How much Bitcoin do you really need in your 401K to retire comfortably by 2035? The answer is more nuanced than most realize, hinging on where you live, your lifestyle expectations, and the ever-evolving landscape of both traditional and digital assets. With Bitcoin currently trading at $115,804 (as of October 13,2025), and credible projections from Bitwise and Finder. com estimating a potential price between $1.02 million and $1.3 million by 2035, the calculus for crypto retirement planning has never been more relevant or dynamic.

Bitcoin Retirement Amounts: Why Location Matters More Than Ever

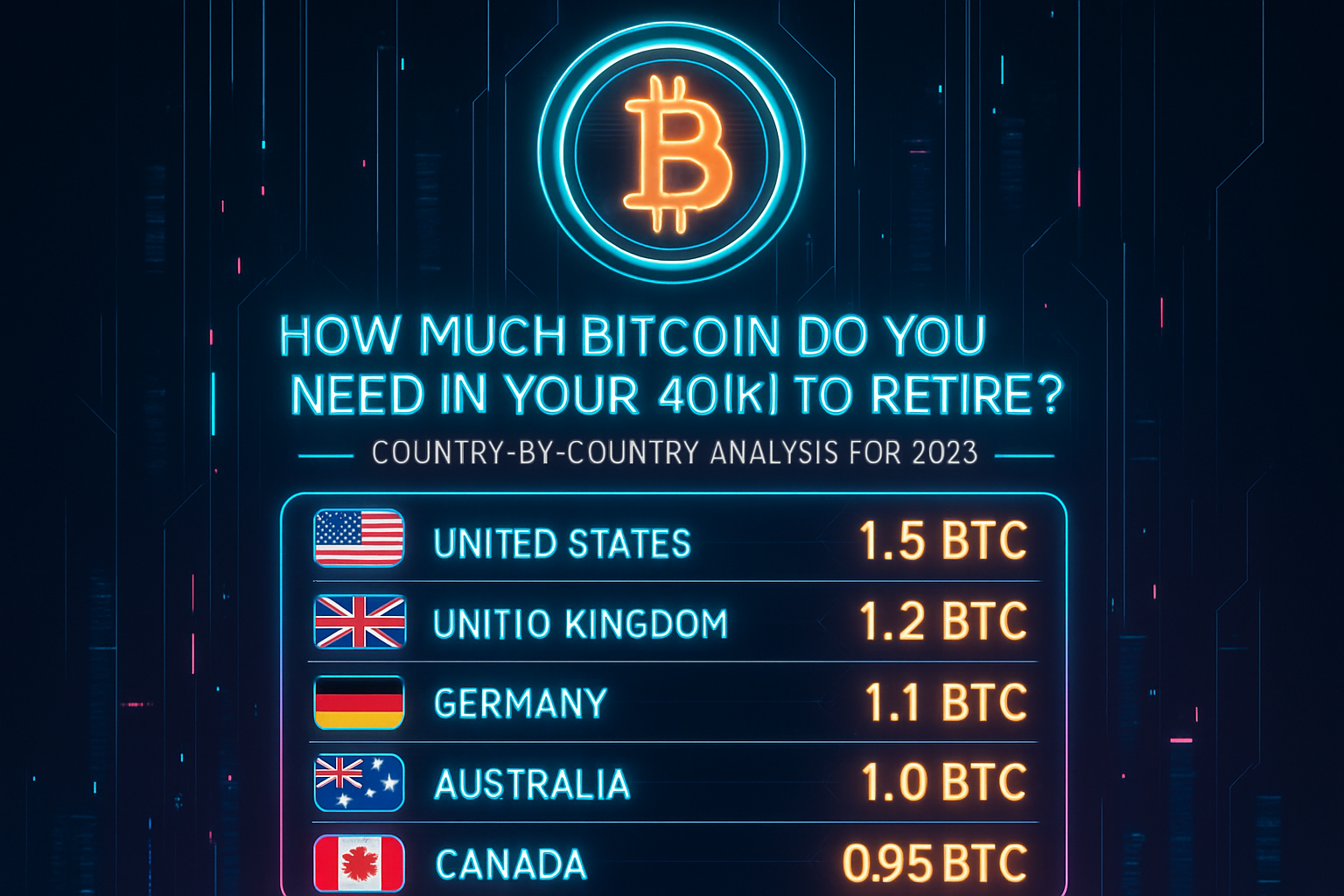

Across the globe, the amount of Bitcoin needed for a comfortable retirement varies dramatically. This is due to differences in cost of living, healthcare systems, tax policies, and social safety nets. Recent market research reveals that in many countries, less than one Bitcoin could suffice by 2035, but in higher-cost nations, the number climbs quickly. Below is a data-driven breakdown based on current research and projected BTC growth:

Estimated Bitcoin Needed to Retire Comfortably by 2035

-

United States: 1.5 BTC needed to retire comfortably by 2035. With higher living costs and healthcare expenses, Americans are projected to require the most Bitcoin among these countries for a secure retirement.

