If you’re eyeing a future where your 401K isn’t just a collection of index funds but also features a slice of Bitcoin, you’re not alone. As of October 12,2025, Bitcoin is trading at $113,962. That figure is more than just a number on your brokerage app; it’s the foundation for any serious crypto retirement planning. But let’s get real: how much Bitcoin do you actually need in your 401K to retire comfortably? Let’s break down the data and strategies that matter most for forward-thinking savers like you.

Bitcoin at $113,962: What Does This Mean for Your Retirement?

First things first: price context is everything. With Bitcoin hovering near all-time highs (recently peaking above $125,000 before pulling back), the crypto landscape is both thrilling and nerve-wracking. If you’re using a Bitcoin 401K retirement calculator, current price action will dramatically impact how much BTC you’ll need to hit your retirement goals.

Let’s say your target nest egg is $2 million – a common benchmark among U. S. retirees who want to maintain their lifestyle and cover healthcare costs. At today’s price, that means you’d need:

| Target Portfolio Value | BTC Price (10/12/25) | BTC Needed |

|---|---|---|

| $2,000,000 | $113,962 | ~17.55 BTC |

This is a moving target. If Bitcoin appreciates by an average of 10% annually (as many bullish models suggest), the number of coins required drops each year, but so does the margin for error if volatility strikes at the wrong time.

How Much Bitcoin Should You Allocate in Your 401K?

The classic advice is diversification, but with crypto in play, things get nuanced fast. According to recent surveys and expert calculators (see sources from Bitcoiner Academy and Crypto Saving Expert), some guidelines look like this:

- If you’re aiming for a moderate risk profile, consider allocating 5-10% of your total portfolio to Bitcoin within your 401K.

- If you’re more aggressive, and can stomach volatility, some investors go as high as 15%, especially if they have other stable assets elsewhere.

- If your goal is simply exposure rather than outsized gains, even holding 0.5-1 BTC could be meaningful in the long run.

The right allocation depends on age, risk tolerance, and how much faith you have in Bitcoin’s long-term growth story. If you want tailored numbers based on your situation, check out our detailed breakdowns like “Will Less Than 1 Bitcoin Be Enough to Retire by 2035?”.

