With Bitcoin currently trading at $115,745.00, the debate over whether to include crypto in your retirement strategy is heating up. Many investors are weighing the potential of Bitcoin as an inflation hedge against the more familiar landscape of traditional 401(k) plans. Let’s break down how these two approaches stack up in terms of inflation protection, long-term value, and risk.

Bitcoin’s Appeal: Scarcity and Inflation Protection

One of the biggest selling points for Bitcoin is its fixed supply. Unlike dollars or other fiat currencies, which central banks can print as needed, Bitcoin is capped at 21 million coins. This algorithmic scarcity is often compared to gold’s finite nature, fueling arguments that Bitcoin could help protect your retirement savings from inflation over time.

Recent market commentary supports this narrative. As noted by Nasdaq and MarketWatch, Bitcoin’s scarcity theoretically shields it from the dilution risks that plague fiat currencies. But here’s where things get nuanced: empirical studies show that while Bitcoin sometimes rises during inflationary periods, it isn’t a consistent or reliable hedge. For example, research from arxiv. org found that Bitcoin prices can actually drop in response to unexpected inflation spikes.

This means that while adding a small allocation of Bitcoin to your 401(k) could potentially provide some inflation protection, it’s far from a guarantee.

Traditional 401(k): Diversification and Stability

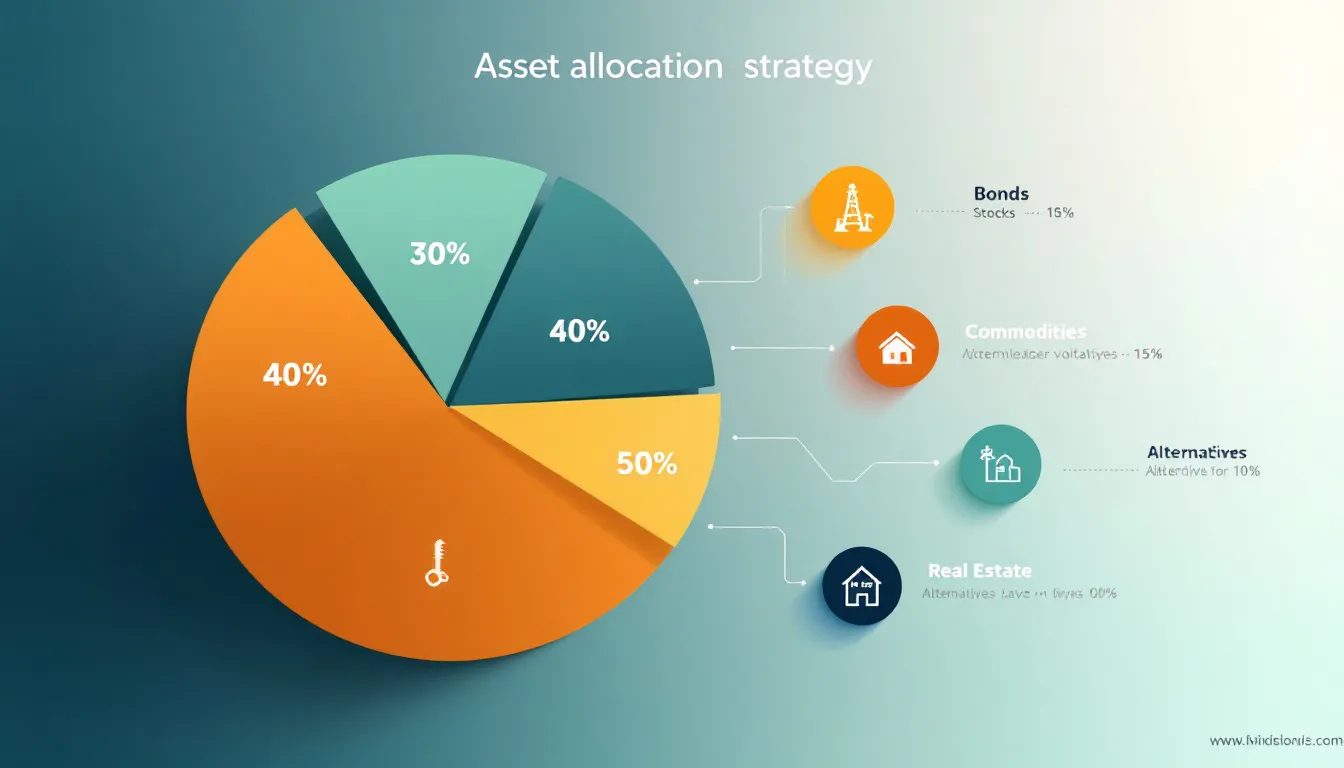

Your standard 401(k) plan invests in a mix of stocks, bonds, and sometimes real estate or commodities. This diversification aims to deliver steady growth while smoothing out the bumps during market downturns. However, as highlighted by Investopedia, traditional portfolios aren’t always immune to inflation risk – especially if bond yields lag behind rising prices or if equity markets stumble during high-inflation periods.

The upside? Over decades, diversified 401(k)s have historically weathered economic storms better than most single assets. The tradeoff is that their average returns may not be as eye-popping as crypto’s best years – but they’re also much less likely to implode during a rough patch.

Long-Term Value: Volatility vs Consistency

Let’s talk performance. Since its launch, Bitcoin has delivered jaw-dropping returns – but with stomach-churning volatility along the way. At its current price of $115,745.00, it remains one of the top-performing assets over the past decade (see analysis here). Still, this wild ride isn’t for everyone – especially those approaching retirement age or with lower risk tolerance.

Traditional 401(k)s aim for slow and steady wins by spreading investments across asset classes. While you won’t see triple-digit annual gains like some crypto years have produced, you’re also less likely to wake up to double-digit losses overnight.

