The retirement landscape in the United States is on the brink of a historic transformation. On August 7,2025, President Donald Trump signed an executive order explicitly designed to democratize access to alternative assets within 401(k) retirement plans. This move could fundamentally reshape how Americans allocate their retirement savings, especially as it relates to digital assets like Bitcoin and other cryptocurrencies. The implications are profound for plan participants, sponsors, and financial advisors alike.

What Does Trump’s Crypto 401(k) Executive Order Actually Do?

The executive order instructs the Secretary of Labor to revisit existing guidance on fiduciary responsibilities for alternative investments in ERISA-governed defined-contribution plans. It also calls for close collaboration with the Securities and Exchange Commission (SEC) and other federal regulators to develop clear rules that allow inclusion of private equity, real estate, and, most notably, cryptocurrencies such as Bitcoin in these portfolios.

This policy shift is part of a broader push to give everyday Americans access to investment opportunities that were once reserved for institutional investors and high-net-worth individuals. By expanding the universe of eligible assets, the administration aims to enhance diversification and potentially boost long-term returns for millions of workers saving for retirement.

Bitcoin Maintains Position Above $100,000: What It Means For Retirement Savers

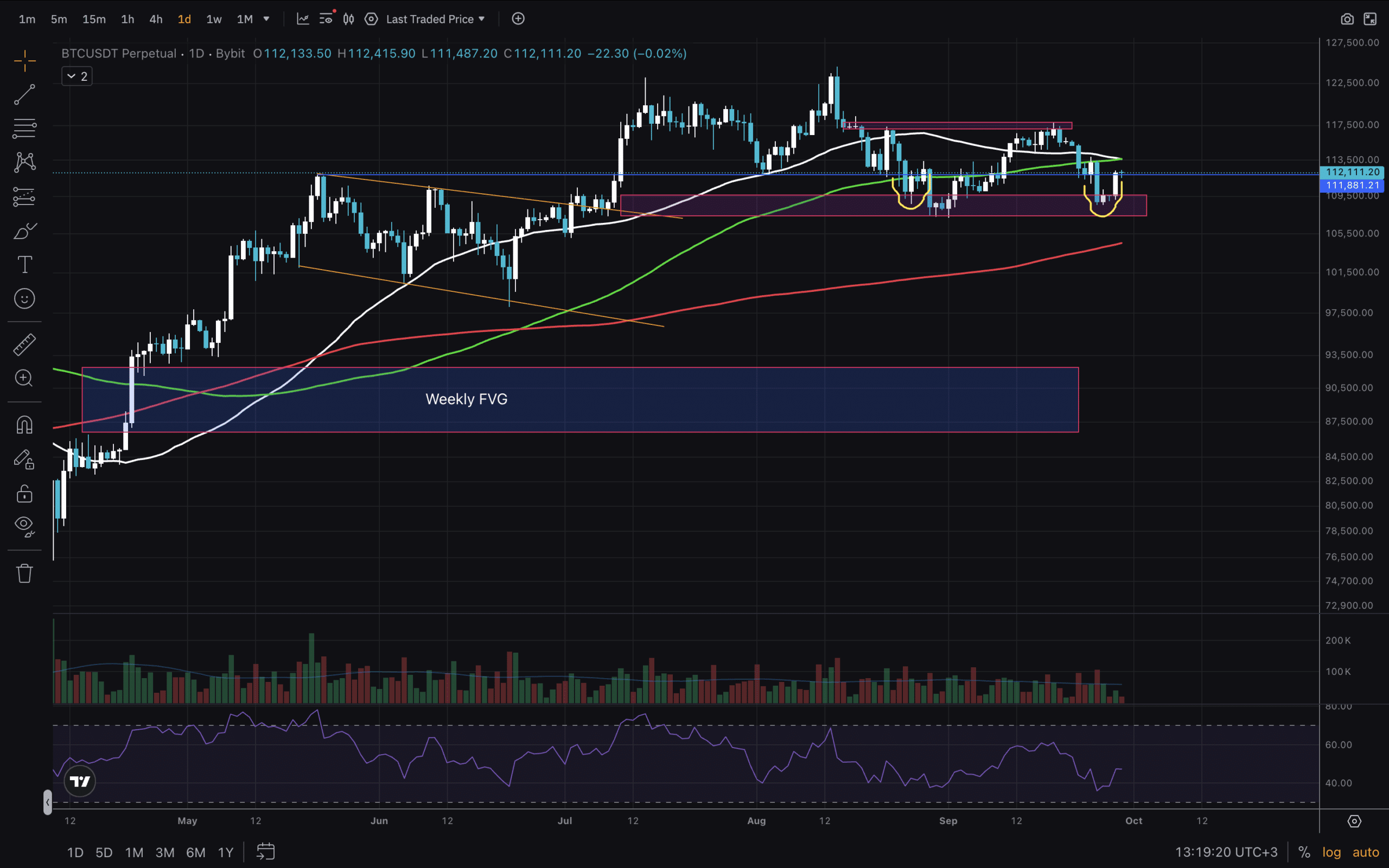

At the time of writing, Bitcoin is trading at $119,960.00, marking a significant milestone in its journey from speculative asset to mainstream investment vehicle. The executive order’s timing could not be more relevant, as digital assets solidify their place in global markets, their inclusion in 401(k)s becomes increasingly attractive for those seeking both growth potential and diversification.

However, it’s important to note: cryptocurrencies are known for their high volatility and unique risk profiles. While proponents argue that adding crypto can improve overall portfolio performance through low correlation with traditional equities and bonds, critics warn that inexperienced investors may underestimate these risks within retirement accounts.

The Push To Expand Crypto Allocation Strategies In 401(k)s

The new directive tasks federal agencies with creating a regulatory environment where alternative assets, including crypto, can be offered responsibly within retirement plans. This means plan sponsors will soon face fresh decisions about whether (and how) to add digital assets like Bitcoin alongside traditional options such as mutual funds or target-date funds.

- Diversification: Crypto can provide uncorrelated returns compared to stocks or bonds.

- Potential Returns: With Bitcoin holding above $119,000, some see strong upside over multi-decade horizons.

- Risk Management: Plan sponsors must ensure robust education and risk disclosures before offering crypto options.

