On August 7,2025, President Donald Trump signed an executive order that could radically reshape how Americans save for retirement by allowing alternative assets like cryptocurrency, private equity, and real estate into 401(k) plans. This move is already sending shockwaves through the financial sector as plan providers and investors scramble to understand what it means for the future of retirement portfolios. If you’re serious about maximizing your nest egg, or just want to know what all the buzz means for your 401(k): you need to get up to speed fast.

What Does Trump’s Executive Order Actually Change?

The Trump crypto 401k executive order directs the Department of Labor to revisit current regulations and work with other agencies to open up 401(k) investment menus. The headline? For the first time, mainstream retirement savers could see allocations to Bitcoin, Ethereum, and other digital assets right alongside stocks and bonds. The goal: democratize access to alternative assets that were once reserved for institutional players or ultra-high-net-worth investors.

This isn’t just political theater. According to the official White House fact sheet, every American preparing for retirement should have access to funds that include investments in alternative assets, including crypto. The directive is clear: broaden what’s possible inside your 401(k).

Bitcoin Surges Past $120,000 on Policy News

The market didn’t wait long to react. As soon as news broke about the executive order, Bitcoin’s price ripped past $122,540.00, marking a surge of $1,953 in just 24 hours (that’s a and 0.0162% gain). This isn’t just a blip, it’s a clear sign that investors believe mainstream adoption in retirement accounts could be a game-changer for crypto demand.

If you’ve been waiting for a catalyst to push digital assets into the American retirement mainstream, this is it. But don’t get swept away by FOMO, there are some critical risks and realities you need to weigh before shifting your portfolio.