Bitcoin Price Prediction 2026-2031

Expert outlook on Bitcoin’s future prices considering inflation protection, volatility, and adoption trends

| Year | Minimum Price | Average Price | Maximum Price | Estimated YoY % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $89,000 | $126,000 | $180,000 | +9% | Possible post-halving retracement; regulatory headwinds may cause volatility, but institutional interest remains strong. |

| 2027 | $95,000 | $142,000 | $210,000 | +13% | Recovery from prior volatility; growing adoption in institutional portfolios; potential new ETF approvals. |

| 2028 | $110,000 | $165,000 | $250,000 | +16% | Pre-halving anticipation; increased use as digital gold; possible technological improvements (e.g., scaling solutions). |

| 2029 | $125,000 | $195,000 | $310,000 | +18% | Post-halving supply shock; macroeconomic uncertainty may drive demand; more mainstream integration. |

| 2030 | $145,000 | $225,000 | $380,000 | +15% | Wider global adoption, increased regulatory clarity; Bitcoin seen as mature store of value. |

| 2031 | $170,000 | $260,000 | $450,000 | +16% | Potential for Bitcoin to rival gold market cap; advanced institutional products and global retail participation. |

Price Prediction Summary

Bitcoin’s price is projected to experience moderate but sustained growth over the next six years, despite continued volatility and regulatory uncertainties. Institutional adoption, technological enhancements, and macroeconomic factors like inflation will play pivotal roles in shaping price action. While minimum prices reflect possible bear markets or regulatory crackdowns, maximum prices assume bullish scenarios with widespread adoption and favorable regulations.

Key Factors Affecting Bitcoin Price

- Regulatory developments in major economies (US, EU, Asia)

- Institutional adoption and integration into retirement portfolios

- Macro trends such as inflation rates and fiat currency debasement

- Technological upgrades (e.g., Lightning Network, scaling solutions)

- Competition from other digital assets and stablecoins

- Global economic conditions and capital flows

- Halving cycles and their impact on supply dynamics

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating Risk: Volatility and Regulation

If you’re considering adding cryptocurrency to your retirement portfolio for diversification or potential inflation hedging (crypto inflation hedge retirement), remember there are significant risks involved:

- Volatility: As seen with recent price swings between $117,117.00 (high) and $115,162.00 (low), dramatic moves are common in crypto markets (Investopedia explains more here). This can lead to outsized gains but also painful losses.

