities, per EY, spotlight a crypto regulatory framework, signaling full-throttle support for sec crypto retirement accounts.

SEC Chair Paul Atkins: “The time is right for 401(k)s to embrace innovation like cryptocurrency. “

Critics like Senator Elizabeth Warren cry foul, warning of volatility risks after her January demands for SEC answers. A Senate letter grilled Atkins on the Trump EO’s investor dangers, and the Economic Policy Institute flags crypto as too risky for savers. Yet, with Bitcoin’s resilience post-$2 trillion rout, as noted by CoinDesk, these fears feel outdated. Atkins counters with measured optimism: educate, protect, and innovate.

The Road to 2026: Regulatory Green Lights for Bitcoin in 401(k)s

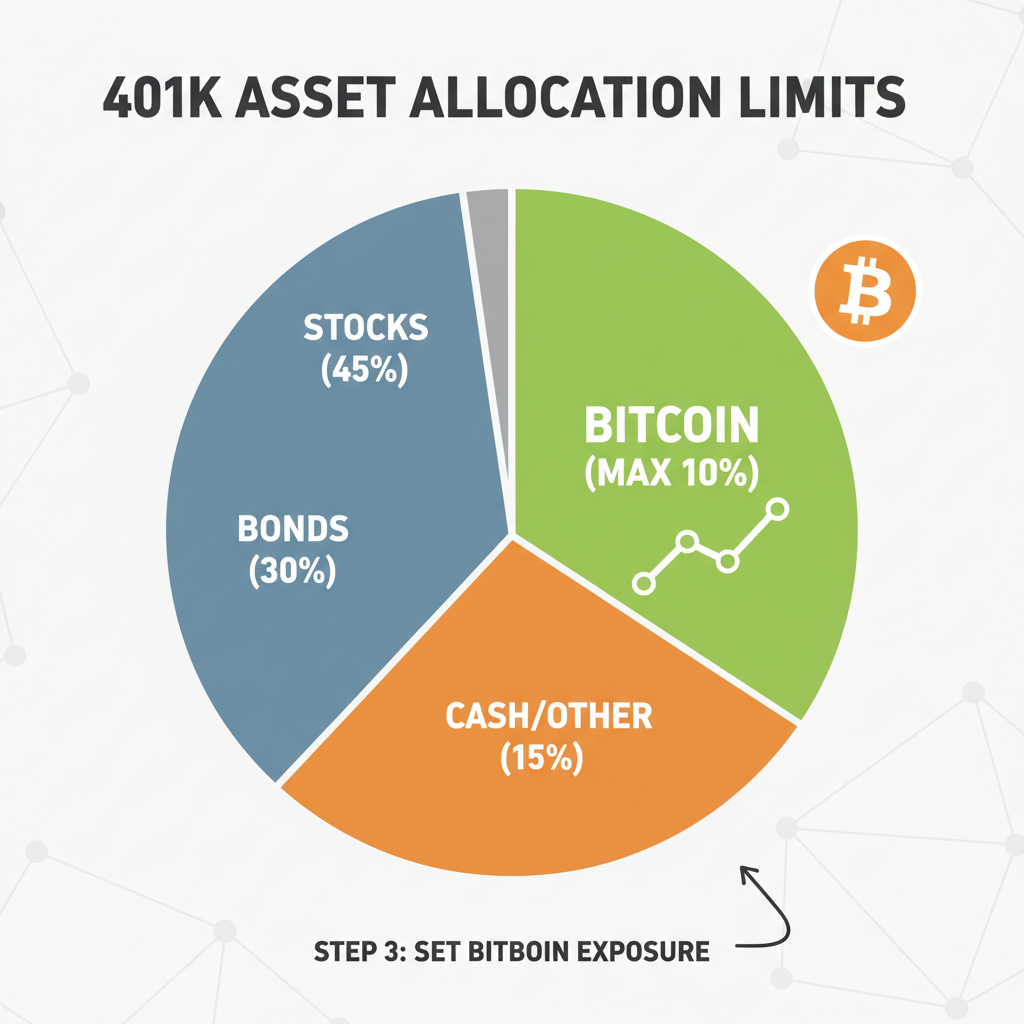

Fast-forward to February 18,2026: regulatory gears are grinding toward approval. The executive order mandates ERISA updates, empowering employers to offer Bitcoin via spot ETFs or direct holdings. DOL and SEC revisions will define fiduciary standards, ensuring plans mitigate volatility through allocation caps, say 5-10% of portfolios.

Planadviser reports Atkins updating Congress on private assets in 401(k)s, a nod to crypto’s inclusion. While Senate crypto talks stall and homeownership withdrawal ideas swirl, the focus sharpens on retail alt access. For financial advisors, this means auditing plans now: assess participant risk tolerance, integrate education modules, and model 401k bitcoin allocation scenarios.

