With Bitcoin now trading at $109,449.00, the question of how much BTC you should hold in your 401K to retire comfortably by 2035 has become more relevant than ever. As more retirement plans begin to allow cryptocurrency allocations and major providers like Fidelity open the door for up to 20% portfolio exposure, understanding the specific amount of Bitcoin needed for retirement in your country is crucial for strategic crypto 401K planning.

How Much Bitcoin Is Enough? The Country-by-Country Perspective

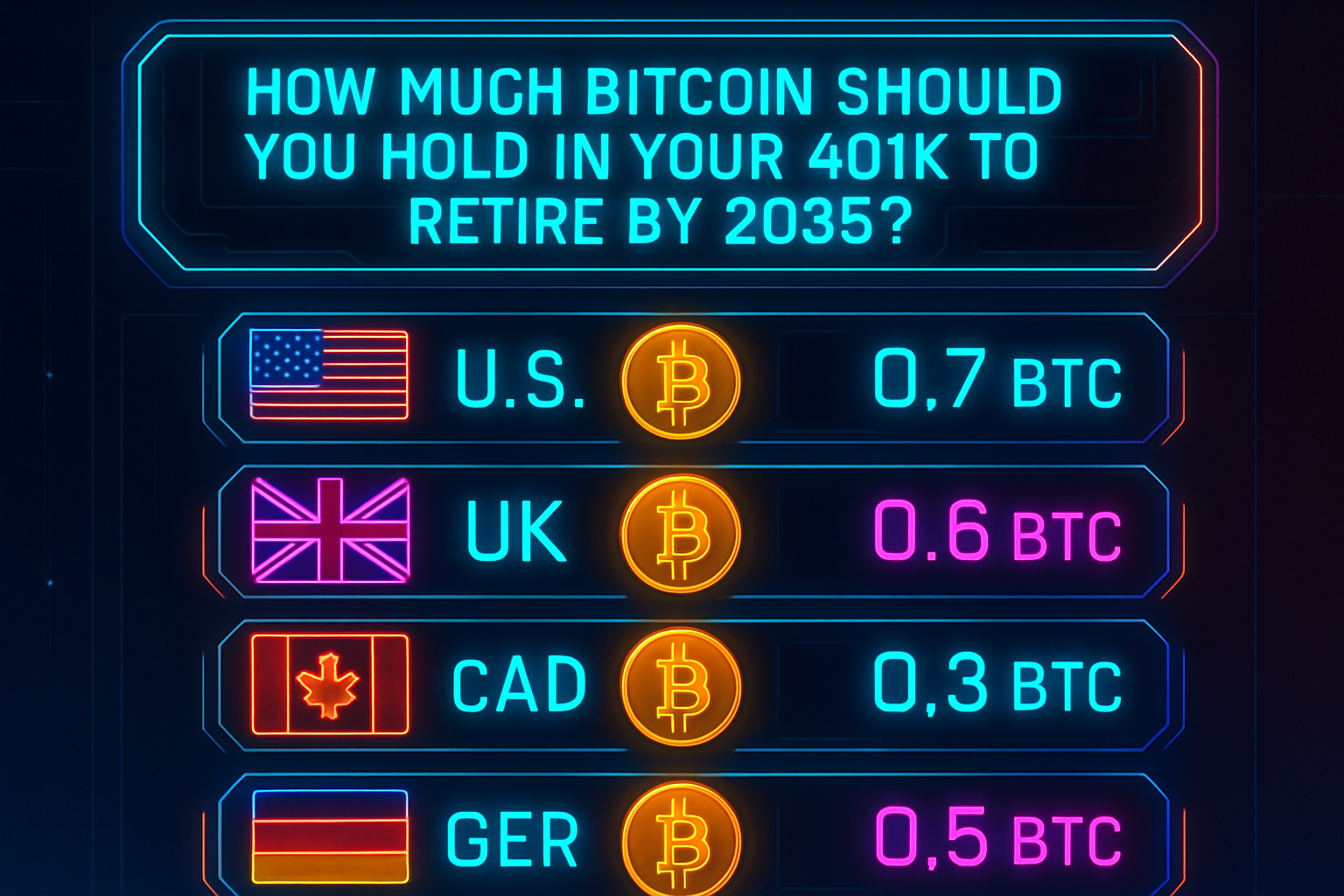

Recent studies and market analysis suggest that retiring with less than 1 BTC could be a reality for many by 2035, but the actual number varies significantly depending on where you live. This variance is driven by local cost of living, inflation rates, and expectations about Bitcoin’s future growth. For example, while someone in India may need only 0.1 BTC to retire comfortably, a retiree in Singapore or the United States might require as much as 0.7 BTC due to higher expenses.