The Opportunity: Diversification and Potential Returns

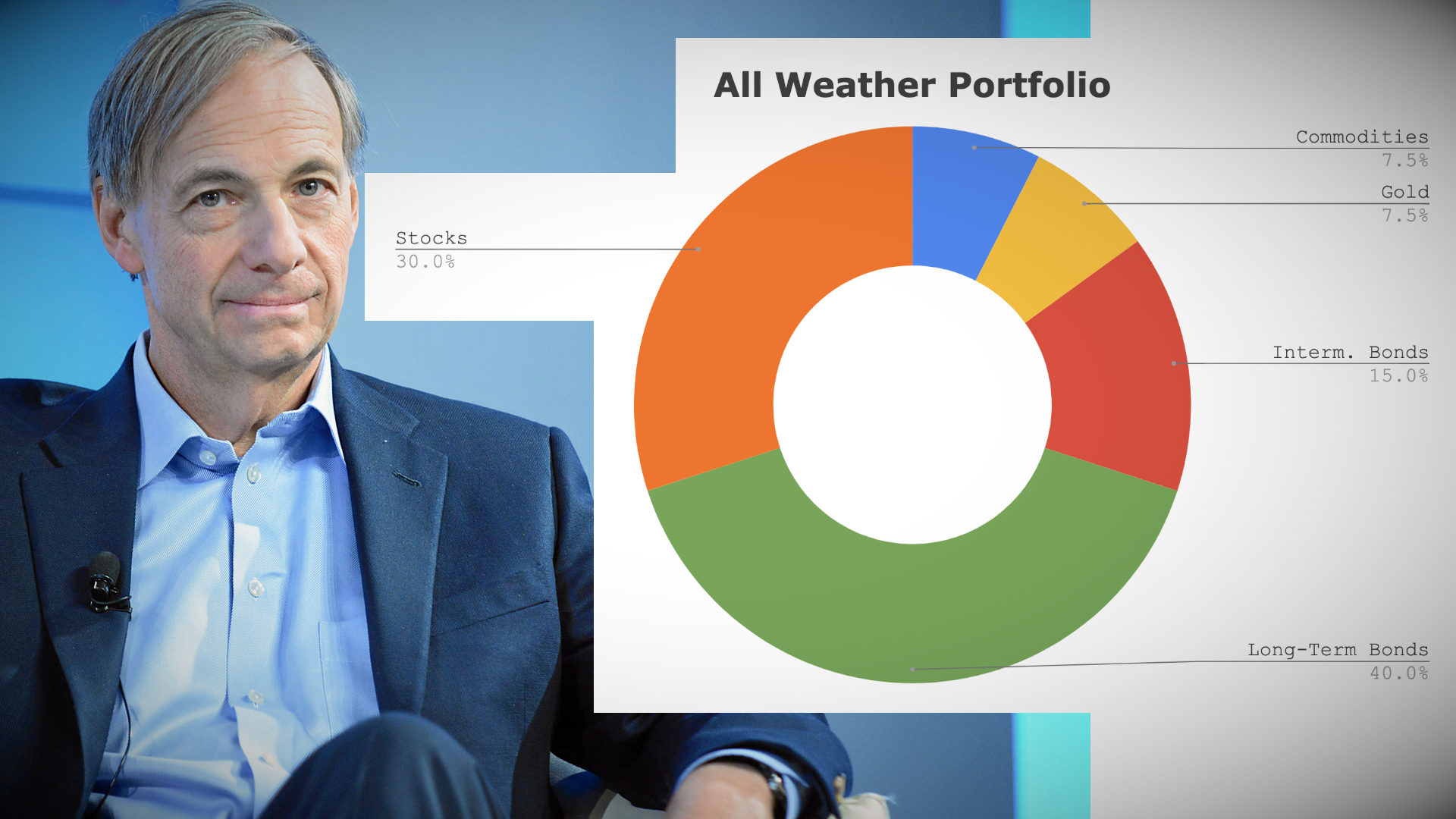

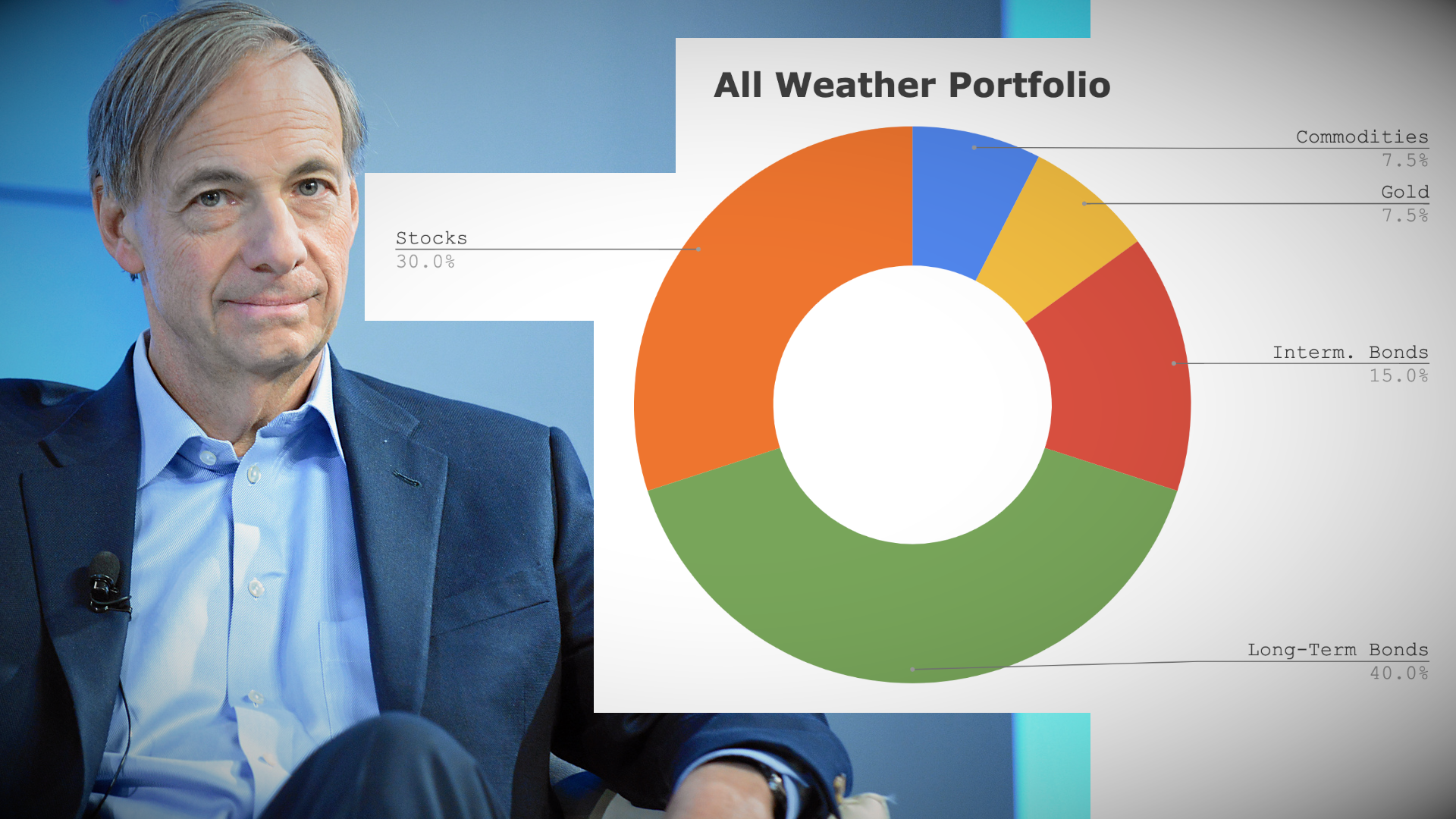

Allowing crypto in 401k retirement plans could provide much-needed diversification beyond stocks and bonds. Alternative assets like Bitcoin have historically had low correlation with traditional markets, meaning they can help smooth out volatility when stocks are tanking or rates are rising.

- Diversification: Crypto’s price cycles don’t always track equities or bonds, potentially reducing overall portfolio risk.

- Pursuit of Higher Returns: With Bitcoin up more than 300% since early 2023, some see huge upside if even a fraction of America’s $12.5 trillion in 401(k) assets flows into digital assets.

- Mainstream Legitimacy: Institutional-grade custody solutions and regulatory clarity from Washington could finally make crypto allocations palatable for conservative plan sponsors, and skeptical retirees.

Bitcoin Price Prediction 2026-2031 After Trump’s Executive Order on 401(k)s

Forecasts based on enhanced institutional access, regulatory shifts, and evolving retirement market participation

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $110,000 | $136,000 | $165,000 | +11% | Initial regulatory implementation phase; institutional inflows begin but volatility remains high. |

| 2027 | $126,000 | $155,000 | $192,000 | +14% | Wider 401(k) adoption, growing mainstream acceptance, but potential regulatory uncertainty persists. |

| 2028 | $140,000 | $172,000 | $215,000 | +11% | Continued 401(k) integration, increased financial advisor support, and maturing custodial solutions. |

| 2029 | $152,000 | $190,000 | $242,000 | +10% | Macro tailwinds, more stable regulatory environment, and possible Bitcoin ETF expansion in retirement accounts. |

| 2030 | $170,000 | $210,000 | $265,000 | +11% | Peak adoption cycle, broader alternative asset inclusion, and improved risk management products. |

| 2031 | $188,000 | $228,000 | $295,000 | +9% | Market maturity, mainstream 401(k) crypto allocations, but heightened competition from other digital assets. |

Price Prediction Summary