This evolving landscape will require careful consideration by both employers and employees. Financial advisors are already emphasizing the importance of education around digital asset risks, including cybersecurity threats and regulatory uncertainties, before any allocation decisions are made.

Bitcoin Price Prediction for 401(k) Portfolios (2026–2031)

Projections consider the impact of President Trump’s 2025 Executive Order enabling cryptocurrency allocations in retirement plans, current adoption trends, and evolving regulatory landscape.

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $98,000 | $127,000 | $160,000 | +6% | Initial 401(k) inflows begin; price volatility elevated as retirement funds cautiously enter the market. |

| 2027 | $110,000 | $142,000 | $181,000 | +12% | Broader adoption among retirement plans and increased institutional demand drive higher price averages. |

| 2028 | $130,000 | $165,000 | $210,000 | +16% | Regulatory clarity and more robust investor protections boost confidence; bull market cycle strengthens. |

| 2029 | $120,000 | $175,000 | $235,000 | +6% | Market cools post-bull run; some profit-taking, but long-term holders and 401(k) allocations stabilize price. |

| 2030 | $145,000 | $195,000 | $265,000 | +11% | Renewed interest driven by technological upgrades and increasing allocation caps for alternative assets. |

| 2031 | $175,000 | $227,000 | $305,000 | +16% | Matured 401(k) participation, mainstream acceptance, and global macro factors support further growth. |

Price Prediction Summary

Bitcoin’s inclusion in 401(k) retirement portfolios is projected to drive a steady increase in both demand and price through 2031. While volatility remains a hallmark of the asset, growing adoption, regulatory clarity, and technological advancements suggest a positive long-term outlook, with average prices potentially doubling by 2031 compared to 2025 levels. Minimum and maximum projections reflect the asset’s inherent risk profile and varying market cycles.

Key Factors Affecting Bitcoin Price

- Impact of the 2025 Executive Order enabling 401(k) crypto allocations and subsequent regulatory developments.

- Pace of institutional and retail adoption within retirement accounts.

- Ongoing volatility and market cycles typical of the crypto sector.

- Global macroeconomic trends, including inflation and monetary policy.

- Technological improvements to Bitcoin’s scalability, security, and integration with financial infrastructure.

- Competitive landscape from other digital assets and alternative investments.

- Potential for further legislative changes impacting retirement plan investment guidelines.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating Regulatory Change: What Comes Next?

The executive order also mandates ongoing consultation between the Department of Labor (DOL), Treasury Department, SEC, and other agencies to identify necessary parallel regulatory changes. This collaborative approach aims to balance expanded investment options with robust investor protections, a crucial step given crypto’s history of volatility and rapid innovation cycles.