- Regulatory Uncertainty: The rules around holding crypto in retirement accounts are still evolving (read more here). New regulations could impact both access and valuation down the road.

- Diversification: A small allocation (think under 5%) might boost returns without overwhelming portfolio risk – but always consult with a financial advisor before making changes to your plan.

It’s clear that both Bitcoin and traditional 401(k) plans bring unique strengths and weaknesses to the table when it comes to retirement portfolio diversification crypto. The question isn’t so much which is “better, ” but rather how each fits into your personal risk profile, time horizon, and financial goals.

Key Pros and Cons: Bitcoin vs. Traditional 401(k)

-

Potential Inflation Hedge: Bitcoin’s fixed supply of 21 million coins makes it theoretically resistant to inflation, unlike fiat currencies that can be printed at will. However, studies show its price doesn’t always rise during inflationary periods, so its effectiveness as a hedge is still debated.

-

High Growth Potential—But High Volatility: Bitcoin has delivered impressive long-term returns since inception, but its price—currently $115,745—can swing dramatically, as shown by a recent $1,106 daily drop. This volatility can lead to substantial gains or steep losses, making it riskier than traditional assets.

-

Regulatory Uncertainty: The rules around cryptocurrencies in retirement accounts are still evolving. Future regulations could impact Bitcoin’s value and how (or if) it can be held in 401(k) plans.

-

Diversification Benefits: Adding a small allocation of Bitcoin to a traditional 401(k) may enhance portfolio diversification and potentially improve returns, but this should be balanced carefully with risk tolerance and retirement goals.

-

Stability and Suitability for Retirement: Traditional 401(k) plans invest in diversified assets like stocks and bonds, aiming for steady, long-term growth. While returns may be lower than Bitcoin’s, these plans are generally more stable and better aligned with most retirement strategies.

For younger investors or those with a high risk tolerance, allocating a small portion of your retirement savings to Bitcoin could make sense. With Bitcoin holding steady above $100,000 and currently at $115,745.00, it’s impossible to ignore its explosive growth potential. But remember: past performance is no guarantee of future returns. Crypto’s wild swings can be exhilarating in bull markets but gut-wrenching during downturns.

If you’re closer to retirement or value stability over big upside, sticking primarily with a diversified 401(k) may be the better move. Stocks, bonds, and other traditional assets have decades of historical data supporting their ability to build wealth steadily while limiting catastrophic losses. Even if inflation eats into some gains, the smoother ride can help preserve your peace of mind as you approach your golden years.

Building a Balanced Retirement Plan: Tips for Crypto-Curious Savers

If you’re intrigued by the idea of blending Bitcoin with your 401(k), here are some practical steps to consider:

First, check if your plan provider allows crypto exposure, many still don’t. Next, decide what percentage (if any) makes sense for your age and goals; most experts suggest keeping it well under 5% of total assets. Finally, stay informed about regulatory changes that could impact crypto holdings in retirement accounts.

The bottom line? Diversification remains key. A well-constructed portfolio might include stocks for growth, bonds for income and stability, maybe some real estate or gold, and yes, perhaps even a dash of Bitcoin for those who can stomach the volatility. Just don’t let FOMO drive your decisions; thoughtful planning always beats chasing headlines.

What’s Next for Crypto in Retirement?

The conversation around Bitcoin vs traditional 401k strategies will only intensify as more employers explore crypto offerings and regulators clarify the rules. For now, the best approach is education: understand what you’re buying, why it fits (or doesn’t fit) your plan, and how much risk you’re willing to accept.

If you’re ready to take action or want more personalized advice about holding crypto in a 401(k), talk with a financial advisor who understands digital assets as well as traditional investments.

No matter which path you choose, classic diversification or adding some digital spice, the most important thing is making choices that align with your long-term vision for financial independence. Stay curious, stay cautious, and keep building toward the retirement you deserve!