Bitcoin’s price outlook for 2026-2031 is strongly influenced by the recent executive order expanding 401(k) access to crypto. The resulting institutional inflows, combined with evolving regulatory clarity and growing mainstream acceptance, are expected to drive progressive price appreciation. However, significant volatility and risks remain due to regulatory, technological, and macroeconomic factors. The forecast anticipates steady growth with occasional corrections, as Bitcoin becomes a more established asset class for retirement portfolios.

Key Factors Affecting Bitcoin Price

- Institutional adoption following 401(k) inclusion and retirement plan inflows.

- US regulatory clarity and Department of Labor guidelines on crypto in retirement accounts.

- Macroeconomic environment, inflation rates, and monetary policy impact on alternative assets.

- Technological advancements in Bitcoin’s scalability, custody, and integration with financial infrastructure.

- Competition from other cryptocurrencies and alternative assets in 401(k) plans.

- Market sentiment, adoption by financial advisors, and educational initiatives for retirement savers.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Risks: Volatility and Regulatory Uncertainty Remain High

This isn’t all upside, far from it. While headlines tout “democratized access, ” adding crypto exposure brings serious risks:

- Extreme Volatility: Bitcoin may be trading at $122,540 now but has seen wild swings, even within single trading sessions, making it unsuitable as an oversized allocation in most retiree portfolios.

- Lack of Historical Precedent: No major economy has fully integrated crypto into tax-advantaged retirement accounts at scale; there are few roadmaps if things go south.

- Higher Fees and Liquidity Concerns: Crypto investment products can carry higher management fees than index funds, and selling during market stress may not be seamless.

- Evolving Crypto 401k Regulations (2024-2025): The Department of Labor still needs to finalize implementation details; plan providers must decide whether they want the operational headache (and liability) of offering these products at all.

If you’re considering jumping in when these options become available, careful due diligence is non-negotiable. For more on how these changes might impact your specific situation, or if you’re trying to figure out if your provider will even offer crypto choices, check out our deep dive: How Trump’s Executive Order Could Change 401(k) Crypto Investing: What Savvy Retirement Planners Need To Know.