“Across most of the world, the amount of Bitcoin needed to retire by 2035 is below 1 BTC. However, the requirements depend on where you live and your lifestyle. ”

The following list provides a detailed breakdown of how much Bitcoin you’d need in your 401K to fund a typical retirement lifestyle in each country by 2035, based on current market data and projections:

Estimated Bitcoin Needed to Retire by 2035 (Country Comparison)

-

United States: Approximately 0.7 BTC needed to retire comfortably by 2035. At today’s price of $109,449 per Bitcoin, this equals about $76,614. The U.S. has a higher cost of living and healthcare expenses, making it one of the top countries for Bitcoin retirement allocations.

-

United Kingdom: About 0.6 BTC needed for a standard retirement by 2035. This amounts to roughly $65,669 at current Bitcoin prices. The UK’s moderate cost of living and strong social safety nets influence this estimate.

-

Canada: 0.3 BTC is required for average retirement needs by 2035, equaling approximately $32,835 today. Canada’s public healthcare and relatively lower living costs contribute to this lower BTC requirement.

-

Germany: 0.5 BTC to meet typical retirement expenses by 2035, or about $54,724 at current rates. Germany’s robust pension system and stable economy factor into this projection.

-

Australia: 0.4 BTC needed for retirement security by 2035, which is around $43,780 today. Australia’s high quality of life and healthcare system are balanced by higher living costs.

-

Japan: 0.45 BTC required for a moderate retirement lifestyle by 2035, equaling about $49,252 at today’s price. Japan’s aging population and urban living expenses inform this estimate.

-

France: 0.5 BTC to cover average retirement costs by 2035, or about $54,724 currently. France’s social programs and healthcare system help keep the BTC requirement moderate.

-

Singapore: 0.7 BTC needed due to higher cost of living by 2035, totaling $76,614 at the current Bitcoin price. Singapore’s status as a global financial hub and high living expenses drive this figure.

-

Mexico: 0.15 BTC is sufficient for basic retirement needs by 2035, or about $16,417 today. Mexico’s lower cost of living makes retirement more accessible with less Bitcoin.

-

India: 0.1 BTC is enough for a comfortable local retirement by 2035, equaling $10,945 at today’s price. India’s affordable living and diverse regions allow for lower retirement thresholds.

Why These Numbers? Understanding the Calculations

The methodology behind these figures combines several key factors:

- Current cost of living in each country, adjusted for inflation through 2035.

- Bitcoin’s price trajectory, assuming a conservative annual growth rate around 7% real p. a. , as suggested by recent research.

- No additional contributions post-retirement, focusing on lump-sum accumulation targets rather than ongoing savings.

- Diversification principles, ensuring that even with high growth potential, crypto remains one part of a broader investment strategy.

This approach yields some striking results: In Mexico and India, even less than one-fifth or one-tenth of a single Bitcoin could cover basic retirement needs if current trends persist. Meanwhile, higher-cost countries like Singapore or the U. S. require more substantial holdings – but still well under one full coin at today’s valuations.

The Role of Volatility and Risk Management in Crypto 401Ks

It’s important to remember that these calculations rest on projections – not guarantees – about both inflation and long-term Bitcoin appreciation. While historical data supports the thesis that even modest allocations can make an outsized impact over time, volatility remains an ever-present risk factor.

This is why fiduciaries and individual investors alike are urged to approach crypto integration with care:

- Diversify beyond just cryptocurrency assets.

- Review employer restrictions or guidelines, especially as regulatory oversight evolves.

- Rebalance regularly as your portfolio grows or market conditions shift.

- Learn more about whether less than one bitcoin will be enough for retirement here.

Bitcoin (BTC) Price Prediction 2026-2031

Annual price projections based on current fundamentals, adoption trends, and market context. All values in USD.

