For many forward-thinking investors, the question is no longer whether to include Bitcoin in a 401(k), but how much Bitcoin is enough to retire comfortably. As of October 4,2025, Bitcoin is trading at $122,228. With the U. S. Department of Labor easing restrictions on digital assets in retirement plans and major financial institutions revising their crypto outlooks, the landscape for crypto in 401(k) retirement planning has fundamentally shifted.

How Much Bitcoin Do You Really Need to Retire?

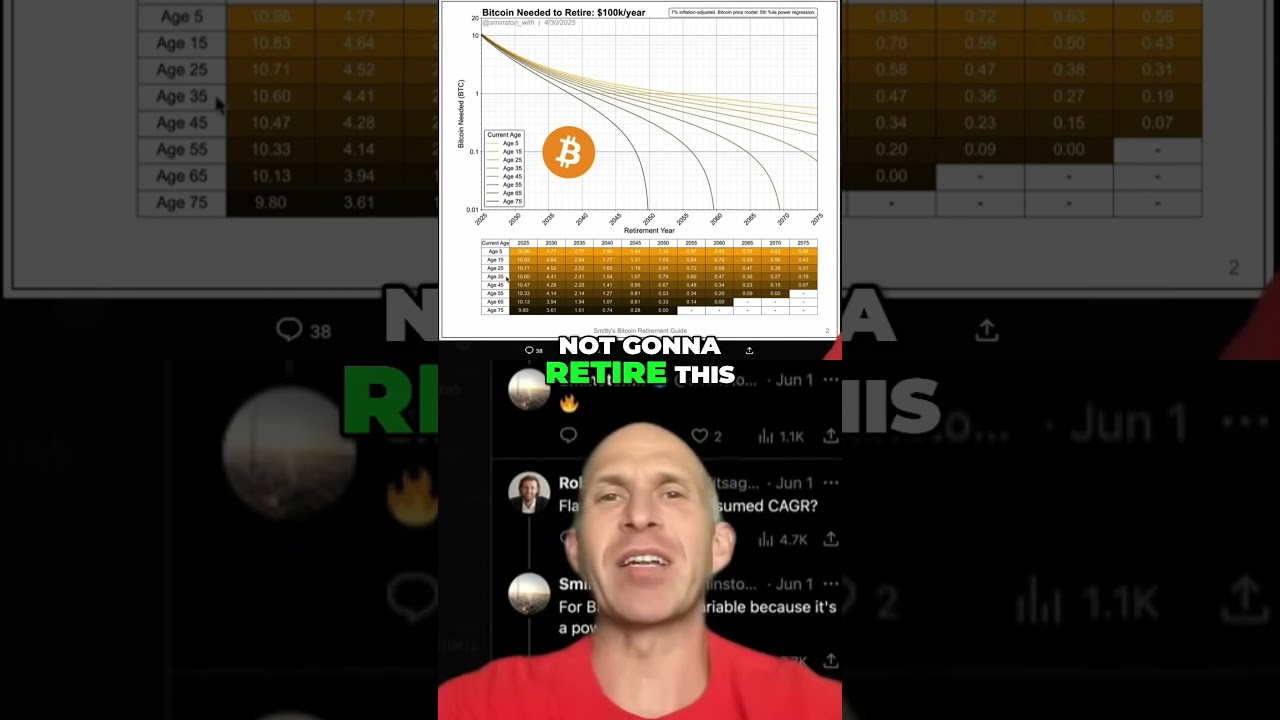

The answer depends on your desired lifestyle, risk tolerance, and how you believe Bitcoin will perform over the next decade. Traditional retirement advice targets a nest egg of around $2 million for a comfortable U. S. retirement at age 65. At today’s price of $122,228 per BTC, that translates to roughly 16.36 BTC. But this static calculation ignores the core appeal of Bitcoin: its asymmetric growth potential.