So, what’s the playbook for retirement investors who want to capitalize on these sweeping changes without taking on unnecessary risk? This is where strategy, discipline, and education matter more than ever. The era of set-it-and-forget-it 401(k) investing is over. With crypto and other alternative assets in the mix, you’ll need to be more hands-on and proactive about portfolio construction.

Smart Moves for Retirement Savers Eyeing Crypto

Top Strategies for Safely Adding Crypto to Your 401(k)

-

Consult a Fiduciary Financial Advisor: Seek guidance from a fiduciary financial advisor with expertise in alternative assets and retirement planning. They can help you assess your risk tolerance, understand crypto’s volatility, and build a balanced allocation strategy.

-

Choose SEC-Regulated Crypto Platforms: If your 401(k) provider offers crypto, ensure they partner with SEC-regulated platforms like Coinbase Institutional or Fidelity Digital Assets for secure custody and compliance.

-

Diversify Across Crypto and Traditional Assets: Avoid concentrating your retirement savings in a single asset. Combine cryptocurrencies like Bitcoin (currently $122,540) with stocks, bonds, and other alternatives to reduce overall portfolio risk.

-

Start Small and Scale Gradually: Begin with a modest allocation to crypto—many experts suggest 1-5% of your total 401(k)—and increase exposure only as you gain comfort and as regulations evolve.

-

Review Plan Fees and Crypto-Related Costs: Examine your 401(k) plan’s fee disclosures for crypto transaction fees, custody charges, and fund expenses. High costs can erode long-term returns.

-

Enable Two-Factor Authentication and Secure Access: Protect your retirement account by enabling two-factor authentication (2FA) and strong password practices, especially when accessing crypto-related features.

1. Start Small: If your plan offers digital assets, consider beginning with a modest allocation, think 1% to 5% of your portfolio. This lets you capture upside potential while limiting downside if volatility spikes.

2. Rebalance Regularly: Crypto moves fast. Set up quarterly or semi-annual rebalancing so Bitcoin or Ethereum gains don’t balloon into an outsized share of your retirement savings.

3. Know Your Fees: Not all crypto investment options are created equal. Look out for high management fees, trading costs, and custodial charges that can quietly erode long-term returns.

4. Stay Informed on Crypto 401k Regulations 2024-2025: The Department of Labor’s rulemaking process could change the landscape overnight. Bookmark trusted resources and subscribe to regulatory updates so you’re never caught flat-footed by compliance shifts or new disclosures.

The Compliance Curve: What Plan Sponsors and Advisors Need To Watch

This executive order doesn’t just impact individual savers, it puts enormous pressure on plan sponsors, HR departments, and financial advisors to get up to speed on digital assets fast. Expect a wave of due diligence requests, policy rewrites, and new compliance checklists as providers race to roll out (or justify not offering) crypto options inside their plans.

If you’re an advisor or employer, now’s the time to review fiduciary responsibilities under ERISA and ensure any alternative asset offerings are supported by robust education materials and risk disclosures. For a broader look at how this shift could unlock $12.5 trillion in retirement assets for digital markets, see our full analysis here.

Your Next Steps: Prepare Now, Even If Crypto Isn’t Live Yet

The bottom line? You don’t have to wait until your provider officially launches a Bitcoin option to start preparing. Here’s how forward-thinking investors are getting ready:

- Brush up on digital asset basics, from custody models to tax implications in retirement accounts.

- Create an investment policy statement that spells out your maximum allocation to alternatives, and stick with it through market turbulence.

- Talk with your financial advisor now, not after new choices hit the menu. Make sure they understand both the upside potential and the unique risks tied to crypto in tax-advantaged plans.

- Monitor real-time prices: With Bitcoin currently at $122,540.00 and recent surges making headlines, price awareness is critical for timing entries or exits if you choose more active management inside your retirement account.

The Takeaway: Opportunity Meets Responsibility

If you’ve ever wanted mainstream access to digital assets, and all the growth (and drama) that comes with them, Trump’s executive order could be your open door. But opportunity always travels with risk in tow. Stay disciplined, stay educated, and use every tool available, from compliance checklists to professional advice, to make sure crypto becomes a smart part of your retirement future instead of an expensive lesson learned too late.

If you want a deeper tactical breakdown or need help navigating plan-specific questions about what opening the $12.5 trillion 401(k) market truly means for your own future, we’ve got actionable guides ready for you right now.