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $92,000 | $120,000 | $180,000 | +9.7% | Adoption in retirement accounts drives demand, but global macro uncertainty creates price swings. |

| 2027 | $105,000 | $137,000 | $210,000 | +14.2% | ETF inflows and broader institutional buy-in; regulatory clarity improves, but volatility persists. |

| 2028 | $113,000 | $148,000 | $235,000 | +8.0% | Next halving cycle anticipation; increasing scarcity narrative. Possible new market entrants. |

| 2029 | $129,000 | $165,000 | $265,000 | +11.5% | Mainstream acceptance in developed markets; rising competition from CBDCs tempers exuberance. |

| 2030 | $147,000 | $185,000 | $295,000 | +12.1% | Wider tech integration, improved scalability; potential for regulatory hurdles in some regions. |

| 2031 | $165,000 | $207,000 | $325,000 | +11.9% | Global adoption accelerates, especially in emerging markets. Macro tailwinds strengthen bullish case. |

Price Prediction Summary

Bitcoin is projected to experience steady, though cyclical, growth through 2031. The average price is expected to rise from $120,000 in 2026 to $207,000 in 2031, with potential for significant volatility. Regulatory clarity, adoption in retirement portfolios, and technological progress are likely to drive prices higher, though risks remain from global macroeconomic factors and potential regulatory crackdowns.

Key Factors Affecting Bitcoin Price

- Adoption of Bitcoin in retirement and institutional portfolios (e.g., 401(k) plans, ETFs)

- Regulatory developments, especially in major markets like the US and EU

- Bitcoin halving cycles and resulting supply shocks

- Technological improvements (scalability, security, usability)

- Global macroeconomic conditions (inflation, recession risk, fiat currency instability)

- Competition from other digital assets and central bank digital currencies (CBDCs)

- Market sentiment and speculative cycles

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Another crucial consideration is the timing of your Bitcoin purchases. Because Bitcoin’s price can fluctuate significantly, as seen with its current price at $109,449.00: the amount of BTC you’ll need to allocate for retirement may shift depending on when you enter the market. For those contributing regularly to their 401K, dollar-cost averaging can help mitigate the impact of volatility and smooth out entry points over time.

Tax implications also play a role in crypto 401K planning. In most jurisdictions, holding Bitcoin within a tax-advantaged account like a 401K allows for tax deferral on capital gains until withdrawal, but it’s essential to stay informed about evolving regulations in your country. Some countries, such as Germany and Australia, are actively updating their retirement account frameworks to accommodate digital assets, while others remain more cautious.

Country Spotlights: What Drives the Differences?

The disparities in required Bitcoin holdings between countries are not arbitrary, they reflect nuanced differences in local economics and policy. For instance:

- United States (0.7 BTC): Higher healthcare costs and lifestyle expectations increase required savings.

- United Kingdom (0.6 BTC): Slightly lower cost of living than the U. S. , but still significant due to housing and services.

- Canada (0.3 BTC): Lower average expenses, especially outside major urban centers.

- Germany and France (0.5 BTC each): Robust public services offset some private expenses, but retirees still need substantial reserves.

- Australia (0.4 BTC): High quality of life with moderate costs compared to North America or Singapore.

- Japan (0.45 BTC): Efficient healthcare but higher daily living costs for retirees in urban areas.

- Singapore (0.7 BTC): Consistently one of the world’s most expensive cities; high standards require larger nest eggs.

- Mexico (0.15 BTC) and India (0.1 BTC): Lower local prices mean even small Bitcoin allocations could suffice for comfort by 2035.

This range demonstrates why a one-size-fits-all approach does not work for global crypto retirement planning, and why geographic context should shape your personal strategy.

Building Your Crypto 401K Roadmap: Next Steps

If you’re considering adding Bitcoin to your 401K, start by assessing how much risk you’re willing, and able, to take on as part of your overall portfolio. Consult with a qualified financial advisor who understands both traditional retirement planning and crypto assets, especially as new products and employer-sponsored offerings continue to emerge.

You may want to use a Bitcoin retirement calculator, factoring in your target country, expected future expenses, and current market prices like today’s $109,449.00 per BTC. This will help you tailor your allocation toward realistic goals rather than speculative hopes.

No matter where you live or how much you ultimately decide to allocate, staying informed is key. Monitor regulatory developments that could impact crypto 401Ks in your country, especially as more providers open access and governments clarify their stances on digital assets in retirement accounts.

Key Takeaways for Secure Crypto Retirement Planning

- Your location dramatically affects how much Bitcoin you’ll need for retirement, ranging from just 0.1 BTC in India, up to 0.7 BTC in the U. S. , U. K. , or Singapore.

- Diversification remains essential; even if projections are bullish for Bitcoin growth through 2035, balance is critical for long-term security.

- The current price environment ($109,449.00 per BTC) means that fractional holdings can represent significant value over time if trends persist, but always review your plan annually as markets evolve.

- If you’re interested in deeper analysis or want practical tips on structuring your own crypto-enhanced retirement plan, see our detailed guide at this resource here.