Bitcoin (BTC) Price Prediction 2027-2032: 401(k) Inclusion Impact

Forecasts for retirement planning post-2026 regulatory approval, based on $66,325 current price (Feb 2026), conservative $80k / optimistic $150k end-2026 targets

| Year | Minimum Price | Average Price | Maximum Price | YoY Avg Growth % |

|---|---|---|---|---|

| 2027 | $90,000 | $140,000 | $220,000 | +40% |

| 2028 | $130,000 | $220,000 | $380,000 | +57% |

| 2029 | $170,000 | $320,000 | $520,000 | +45% |

| 2030 | $220,000 | $420,000 | $680,000 | +31% |

| 2031 | $280,000 | $550,000 | $850,000 | +31% |

| 2032 | $350,000 | $700,000 | $1,050,000 | +27% |

Price Prediction Summary

Bitcoin prices are poised for substantial growth from 2027-2032 following 401(k) inclusion, driven by massive retirement fund inflows ($12.5T market). Conservative mins reflect bear markets or regulatory delays; optimistic maxes assume full adoption and halving cycles. Average trajectory projects 5x growth by 2032 amid institutional demand.

Key Factors Affecting Bitcoin Price

- 401(k) regulatory approval enabling $12.5T inflows from retirement savers

- Post-2024 halving bull cycles peaking in 2028/2032

- Institutional adoption and ETF expansions reducing volatility

- Technological upgrades (e.g., scalability improvements)

- Macro risks: regulatory pushback (e.g., Warren critiques), market routs, competition from altcoins

- Historical cycles: 4-year patterns with 3-10x gains in bull phases

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Step-by-Step: Preparing Your 401(k) for Bitcoin Post-Approval

First, monitor SEC rulemaking. Atkins’ priorities promise clarity on crypto custody, disclosure, and valuation. Once greenlit, employers collaborate with recordkeepers like Fidelity or Vanguard, who already offer crypto IRAs. Select Bitcoin via regulated vehicles: think BlackRock’s IBIT ETF, proven in volatility.

Key: fiduciary duty. Under updated ERISA, prove Bitcoin suits your workforce. Younger savers crave growth; boomers prioritize stability. Start with opt-in models, defaulting to diversified funds. Tools like risk quizzes will gauge suitability, blending Bitcoin’s upside with bonds and stocks.

Volatility? Bitcoin’s 24-hour range from $65,907 to $68,389 shows resilience at $66,325.00. Historical cycles reward patience: post-halving surges have minted millionaires. Atkins’ push democratizes this for 401(k)s, but demands discipline. Limit exposure, rebalance quarterly, and watch regulations evolve.

Picture this: your 401(k) portfolio humming with Bitcoin’s potential, capturing upside from its current $66,325.00 perch even after dipping 1.80% in the past day. Advisors, seize Atkins’ momentum; model allocations that thrill millennials without spooking near-retirees. Fidelity’s crypto IRA success proves the playbook works: seamless integration, robust custody, real-time reporting.

Risks Real, Rewards Bigger: Smart 401k Bitcoin Allocation Strategies

Volatility naysayers like Warren spotlight real hurdles, yet Bitcoin’s 24-hour swing from $65,907.00 low to $68,389.00 high underscores its maturing profile. Post-rout recovery, as CoinDesk highlighted, flips the script on ‘too risky’ labels. Atkins’ framework mandates disclosures, stress tests, and caps; think 5% max for conservative plans, scaling to 15% for aggressive ones. This isn’t gambling; it’s calibrated growth in a crypto 401k regulations 2026 era.

Opinion: dismiss the fearmongers. Trump’s EO and Atkins’ priorities unlock $12.5 trillion in dry powder for Bitcoin, fueling innovation over stagnation. Economic Policy Institute FAQs miss the mark; diversified alts like private equity thrive in pensions. Crypto joins the party, supercharging returns for savers sidelined too long. Younger workers, with decades to compound, stand to gain most; simulate a 7% annual Bitcoin boost atop S and P averages, and watch nest eggs explode.

Financial advisors, lead the charge. Audit participant demographics, deploy quizzes for risk profiling, and stress-test portfolios against Bitcoin’s cycles. Rebalance mandates under new rules keep exposure dynamic, selling highs to fund lows. Custody via SEC-approved spots like Coinbase Institutional ensures ERISA compliance, dodging DOL pitfalls.

What Comes Next: Your Action Plan for Add Bitcoin to 401k

2026 approvals aren’t distant; they’re imminent. Track DOL filings, SEC rulemakings, and Atkins’ House updates. Employers, poll your workforce: does paul atkins 401k crypto excite or intimidate? Opt-in frameworks empower choice, blending Bitcoin’s fire with traditional ballast. Vanguard and Fidelity gear up; their Bitcoin ETFs already handle billions, primed for 401(k) scale.

At $66,325.00, Bitcoin whispers opportunity amid the dip. Halving echoes and institutional inflows propel it toward new peaks, perfect for long-term holds. Critics’ volatility warnings ignore this: disciplined allocation turns risk into rocket fuel. Plan sponsors ignoring Atkins’ call risk obsolescence; those embracing it pioneer retirement’s future.

Forward-thinkers, the gate swings open. Align with Atkins’ vision, fortify with safeguards, and position your 401(k) for Bitcoin’s ascent. Growth awaits those bold enough to claim it; in this $66,325.00 landscape, hesitation costs compound interest. Your retirement revolution starts now.