If you believe forecasts projecting Bitcoin could reach $250,000–$350,000 by 2030, your required holdings drop dramatically. For example:

- If BTC hits $250,000: You’d need 8 BTC for a $2 million portfolio.

- If BTC hits $350,000: Only about 5.7 BTC would be required.

Bitcoin Price Prediction 2026-2031 (For 401K Retirement Planning)

A comprehensive, data-driven outlook for Bitcoin’s price trajectory, helping investors estimate required BTC holdings for a $2M retirement goal.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | YoY % Change (Avg) | BTC Needed for $2M (Avg) |

|---|---|---|---|---|---|

| 2026 | $115,000 | $135,000 | $170,000 | +10.4% | 14.81 |

| 2027 | $130,000 | $165,000 | $210,000 | +22.2% | 12.12 |

| 2028 | $150,000 | $200,000 | $260,000 | +21.2% | 10.00 |

| 2029 | $180,000 | $240,000 | $320,000 | +20.0% | 8.33 |

| 2030 | $210,000 | $295,000 | $400,000 | +22.9% | 6.78 |

| 2031 | $250,000 | $350,000 | $480,000 | +18.6% | 5.71 |

Price Prediction Summary

Bitcoin is expected to continue appreciating over the next six years, with average prices potentially reaching $350,000 by 2031. While volatility and regulation remain key risks, growing institutional adoption and easier 401(k) access could support further price growth. Investors targeting a $2M retirement goal will need less BTC over time as prices rise, with the estimated requirement dropping from ~14.8 BTC in 2026 to just ~5.7 BTC in 2031 at projected average prices.

Key Factors Affecting Bitcoin Price

- Regulatory clarity in retirement accounts (401k rules, SEC/IRS guidance)

- Institutional and mainstream adoption rates

- Macro-economic conditions (inflation, interest rates, global instability)

- Technological upgrades (e.g., Bitcoin scaling, Layer 2 adoption)

- Market cycles and halving events

- Competition from other cryptocurrencies and digital assets

- Potential for spot Bitcoin ETF approvals and inflows

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This highlights why using a bitcoin retirement calculator or modeling different scenarios is essential for anyone considering crypto in their retirement portfolio.

The Volatility Factor: Risk vs Reward in Crypto Retirement Planning

Bitcoin’s volatility remains its double-edged sword. While some advisors warn that “Bitcoin in 401(k)s is still a terrible idea” due to its speculative nature and lack of investor understanding (as echoed by the Center for Retirement Research), others point out that crypto’s low correlation with traditional markets can provide true diversification benefits, especially during periods when stocks and bonds move together.

The key is not to go all-in but rather to determine a prudent allocation, often between 1% and 5% of your total portfolio, balancing upside potential with overall risk management. This approach lets you benefit if Bitcoin outperforms while keeping your core capital protected from extreme drawdowns.

Scenario Modeling: Building Your Personalized Crypto Retirement Plan

The best way to answer “how much bitcoin do you need to retire” is through scenario modeling tailored to your goals and timeline. Consider variables such as:

- Your target retirement age and annual spending needs

- Your current 401(k) balance (traditional assets vs crypto)

- Your conviction level in future bitcoin price appreciation

- Your willingness to rebalance or take profits during bull runs

If you’re starting from scratch or want more granular guidance by country or region, see our detailed breakdown at How Much Bitcoin Should You Hold in Your 401K To Retire By 2035?.

This data-driven approach ensures your bitcoin-powered retirement isn’t left up to chance or hype but grounded in realistic assumptions and robust risk management frameworks.

It’s also important to recognize the unique behavioral challenges that come with holding highly volatile assets like Bitcoin in a retirement account. Investors often overestimate their risk tolerance during bull markets, only to panic-sell during sharp corrections. Unlike traditional equities, Bitcoin can experience drawdowns of 50% or more within a single year. To counteract this, many experts recommend establishing clear rebalancing rules and sticking to them regardless of market sentiment.