-

United Kingdom: 1.2 BTC needed to retire comfortably by 2035. The UK’s robust social programs help, but London’s high costs keep the BTC requirement above 1.

-

Germany: 1.1 BTC needed to retire comfortably by 2035. Germany’s strong social safety net and moderate living costs result in a slightly lower BTC target.

-

Australia: 1.0 BTC needed to retire comfortably by 2035. Australia’s high quality of life and healthcare standards set the requirement at a round 1 BTC.

-

Canada: 0.95 BTC needed to retire comfortably by 2035. Canada’s universal healthcare and relatively lower costs reduce the BTC needed compared to the US.

-

Japan: 0.9 BTC needed to retire comfortably by 2035. Japan’s efficient public services and lower retirement expenses help keep the BTC requirement under 1.

-

France: 0.85 BTC needed to retire comfortably by 2035. France’s generous pensions and healthcare system lower the Bitcoin needed for a comfortable retirement.

-

Spain: 0.7 BTC needed to retire comfortably by 2035. Spain’s affordable cost of living and vibrant expat communities make retirement more accessible.

-

Mexico: 0.4 BTC needed to retire comfortably by 2035. Mexico’s low cost of living means retirees can enjoy comfort with less Bitcoin.

-

Thailand: 0.25 BTC needed to retire comfortably by 2035. Thailand offers one of the most affordable retirements, requiring just a fraction of a Bitcoin.

Country-by-Country Analysis: How Much Bitcoin Will You Need?

United States: Americans will need approximately 1.5 BTC in their 401K by 2035 to match median retirement targets, reflecting both high living standards and rising healthcare costs. For context, that’s about $173,700 at today’s price but could represent over $1.5 million if bullish projections hold true.

United Kingdom: Retirees should aim for around 1.2 BTC. The UK’s mix of public health coverage and relatively high urban costs puts it near the top tier globally.

Germany: Estimated needs are slightly lower at 1.1 BTC, thanks to robust social programs but persistent inflationary pressures on consumer goods.

Australia: A target of 1.0 BTC aligns with Australia’s strong but expensive healthcare system and urban-centric retiree population.

The pattern is clear: Developed economies require larger Bitcoin allocations due to higher expected expenses, even as crypto adoption grows within their retirement systems.

The Global Middle: Where Less Than 1 Bitcoin May Suffice

Canada: About 0.95 BTC. While Canada’s universal healthcare helps reduce out-of-pocket costs, housing remains expensive especially in cities like Toronto and Vancouver.

Japan: At 0.9 BTC, Japanese retirees benefit from strong public pensions but face longevity risk, outliving their savings due to one of the world’s highest life expectancies.

France and Spain: France clocks in at 0.85 BTC, while Spain requires just 0.7 BTC. Both offer generous social programs and lower average living costs compared to Anglo-Saxon peers.

A Closer Look at Emerging Markets: The Power of Fractional Bitcoin Holdings

The disparity widens as we move toward emerging economies where cost-of-living indices are far lower, and so are crypto requirements for a dignified retirement:

- Mexico: and nbsp;Just 0.4 BTC and nbsp;could be enough for a comfortable post-career lifestyle.

- Thailand: and nbsp;A mere and nbsp;0.25 BTC and nbsp;might secure local purchasing power well into old age. and nbsp;

This means that even modest exposure through a crypto-enabled 401K can have an outsized impact for those considering international relocation or geoarbitrage strategies, a growing trend among digital nomads and remote workers seeking value abroad.

Bitcoin (BTC) Price Prediction Table: 2026–2031

Based on current market data ($115,804 in 2025) and expert projections, this table provides minimum, average, and maximum Bitcoin price forecasts through 2031, incorporating both bullish and bearish scenarios. Predictions consider adoption rates, global regulation, and macroeconomic factors.

