So, you’re wondering: how much Bitcoin do you really need in your 401(k) to retire comfortably? It’s a hot topic for 2024, and it’s no wonder. As of October 11,2025, Bitcoin is trading at $111,971, after a recent dip of nearly 6%. With prices this high – and with so much volatility in the air – figuring out your crypto-powered retirement strategy is more relevant than ever.

Bitcoin’s Place in Your 401(k): How Much Is Enough?

The million-dollar (or should we say, Bitcoin-sized) question isn’t just about how much you need to retire – it’s about what role Bitcoin should play in your retirement mix. Recent surveys suggest Americans believe they’ll need around $1.8 million to retire comfortably by age 67. But how does that translate into BTC terms when the price is hovering near $112k?

If you’re aiming for a $1.8 million nest egg and want to rely solely on Bitcoin (a risky move!), you’d need roughly 16 BTC at today’s price. But most experts recommend a diversified approach:

- BlackRock: Suggests up to 2% of your portfolio in Bitcoin for those interested.

- Fidelity: Allows up to 20%, but most plans set stricter limits.

- Ric Edelman: Advocates for 10-40% depending on risk tolerance and age.

The consensus? A modest allocation – say, 2% to 5% – gives you exposure to potential upside while limiting risk from wild market swings. For a $100,000 portfolio, that means investing between $2,000 and $5,000 in BTC (about 0.018-0.045 BTC). If your goal is seven figures by retirement, scale accordingly!

Modeling Your Crypto Retirement: Realistic Scenarios for 2024-2025

The math isn’t just about buying as much Bitcoin as possible; it’s about creating a balanced plan that can weather volatility while taking advantage of growth potential. Let’s break down some practical models:

Comparing 3 Sample 401(k) Portfolios With Bitcoin

-

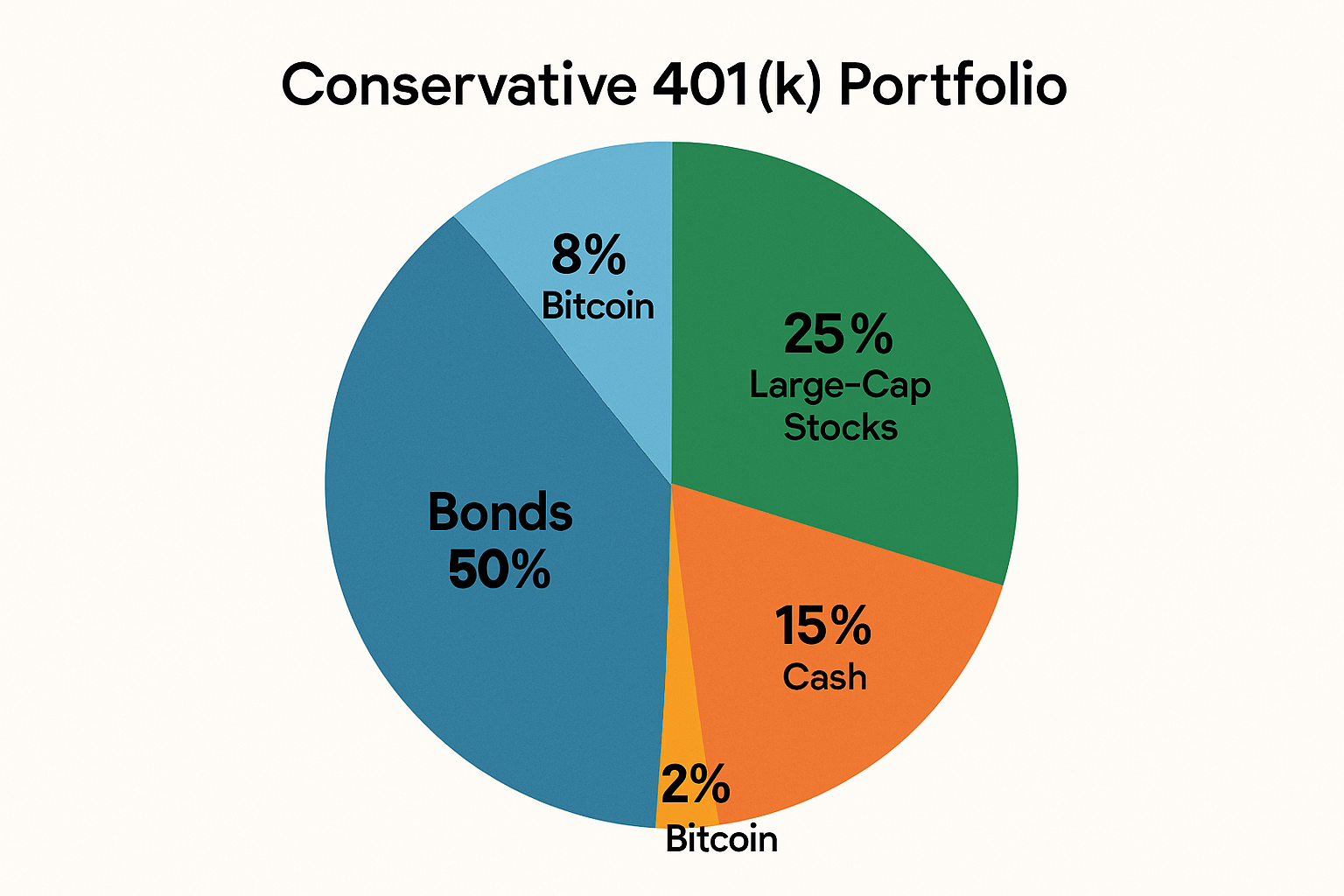

Conservative Portfolio (2% BTC): Allocating 2% of your 401(k) to Bitcoin follows BlackRock’s cautious recommendation. With a $100,000 portfolio, that’s $2,000 in Bitcoin—equal to 0.0179 BTC at today’s price of $111,971. The rest remains in traditional assets, aiming for stability with a small crypto boost.