Essential Steps to Add Bitcoin to Your 401(k) Safely

-

Understand Regulatory and Plan Rules: Stay updated on Department of Labor guidelines and your plan’s specific crypto policies. As of October 2025, recent rule changes have made it easier for employers to include digital assets like Bitcoin in 401(k) plans (source).

-

Determine Your Bitcoin Allocation: Use established calculators like the Bitcoiner Academy Bitcoin Retirement Calculator to model different scenarios. With Bitcoin priced at $122,228.00 as of October 4, 2025, assess how much BTC aligns with your retirement goals and risk tolerance.

-

Implement Robust Risk Controls: Limit your Bitcoin exposure to a small percentage of your total 401(k)—many advisors suggest 1–5%. Regularly rebalance your portfolio and consider dollar-cost averaging to reduce volatility risk.

-

Monitor and Adjust Your Strategy: Track your Bitcoin holdings, market conditions, and regulatory changes. Use portfolio tracking tools like Personal Capital or Morningstar to maintain a diversified and risk-aware retirement plan.

Another consideration is the evolving regulatory landscape. With the Department of Labor’s relaxed stance on digital assets in 401(k) plans, more custodians and plan providers are rolling out crypto options. However, fiduciary responsibility still rests with both plan sponsors and participants. It’s crucial to vet your provider’s security measures, custody arrangements, and fee structures before allocating any significant portion of your retirement savings to Bitcoin.

Bitcoin at $122,228: Practical Allocation Strategies

Given Bitcoin’s current price of $122,228, even a modest allocation can have an outsized impact on your long-term wealth trajectory if bullish forecasts materialize. For example, allocating just 5% of a $500,000 401(k) portfolio, about $25,000, would buy approximately 0.204 BTC today. If Bitcoin appreciates to $250,000 by 2030 as some analysts predict, that allocation alone could grow to over $51,000.

The table below illustrates how different allocation levels at today’s price could translate into future value under various price scenarios:

Projected Value of Bitcoin Allocations in a 401(k) at Various Price Targets

| BTC Allocation | Value at Current Price ($122,228) | Value at $250,000 | Value at $350,000 |

|---|---|---|---|

| 0.25 BTC | $30,557 | $62,500 | $87,500 |

| 0.5 BTC | $61,114 | $125,000 | $175,000 |

| 1 BTC | $122,228 | $250,000 | $350,000 |

| 2 BTC | $244,456 | $500,000 | $700,000 |

| 5 BTC | $611,140 | $1,250,000 | $1,750,000 |

| 10 BTC | $1,222,280 | $2,500,000 | $3,500,000 |

This reinforces why even small allocations can serve as a powerful diversifier within a broader retirement strategy, provided you’re prepared for both the upside and the volatility along the way.

“Risk managed is opportunity unlocked. ” That motto is especially true when it comes to crypto in your retirement plan. The goal isn’t to chase headlines or time tops but to thoughtfully integrate innovative assets that align with your long-term objectives.

Action Steps for Building Your Crypto-Enhanced Retirement Plan

If you’re ready to take action:

- Start small: Consider an initial allocation between 1%–5% based on your risk appetite.

- Use scenario modeling tools: Leverage calculators to visualize how different BTC prices affect your retirement outcomes.

- Monitor regulatory changes: Stay updated on plan provider offerings and compliance requirements as the industry evolves.

- Diversify within reason: Don’t neglect traditional assets, use Bitcoin as a complement rather than a replacement.

- Create rebalancing rules: Set guidelines for trimming or adding exposure based on portfolio thresholds rather than emotions.

The bottom line: There’s no one-size-fits-all answer for how much bitcoin you need in your 401(k) to retire securely. The right amount depends on your goals, beliefs about crypto’s future role in finance, and willingness to weather volatility along the journey. By staying informed and disciplined, and using data-driven tools, you can position yourself at the frontier of modern retirement planning while keeping risk firmly in check.