The Power (and Pitfalls) of Crypto Retirement Calculators

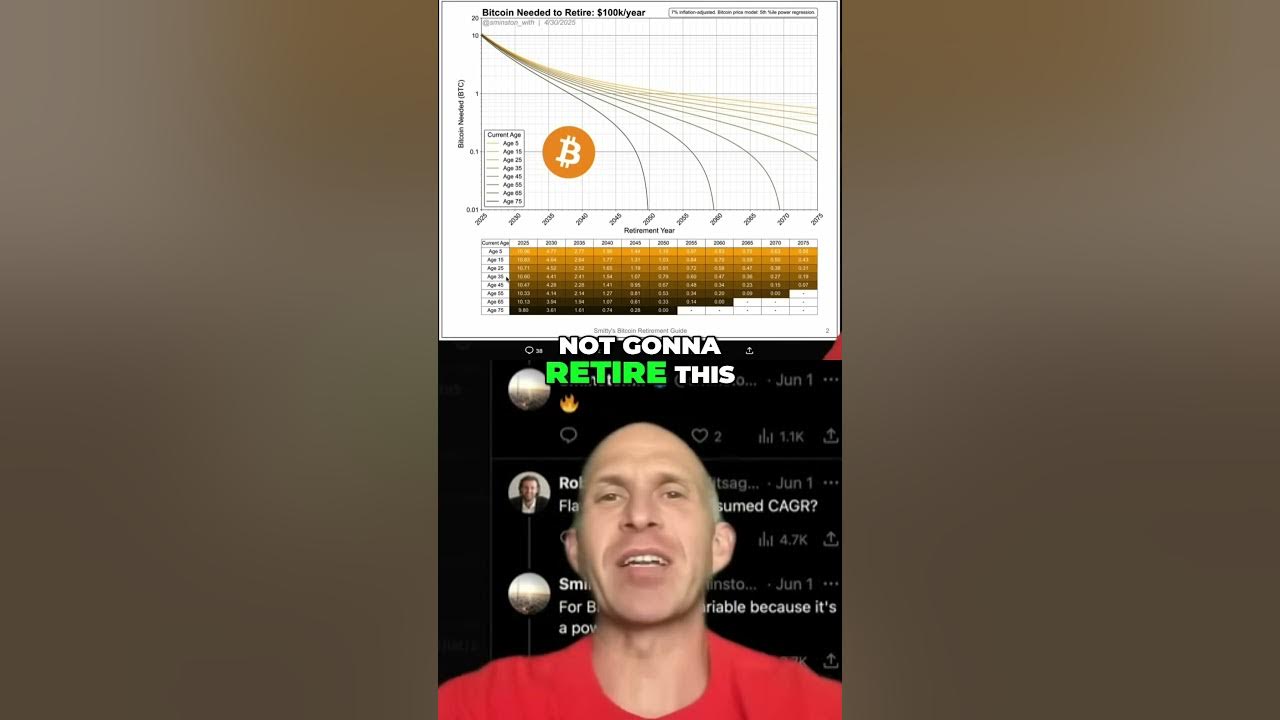

If spreadsheets aren’t your thing (no judgment!), there are now intuitive online tools designed specifically for crypto retirement projections. The Bitcoin Retirement Calculator from Bitcoiner Academy, for example, lets you plug in variables like current age, annual contributions, expected BTC growth rate, and inflation assumptions.

This kind of modeling reveals some eye-opening scenarios:

Key Insights from Leading Bitcoin Retirement Calculators

-

Personalized Projections with Bitcoiner Academy’s Calculator: This tool lets you input your current Bitcoin holdings, age, and expected price growth to estimate your retirement nest egg. For example, with Bitcoin at $113,962, it helps visualize how price appreciation and annual contributions could impact your 401(k).

-

Reddit’s r/Bitcoin Community Consensus: Many users suggest that, in the US, retiring comfortably in 10 years may require about $2 million in assets (excluding a paid-off house and car). At today’s price of $113,962 per Bitcoin, that’s roughly 17.5 BTC needed for retirement.

-

Crypto Saving Expert’s Calculator Estimates: According to recent Medium analysis, retiring at age 65 with a target of $6.4 million in savings would require a minimum of 1.08 BTC at the current price. For a more modest goal, 0.72 BTC could suffice for a leaner retirement.

-

Bitcoin Financial Services Visualizes Scenarios: Their calculator models retirement outcomes with and without Bitcoin, helping users see the potential impact of adding BTC to their 401(k) alongside traditional assets.

-

David Lawrence’s LinkedIn Analysis: For those aged 45 aiming to retire at 55, the estimate is 2.28 BTC at retirement, based on current market prices and projected growth.

-

ForUsAll Enables Direct Crypto 401(k) Investing: This platform offers access to cryptocurrencies, including Bitcoin, directly within your 401(k), with low trading fees and no setup costs, making it easier to implement calculator recommendations.

The catch? These calculators often assume steady growth or ignore black swan events, like regulatory crackdowns or sudden market crashes, that can seriously alter outcomes. It’s wise to run best-case and worst-case scenarios before making any big allocation decisions.

Bitcoin (BTC) Price Prediction 2026–2031

Professional Outlook for Long-Term Retirement Planning (Based on 2025 Market Context)

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $88,000 | $120,000 | $150,000 | +5% | Post-ATH consolidation; volatility from global macro events |

| 2027 | $95,000 | $135,000 | $180,000 | +12.5% | New adoption wave; ETF inflows; possible regulatory headwinds |

| 2028 | $110,000 | $160,000 | $220,000 | +18.5% | Halving year; supply shock narrative; institutional FOMO |

| 2029 | $130,000 | $200,000 | $280,000 | +25% | Wider global adoption; central bank integration; tech upgrades |

| 2030 | $155,000 | $250,000 | $350,000 | +25% | Mature market; Bitcoin as strategic reserve; mainstream 401(k) adoption |

| 2031 | $180,000 | $300,000 | $420,000 | +20% | Potential for ‘digital gold’ status; global competition emerging |

Price Prediction Summary

Bitcoin is projected to experience steady growth from 2026 through 2031, with average annual price increases ranging from 5% to 25%. The minimum price scenario reflects potential bear markets or global shocks, while the maximum scenario assumes strong institutional adoption and favorable regulation. By 2030, Bitcoin could realistically reach an average of $250,000, making it a compelling asset for long-term retirement planning, though significant volatility remains possible.

Key Factors Affecting Bitcoin Price

- Regulatory clarity and government policy (e.g., U.S. Strategic Bitcoin Reserve, global regulations)

- Institutional adoption, including ETFs and 401(k) integration

- Impact of Bitcoin halving cycles on supply and demand

- Macro-economic events and geopolitical tensions

- Technological improvements (scalability, security, integration)

- Competition from other digital assets and stablecoins

- Changing investor demographics and retirement planning trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