-

Moderate Portfolio (5% BTC): A moderate approach puts 5% of your 401(k) in Bitcoin, as some financial experts suggest for balanced diversification. For a $100,000 portfolio, that’s $5,000 in Bitcoin—about 0.0446 BTC at the current price. This mix seeks a balance between growth and risk.

-

Aggressive Portfolio (20% BTC): Following Fidelity’s upper limit, an aggressive investor might allocate 20% of their 401(k) to Bitcoin. On $100,000, that’s $20,000 in Bitcoin, or 0.1786 BTC at today’s price. This strategy aims for higher potential returns—alongside higher volatility.

If you’re using a bitcoin 401k retirement calculator, plug in today’s price ($111,971) and experiment with different allocations. Notice how even small percentages can have an outsized impact if Bitcoin continues its historic growth pattern – but also observe how sharp drops can sting if you’re overexposed.

The Volatility Factor: Can You Stomach the Ride?

No sugarcoating it: Bitcoin is not for the faint of heart. In just one day this October, we saw a swing from $119,394 down to $105,262 – that kind of turbulence can be tough on long-term savers. The upside? Over the past decade, patient holders have been rewarded handsomely.

This is why most fiduciaries advocate keeping crypto as a small slice of your overall pie. Diversification remains key – think of Bitcoin as your portfolio’s rocket fuel rather than its foundation.

Bitcoin (BTC) Price Prediction Table: 2026–2031

Forecasted minimum, average, and maximum BTC prices based on current 2025 market context, adoption trends, and macroeconomic factors.

| Year | Minimum Price | Average Price | Maximum Price | Estimated % Change (Avg YoY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $80,000 | $130,000 | $180,000 | +15% | Post-halving consolidation, moderate adoption, regulatory clarity improves |

| 2027 | $95,000 | $155,000 | $220,000 | +19% | Bullish cycle resumes, increased 401(k)/institutional adoption |

| 2028 | $120,000 | $190,000 | $260,000 | +23% | ETF inflows, global macro uncertainty drives demand |

| 2029 | $140,000 | $225,000 | $310,000 | +18% | Next halving anticipation, supply squeeze, increased global adoption |

| 2030 | $160,000 | $260,000 | $370,000 | +16% | Mainstream integration, tech improvements, possible regulatory tightening |

| 2031 | $180,000 | $290,000 | $410,000 | +12% | Mature market, high institutional share, competition from new assets |

Price Prediction Summary

Bitcoin is expected to see steady price appreciation through 2031, driven by continued adoption in retirement portfolios, increased institutional investment, and periodic supply shocks from halving events. While volatility and regulatory risks persist, the overall trend remains positive, with average price growth rates moderating as the market matures. Investors should prepare for wide price ranges, reflecting both bullish and bearish scenarios each year.

Key Factors Affecting Bitcoin Price

- Bitcoin halving cycles and their impact on supply dynamics

- Institutional and 401(k) adoption rates

- Regulatory developments in major economies (US, EU, Asia)

- Macro environment: inflation, fiat debasement, and global risk appetite

- Technological improvements (scalability, security, interoperability)

- Emergence of competing crypto assets or new store-of-value technologies

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you’re curious about what less than one full bitcoin could mean for your retirement prospects by 2035, check out our deep dive here: Will Less Than 1 Bitcoin Be Enough to Retire by 2035?

It’s tempting to get caught up in the headlines and dream of Bitcoin skyrocketing to new highs, but any retirement strategy should be grounded in your personal goals, risk tolerance, and time horizon. Even with the current price at $111,971, the future remains uncertain. While some Redditors toss around the idea that 1 BTC could be enough to retire if it hits $500,000 or $1 million, that’s only realistic for those with modest retirement needs or who plan to supplement their income.

Pro tip: Don’t let FOMO dictate your allocation. Instead, revisit your plan annually and adjust as needed as both your life and the crypto market evolve.

Practical Steps: Building a Bitcoin 401(k) Strategy

If you’re ready to integrate Bitcoin into your 401(k), start by checking what your plan allows. Some providers, like Fidelity, let you allocate up to 20%, but many plans are far more restrictive or require you to use a self-directed option. If direct exposure isn’t available, look for crypto-adjacent funds or trusts that track Bitcoin’s price.

Here are a few action items for anyone considering a crypto allocation:

- Start small: Even a 2% allocation can move the needle over time.

- Stay diversified: Maintain exposure to stocks, bonds, and other assets alongside BTC.

- Automate contributions: Dollar-cost averaging can help smooth out volatility.

- Keep fees in mind: Crypto investment vehicles sometimes charge higher management fees than traditional funds.

If you want to experiment with portfolio models before making changes, use a bitcoin 401k retirement calculator. This lets you visualize how different allocations might perform under various market scenarios, and how much risk you’re truly comfortable taking on.

Staying Flexible: Adapting as Markets Evolve

The world of crypto moves fast. Regulatory shifts, technological breakthroughs, and macroeconomic events can all impact both price and access within retirement accounts. Stay informed by following trusted sources, and don’t hesitate to consult a financial planner who understands digital assets.

The bottom line? There’s no one-size-fits-all answer for how much bitcoin to retire. But by approaching it thoughtfully, balancing upside potential against real-world risks, you can harness Bitcoin’s unique qualities as part of a modern retirement strategy. Remember: small steps today can lead to outsized rewards tomorrow if you remain disciplined and adaptable along the way.