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | Estimated % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $95,000 | $140,000 | $180,000 | +20% | Potential post-halving consolidation; regulatory uncertainty; institutions accumulate on dips |

| 2027 | $120,000 | $180,000 | $260,000 | +29% | Increased institutional adoption, potential ETF inflows, moderate global regulation |

| 2028 | $150,000 | $240,000 | $350,000 | +33% | Halving year; supply shock, growing use as store-of-value, some macro headwinds |

| 2029 | $210,000 | $320,000 | $470,000 | +33% | Mainstream adoption accelerates, major banks integrate BTC, regulatory clarity improves |

| 2030 | $280,000 | $420,000 | $630,000 | +31% | Global pension/sovereign funds exposure, improved scalability, rising competition from alternatives |

| 2031 | $350,000 | $520,000 | $800,000 | +24% | BTC matures as digital gold, robust on-chain utility, possible high volatility from macro events |

Price Prediction Summary

Bitcoin’s price is projected to rise significantly through 2031, with the average price forecast reaching $520,000 by 2031. The range between minimum and maximum prices reflects Bitcoin’s volatility and sensitivity to regulatory, macroeconomic, and adoption-related developments. While long-term bullish scenarios foresee prices surpassing $800,000, bearish outcomes could see more moderate growth, especially if regulatory or technological risks materialize. Overall, the outlook remains positive, driven by increasing institutional adoption, diminishing new supply, and growing recognition of Bitcoin as a global store of value.

Key Factors Affecting Bitcoin Price

- Institutional and governmental adoption rates, including ETF and pension fund allocations

- Global regulatory developments and clarity regarding crypto in retirement accounts

- Macroeconomic conditions, inflation rates, and demand for inflation hedges

- Bitcoin halving cycles reducing new supply

- Technological improvements (scalability, security, integration with financial systems)

- Competition from other cryptocurrencies and digital assets

- Geopolitical events and their impact on global markets and capital flows

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you’re curious about how these numbers were calculated or want more granular guidance tailored to your situation, check out our comprehensive breakdown here: How Much Bitcoin Do You Need In Your 401K To Retire By 2035?

Of course, these projections rest on the assumption that Bitcoin’s upward trajectory continues and that adoption within retirement accounts like 401Ks accelerates. But what if you’re not in one of these ten countries? The same principles apply: estimate your local retirement needs, convert those to USD (or your base currency), and divide by the projected 2035 BTC price. The result is a surprisingly accessible target for many, especially as fractional investing becomes more mainstream.

Strategic Allocation: Bitcoin’s Role in a Diversified 401K

It’s tempting to see these numbers and go all-in on Bitcoin. However, prudent crypto 401K retirement planning demands diversification. Even if you’re bullish on digital assets, most experts recommend limiting crypto exposure to 5, 15% of your total portfolio. This helps manage volatility while still capturing potential upside from Bitcoin’s asymmetric growth profile.

For example, if your target is 1 BTC for retirement, holding just 0.1, 0.2 BTC today could be sufficient if Bitcoin appreciates as forecasted. The rest of your portfolio should balance traditional equities, bonds, and perhaps other alternative assets to smooth out risk.

Beyond Borders: The Appeal of Geoarbitrage

The global nature of Bitcoin means your retirement isn’t necessarily tied to your home country’s economic fate. If you’re willing to relocate or split time between countries, the purchasing power of even a fraction of a Bitcoin can multiply dramatically in lower-cost regions like Mexico or Thailand. This opens up flexibility for retirees seeking adventure or better value abroad, an increasingly popular strategy among digitally savvy investors.

Which country would you consider retiring in to maximize your Bitcoin’s purchasing power by 2035?

With Bitcoin projected to reach over $1 million by 2035, the amount needed to retire varies greatly by country. Would you consider moving abroad to stretch your Bitcoin further? Pick the country that most appeals to you based on the estimated BTC needed for a comfortable retirement.

Key Risks and amp; Best Practices: Protecting Your Crypto Nest Egg

While the idea of retiring on less than one Bitcoin is compelling, it comes with caveats:

- Volatility: Even with bullish forecasts, Bitcoin can experience sharp corrections. Don’t stake everything on a single asset.

- Regulatory Shifts: Crypto rules are evolving worldwide; always ensure your 401K provider supports compliant crypto custody and reporting.

- Security: Use reputable custodians and consider multi-signature wallets for large holdings to reduce risk of hacks or loss.

- Withdrawal Planning: Develop a systematic withdrawal strategy that minimizes tax impact and liquidity risks as you approach retirement age.

If you want more insight into realistic models or want help crafting a data-driven plan for your own situation, our deep-dive resource can help: How Much Bitcoin Do You Need To Retire By 2035? A Data-Driven Guide For 401K Investors.

The bottom line: In an era where $115,804 buys just one Bitcoin and projections place its future value at over $1 million by 2035, even modest crypto allocations could make a significant difference, especially when tailored to your country’s unique cost structure and personal goals.