If you’re considering how these changes might affect your own retirement strategy or advising clients on next steps, it’s essential to stay informed about both market developments and regulatory updates. For a deeper dive into practical impacts, and what savvy planners should watch out for, see How Trump’s Executive Order Could Change 401(k) Crypto Investing: What Savvy Retirement Planners Need To Know.

As the dust settles from this landmark executive order, the financial industry is bracing for a wave of product innovation and new guidance. Recordkeepers, asset managers, and fintech providers are preparing to launch crypto-enabled 401(k) offerings that comply with evolving Department of Labor (DOL) standards. Expect to see a spectrum of solutions, from broad-based digital asset funds to targeted Bitcoin-only options, each with distinct risk-return profiles and fee structures.

Plan fiduciaries will be under increased scrutiny as they assess whether adding crypto aligns with their duty to act in participants’ best interests. The DOL’s updated guidance, expected in the coming months, will likely focus on prudent selection processes, robust participant education, and ongoing monitoring of these high-volatility assets. As always, transparency and documentation will be key for plan sponsors navigating this new frontier.

Key Considerations for Crypto Diversification in 401(k)s

Essential Tips for Evaluating Crypto in Your 401(k)

-

Understand Crypto Volatility: Cryptocurrencies like Bitcoin (BTC) are highly volatile. For example, as of October 2, 2025, Bitcoin’s price is $119,960.00, with a 24-hour change of +$2,476.00 (+0.0211%). Be prepared for significant price swings in your retirement portfolio.

-

Review Your Plan Provider’s Offerings: Not all 401(k) plans will immediately offer crypto options. Check if your provider partners with platforms like Fidelity Investments or ForUsAll, which have begun supporting crypto allocations in retirement accounts.

-

Assess Regulatory Protections: The executive order directs the Department of Labor and SEC to develop new guidelines for crypto in 401(k)s. Stay updated on evolving regulations to ensure your investments are protected under federal law.

-

Limit Allocation to a Small Percentage: Financial advisors often recommend limiting crypto exposure to a modest portion (typically 5% or less) of your total retirement portfolio to manage risk.

-

Prioritize Security and Custody: Ensure your plan uses reputable custodians such as Coinbase Custody or BitGo to safeguard digital assets against theft and cyber threats.

-

Educate Yourself on Crypto Risks: Use resources from trusted organizations like the Financial Industry Regulatory Authority (FINRA) and the SEC to understand the unique risks of digital assets before investing.

-

Consult a Certified Financial Planner: Seek advice from a CFP or fiduciary advisor experienced in digital assets to tailor your 401(k) strategy to your long-term retirement goals.

For individual savers, the opportunity to allocate a portion of retirement assets to Bitcoin or other cryptocurrencies is both exciting and daunting. While recent price action, Bitcoin at $119,960.00: may tempt some to chase performance, prudent investors must weigh volatility against long-term goals.

Here are several factors retirement investors should consider:

- Asset Allocation: Experts generally recommend limiting high-volatility assets like crypto to a small percentage (often less than 5%) of your total portfolio.

- Education: Before investing, take advantage of plan-provided resources and seek independent advice on how digital assets work within diversified portfolios.

- Security: Understand how your plan custodian secures digital assets against hacking and fraud.

- Liquidity and Withdrawal Rules: Crypto’s unique trading hours and volatility can impact how quickly you can access funds or rebalance positions.

The executive order’s intent is clear: broaden access while maintaining appropriate guardrails. But with greater choice comes greater responsibility, for both plan sponsors and participants, to stay informed about market dynamics, regulatory changes, and best practices in portfolio construction. For more on how this policy shift could unlock trillions in new retirement capital for crypto markets, see How Trump’s Executive Order Unlocks $12.5 Trillion for Crypto 401(k)s: What Investors Need To Know.

The Road Ahead: Balancing Innovation With Investor Protection

The coming year will be pivotal as regulators finalize frameworks and employers decide whether, and how, to offer digital asset exposure within workplace retirement plans. The debate over appropriate guardrails is far from over; expect ongoing dialogue between policymakers, consumer advocates, industry groups, and the investing public.

If you’re an investor eager to participate in this new era of retirement diversification, prioritize education above all else. Ask your employer about upcoming changes to your plan’s investment menu. Consult with a fiduciary advisor who understands both traditional finance and the rapidly evolving world of digital assets.

This executive order marks a defining moment for American retirement savers, a chance to harness innovation while staying true to time-tested principles like diversification and risk management. As always, thoughtful planning today empowers your financial future tomorrow.