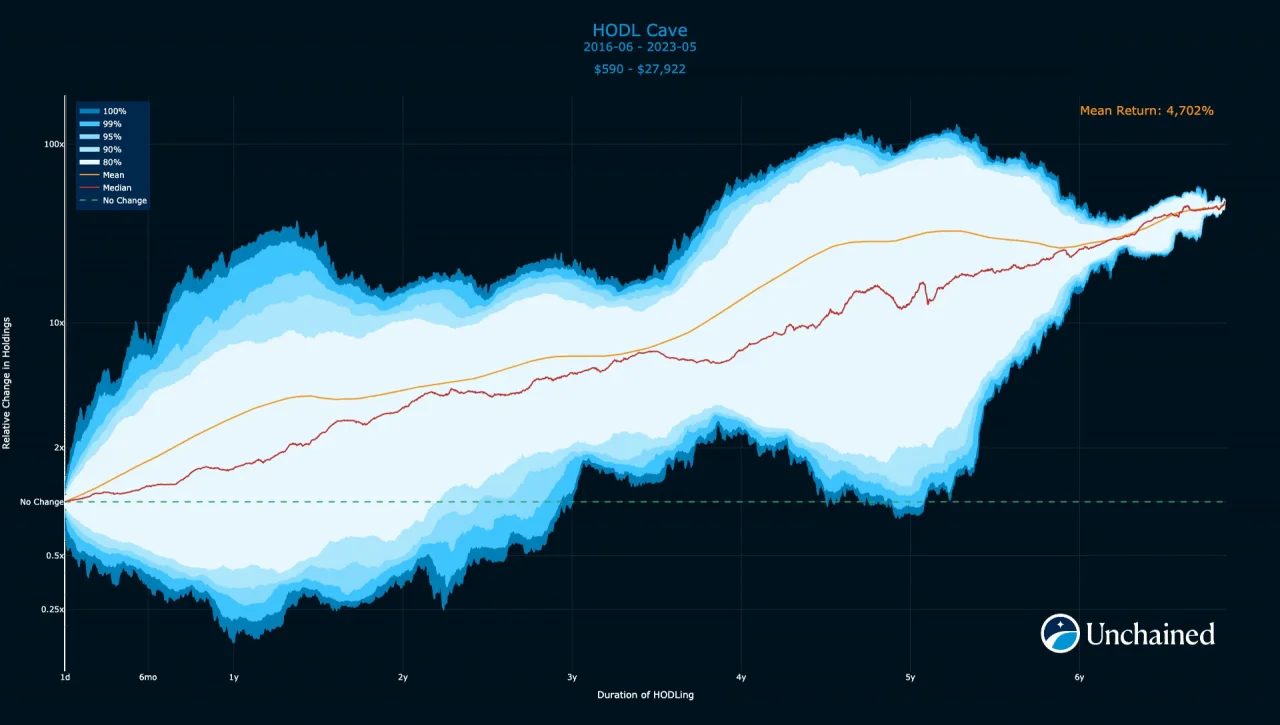

While the math is tempting, remember that Bitcoin’s volatility can be both a blessing and a curse. If your retirement is still 10 or 20 years away, time is on your side to ride out price swings. But if you’re approaching retirement age, a sudden drop in BTC price could mean rethinking your strategy or delaying your plans. That’s why many financial advisors recommend dollar-cost averaging into Bitcoin and rebalancing regularly, especially as you near your target retirement window.

Stress-Testing Your Crypto Retirement Plan

Let’s get practical. Imagine you’re 45 today and want to retire at 65. If you steadily accumulate Bitcoin in your 401K while it hovers around $113,962, you might aim for 1 to 2 BTC over the next decade, depending on your risk profile and other assets. But what if Bitcoin faces another major correction? Or what if it doubles again by the time you hit retirement?

This is where scenario planning becomes essential. Use online calculators to model different outcomes: What happens if BTC grows at only 5% per year instead of 10%? How does inflation eat into your purchasing power? And crucially, how does adding even a small amount of BTC impact your overall portfolio risk and return?

Regulatory Watch: What’s Next for Bitcoin in Your 401K?

The landscape for crypto in retirement accounts is evolving fast. The U. S. government’s creation of a Strategic Bitcoin Reserve earlier this year signaled growing institutional acceptance, but regulatory risks remain front and center. Some experts argue that fiduciary rules under ERISA still make widespread adoption tricky, while others point to new platforms (like ForUsAll) that offer compliant crypto options within employer plans.

If you’re considering increasing your exposure, stay tuned for regulatory updates and always check whether your plan provider offers robust security and insurance protections for digital assets.

Checklist: Building a Resilient Crypto Retirement Strategy

Ultimately, there’s no one-size-fits-all answer to how much Bitcoin you need in your 401K to retire, it depends on personal goals, market conditions, and evolving regulations. But with $113,962 as today’s anchor price, even holding half a coin could have significant upside potential over the next decade.

If you’re curious about more detailed models or want country-specific insights, check out our guide on how much Bitcoin should you hold in your 401K by 2035.

The best advice? Stay informed, diversify smartly, and let data, not hype, drive your crypto retirement decisions. The path may be volatile, but with careful planning and realistic expectations, integrating Bitcoin into your long-term savings can be both exciting and rewarding.